GoPro, Inc. (GPRO - Get Rating) develops and sells cameras, mountable and wearable accessories, and subscription services and software internationally.

The company is currently witnessing a competitive landscape where smartphones with advanced camera capabilities are becoming more affordable. In the second quarter, revenue declined 3.9% year-over-year.

However, GPRO launched a go-to-market strategy in the second quarter of 2023, including restoring GoPro camera pricing to pre-pandemic levels. This strategic decision aims to reposition GPRO as a premium brand in the market and reclaim its competitive edge.

Brian McGee, GPRO’s CFO and COO, said, “In Q2, GoPro saw an immediate retail sales and GoPro subscription lift as a result of our mid-quarter go-to-market strategy shift that included a return to pre-pandemic pricing and a greater emphasis on retail sales. We exceeded our Q2 expectations for unit sales, revenue, and subscriber growth, all positive indicators that our strategy shift is working.”

Although GPRO’s business strategy might be beneficial, I think this might not be the right time to invest in the stock. Let’s delve deeper into some of its key metrics to understand the situation.

Analyzing GPRO’s Financial Performance

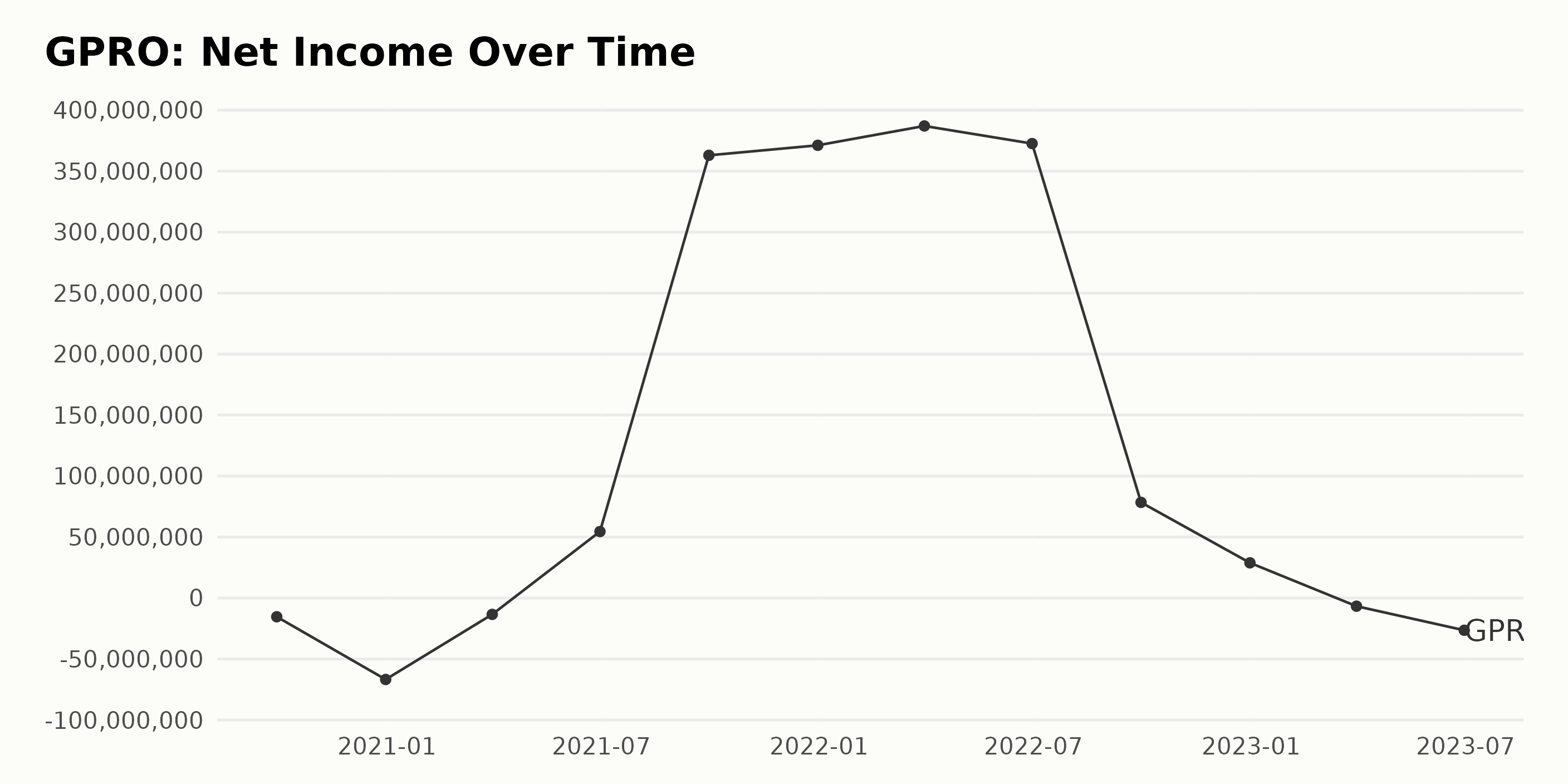

GPRO’s trailing-12-month net income from 2020 to 2023:

- Initially, in late 2020 through to early 2021, GPRO’s net income was in a deficit, with lows of negative $15.38 million and negative $66.78 million recorded on September 30, 2020, and December 31, 2020, respectively.

- A significant positive trend was then noted from March 2021, with a net income rebounding to negative $13.42 million, progressing steadily upwards over the following quarters, culminating in a valuation of $387.02 million by March 2022. This dynamic reflects a growth rate of 2766% during that period.

- Post this peak, a rapid decline is seen, with the net income reducing to $78.4 million and $28.84 million in September 2022 and December 2022, respectively.

- Into 2023, GPRO returns into a deficit position, with net incomes of negative $6.70 million and negative $26.43 million recorded for March 2023 and June 2023, respectively.

In conclusion, the data shows quite a volatile performance for GPRO. Despite enjoying an impressive growth rate in its net incomes through 2021 into early 2022, the trend reversed soon after, with GPRO’s net incomes dipping back into negative territory by early 2023.

