- Koppers Holdings (KOP) provides value-added products for commodities

- Rising commodity demand in 2021 favors the stock

- US infrastructure rebuilding could add another dimension for the company

- A bullish earnings trend for KOP

- A substantial recovery since March- More upside potential for 2021

2020 was a year where technology stocks did best as share prices exploded from the March lows. Technology has changed people’s lives over the past decades, but the global pandemic put a spotlight on the sector. It allowed for communication, working from home, shopping, and entertainment during lockdowns and social distancing. The addressable market for technology expanded as the coronavirus forced those who were not technologically savvy to learn and get up to speed with the products.

Each year is different in markets. As we head into 2021, vaccines promise to create herd immunity to the virus. While the sickness and death will hopefully become a sad memory, the pandemic’s financial legacy will continue over the coming years. Many businesses will not survive 2020, and unemployment will remain high. The massive injections of liquidity and stimulus into the financial system are inflationary seeds that will impact markets.

Governments will need to help businesses and individuals dig out from underneath the economic rubble created by the virus. In the US, a new administration will take over before the end of January. The need for a massive government-funded program that promotes economic growth and employment has not been higher since the Great Depression in the 1930s.

Infrastructure rebuilding could be an answer as it is long overdue and US. Koppers Holdings Inc (KOP) is a company that manufactures products that will be critical infrastructure rebuilding projects.

Koppers Holdings (KOP) provides value-added products for commodities

Koppers Holdings (KOP) provides customers with treated wood products, wood treatment chemicals, and carbon compounds in the United States and worldwide.

The company operates in three segments. The Railroad and Utility products segment procures and treats crossties, switch ties and various lumber products required for railroad bridges and crossings. It also offers rail joint bars that join railroad rails together, transmission and distribution poles for electric and utility poles, and pilings. The segment also provides services, including engineering, design, repair, and inspections.

The Performance Chemicals segment develops and manufactures copper-based wood preservatives for decking, fencing, utility poles, construction lumber and timbers, and vineyard stakes. It also provides water-based wood preservatives and additives, fire-retardant chemicals for pressure-treating wood for commercial construction applications.

The Carbon Material and Chemicals segment manufactures creosote used in wood treatment or as a feedstock for carbon black, carbon pitch. Carbon patch is a raw material for aluminum and steel production. KOP’s customers include railroads, specialty chemicals, utilities, residential lumber suppliers, agricultural, steel, rubber, and construction companies. KOP has been around since 1988, with its headquarters in Pittsburgh, Pennsylvania.

Rising commodity demand in 2021 favors the stock

As we move into 2021, and the global pandemic begins to fade into our rearview mirrors, the demand for construction worldwide is likely to rise. We have already seen economic growth in China. One of the signs has been increasing commodity prices.

Over the past months, an almost perfect bullish storm in industrial commodities has been brewing. Central bank liquidity and monetary policy, together with government stimulus, have increased the money supply and deficits as they increase borrowing and spending and inhibit saving. A falling US dollar has also provided support for commodity prices.

Leading industrial commodity prices soared over the past months. After trading below zero in late April, the crude oil price was over $52 per barrel on January 8. Copper, a bellwether industrial commodity, rose from $2.0595 in March to over $3.70 per pound during the first week of 2021. Copper rose from its lowest price since 2016 as the pandemic gripped markets to its highest level since early. The lumber price reached an all-time peak in September 2020.

Source: CQG

Source: CQG

The monthly chart shows that after reaching a low of $251.50 per 1,000 board feet in April 2020, the wood price rose to $1,000 in September, surpassing the previous record peak from 2018 at $659 per 1,000 board feet. Nearby lumber futures were at $870 on January 8.

Increasing industrial commodity demand, a falling dollar, a tidal wave of central bank liquidity, and a tsunami of government stimulus have created an almost perfect bullish storm for construction materials. The bullish trend looks set to continue in 2021.

While companies like KOP will see raw material input costs rise, the demand for their products is a function of the growth in construction projects. As lumber, copper, and other raw material prices increase, KOP will pass along the higher costs to their customers.

US infrastructure rebuilding could add another dimension for the company

There has been bipartisan support for a massive government initiative to rebuild the crumbling roads, bridges, railroads, tunnels, airports, government buildings and schools, and many other infrastructure parts over the past years in the US.

