Amid a gradual rebound in air travel, Southwest Airlines Co. (LUV - Get Rating) has hit new revenue records in the fiscal second quarter. However, a surge in expenses complicates its financial landscape. So, prospective investors should hold off for a more opportune moment to buy into the stock.

Operating revenue soared to a record-setting $7 billion in the mentioned fiscal timeframe. Conversely, rising costs due to inflation triggered a surge in operating expenses. Operating expenses for the quarter increased 12.1% compared with the year-ago quarter.

Moreover, unit revenue experienced an 8.3% year-over-year dip in the second quarter, and the company anticipates a further decline of 3% to 7% in the third quarter of 2023.

“Although our network is largely restored, it is not yet optimized,” CEO Bob Jordan said in the earnings release.

To provide a more in-depth perspective, let’s analyze some key financial metrics of the company.

Analyzing Southwest Airlines Financial Performance and Market Trends (2020-2023)

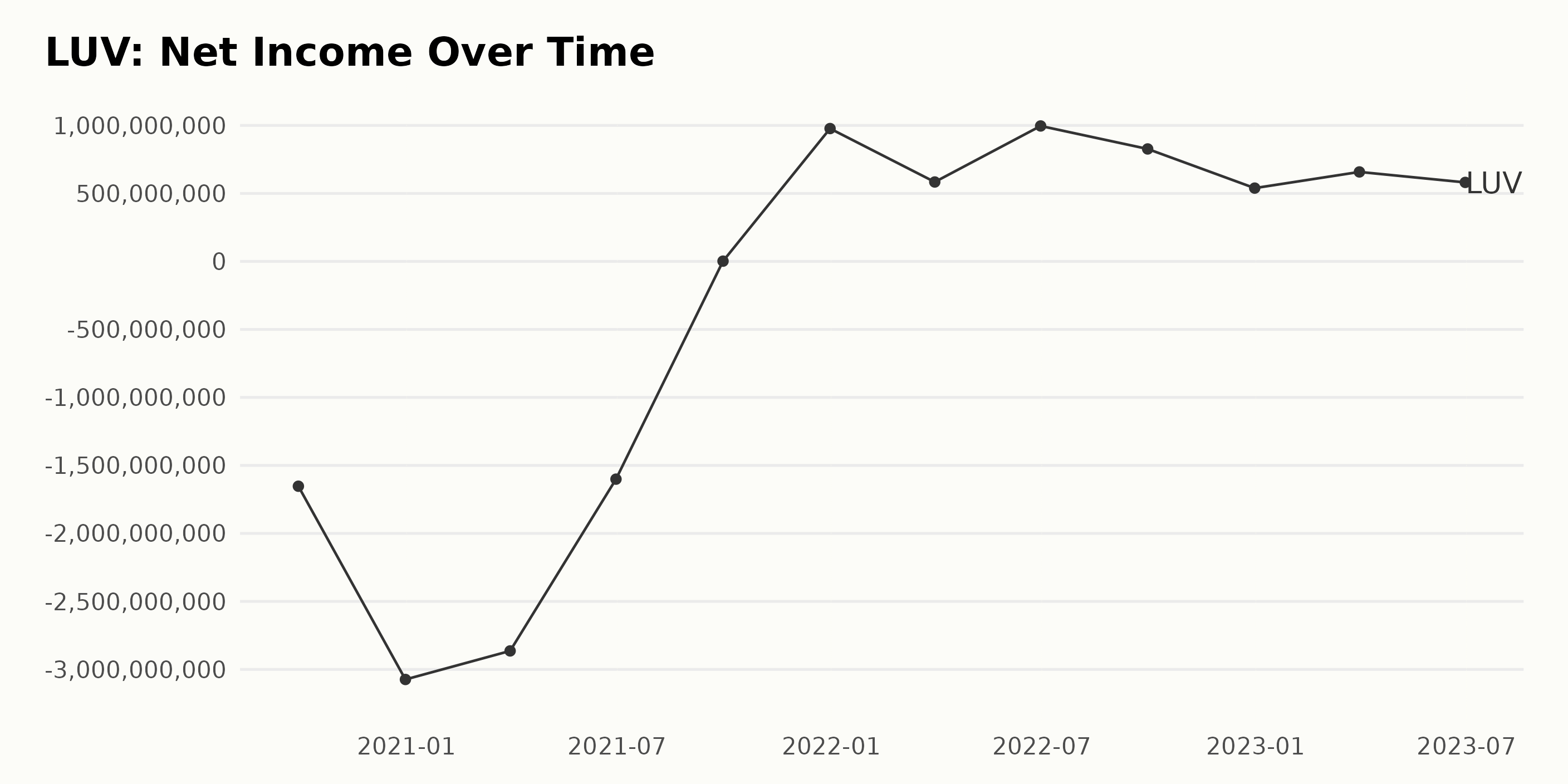

The trailing-11-month net income of LUV has shown some noticeable trends and fluctuations over the past few years, according to the provided data series.

- In the third quarter of 2020, LUV recorded a large net loss of $1.65 billion. This loss increased significantly by the end of the year, with a reported net income of -$3.07 billion on December 31, 2020.

- Throughout 2021, there was a positive trend in net income, starting at -$2.86 billion in March and gradually improving throughout the year. By September 30, 2021, the company posted a positive net income of $2 million for the first time since the start of this series. This upward trend continued into the year’s end, with LUV showing a significant increase in net income – reaching $977 million in December 2021.

- The growth continued into the first half of 2022, climbing from $584 million on March 31 to $996 million on June 30. However, the second half of the year saw a dip in net income, dropping to $827 million in September and further declining to $539 million by the close of 2022.

- As we moved into 2023, the net income began to rise again, reaching $658 million by March 31, but it slightly decreased to $581 million on June 30.

Despite some dips, there has been a positive growth rate from the first value of -$1.65 billion in the third quarter of 2020 to the last value of $581 million in the second quarter of 2023.

