Record cold weather is sweeping across the U.S this week. This should give retailers a good jump start on the all-important holiday sales as consumers buy warm weather apparel.

But one of last year’s hottest names, Canada Goose (GOOS) could give investors a chill when it reports earnings tomorrow morning.

Unlike last year, in which unseasonably warm weather persisted through Christmas, forcing retailers to offer deep discounts in order to unload inventory in January, Canada Goose, which makes and sells high-end winter coats, should be well-positioned to benefit from the early cold snap.

Unfortunately, GOOS faces some company-specific headwinds, including a valuation that’s as stuffed as its namesake down jackets.

GOOS has its initial public offering (IPO) in mid-2017 and built a head of steam in 2018, nearly tripling in price to a peak of $70, before a couple of disappointing reports sent valuation and shares to the current $40 level.

But, I think there is still more downside to come, possibly into the $30 level, or another 25%, in the coming months.

Valuation is still very high at nearly 60x eps while expectations for revenue growth has declined from over 60% annually in 2018 to much more moderate to 25% in 2019 and 2020.

A few of the challenges are broad macro issues such as the consumers pulling back spending over the past few months on worries of a slowing economy especially for the segment of people that would buy GOOS jackets as an aspirational item, which can cost north of $1,000, opting for a more economical choice.

This also speaks to the continuing shift towards online shopping. While GOOS does sell wholesale to some department stores it was predicting much of its growth on the rollout of company-owned locations. It currently operates just 11 stores and expansion overseas has proved more difficult than expected.

But to achieve the scale and international footprint it needs to build its online presence. Like many other retailers, it’s finding that running it’s own direct-to-consumer site isn’t enough and needs the likes of Amazon (AMZN) and other third-party platforms.

Unfortunately, it’s also finding that being on AMZN creates a new set of issues which includes knocks-offs of fake merchandise or competitors paying for higher listing position on search.

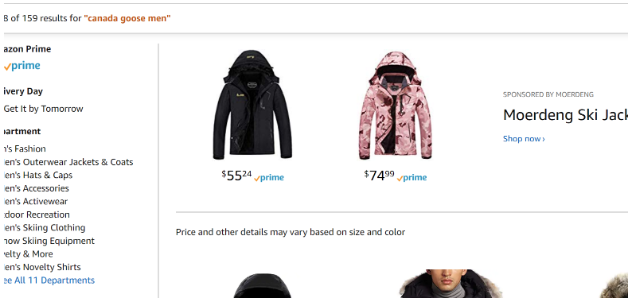

For example, when I type in ‘Canada Goose Men” into AMZN, the first listings offer similar styles that sell for about 1/10th of the price. Goose’s products don’t appear until the third row down.

Goose’s high price point does give it great margins. But, fashion by its very nature is fickle to trends especially the high end unless something is deemed “a classic” and I don’t think GOOS has achieved that status yet.

The holiday season will be crucial to Goose’s profitability it may be too early for the company to provide solid guidance one way or another.

I think the company is going to need to continue to tamp down growth expectations and the stock will take another leg lower.

My strategy is to buy a put spread in the December expiration using the 40/35 strikes for a $2 net debit. If shares are below $35 come Christmas time I will have a nice present of a 125% profit.

GOOS shares were trading at $39.16 per share on Tuesday afternoon, up $0.01 (+0.03%). Year-to-date, GOOS has declined -10.43%, versus a 25.34% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GOOS | Get Rating | Get Rating | Get Rating |