Republicans and Democrats agree that the program to repair, refresh, and modernize infrastructure is necessary and critical, but neither side wanted to give the other any political victory going into the 2020 election. Meanwhile, with unemployment at a high level, the incoming Biden administration is likely to initiate a massive project to rebuild the US, killing two birds with one stone.

In 2021 and the coming years, a multi-trillion-dollar infrastructure project would put people back to work and supply government contracts to US businesses, increasing profits and tax receipts. The last time the US embarked on a substantial infrastructure project was in the 1950s when the Eisenhower administration built the interstate highway system. However, FDR’s New Deal of the 1930s could be the model for the US under the incoming administration.

FDR’s three Rs included relief, reform, and recovery. Relief continues to come in the form of stimulus and individual payments. Reform will be legislative programs on the energy and tax fronts that address climate change and the wealth gap. Recovery is likely to include getting workers back on the job via an infrastructure program. KOP and other companies that provide the critical construction raw materials stand to benefit from a massive government-funded project.

While some may argue that spending trillions after the 2020 stimulus will push the deficit to an uncontrollable level, legislators and the administration are likely to succeed as the level is already so high that a couple more trillion amounts to a drop in the bucket.

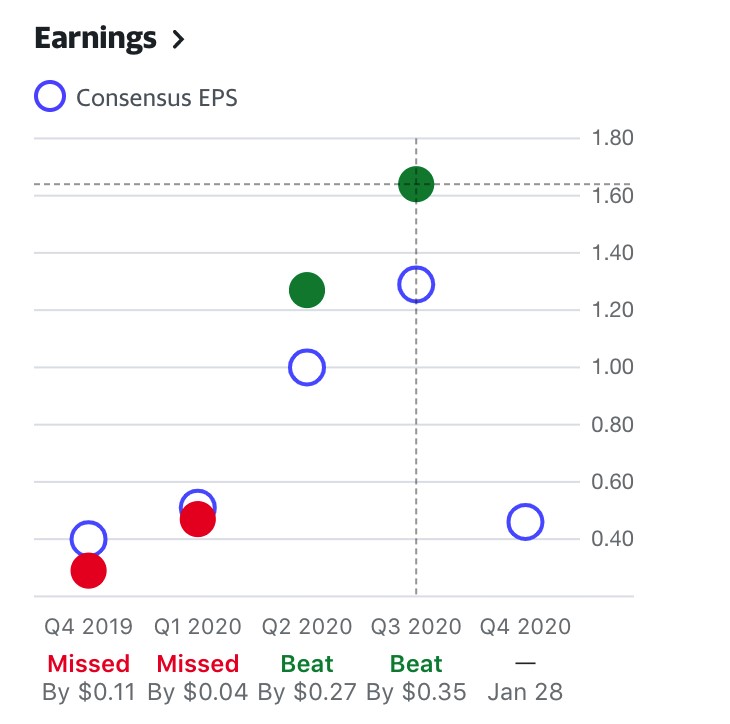

A bullish earnings trend for KOP

The trend in earnings and revenues for Koppers Holdings is impressive.

Source: Yahoo Finance

Source: Yahoo Finance

While KOP has beat analyst’s EPS forecasts in two of the past four quarters, the company has posted four consecutive quarterly profits. In the third quarter, KOP reported earnings of $1.64 per share compared to a consensus estimate of $1.29.