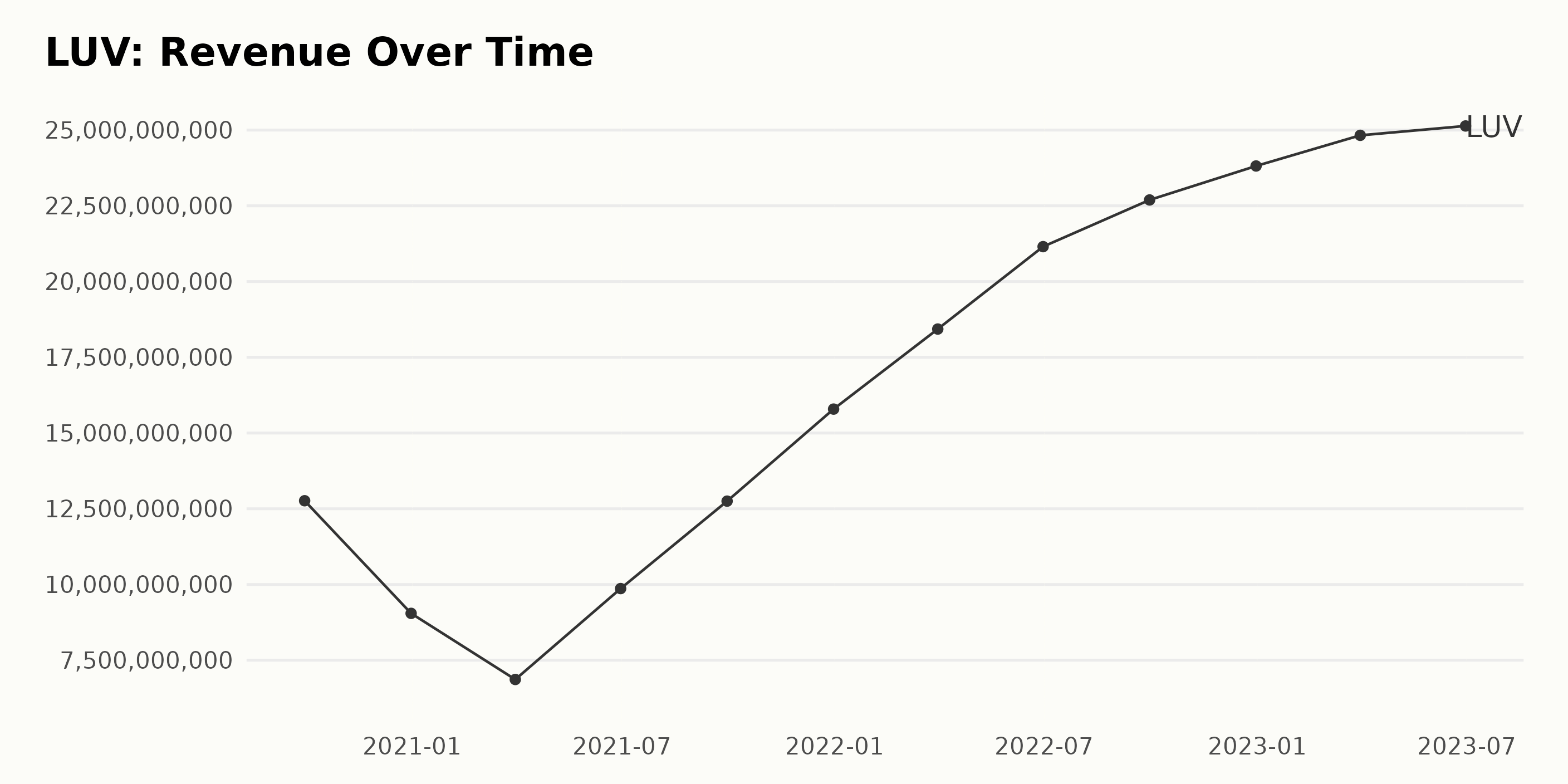

The trailing-12-month revenue of LUV has shown a fluctuating trend over the recent years. Here is a brief summary:

- On September 30, 2020, the revenue was reported to be $12.77 billion.

- There was a decrease to $9.05 billion at the end of 2020 (December 31).

- In the first quarter of 2021, the revenue dipped to $6.87 billion.

- The numbers picked up in the second quarter of the same year, reporting $9.87 billion on June 30, 2021.

- A substantial recuperation was observed by the end of the third quarter of 2021, when the revenue reached $12.75 billion.

- By the end of 2021, LUV reported a significant boost in its revenue to $15.79 billion.

- In 2022, there was consistent upward growth, with revenue hitting $18.43 billion in the first quarter, $21.15 billion in the second quarter, and $22.69 billion in the third quarter.

- Revenue peaked at the end of 2022, reaching $23.81 billion in December.

- Mild variations were seen in the first and second quarters of 2023, with revenue figures reported at $24.83 billion and $25.14 billion, respectively.

However, emphasis should be placed on the most recent figure, which shows that as of June 30, 2023, the revenue stands at $25.14 billion. This shows an impressive uptick from the initial reported revenue in the series, bearing evidence to a positive growth rate.

