The stock market is laser-focused on interest rate cuts, with various Federal Reserve statements indicating how hawkish or dovish the FOMC plans to be often causing wild swings in the S&P 500.

But, while the main thing Wall Street focuses on is the number of rate cuts the Fed is likely to deliver, there is actually much more important recent news from Jerome Powell and the Fed’s Open Market Committee or FOMC.

So let’s start by looking at what the market currently expects in terms of rate cuts, how effective those are at stimulating the economy, and what important news investors might have missed, about the most important Fed actions in years.

Rate Cuts Have a Moderately Stimulatory Effect on the Economy… If Done Early Enough

The market LOVES rate cuts, which is why it’s worth knowing what the bond market, via futures contracts, is pricing in at any given time.

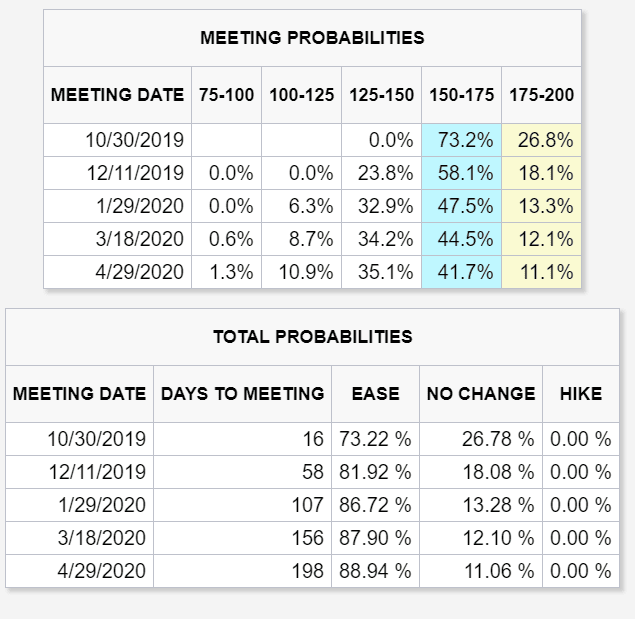

(Source: CME Group)

Currently, the bond market estimates a 73% probability of an October cut, and then a 50% probability of another one by April 2020. The reason stock investors love lower rates is because they tend to drive up prices, all else being equal.

With FactSet Research now reporting the consensus for 2019 S&P 500 EPS growth at 1.1% in 2019, lower rates are might help the consensus 13% market rally analysts expect actually happen.

But what about the actual economy? How much do rate cuts actually help Main Street, and

Moody’s Analytics estimates each 25 bp rate cut boosts economic growth by 0.1% to 0.15% within 12 months. However, there is a lot of uncertainty surrounding the Fed’s ability to head off recessions with rate cuts, since it can find itself “pushing on a string”.

Basically, even if it costs little to nothing to borrow, debt is still a liability that few consumers or businesses want to take on if they are worried about a shrinking economy and potential job losses.

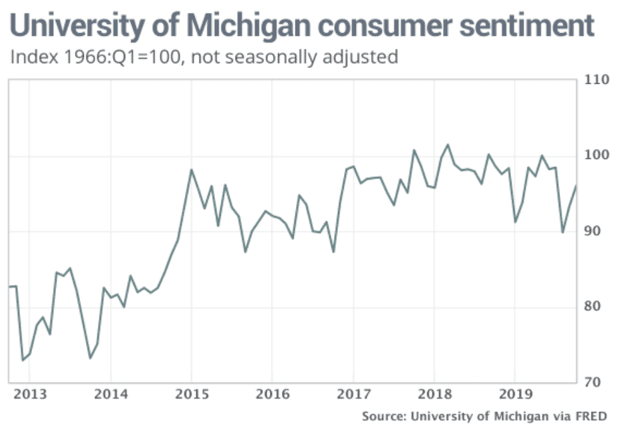

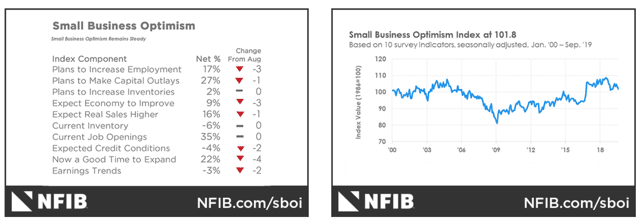

This is why I’m with the Fed doves when it comes to cutting rates. An ounce of prevention is worth a pound of cure. The time when rates cuts will do the most good is when consumer confidence is still strong, as it is now.