Source: Yahoo Finance

Source: Yahoo Finance

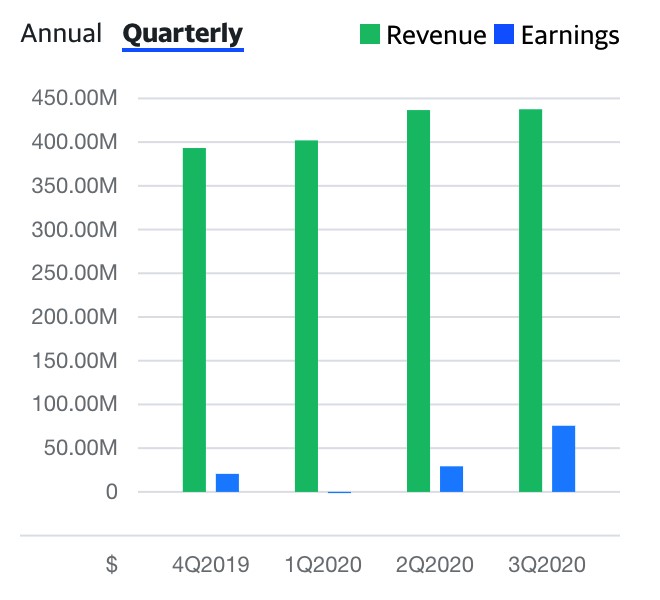

Revenues trended higher from 2016 through 2019.

Source: Yahoo Finance

Source: Yahoo Finance

The trend continues over the past four quarters. KOP was trading at the $33.16 level on January 8. A survey of five analysts on Yahoo Finance has a price target of $35 for the stock, with forecasts ranging from $32 to $38 per share.

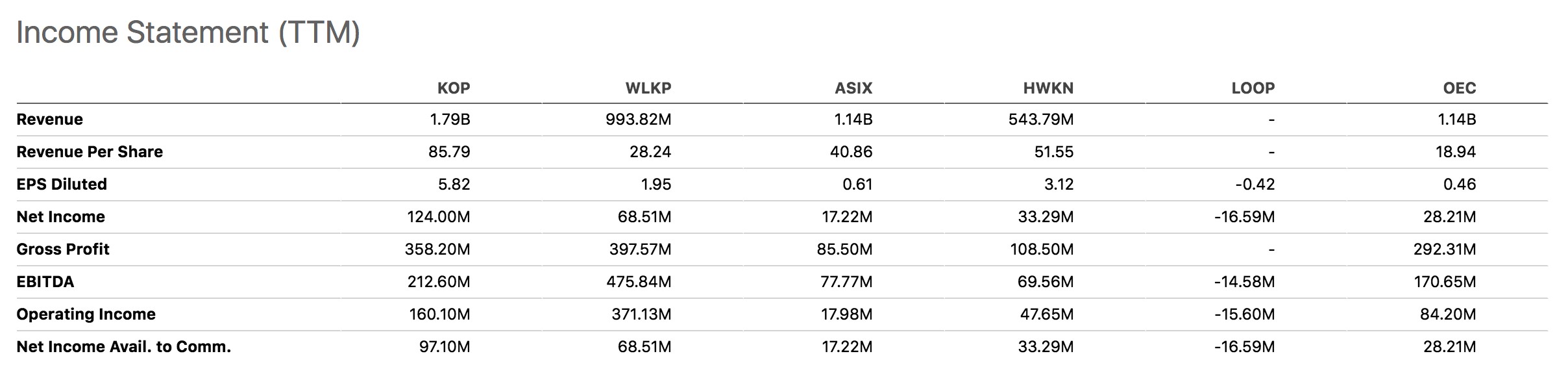

Source: Seeking Alpha

Source: Seeking Alpha

A comparison of KOP’s income statement with other competitors shows Koppers leads in revenue, revenue per share, and net income categories.

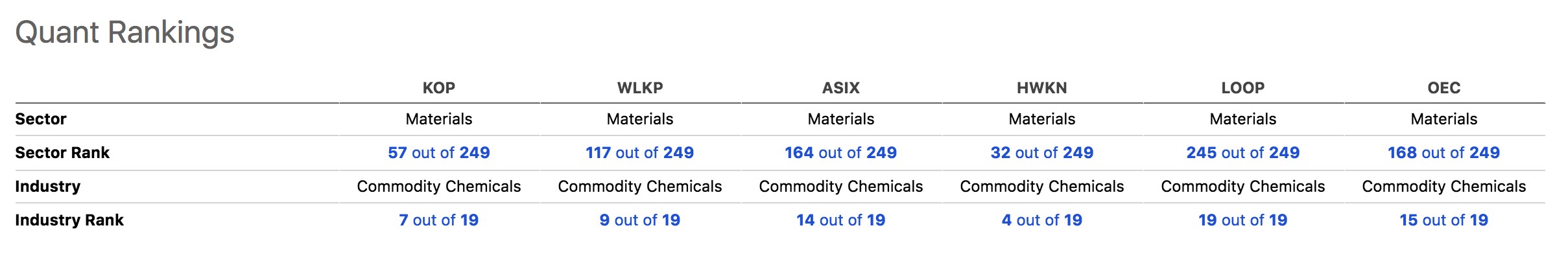

Source: Seeking Alpha

Source: Seeking Alpha

The company was close to the top of the sector and industry ranking compared to its competitors. KOP’s market cap was just below $700 million. An average of 170,673 shares changes hands each day.