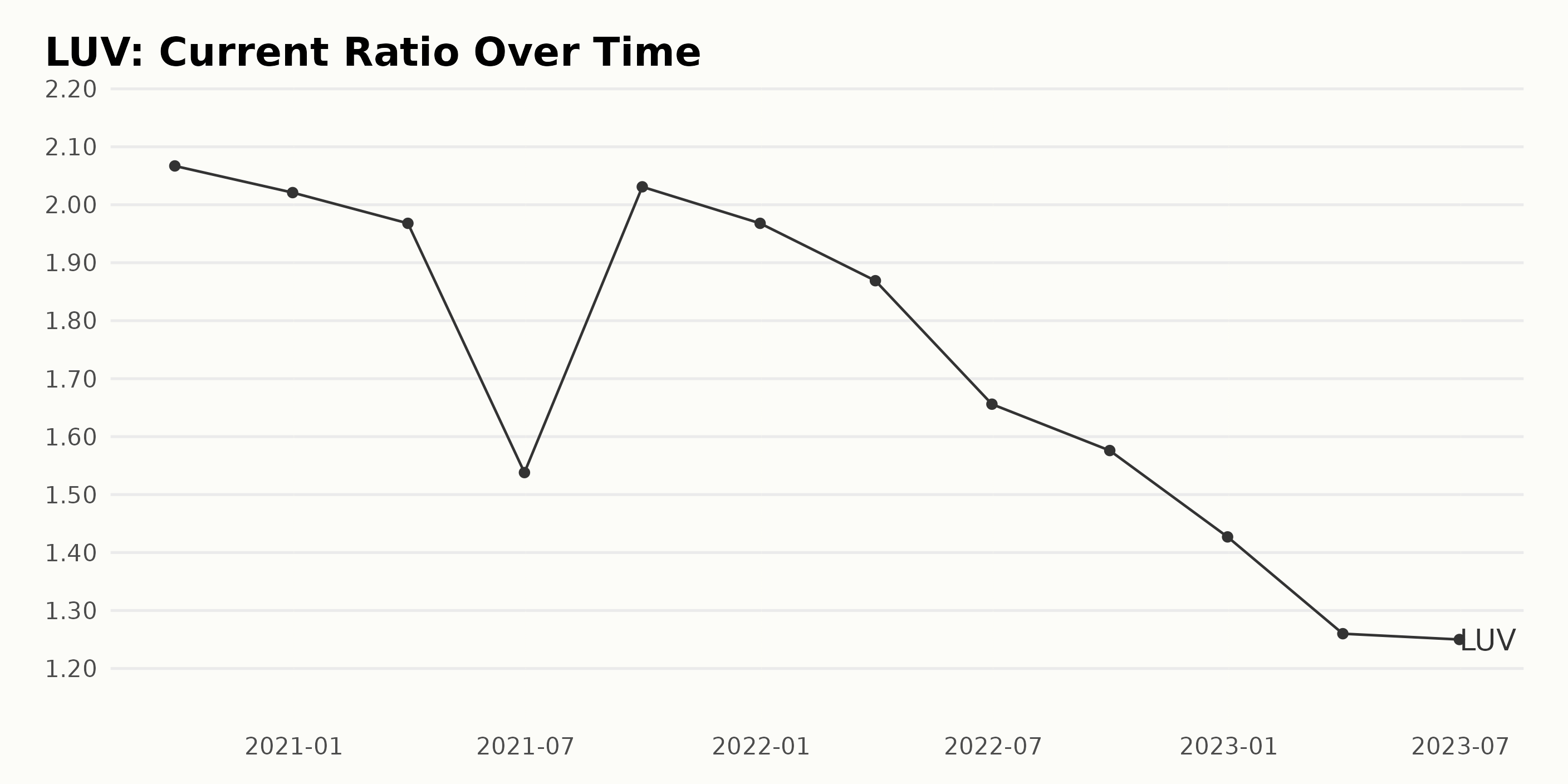

The overall trend observed for the Current Ratio of the LUV from September 2020 to June 2023 shows a gradual decline. Here’s a summarized breakdown:

- The Current Ratio started at 2.07 as of September 2020 and experienced minor fluctuations throughout 2021, with a notable dip in June (1.54) before rising back to 2.03 in September. However, by the end of 2021, it fell again to 1.97, signifying reduced liquidity.

- As of 2022, a continuous drop in the ratio was evident through each quarter, falling from 1.87 in March to 1.58 by September and closing the year at 1.43, indicating a deteriorating short-term financial health.

- A further decline was noticed within the first half of 2023, reporting a Current Ratio of 1.26 and 1.25 in March and June, respectively, signaling an increasing difficulty for the company to cover its short-term liabilities with its short-term assets.

Calculating the growth rate from the initial value in September 2020 to the latest reported value in June 2023, there is a noteworthy reduction of approximately 40% in the Current Ratio. This suggests that LUV has seen a pronounced decrease in its ability to cover short-term liabilities over the examined period.

