- A dating stock with a twist

- A successful IPO

- Turning million settlement into a billion-dollar fortune

- Plans for the future

- Do not bet against Whitney Wolfe Herd

Initial public offerings are always a significant event in the stock market. On February 11, with backing from Blackstone Group, Bumble Inc (BMBL) priced its IPO of 50 million shares at $43, raising $2.2 billion. Bumble is a dating app with a twist.

The timing could not have been more perfect for the IPO. The stock market is at record highs, technology stocks continue to soar, and social media platforms are raking in profits from subscriptions and advertising. Bumble Inc. owns Bumble and Badoo, a dating-based social network. According to pre-IPO filings, Bumble and Badoo posted $489 million in revenue and $85.8 million in profits in 2019. Like many other technology and social media companies, the worldwide pandemic boosted business in 2020.

The company’s founder and CEO Whitney Wolfe Herd recently said, “We’re profitable because of our commitment to engineering and authentic and genuine experience. Nobody, not in the physical world nor in the digital world, had ever built a technology platform or brand fully centered around women’s wants and needs. We identified this massive white space, and it has proven to be an incredible business model. This just proves that passion, purpose, and profit can coexist.”

A dating stock with a twist

Bumble Inc operates online dating and social networking platforms. The company provides subscription and credit-based dating products in North America, Europe, and other countries. The platform connects people and builds relationships across various life areas, including love, friendships, careers, and beyond. Bumble incorporated in 2020. The headquarters are in Austin, Texas.

Bumble has lots of competition. The Match Group (MTCH), which owns Match.com, Tinder, Meetic, OkCupid, PlentyOfFish, Ship, OurTime, and a total of over forty-five global dating companies that are other social media dating sites. However, Bumble.com is the first to have women talk first to set an “equal tone from the start.” Women make the first move on Bumble.