Source: Seeking Alpha

Source: Seeking Alpha

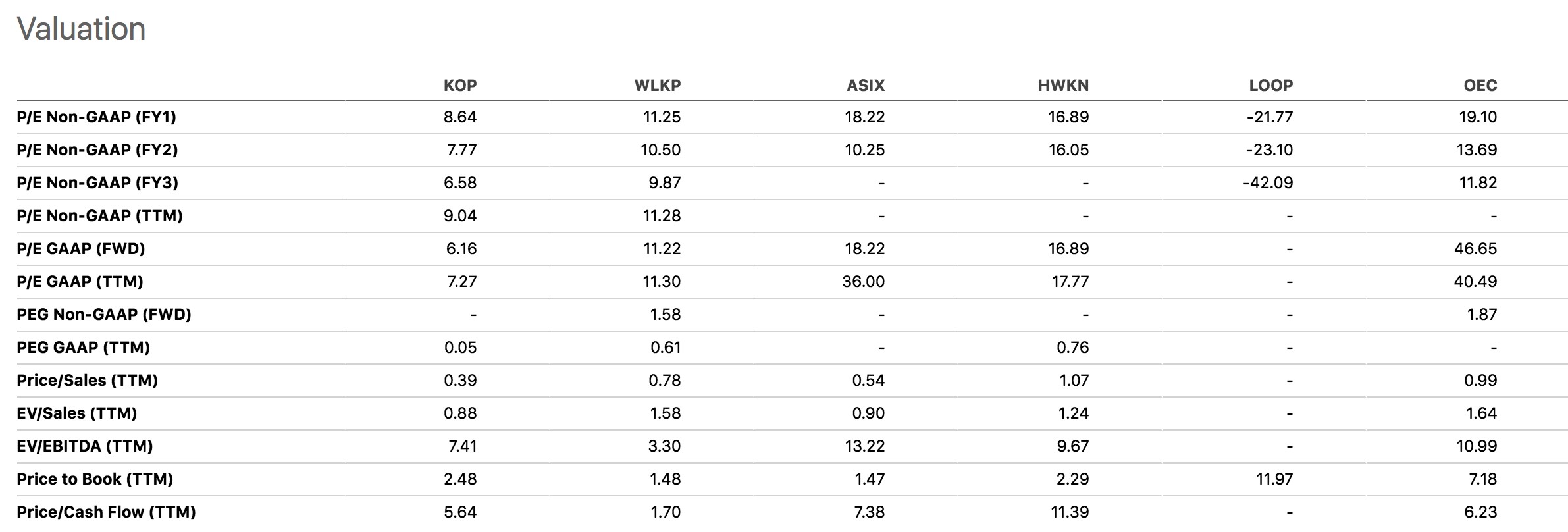

KOP’s price to earnings ratio is the lowest among its competitors.

