Hewlett Packard Enterprise (HPE - Get Rating) in Palo Alto, Calif., is a global edge-to-cloud company that helps enterprises accelerate outcomes by extracting value from all of their data, anywhere. With offerings spanning Cloud Services, Compute, High-Performance Computing and AI, Intelligent Edge, Software, and Storage, HPE provides a consistent experience across all clouds and edges, assisting customers in developing new business models, engaging in new ways, and in increasing their operational performance.

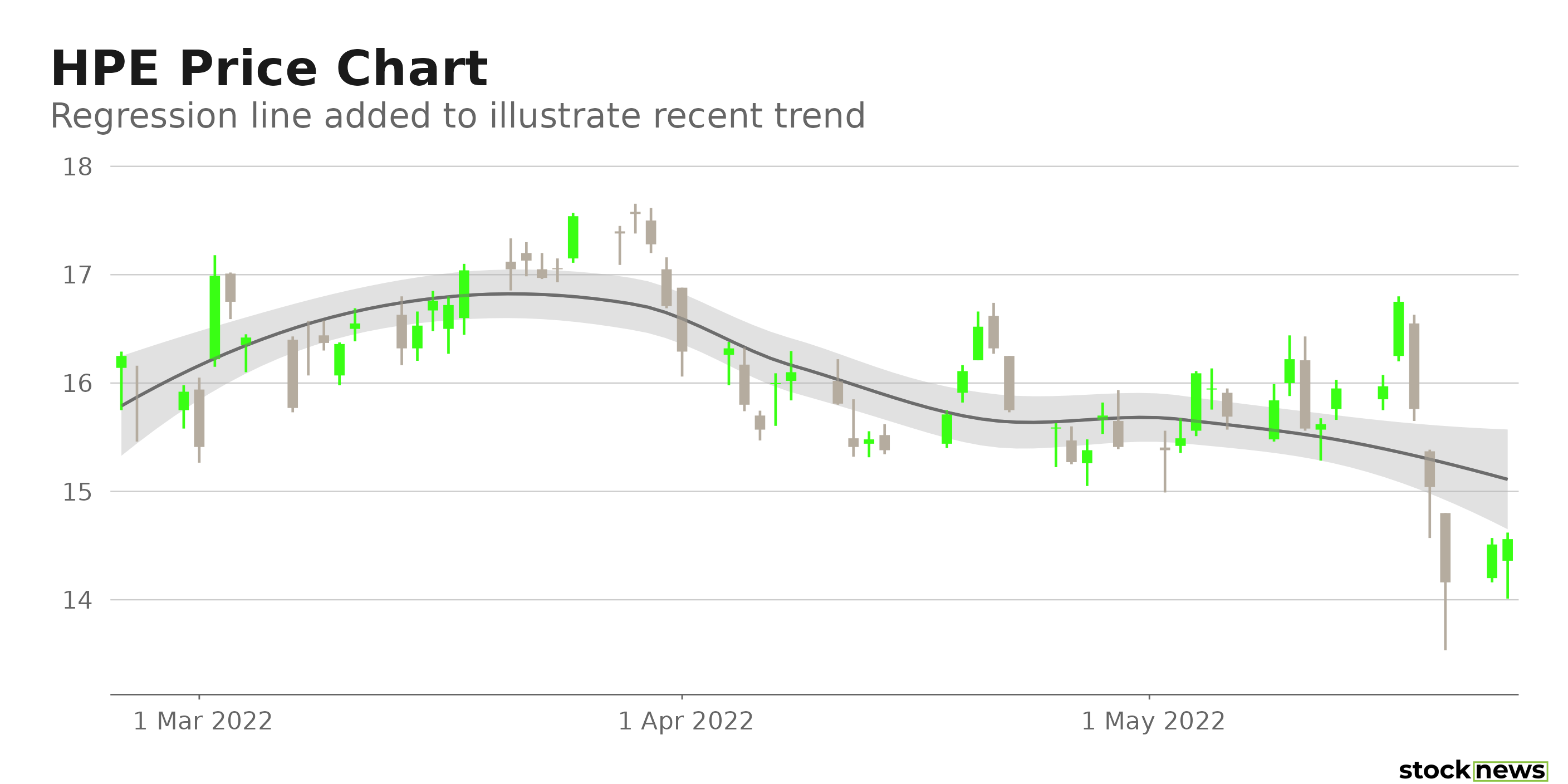

While the stock is down 11% in price over the past year, HPE’s robust customer demand and profitability, differentiated edge-to-cloud strategy, and portfolio innovation should help it gain a strong foothold in the industry.