A successful IPO

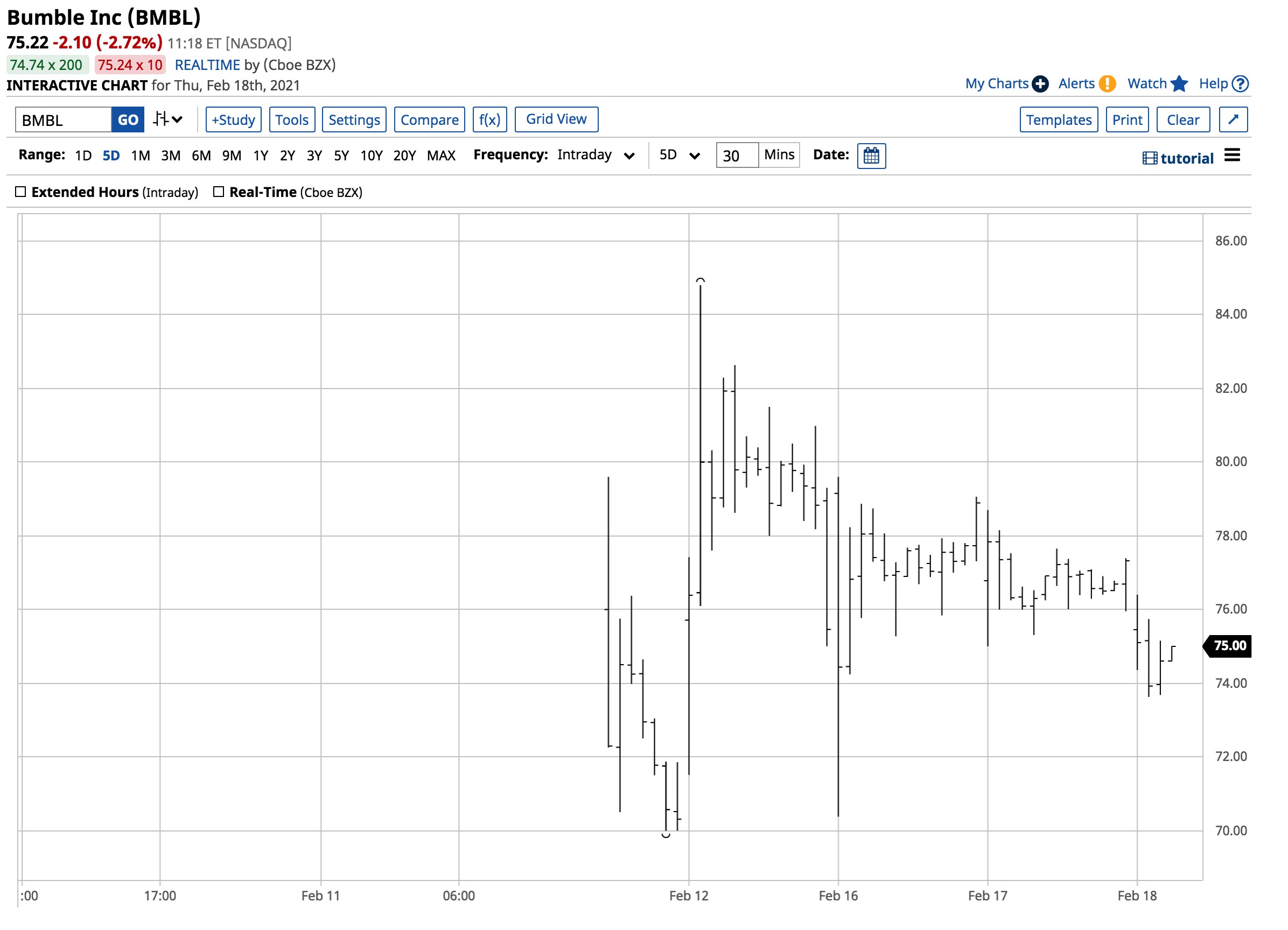

BMBL’s IPO was a huge success. The shares opened on February 11 at $76, 76.7% above the IPO price.

Source: Barchart

Source: Barchart

As the chart highlights, the shares reached a peak of $84.80 before pulling back to the $75.22 level on February 18.

Meanwhile, Bumble is not the CEO’s first rodeo in the sector. She was a co-founder of Tinder in 2012 when she was only 22 years old.

Turning a million settlement into a billion-dollar fortune

Whitney Wolfe Herd began working for MTCH in 2012 and claims she came up with the successful name “Tinder.” She was the vice president of marketing at Tinder when user growth among young people experienced explosive growth. Ms. Wolfe Herd left the company in 2014 and filed a lawsuit for sexual harassment. She received over $1 million-plus stock as part of a settlement with the company.

The CEO owns 21.5 million shares worth over $1.6 billion at last Friday’s closing price for BMBL. At 31, she is the youngest female CEO ever to lead a company.

Plans for the future

Ms. Wolfe Herd has big plans for BMBL. Her company’s philosophy fits squarely into the current political and social landscape. She told Yahoo Finance, “We are not scared to take a stance for what we believe aligns with our values and our mission. Historically, we banned guns from our platform, and just two weeks ago, we banned any form of body shaming. This is not going to be tolerated on our platform.” The company has zero-tolerance for hate and toxicity. It has taken a firm stance on what it deems harmful behavior on the website, including banning language that is fat-phobic, ableist, racist, colorist, homophobic, or transphobic. Ms. Wolfe Herd has made it clear that the website has rules to make its members comfortable and, “if you behave poorly, you cannot do it here.”

Social media websites have been under pressure to curb hate speech, extremism, and other forms of anti-social behaviors. Bumble now has 42 million monthly users across 150 countries. The company plans to increase its investment in Bumble Bizz and Bumble BFF for users to meet their next business partner or best friend. Ms. Wolfe Herd’s vision is for Bumble to grow with women who first join the app to find a partner and then use it to enhance their professional or personal lives.

Do not bet against Whitney Wolfe Herd

After her experience with sexual harassment, she became a driving force for Texas legislation that made sending lewd photos without permission a crime in the state. After Governor Greg Abbott signed the bill into law in 2019, Ms. Wolfe Herd said, “It is time that our laws mirror this way we lead double lives, in the physical and the digital. You look at government right now, it only protects the physical world. But our youth are spending a lot more time in the digital world than they are in the physical.”

At 31 years old, Whitney Wolfe Herd is an entrepreneur, a survivor of sexual harassment, and an advocate. She is also a newly minted technology billionaire in the social media world.

Her leadership is likely to make BMBL a growth stock for the coming years. Bet against her continued success at your risk.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

BMBL shares were trading at $71.17 per share on Friday morning, down $2.83 (-3.82%). Year-to-date, BMBL has gained 1.22%, versus a 4.91% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BMBL | Get Rating | Get Rating | Get Rating |