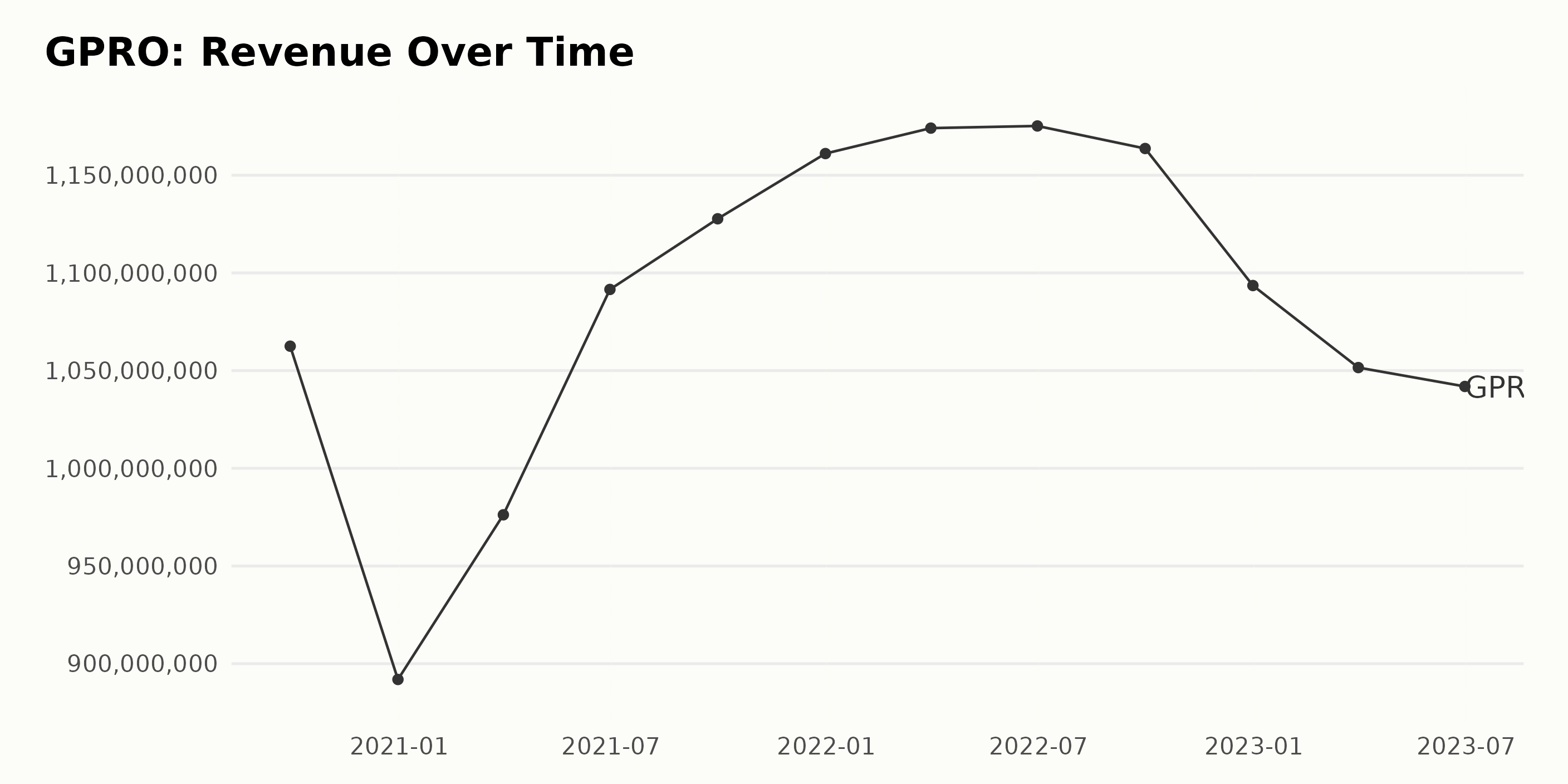

The series of data describes the trend and fluctuations in the reported trailing-12-month revenue of GPRO from the third quarter of 2020 to the second quarter of 2023. Here is a summarized analysis of the trend:

- In the third quarter of 2020, the revenue was at $1.06 billion.

- Followed by a decrease to about $0.89 billion by the last quarter of 2020.

- Revenue rose again in the first quarter of 2021 to around $0.98 billion and continued its upward trajectory, reaching $1.17 billion at the end of the second quarter of 2022.

- The data shows slight instability between the third quarter of 2022 and the fourth quarter of 2022, with values fluctuating around $1.16 billion and $1.09 billion, respectively.

- A gradual decline is seen from the first quarter of 2023, having a reported value of about $1.05 billion, to $1.04 billion by the second quarter of 2023.

Focusing on more recent data, the trend since the first quarter of 2023 has generally been downward. The last value in the series, corresponding to the second quarter of 2023, reports revenue of about $1.04 billion, lower than the start of the period ($1.06 billion in the third quarter of 2020). This represents a decrease of approximately 1.8%, indicating a slight contraction over this period. Lastly, it’s important to note while there have been fluctuations throughout the mentioned period, GPRO’s revenues beyond the first quarter of 2021 have remained above $1 billion despite some volatility.