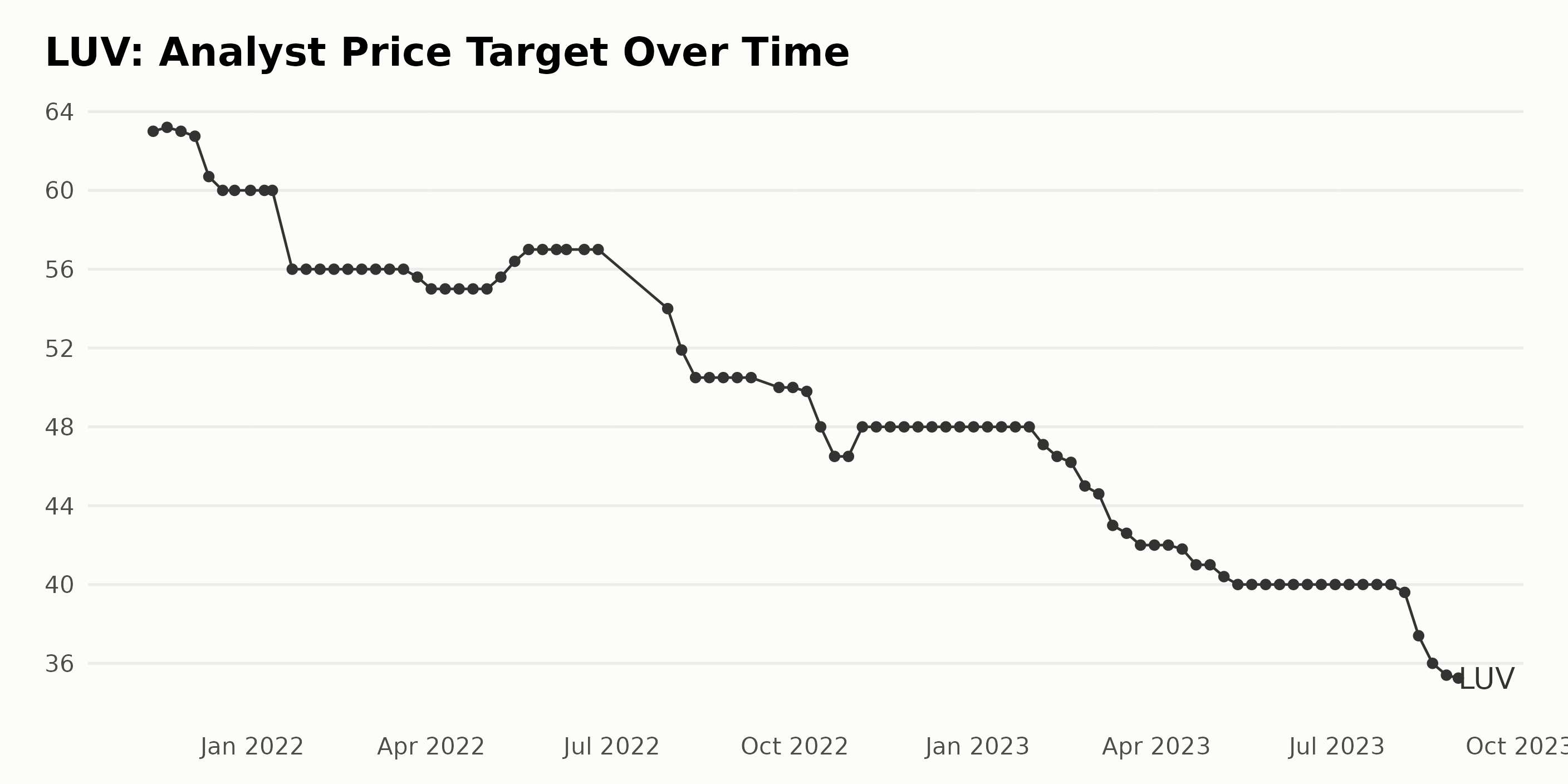

The provided data series represents the Analyst Price Target (APT) from November 12, 2021, to August 31, 2023. A clear trend is evident in the fluctuations and movements over this period. Summary of the observed trend:

- The series starts with an APT value of $63 on November 12, 2021, indicating a relatively positive outlook for the company during this period.

- There is a gradual decline in the APT from $63 (November 21) to $35.25 (August 23), reflecting a less optimistic perspective of the airline’s financial health.

- More emphasis has been given to recent trends, showing a decrease in price target since May 2023, with a significant drop noticed in August 2023.