A substantial recovery since March- More upside potential for 2021

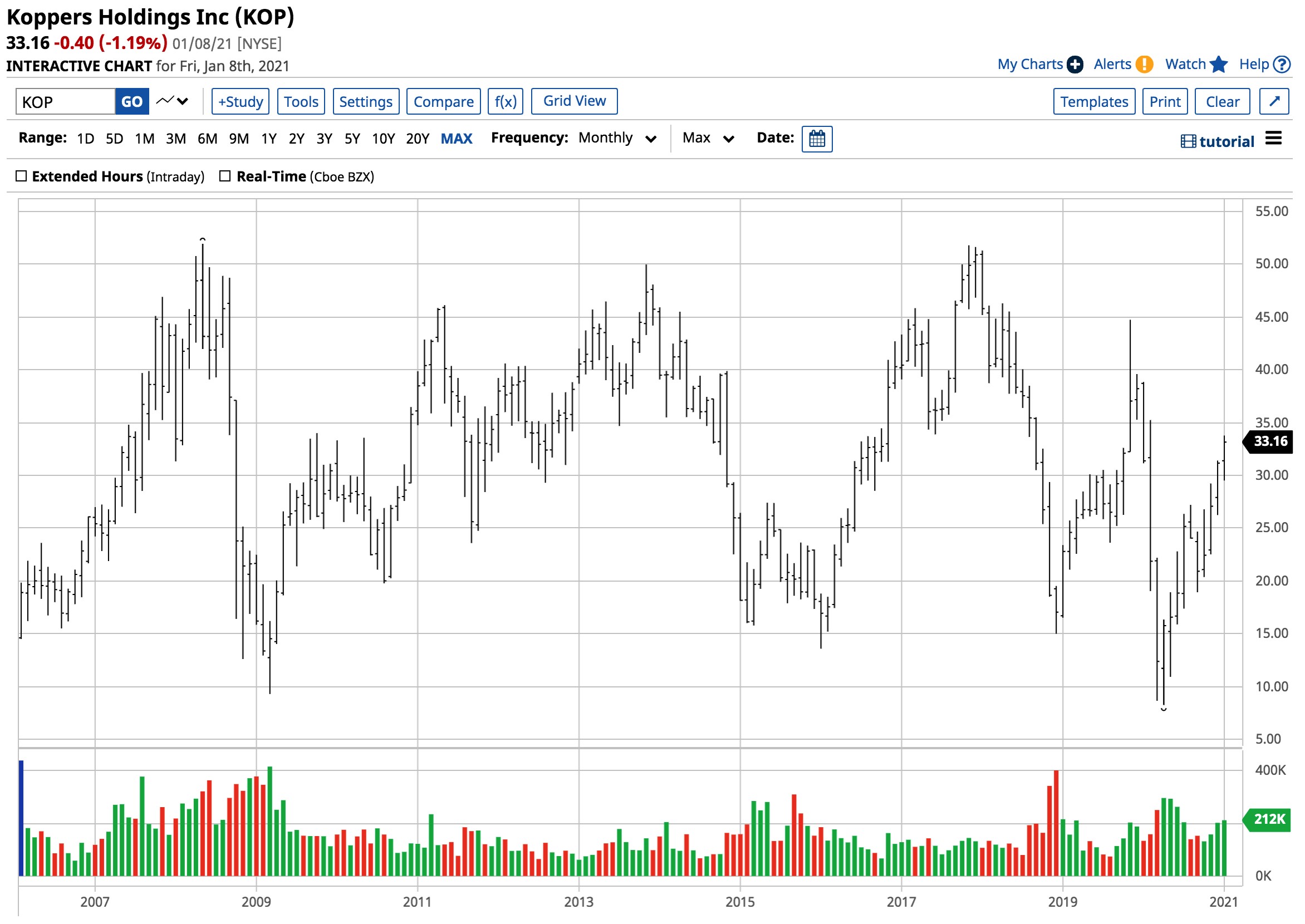

KOP shares have run into selling at around the $50 level since 2006.

Source: Barchart

Source: Barchart

The chart shows that the stock hit an all-time high of $51.95 in 2008 before the global financial crisis sent the stock to a low of $9.29 in March 2009. KIOP recovered to over $46 in 2011 as commodity prices rallied and the global economy recovered in the aftermath of the 2008 crisis.

The most recent move above $50 came in late 2017 when KOP shares rose to a slightly lower high of $51.80. After making lower highs and lower lows, the stock fell to $8.25 in March 2020 as the global pandemic caused risk-off selling to grip markets across all asset classes. Since then, KOP shares have recovered.

Source: Barchart

Source: Barchart

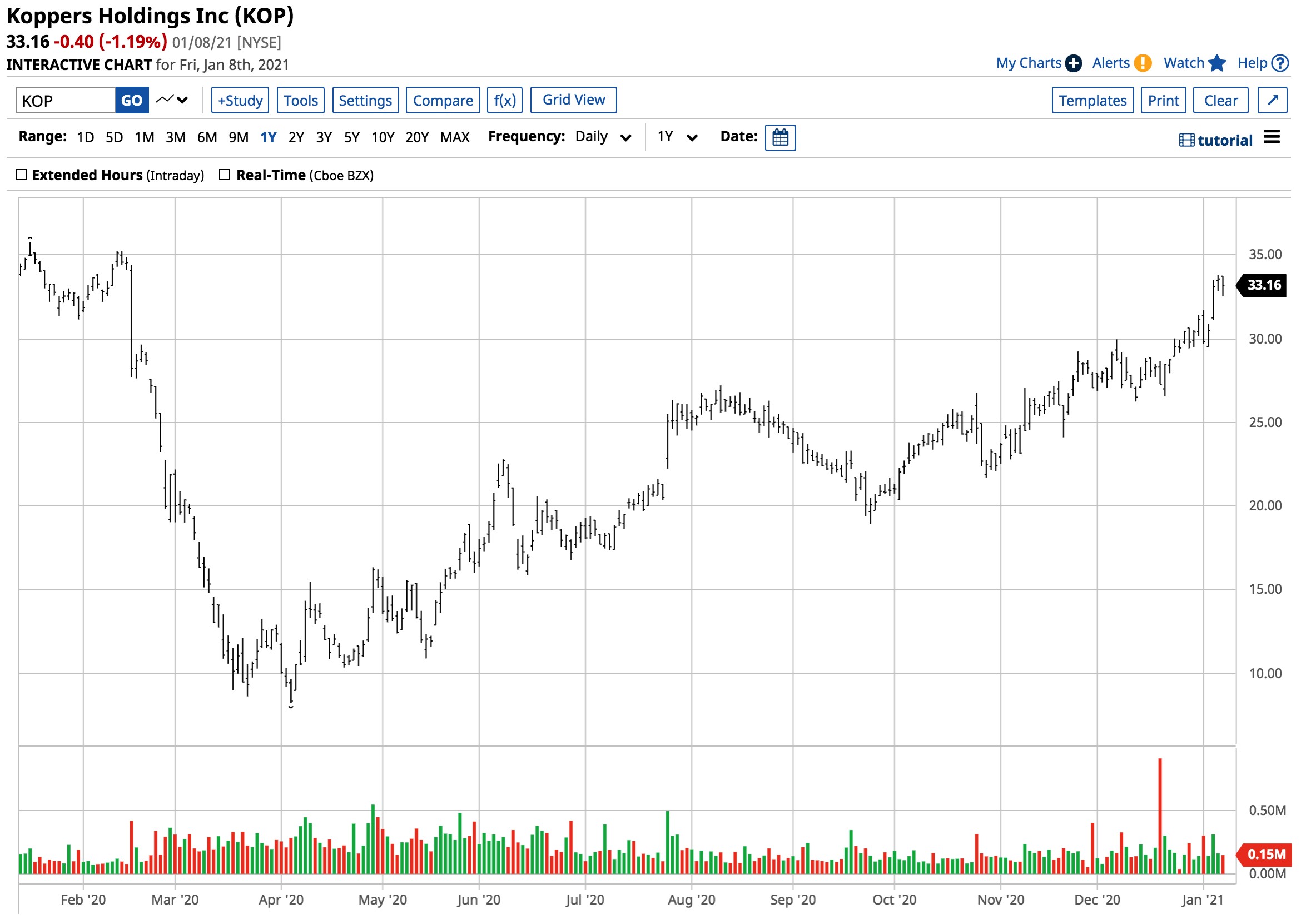

The chart shows the recovery from the March low of $8.25 to above $33 per share on January 8. The first level of technical resistance stands at $35.24, the February 2020 high. Above there, the target is the 2019 high of $44.75 per share.

KOP is another company that stands to benefit from the rising demand for commodities as we head into 2021. A US infrastructure project could turbocharge the stock and send it back towards another test of the $50 level where the most significant technical resistance stands.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

5 WINNING Stocks Chart Patterns

7 Best ETFs for the NEXT Bull Market

KOP shares were trading at $33.25 per share on Tuesday morning, up $0.09 (+0.27%). Year-to-date, KOP has gained 6.71%, versus a 1.37% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| KOP | Get Rating | Get Rating | Get Rating |