- Impressive performance since March

- Earnings growth support gains

- Revenue trends are positive

- A franchise in e-commerce pet supplies

- CHWY can continue to rise- The Tesla of the pet sector

People love their pets. Cats and dogs provide companionship, love, and a feeling of security. In 2020, dogs and cats have taken on an even more significant role in our lives as we spend a lot more time at home. In 2019, the United States spent $95.7 billion on pets. The number is likely to grow to $99 billion in 2020.

Like many other sectors of the economy, technology and e-commerce are making an ever-expanding footprint in the pet supplies business. Chewy, Inc. (CHWY) is a pure e-commerce business in pet supplies. The company has been around since 2010, with its headquarters in Dania Beach, Florida. CHWY is a subsidiary of PetSmart, Inc. and a publicly traded company.

CHWY provides pet food, treats, supplies, medications, and health products for dogs, cats, fish, birds, small pets, horses, and even reptiles. The company offers approximately 60,000 products from 2,000 partner brands. Ordering from Chewy is as simple as a click of a mouse.

PetSmart acquired Chewy in 2017 for around $3 billion to add an online business as a complement to its stores. In June 2019, CHWY’s initial public offering was at $22 per share. The company raised just over $1 billion at an $8.8 billion valuation. As of the end of last week, CHWY shares were trading at $74.94, and its market cap was almost $31 billion.

CHWY is a technology stock with a franchise, and our love of pets makes it a recession-proof business with tremendous growth potential. At the end of last week, PetSmart announced it would once again have an IPO. The ticker symbol will be WOOF, how appropriate!

