Coming into 2020, the outlook was clear sailing as the two biggest bugaboos: interest rates, and trade tariffs both had been removed and the economy was on solid footing.

Then came the Iran/Iraq conflagration. The market dipped a whopping 1% before recovering the next day and making new highs within the week.

The China Coronavirus followed and the market dropped a whopping 1.2% before reclaiming those losses within the next two days.

Neither of these issues are resolved, which begs the question: is the stock market immune from bad news? And how do we play this increasingly precarious rise while these uncertainties loom in the background?

Before January 20th, the date virus went viral, healthy inflows had boosted global equity markets, ironically the Shanghai Composite most of all.

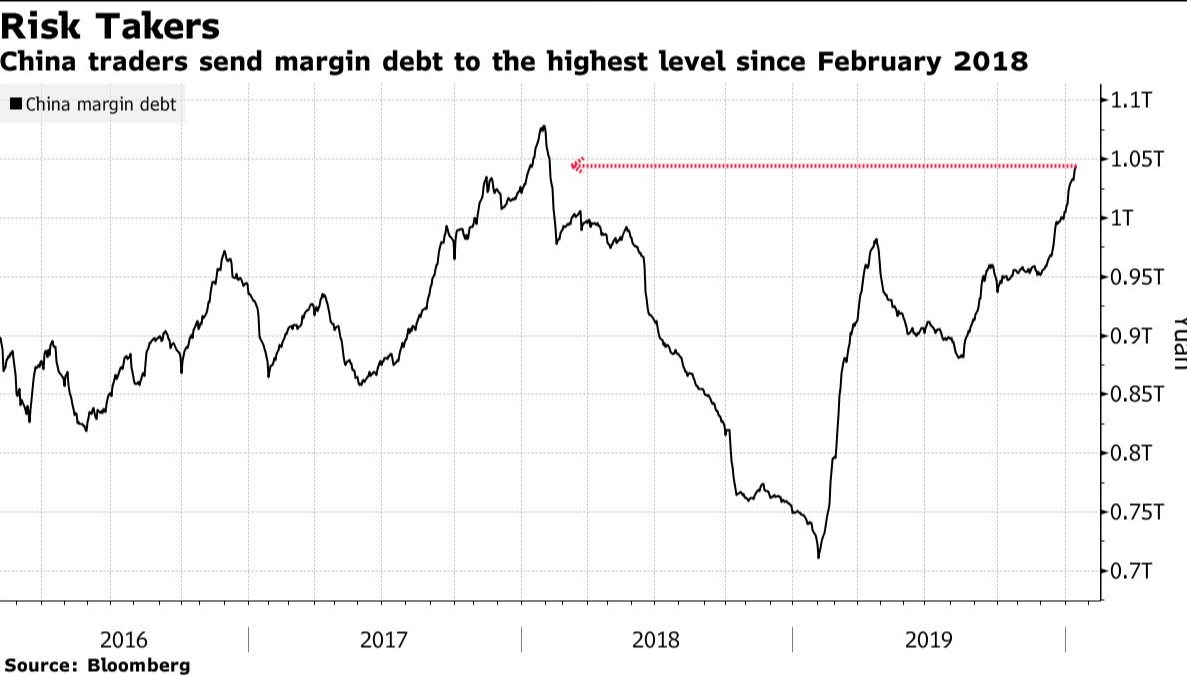

The CSI Index gain nearly 8% since a November low, making it one of the best performers among global benchmarks in that time. Chinese investors lifted their leverage to about 1.04 trillion yuan to chase the rally.

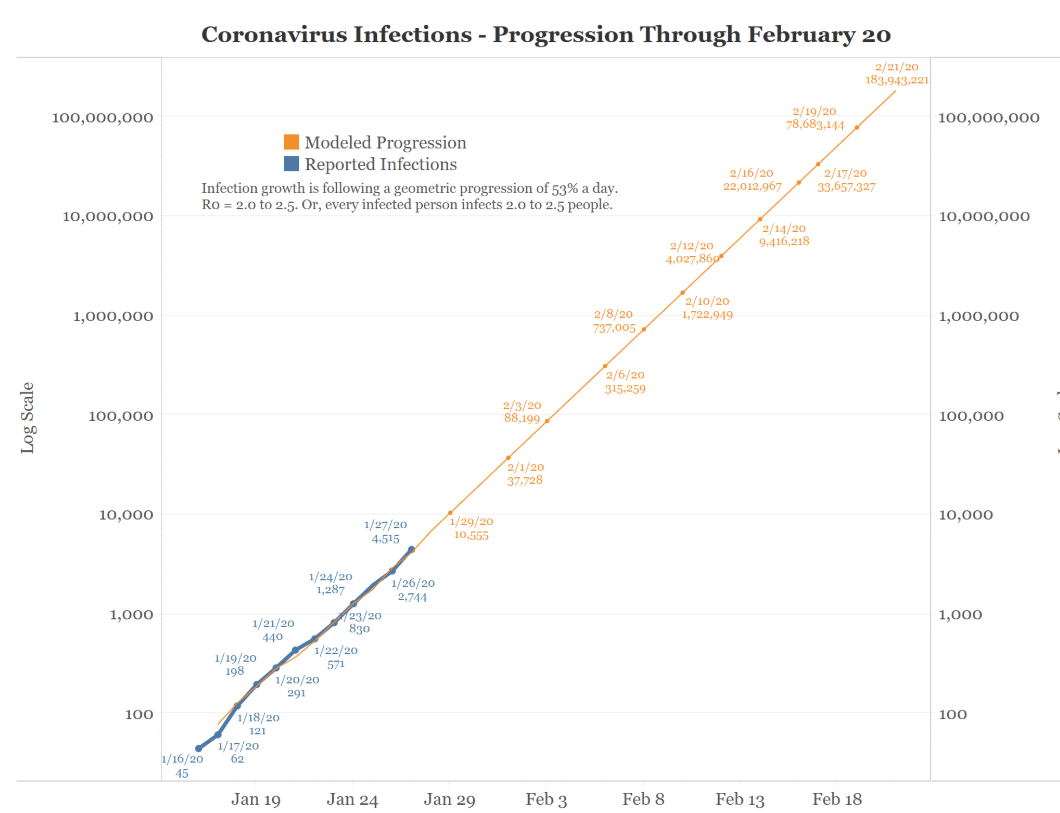

It’s almost impossible to model how the virus will play out but people are certainly trying.

Basic models offer a bleak scenario of a geometric spread of the disease reaching 100 million by the end of February.

Others are looking at the more reality-based analog from the SARS virus back in 2002 which ultimately infected some 3,000 people and killed 778 over a 9 month period.

It disrupted travel and tangentially created a 10% slide in global equity markets. But the numbers show the true spread was not only stemmed in a relatively short time from but also was limited; by comparison in the U.S alone, nearly 80,000 people die each year from the common flu.

The Corona or Wuhan virus seems to be more contagious but less fatal than SARS. It has also led to extensive travel restrictions but so far the economic and stock price impact has been limited to sectors such as casinos in Macau such as “Wynn (WYNN)” and “Starbucks (SBUX)” which has temporarily shut down over 2,000 locations.

The options market has also begun pricing in short-term uncertainty as you can see the term structure went into backwardation. Also, note the big hump in October leading into the election.

Nevertheless, the resilience of this market remains unmistakable. And while some unknowns are trying to get priced it seems, as always, the best course of action is not to panic.

.INX shares were trading at $328.59 per share on Wednesday afternoon, up $1.70 (+0.52%). Year-to-date, .INX has gained 2.09%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| .INX | Get Rating | Get Rating | Get Rating |