Here is what could shape HPE’s performance in the near term:

Recent Developments

This month, HPE announced its continuing commitment to Europe by constructing the region’s first factory for next-generation high-performance computing (HPC) and artificial intelligence (AI) systems to improve customer delivery and boost the region’s supplier ecosystem. The new facility will produce HPE’s industry-leading systems as custom-designed solutions to further scientific research, mature AL/ML projects, and boost innovation.

In April, HPE announced the launch of HPE Swarm Learning, a groundbreaking AI solution that accelerates insights at the edge, from medical diagnosis to credit card fraud detection, by sharing and unifying AI model learnings without sacrificing data privacy.

Also, last month, HPE announced the completion of 24 research tests by the HPE Spaceborne Computer-2 (SBC-2), the first in-space commercial edge computing and AI-enabled system to run on the International Space Station (ISS), reducing time-to-insight from months and days to minutes.

Robust Financials

During the first quarter, ended Jan. 31, 2022, HPE’s net revenue increased 1.9% year-over-year to $6.96 billion. Its operating income increased 101.8% year-over-year to $448 million. The company’s net income grew 130% from its year-ago value to $513 million, while its EPS grew 129.4% from the prior-year quarter to $0.39.

Impressive Growth Prospects

The Street expects HPE’s revenues and EPS to rise 2.9% and 6.6%, respectively, year-over-year to $28.6 billion and $2.09 in fiscal 2022. In addition, HPE’s EPS is expected to rise at a 6.16% CAGR over the next five years. Furthermore, the company has an impressive earnings surprise history; it topped Street EPS estimates in all the trailing four quarters.

Discounted Valuation

In terms of forward non-GAAP P/E, the stock is currently trading at 6.95x, which is 61.9% lower than the 18.26x industry average. Also, its 1.04x forward EV/Sales is 62.8% lower than the 2.79x industry average. Furthermore, HPE’s 0.88x forward Price/Book is 77.2% lower than the 3.86x industry average.

Consensus Rating and Price Target Indicate Potential Upside

Among the nine Wall Street analysts that rated HPE, three rated it Buy, and four rated it Hold. The 12-month median price target of $17.13 indicates a 17.7% potential upside. The price targets range from a low of $14.00 to a high of $21.00.

POWR Ratings Reflect Solid Prospects

HPE has an overall grade of B, which equates to a Buy rating in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. HPE has a B grade Value, which is justified given the company’s lower-than-industry multiples.

Among the 53 stocks in the C-rated Technology – Communication/Networking industry, HPE is ranked #8.

Beyond what I stated above, we have graded HPE for Sentiment, Growth, Quality, Stability, and Momentum. Get all HPE ratings here.

Bottom Line

HPE has been making consistent product and service improvements and several strategic collaborations to boost its growth. Despite persistent supply chain difficulties, it intends to provide higher-quality earnings, as seen by its improved gross margin and Q1 EPS. In addition, analysts expect its EPS and revenue to soar in the near term. So, we think the stock could be an ideal bet now.

How Does Hewlett Packard Enterprise Company (HPE) Stack Up Against its Peers?

HPE has an overall POWR Rating of B, which equates to a Buy rating. Check out the other stock within the same industry with an A (Strong Buy) rating: Extreme Networks Inc. (EXTR - Get Rating).

Want More Great Investing Ideas?

HPE shares were unchanged in premarket trading Wednesday. Year-to-date, HPE has declined -6.99%, versus a -17.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| HPE | Get Rating | Get Rating | Get Rating |

| EXTR | Get Rating | Get Rating | Get Rating |