Impressive performance since March

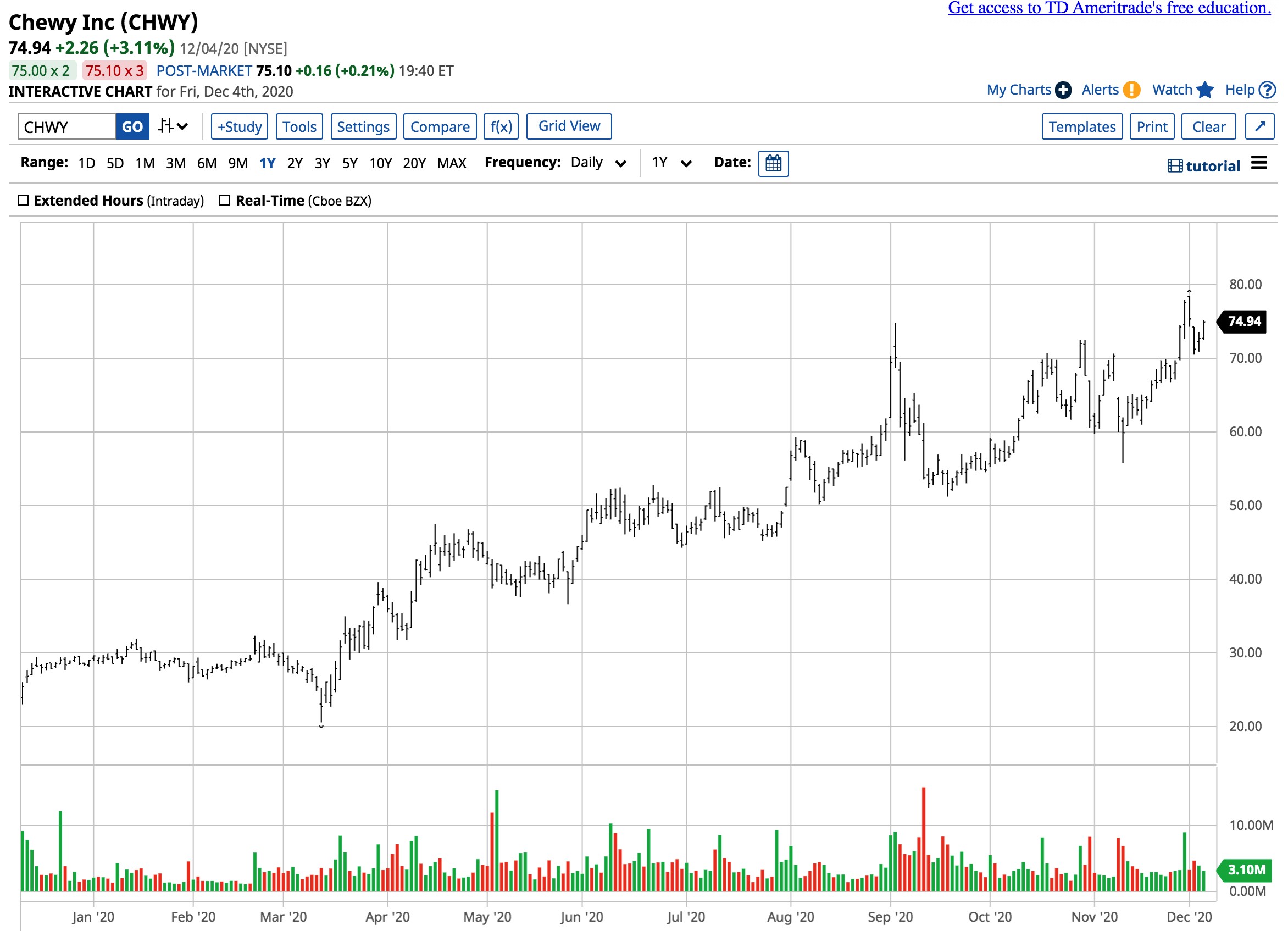

After falling to a low of $20.62 on March 12, 2020, during the heart of the risk-off selling in the stock market, CHWY shares have almost quadrupled.

Source: Barchart

Source: Barchart

As the chart highlights, CHWY peaked at $78.50 per share on December 1, a new record high for the company. The low this March was below the IPO price from June 2019.

Source: Barchart

The chart shows the impressive price action in CHWY over the past eight months after it trended lower in post-IPO trading from June 2019 through March 2020.

Earnings growth support gains

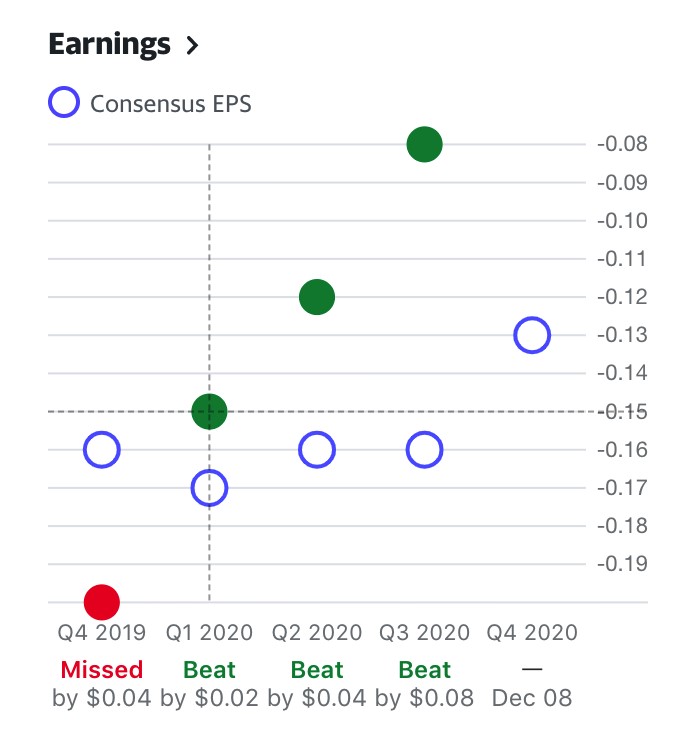

While CHWY is still a new business, the global pandemic in 2020 has supported its business. CHWY has yet to report a quarterly profit, but the EPS trajectory has been bullish.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart shows, after missing consensus projections by four cents per share in Q4 2019, CHWY has consistently beat the past quarters’ estimates. A survey of thirteen analysts on Yahoo Finance has an average price target of $73.15 for the stock, ranging from $49 to $100 per share.