- In August 2023, the price target reached its lowest point at $35.25, which might indicate analysts’ predictions of potential challenges or a decline in the performance on the horizon for Southwest Airlines.

To summarize the growth rate from the first to the last recorded APT, the company experienced a decrease of approximately 44%.

This summary report signifies a notable downward trend in the outlook for Southwest Airlines as indicated by these analyst price targets. It would be interesting to relate this to the broader market and industry trends or specific internal events impacting Southwest Airlines’ prospects. Analysts could have factored in elements such as fluctuating fuel prices, operational expenses, competitive landscape, or ongoing impacts from the COVID-19 pandemic.

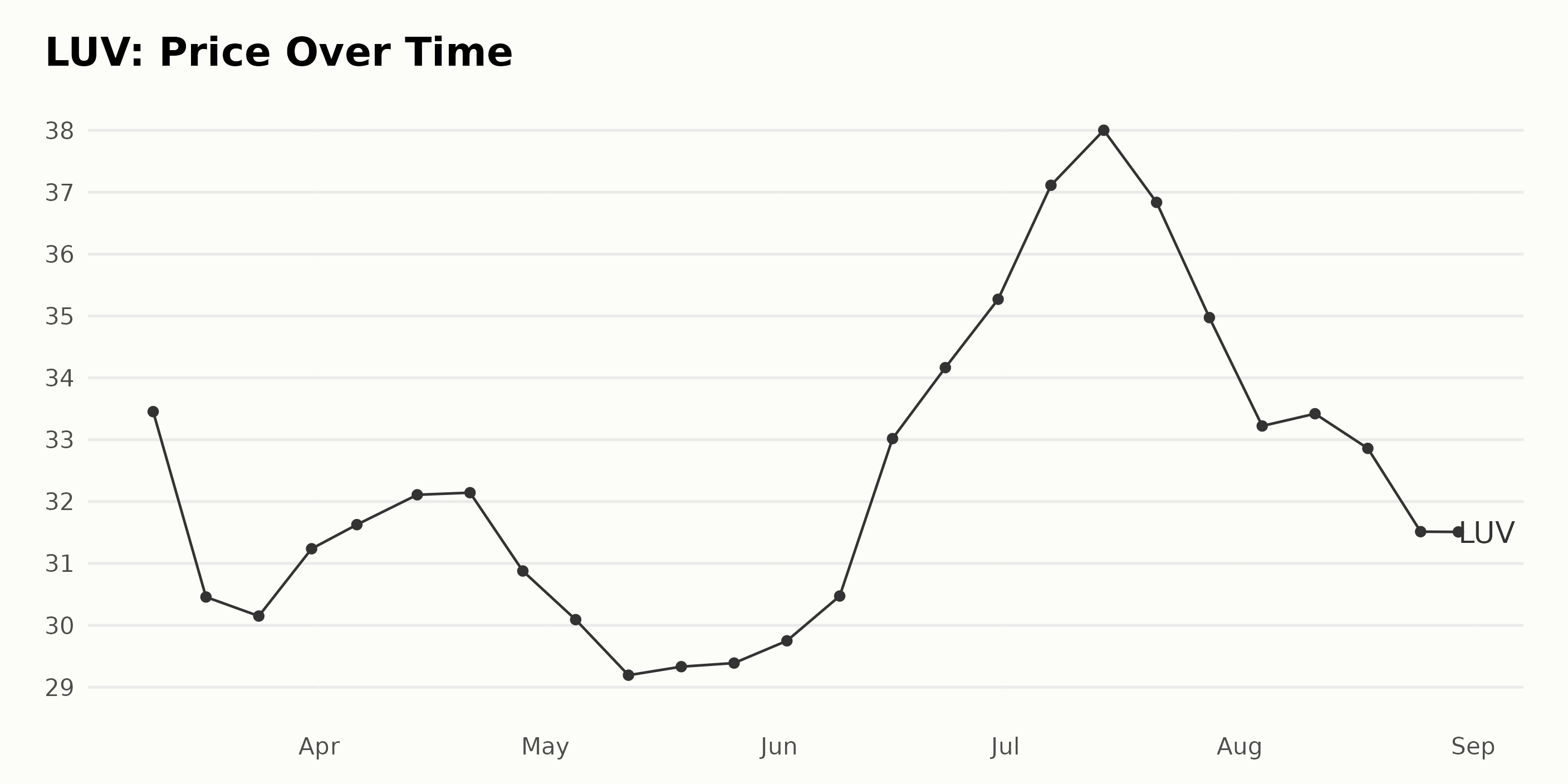

Analyzing Southwest Airlines’ Share Trends and Fluctuating Growth Rate from March to August 2023

Based on the given data, LUV’s share price varies from March 10, 2023, to August 30, 2023. Here are the significant observations regarding the trend and growth rate:

- In March 2023, the share price decreased from $33.45 on March 10 to $31.24 on March 31.

- During April 2023, the share price gradually increased to reach a maximum of $32.14 on April 21 before declining again to $30.88 by April 28. This denotes a slight upward trend within this month.

- May 2023 witnessed a general decline, starting at $30.09 on May 5 and ending at roughly $29.39 on May 26.

- Through June 2023, there’s a strong positive trend observed. Starting at $29.75 on June 2, the share price consistently increased to reach $35.27 by June 30. This period showcased significant growth.

- In July 2023, the price continued its upward trend until it reached a peak of $38.00 on July 14 before starting to decline, ending up at $34.97 by July 28.

- In August 2023, the share prices declined further with minor fluctuations, registering a low of $31.63 on August 31.

The growth rate appears to fluctuate throughout this period, evidenced by the changes in price rising and falling at different points throughout each month. However, the most pronounced growth phase is seen in June 2023. Subsequently, there is a decelerating trend with a few minor recoveries. Here is a chart of LUV’s price over the past 180 days.

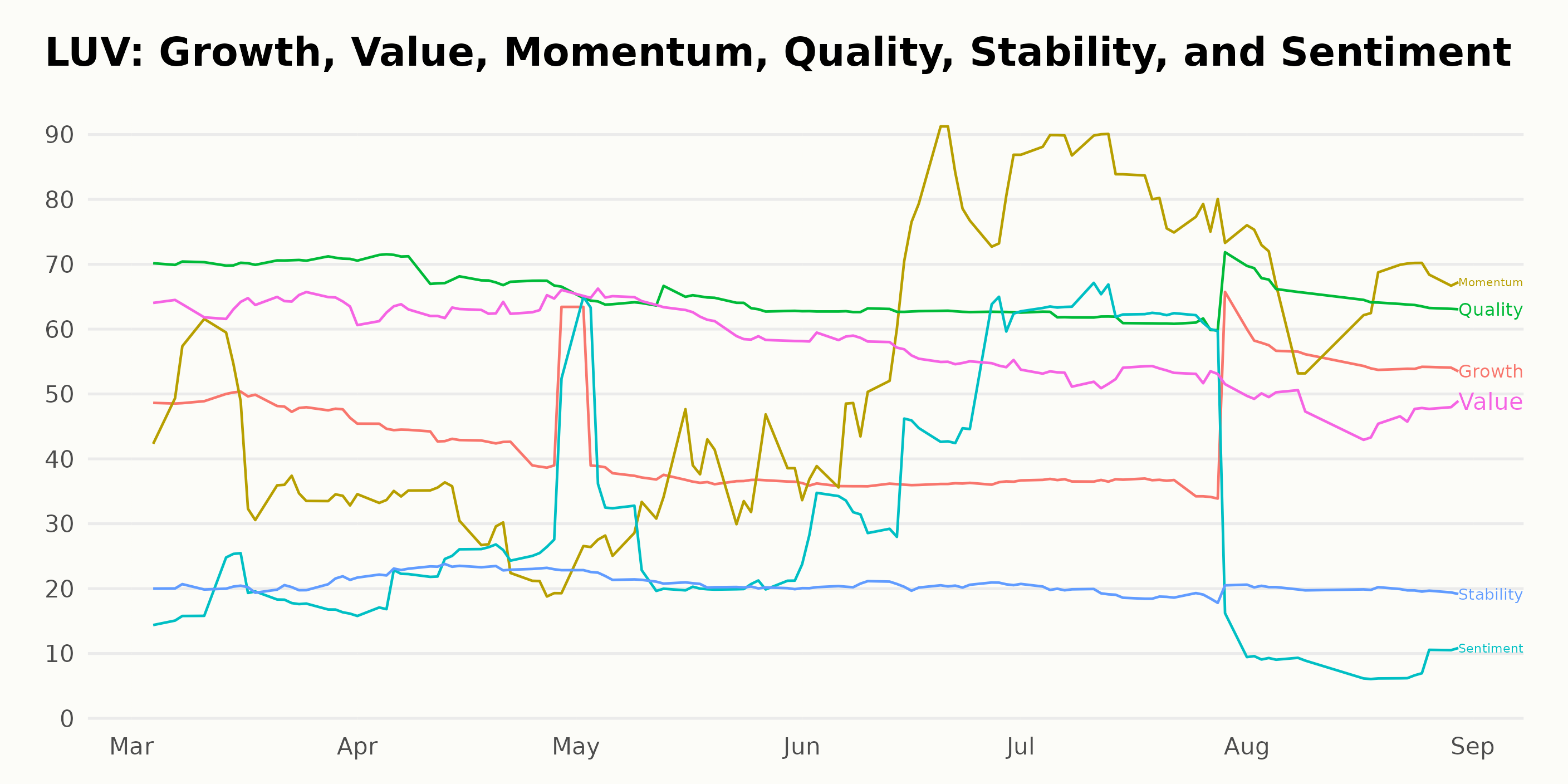

Analyzing Southwest Airlines’ POWR Ratings: Quality, Value, and Momentum Trends

LUV has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #20 out of the 28 stocks in the Airlines category. Here are some highlights:

- Throughout the covered period, from March 2023 to August 2023, the POWR grade consistently remained at C.

- The rank within the category varied during this period but was mostly around the 20th position. The highest rank it achieved was 18 (April 29, 2023), and the lowest was 21 on several occasions (last observed on August 19, 2023).

The continuous C POWR grade indicates a neutral outlook for LUV during this period. With the company positioned towards the lower end of the spectrum, it suggests that there might have been other players in the market delivering stronger performances during this timeframe.

The three dimensions of the POWR Ratings for LUV that show clear trends and high ratings are Quality, Value, and Momentum.

Quality: The quality dimension has had consistently high ratings for Southwest Airlines Company. These ratings saw a slight decline starting from March 2023, with a Quality rating of 70. This value dipped to 68 in April, 64 in May, 63 in June, and reached its lowest at 62 in July. However, a recovery was noted in August 2023 as the rating increased to 65.

Value: In the Value dimension, LUV had a strong start at 64 in March 2023, making it one of the most noteworthy dimensions. The value declined gently over the next few months — 63 in April, 62 in May, 57 in June, reaching 53 in July. August 2023 saw a further fall to 48, marking a considerable decrease over five months.

Momentum: The Momentum was initially low at 42 in March 2023. A drop to 29 in April was followed by a moderate increase to 35 in May. However, an impressive surge in momentum was observed from June onwards. Momentum jumped to 64 in June and further skyrocketed to 83 in July. In August, Momentum continued to hold high at 67, marking a significant upward trend.

Overall, Quality and Value showed high ratings but downward trends, while Momentum demonstrated a compelling upward trend over the observed period.

How does Southwest Airlines Company (LUV) Stack Up Against its Peers?

Other stocks in the Airlines sector that may be worth considering are Cathay Pacific Airways Limited (CPCAY - Get Rating), Air Canada (ACDVF - Get Rating), and Air France-KLM (AFLYY - Get Rating) — they have better POWR Ratings. For exploring more A and B-rated Airlines stocks, click here.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

Want More Great Investing Ideas?

LUV shares were unchanged in premarket trading Friday. Year-to-date, LUV has declined -4.66%, versus a 18.65% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| LUV | Get Rating | Get Rating | Get Rating |

| CPCAY | Get Rating | Get Rating | Get Rating |

| ACDVF | Get Rating | Get Rating | Get Rating |

| AFLYY | Get Rating | Get Rating | Get Rating |