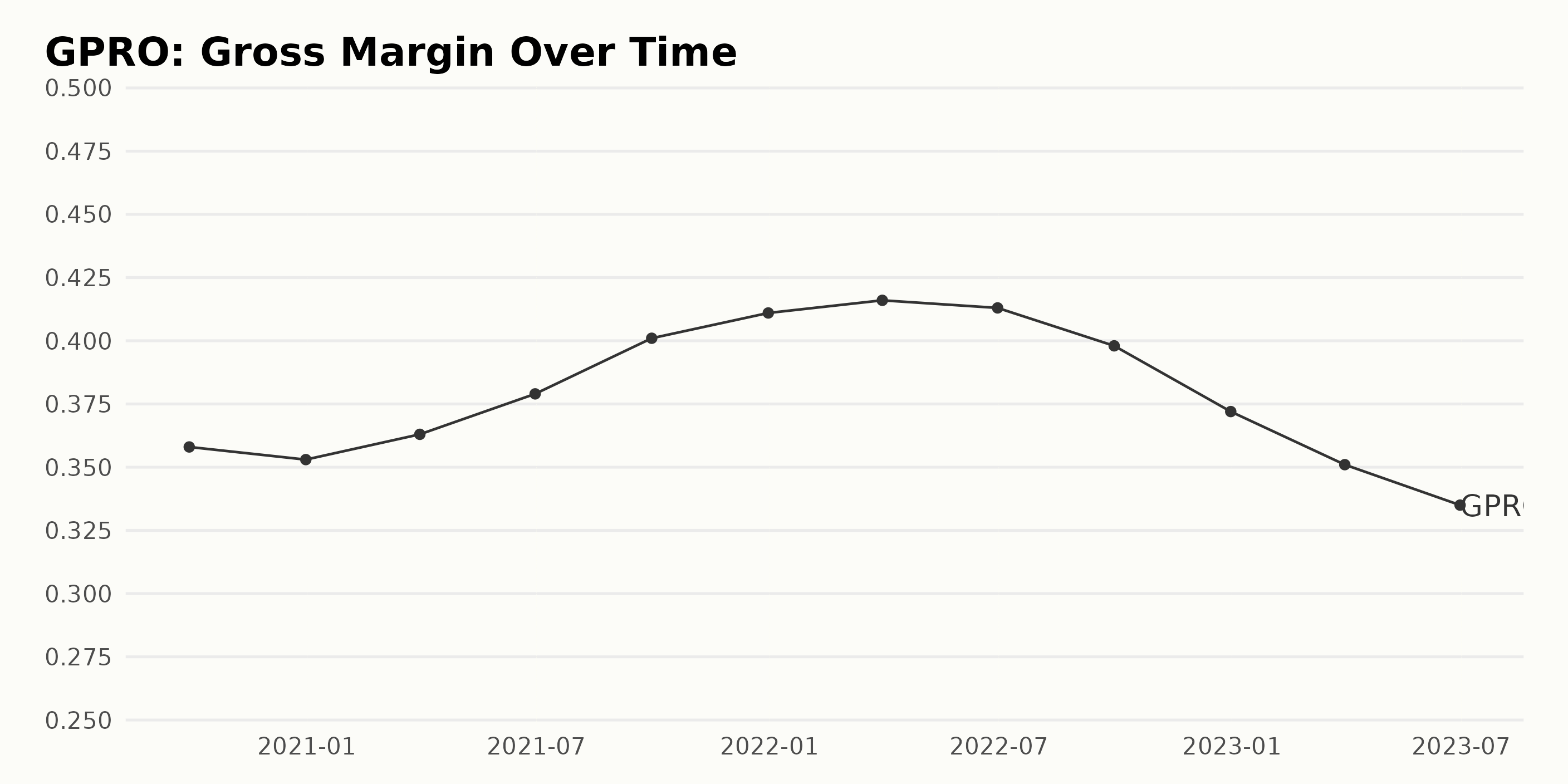

This series of data reports the gross margin of GPRO from September 2020 to June 2023, documenting the company’s financial performance over this period. The data representation by month and year is as stated below:

- September 2020 – gross margin was 35.8%.

