Recession is understandably a major fear of many investors. Not just because the last one saw the US economy fall by 5% (worst once since 1945) but because the S&P 500 crashed 57% by the March 9th, 2009 lows.

In December 2018 we saw a spike in recession fears, triggered by a combination of worries over the US/China trade conflict and concerns that the Fed wouldn’t cut rates fast enough to head off an economic contraction.

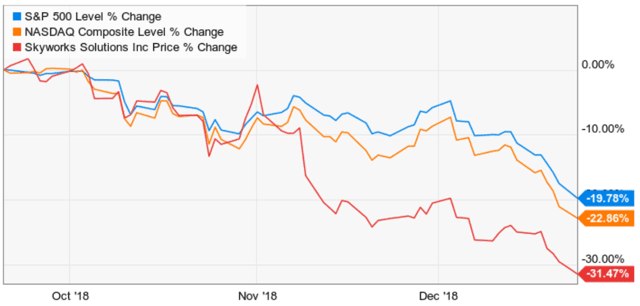

(Source: Ycharts)

As a result, the S&P 500 plunged 17% within three weeks and ended up closing down 19.8% from its all-time highs, a hairsbreadth from an official bear market. More trade-sensitive tech stocks drove the Nasdaq into a bear market while chip makers like Skyworks Solutions (SWKS) crashed 31%.

Today we face a lot of uncertainty surrounding risks that might potentially cause a recession and bear market including

- US/China trade conflict that will likely persist through 2020

- US political uncertainty created by impeachment proceedings

- a potential government shutdown starting November 21st

- Brexit uncertainty

- Federal Reserve that might not cut rates as fast as the bond/stock market expect

However, despite all these headwinds I’m not losing a wink of sleep worrying about recession, or how it might affect my 100% stock retirement portfolio. That’s for three important reasons.

Reason One: Recession Risks Are 33% And Have Decreased Significantly Over the Past Month

According to the bond market, via the Cleveland Feds/Haver Analystics yield curve model, the 12-month recession risk is down to 33% from its recent highs of 48%. That means that assuming that current economic conditions persist, there is a 67% probability of no recession in 2020 or 2020.

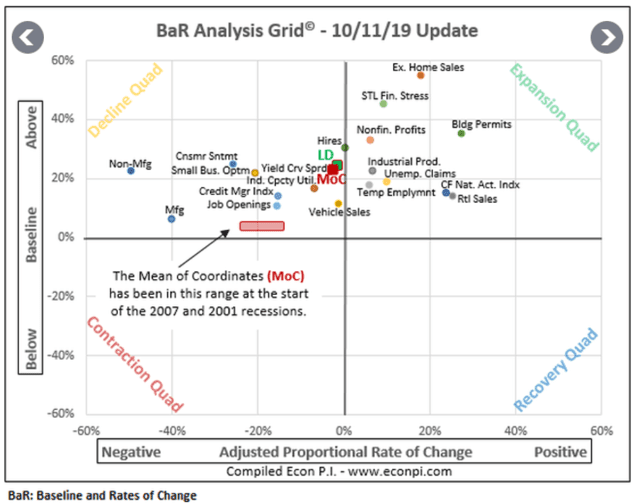

That model is supported by the economic fundamentals, including 19 leading indicators that collectively predicted the last four recessions.

(Source: David Rice)

Here’s where those 19 indicators stand today, graphed based on how high they are above historical baseline and how fast they are contracting on a month to month basis.

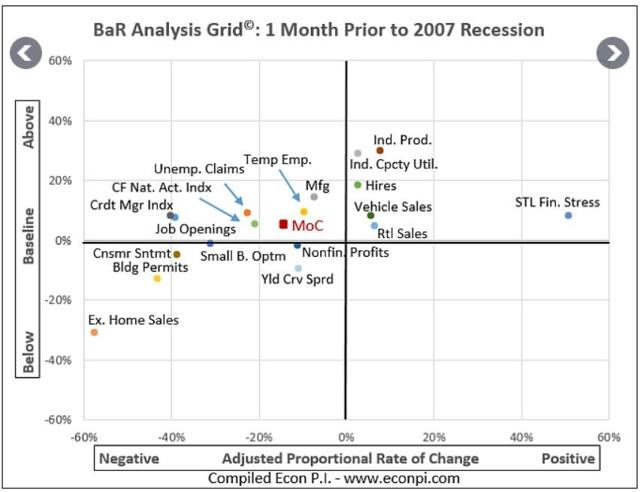

This is what it looks like right before a recession begins. The average of all indicators (the red MoC dot) is well above recessionary levels. According to David Rice, who created and maintains this valuable macroeconomic monitoring tool,

- 20% above baseline is the cutoff for when to start worrying

- 15% above baseline is when a recession becomes likely (though not inevitable)

(Source: David Rice)

Here are how high the average of all indicators was in the months before the last three recessions. We’re currently 24.5% above baseline and the eight most sensitive indicators, including the yield curve, are at 26.1% above baseline.