(Source: MarketWatch)

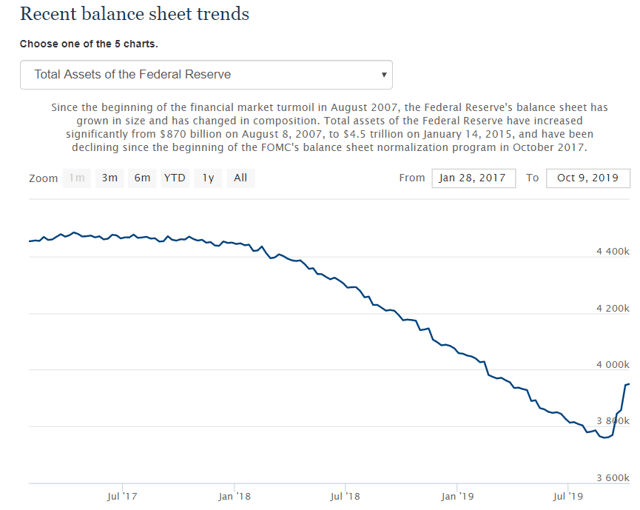

But during the Great Recession, the Fed tried its hand at quantitative easing, meaning buying $4 trillion in bonds, to try to stimulate the economy. That is what the Fed is planning to do again, starting October 15th, for six months, to the tune of nearly $400 billion…kind of.

The Most Important Fed News In Years And What It Likely Means for Stocks

On Friday, Oct 11, the Fed announced it would start buying $60 billion per month worth of 5 to 52 week US T-bills to stabilize the Repo market, beginning on October 15th and running through Q2 2020.

Unlike the QE the Fed did between 2008 and 2013, which was designed to lower long-term interest rates, this is merely meant to keep the $3 trillion overnight lending market that banks use to balance their books each day, running smoothly. The seizing up of the repo market in 2008 was largely what brought about the Financial Crisis because banks refused to lend out of fear of running out of liquidity.

The Federal Reserve is adamant, with no less than Chairman Jerome Powell, Dallas Fed President Robert Kaplan and other FOMC members saying this is not quantitative easing and thus should have little stimulatory effects on the economy. That may be true in a direct fashion, but it will do a lot to calm fears of another impending crisis and could have modestly stimulatory effects as I’ll now explain.

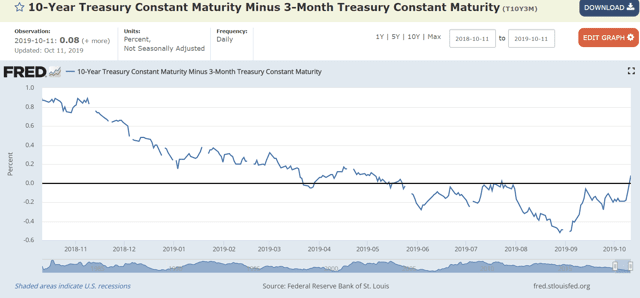

The yield curve steepened by 8 basis points on Friday, the strongest single-day gain in the spread between 10-year Treasury yields and three-month notes since May 7th.

In the last six weeks the 10y-3m yield curve, the most accurate single recession forecasting tool ever discovered is up 60 basis points. From a low of -52 bp it’s now positive 8.

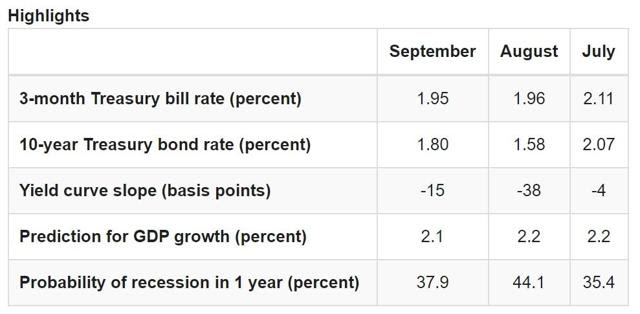

That’s the difference between 48% 12-month recession risk and 32%, based on the Cleveland Fed’s economic growth/recession prediction model.