- December 2020 – gross margin decreased slightly to 35.3%.

- March 2021 – saw a rebound with an increase to 36.3%.

- June 2021 – saw another rise to 37.9%.

- September 2021 – marked a significant increase to 40.1%.

- December 2021 – continued the upward trend, reaching 41.1%.

- March 2022 – saw a further increase to 41.6%.

- June 2022 – gross margin decreased slightly to 41.3%.

- September 2022 – saw a larger decrease to 39.8%.

- December 2022 – observed more decline to 37.2%.

- March 2023 – carried on the falling trend down to 35.1%.

- June 2023 – hit the lowest point at 33.5% in the series.

Putting more emphasis on the recent data, it is clear that beginning September 2022, GPRO has been experiencing a downtrend in its gross margin, falling from 41.3% in June 2022 to 33.5% in June 2023, signifying an overall decrease of 7.8% points. From the first value (35.8% in September 2020) to the last value (33.5% in June 2023), there is a measurable gross margin reduction by 2.3%, indicating a negative growth rate during this period for GPRO.

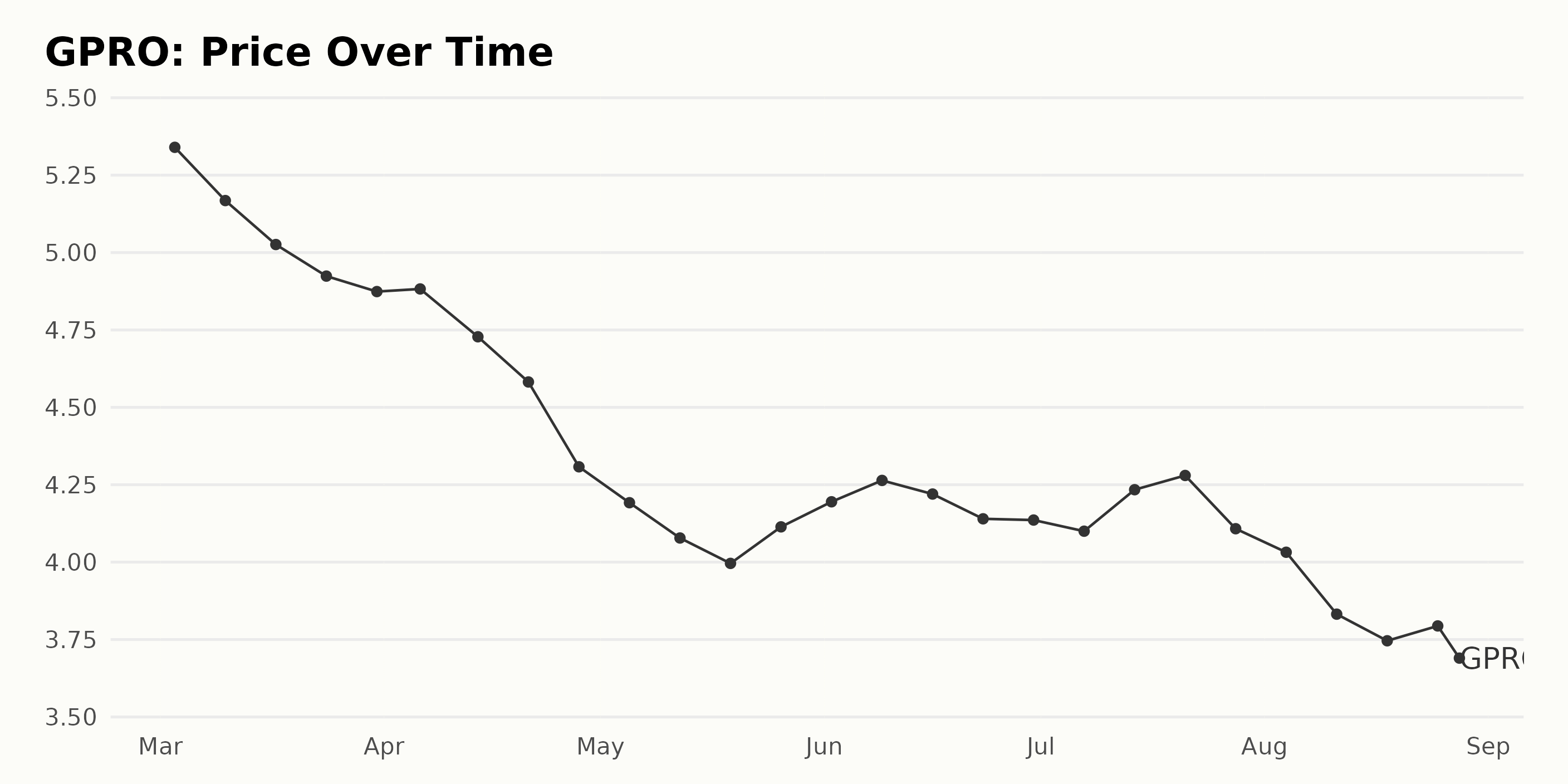

Analyzing GPRO’s declining stock performance from March to August 2023

Looking closely at the share price data of GPRO from March to August 2023, a clear downward trend can be observed.

- The price hovered at $5.31 on March 3, 2023

- It gradually fell over the subsequent months, falling to $4.11 by the end of July.

- There was a slight increase in June, from $4.08 on June 9 to $4.22 on June 16.

- From mid-June onwards, the share price started to show signs of a declining trend again until the end of July, despite the transient increase to $4.28 on July 21.

- In August, the share price continuously fell from $4.03 on August 4 to as low as $3.74 on August 18, then slightly increased to $3.67 by August 28.

The overall growth rate during this period is negative – indicating that the company’s shares were less valuable at the end than they were at the beginning. The decreasing trend seemed to accelerate during April, May, and the second half of July. Here is a chart of GPRO’s price over the past 180 days.

Assessing GPRO’s POWR Ratings Performance: Quality, Value, and Sentiment

GPRO has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #29 out of 42 stocks in the Technology – Hardware industry.

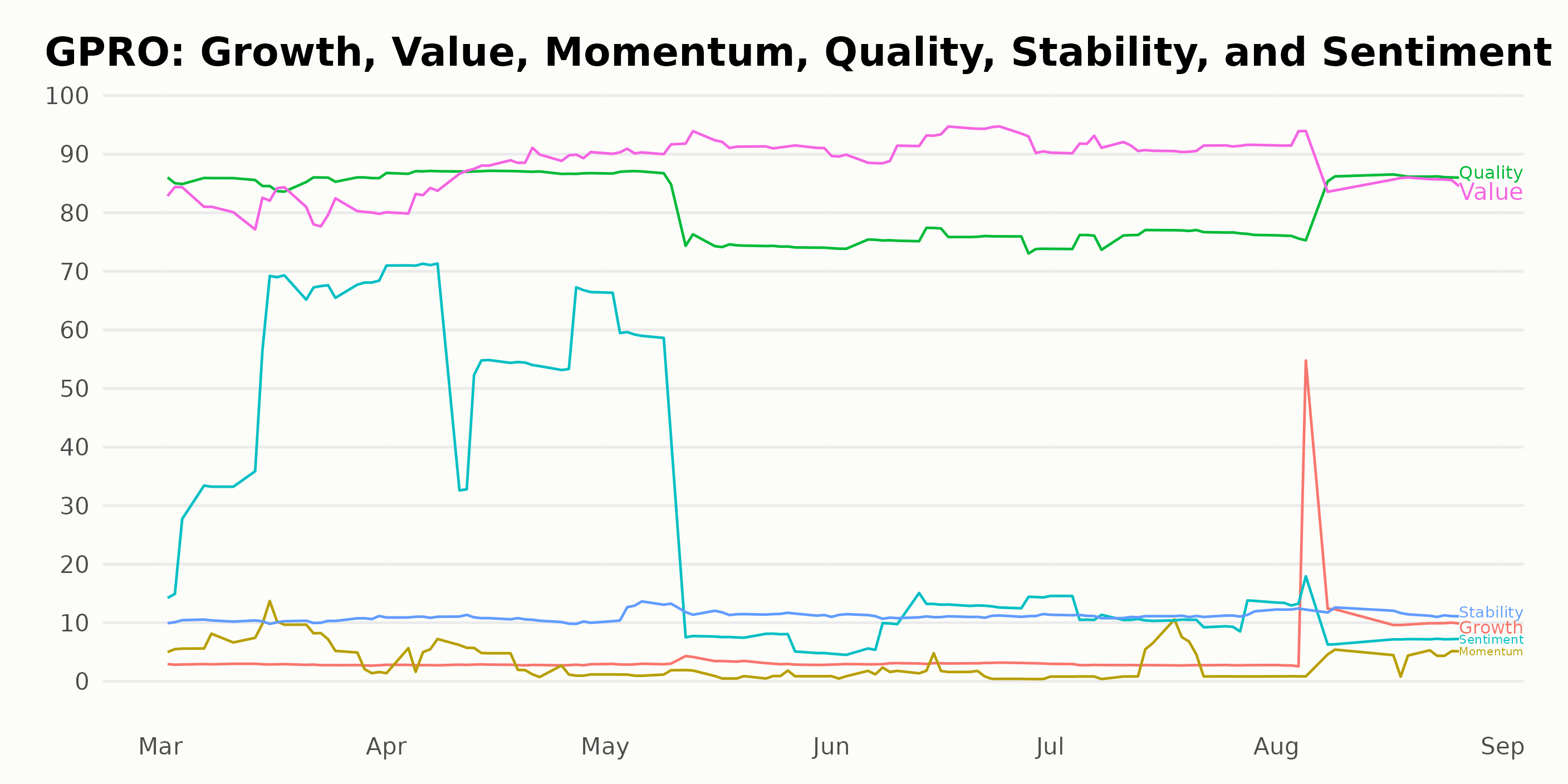

The three most noteworthy dimensions in the POWR Ratings for GPRO are Quality, Value, and Sentiment. Let’s dive into key instances:

- Quality: This dimension has highly favorable ratings over time. It started with 85 points in March 2023 and varied between 75-87 in the subsequent months through August 2023.

- 9 by August 2023, with occasional rises in between.

These trends provide a mixed insight into GPRO market performance across these dimensions over the given period. While the company’s Quality and Value illustrate positive indicators, the dwindling sentiment must be addressed critically.

How does GoPro Inc. (GPRO) Stack Up Against its Peers?

Other stocks in the Technology – Hardware sector that may be worth considering are Panasonic Holdings Corporation (PCRFY - Get Rating), TransAct Technologies Incorporated (TACT - Get Rating), and Seiko Epson Corporation (SEKEY - Get Rating) — they have better POWR Ratings. For more Strong Buy-rated Hardware stocks set to outperform, click here.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

GPRO shares rose $0.02 (+0.54%) in premarket trading Tuesday. Year-to-date, GPRO has declined -26.71%, versus a 16.51% rise in the benchmark S&P 500 index during the same period.

About the Author: Rashmi Kumari

Rashmi is passionate about capital markets, wealth management, and financial regulatory issues, which led her to pursue a career as an investment analyst. With a master's degree in commerce, she aspires to make complex financial matters understandable for individual investors and help them make appropriate investment decisions. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GPRO | Get Rating | Get Rating | Get Rating |

| PCRFY | Get Rating | Get Rating | Get Rating |

| TACT | Get Rating | Get Rating | Get Rating |

| SEKEY | Get Rating | Get Rating | Get Rating |