Given that the Fed is planning to buy $60 billion worth of 5 to 52 week T-bills starting in November and running through at least Q2 2020, the yield curve is likely to steepen, banking profitability will go up a bit, and the economy will see modest stimulation.

We also can’t forget that we’ve had two rate cuts, each which adds $47 billion to the economy via lower borrowing costs. Mind you that doesn’t necessarily mean that companies or consumers will spend that money and thus boost the economy. For that to happen we need to see strong confidence, which has a plausible story behind it to keep sentiment high.

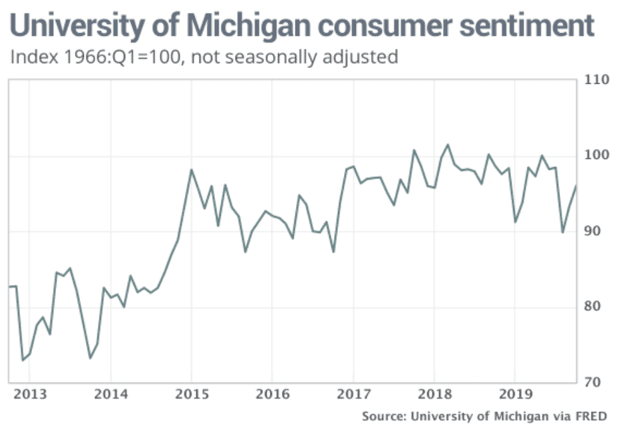

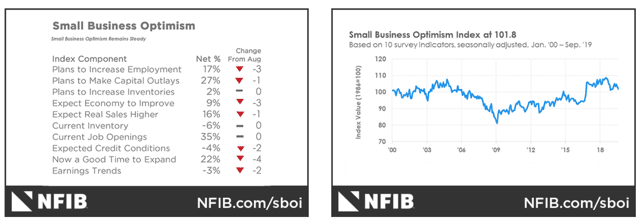

(Source: MarketWatch)

But consumer confidence, thanks to the strongest job market in 50 years, is still near all-time highs. Similarly, small business confidence remains at the strongest levels in years (higher than any time since 2004).

Maybe it’s down a bit from 2018’s record levels, but most companies are still looking to hire and expand. Which brings us to the latest bit of good, confidence-boosting news, the partial China/US trade deal.

Reason Two: US/China Partial Trade Deal Likely Means Things Will Get Slightly Better, Not Worse

The October 10th trade deal, while far from perfect, is a step in the right direction.

- October 15th tariffs (25% to 30% on half of US imports from China) are called off indefinitely.

- China will buy $40 to $50 billion more in annual agricultural imports

- 5 weeks of negotiations planned for the November talks (phase two)

Now I’m sure that many investors are skeptical of talks about a potential breakthrough in November (Trump hinted a final deal might be signed with Chinese President Xi then) and so am I.

In reality, the trade talks are likely to last through much of 2020 given the important and thorny issues we’re dealing with including

- non-tariff barriers for US companies

- intellectual-property protections

- cybersecurity

- government subsidies of certain industries (under the “made in China 2025” plan)

- the US/China trade deficit (President Trump is especially passionate about reducing that)

However, as Jeff Miller, one of my most trusted sources of macroeconomic analysis points out, the “90% complete” deal that fell apart in May, does not mean these future talks will crumble just as fast.

The May “agreement” was never announced by both parties. The US version was never supported by China. This time there is a joint announcement with plenty of reputation on the line… The chance of things breaking down is much lower than before. The parties agreed on some provisions as well as categorizing the remaining issues. This is much better than dealing with all at once. ” – Jeff Miller

Does that mean we’re going to see a major breakthrough in November that sends stocks soaring and eliminates business uncertainty? Probably not. Most likely we’ll simply agree to keep talking and the December 15th tariffs, 15% on $160 billion worth of technology and apparel, will be postponed.

It’s always possible that talks might tank again, but the difference between now and May/August is that our President’s needs for a “huge win” are much higher.

While 1.5% to 2% growth might not be terrible, nor likely to trigger a bear market, it certainly wouldn’t help his re-election chances when he ran on 3%, 4%, or even 6% economic growth and called 2% growth during the Obama years horrible and basically a recession for most people.