Revenue trends are positive

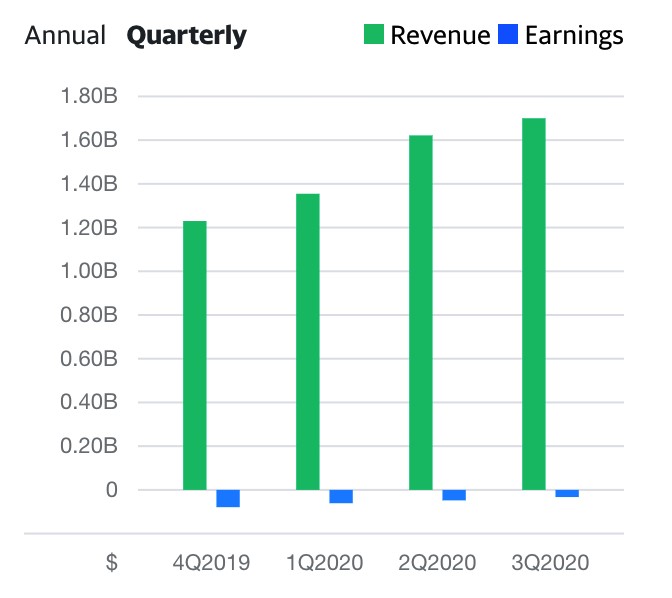

The trend in revenues is also supporting CHWY shares.

Source: Yahoo Finance

Source: Yahoo Finance

The annual revenue trend displays a steady growth trend.

Source: Yahoo Finance

Source: Yahoo Finance

The quarterly chart shows that in Q2 and Q3, revenues were higher than in 2017, and the combined revenues for the two quarters exceeded annual levels for 2018 and we almost at the full-year level in 2019.

A franchise in e-commerce pet supplies

Social distancing has caused many people to remain at home during the pandemic. E-commerce services have thrived. Amazon.com (AMAZ), the king of E-commerce, has seen its business explode.

Source: Barchart

Source: Barchart

The chart illustrates that AMZN shares have risen from a low of $1,626.03 in March to over the $3,160 level at the end of last week. AMZN shares have almost doubled as the market cap of the giant was at nearly $1.6 trillion. Companies like AMZN and CHWY have benefited from the pandemic as it hastened the demise of retail businesses.

Many of the consumer shopping habits developed in 2020 will remain as a legacy of the coronavirus. The ease of online ordering will change future behavior. Many consumers who were not tech-savvy and never used the services in the past will continue to use them in the post-pandemic era.

CHWY has a franchise in the pet supplies sector, which has a massive addressable market.

CHWY can continue to rise- The Tesla of the pet sector

I see CHWY as both a technology and a growth stock with the potential to become the Amazon of pet supplies. Jeff Bezos’s hunger for acquisitions could even make CHWY a target before its market cap grows too large. At $30.912 billion at the end of last week, with substantial growth prospects, AMZN’s infrastructure and logistics could create economies of scale for the company.

Meanwhile, CHWY is one of the 175 companies in the consumer staples group. According to Zacks Equity Research, CHWY’s positive earnings outlook trend and improving analyst sentiment has caused Zacks to rate the company’s shares a rank of #2 (Buy). CHWY shares have gained almost 140% in 2020, compared to an average return of 0.33% in the consumer staples sector.

Even if Jeff Bezos does not add CHWY to his portfolio, continued growth and market penetration could make the company the Tesla (TSLA) of pet supplies.

Many critics did not believe that TSLA would experience its share growth that has vaulted Elon Musk into the position as the world’s second-wealthiest person. Some thought that TSLA would disappear as the company would not have the revenues to service debt levels. They were dead wrong.

I can see CHWY rise to become the TSLA of the pet supplies industry in the coming years with similar share price growth. TSLA was trading at a split-adjusted $83.67 at the end of 2019 and was at the $580 per share level at the end of November. On Friday, it closed at $599.04. Moreover, CWHY, like most consumer staples, is a recession-proof business.

People love their pets. Pet foods, treats, medications, and other supplies are not discretionary products; they are requirements that will continue to support Chewy’s growth as it moves towards profitability. I would be a buyer of CHWY shares on price weakness, but the shares seem poised to continue to make higher lows and higher highs. The first level of technical support stands at the November 19 low of $55.81. A pullback into the $60s could be the most CHWY gives up as its business continues to expand.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

Chart of the Day- See Christian Tharp’s Stocks Ready to Breakout

CHWY shares fell $0.84 (-1.06%) in after-hours trading Tuesday. Year-to-date, CHWY has gained 172.93%, versus a 16.66% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CHWY | Get Rating | Get Rating | Get Rating |