(Source: Cleveland Federal Reserve)

(Source: Cleveland Federal Reserve)

Why is the Fed’s “none QE” bond-buying potentially good news? Because if the Fed follows through with its plans, it could buy almost $400 billion (some analysts think it will extend the program) or more worth of ultra-short-term treasuries.

(Source: Federal Reserve)

Whether the Federal Reserve wants to call this QE 5 or not, its balance sheet is up nearly $200 billion in the last month, and now that’s set to expand by nearly $400 billion more in the coming six months.

That will likely drive the short-end of the curve lower, steepening the curve. The direct benefits to the economy would indeed be slight, with banking becoming SLIGHTLY more profitable. Given that our economy continues to grow at a modest 1.3% to 2.0% rate right now (depending on which models you look at), that small banking profitability boost should cause GDP growth to accelerate a bit or at least stabilize at current levels.

But even a modest increase in short-term liquidity, when combined with healthier banking profits would create an incentive for increased lending to businesses and consumers who remain resiliently confident and looking to spend/grow their businesses.

Does this ensure that the economy will improve in the coming months? No. But as long as the trade conflict doesn’t get worse, it should go a long way in minimizing the risks of a recession and thus bear market, in 2020 and 2021.

What implications does that have for stocks? Since 1945 we’ve had just two non-recessionary bear markets, one of which was a 22% single-day crash in 1987. This means that any pullbacks/corrections we face during the next 12 to 18 months are more likely to be run of the mill buying opportunities and not the start of a “here comes the big one” market crash that so many have feared has been imminent for the past decade.

Bottom Line: The Fed’s Unofficial QE5 Might Be Just What We Need to Ensure No Recession or Bear Market in 2020 or 2021

Don’t get me wrong, I’m not claiming there is now zero chance of a recession in 2020 or 2021 or a bear market that has always accompanied economic contractions.

There are no guarantees on Wall Street, merely probability-based estimates of what’s most likely to happen given the best available data and evidence we have today.

However, based on the current state of the economy (1.3% to 2% growth this quarter and 1.5% to 2% next year), the Fed’s decision to restart QE (in all but name), at the short end of the yield curve this time, is potentially very good news.

- the un-inverted yield curve will now likely steepen (barring trade talks breaking down again)

- bank profitability will increase modestly (increasing incentives to lend more)

- the overall economy will potentially gain a modest boost as long as consumer and business confidence remains at current levels

While the Fed’s $400 billion in planned T-bill purchases isn’t likely to send the economy or stock market soaring, it comes at the right time to stabilize growth at levels that make recessions and bear markets far less likely.

More importantly, with the October 10th trade deal likely to modestly boost consumer and small business confidence in November, more of the stimulatory effects of recent rate cuts are likely to be spent, thus enhancing the multiplier effect and keeping US growth the envy of the developed world.

While market volatility is likely to persist over the next year or two, that’s table stakes for anyone who wants to own the best performing asset class in history.

As Joshua Brown aka “the Reformed Broker” says “volatility isn’t risk, it’s the source of future returns.”

Which is why I and the Dividend Kings’ are sticking with our long-term and carefully constructed investing plans which aim to profit from such volatility by

- buying above-average quality dividend stocks at below-average or outright firesale prices

- holding on or adding to our positions as long as fundamentals remain intact and dividends remain safe

- getting paid handsomely (2.7% to 5.6% on our various portfolios) while we wait for trustworthy and competent management to execute on each companies long-term growth plan

Combined with proper risk management, based on your individual risk profile, this is how you can ultimately profit from this potentially game-changing Fed news and maximize the chances of achieving your long-term financial goals.

.INX shares were trading at $298.96 per share on Wednesday morning, up $0.08 (+0.03%). Year-to-date, .INX has gained 21.29%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| .INX | Get Rating | Get Rating | Get Rating |