But even if trade talks fall apart and we end up falling into a recession, I still wouldn’t lose any sleep over it and here’s why.

Reason Three: Even If We Got a Recession Next Year It Would NOT Likely Be As Painful As the Last One

Recency bias is the psychological principle that the last example of something we can remember is what we expect the next recurrence of something bad to look like.

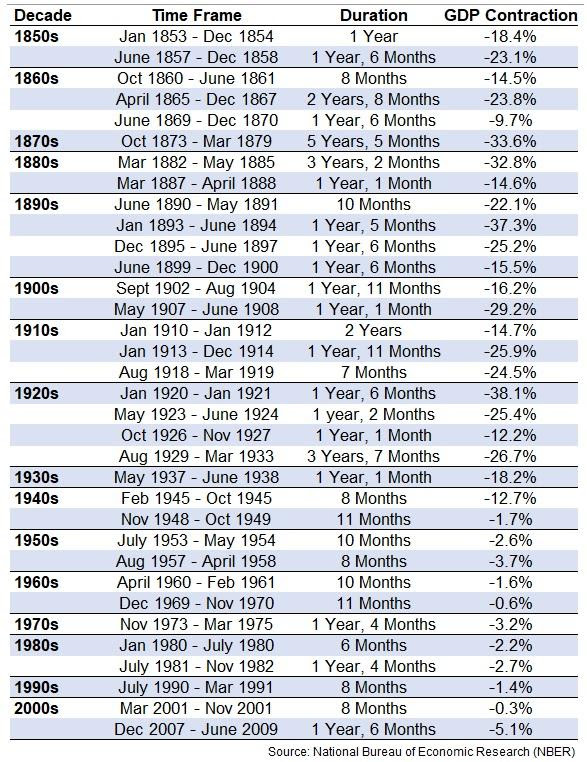

The Great Recession saw the US economy contracted 5% over 18 months, which was much longer than the last two recessions. But it’s important to note that recessions have been getting less frequent and less severe over time, with the Financial Crisis a noted aberration from that trend.

Since 1945 here is what the average recession looks like

- 11.1 months long (not 18 months like the Great Recession)

- peak GDP decline of 1.4% (27% as bad as the Great Recession)

- unemployment rises for 15 or 16 months, by an average of 2.4% from recent lows (5.9% in our case, not 10% like Great Recession) – NOT the doubling we saw during the Great Recession

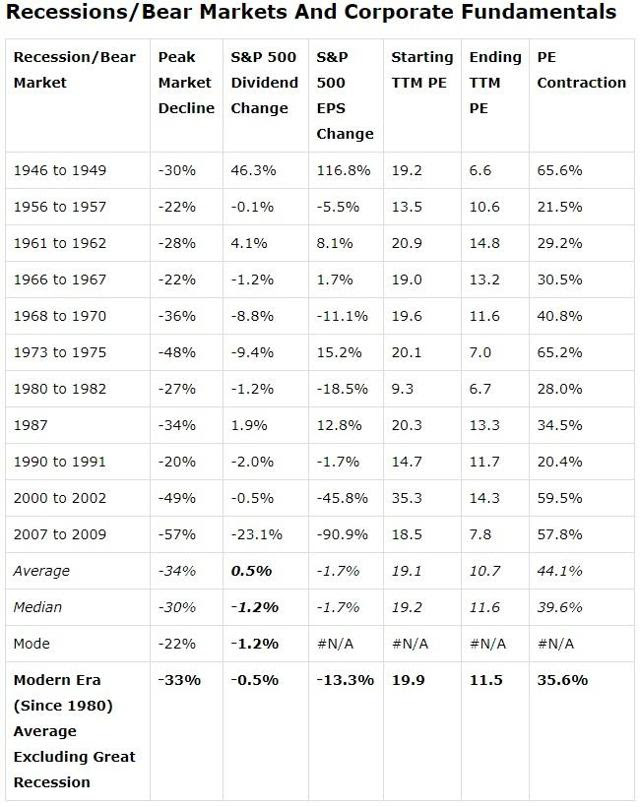

What about corporate fundamentals?

(Sources: Moon Capital Management, NBER, Multipl.com)

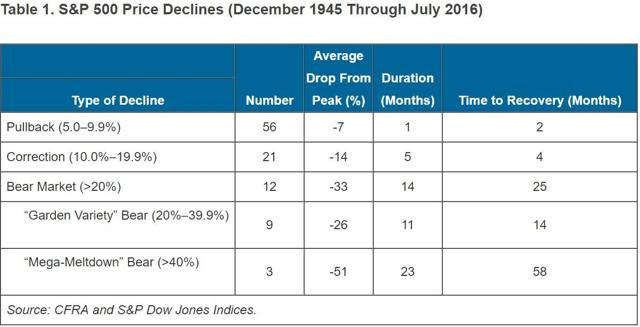

In our modern era, excluding the bank induced collapse of earnings, corporate profits fall just 13%. Dividends barely budge at all, declining just 0.5%. Panicky investors do value companies a lot less with the market’s PE ratio contracting 35.6%.

This is why the garden variety bear market sees stocks decline 26% over 11 months. Even including the market crashes so many investors fear, the average bear market sees stocks decline 30% over 12 months before recovering to fresh record highs with 15 months (14 months excluding crashes).

This is why the garden variety bear market sees stocks decline 26% over 11 months. Even including the market crashes so many investors fear, the average bear market sees stocks decline 30% over 12 months before recovering to fresh record highs with 15 months (14 months excluding crashes).

Volatility isn’t risk. It’s the source of future returns.” – Joshua Brown, The Reformed Broker

As long as your portfolio is well constructed, such as owning sufficient cash/bonds to ride out a bear market without having to sell dirt cheap stocks, volatility isn’t a risk to your financial goals.

In fact, it can often help you immensely, by offering great opportunities on quality companies that suddenly go from Wall Street Darling to the most hated thing on the street.

For example, from September 2018 to January 2019, Apple fell from $228 to $142, a nearly 40% crash. Since then it’s rallied to a new record high of $236, up 67% from its January lows, and generating almost 100% annualized total returns.

I didn’t buy Apple at the bottom, not even close ($173). Yet I’m still sitting on a nearly 40% total return in less than a year.

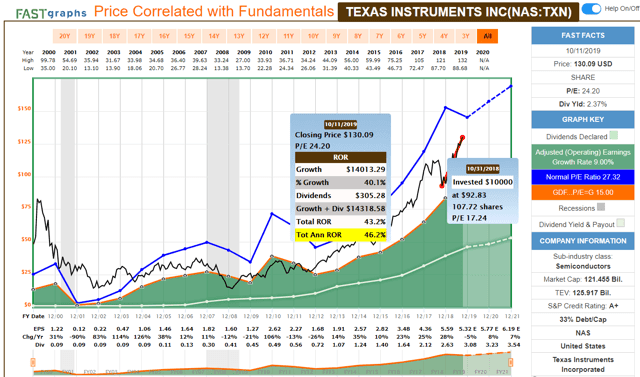

(Source: F.A.S.T Graphs, FactSet Research)

Texas Instruments fell hard as well during that correction, before then rallying over 40% and delivering nearly 50% CAGR total returns.

The point is that during these company’s most recent bear markets they were trading at reasonable to downright attractive valuations. Everyone says they want a bargain so they can, in the words of Warren Buffett “be greedy when others are fearful.” But only during times of severe market fear are such bargains actually available.

Run of your mill corrections and market pullbacks are common, occurring on average every six months, both since 1945 and during the longest bull market in US history.

What Normal Market Volatility Looks Like

(Source: Advisor Perspectives)

But while regular pullbacks and corrections are great, there is nothing quite like the market overreacting to a moderate decline in corporate earnings seen during average recessions, to allow you to enjoy truly spectacular long-term total returns.

Bottom Line: A Recession Will One Day Happen, But Probably Not for Some Time And It Will Probably Be Far Milder Than Most People Expect

Don’t get me wrong, I’m not saying that recessions aren’t bad nor that investing through a bear market doesn’t suck. I was fully invested in both 2000- 2003 and 2008-2009 and remember well the pain of watching my portfolio decline steadily for months on end.

Today 12-month recession risk, at 33%, remains elevated, though far off the 48% it hit last month. That’s supported not just by the yield curve, which the Fed’s new $60 billion per month T-bill buying plan will likely steepen through Q2 2020, but the actual economic fundamentals.

Those fundamentals point to 1.3% to 2% growth through 2020. While that’s a far cry from the 4.2% we hit in Q2 2018, it’s also similar to 2016’s economy (1.6% full-year growth and three quarters at 0.9%). One that saw lots of recession fears, plenty of volatility, but ultimately no bear market and smart investors were able to cash in on top-quality bargain companies.

One day a recession will happen. When it does, it will likely be mild, equal to or less painful than the typical 2.4% GDP decline. Stocks will likely fall into a bear market then, but for anyone with the proper risk management plan in place, around which their diversified portfolio is based, there will be little to fear during such a temporary downturn in our economy and the stock market.

SPY shares were trading at $299.43 per share on Tuesday morning, up $3.48 (+1.18%). Year-to-date, SPY has gained 21.48%, versus a 21.48% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |