Cannabis stocks were all the rage in 2016-2017 as legalization and medical applications started to gain approval. New companies sprouted up in the green fields, the high growth industry with many coming public to massive valuations and enjoying big run-ups in share prices. The action was very reminiscent of the dot.com daze as investors/speculators seemed simultaneously aware that a bubble was building while also believing there would ultimately be a few massive winners giving justification to the gold rush mentality.

Indeed, the stocks suffered a massive collapse with many of the smaller, and less above board, companies going out of business. But even major players companies such as “Canopy Growth (CGC)” in which beer and liquor giant “Constellation Brands (STZ)” took a $3 billion 30% stake, saw its shares decline by over 85% from the 2018 highs to 2020 lows as legalization legislation stalled and supply far outstripped demand. It seemed as if the prospects, especially for a thriving recreational market, had been severely misjudged and the industry would never develop beyond a niche market.

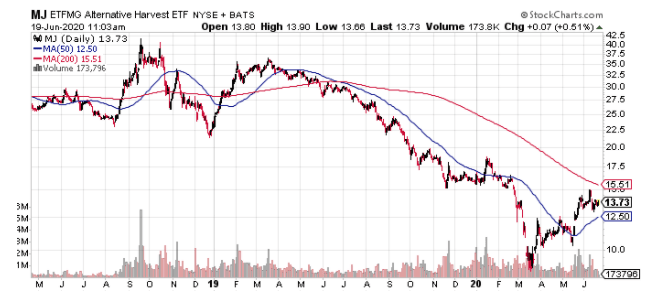

But, for the first time in more than two years, there appears to be signs that the industry is finding its footing and the stocks have found a bottom. You can see the popular cannabis ETF, “ETFMG Alternative Harvest (MJ - Get Rating)” has enjoyed a nice 30% bounce from the lows.

Now, the question is whether this is sustainable? Because cannabis is still a speculative sector facing numerous challenges using options to gain exposure to the upside potential makes sense. There are a number of reasons I think this cannabis sector can move higher in the coming months.

First, it appears the coronavirus pandemic may have actually proven to be a positive for the industry, especially on the legalization front. While Canada passed a national legalization platform back in 2018, the U.S. still remains a patchwork of different rules in different states and remains illegal from the federal standpoint.

But, the pandemic and its economic destruction has brought certain realities to bear; among them, the need for a legal and regulated global cannabis industry and the tax-revenues and jobs that come with it. The first hint that cannabis would benefit from the coronavirus pandemic emerged when it was deemed to be “essential” by most states allowing pot stores to remain open. The next positive sign was the House of Representatives including federal banking provisions in their most-recent relief bill.

It still needs to pass the Senate but it has the endorsement of the American Bankers Association. Federal legalization is crucial to allow cannabis companies to engage in the traditional banking and financial markets. Once the corporate conduits of capitalism open to U.S. cannabis companies with the ability for institutions such as pension funds to invest directly U.S. cannabis companies will bring down the cost of capital and help spur a maturation of the industry.

In a sense, the cannabis sector offers a form of regulatory arbitrage compared to other industries. Currently, cannabis companies must currently cope with a lack of national banking access, undue reliance on cash transactions, and onerous tax treatment. If those points of friction are lifted it will provide a huge positive catalyst from both an operational and investment standpoint.

Another reason for the bullish case is the latest round of earnings reports from companies alike “Curaleaf (CURLF)” and “Green Thumb Industries (GTBIF)” showed solid sales growth and improving margins suggesting consolidation are leading to better fundamentals and rationalization of valuations.

Lastly, large-cap cannabis equities were heavily shorted entering May despite many leaders trading near all-time lows. In fact, it was becoming near impossible to borrow (needed to short stocks) which seemed evidence that positive cannabis bears had outstayed their welcome and were ripe to get caught off-sides Market turns often start with short covering, which appears a good portion of the initial rally off the lows was, but now I believe improving fundamentals and positive legislative reform will take cannabis stocks higher.

Want More Great Investing Ideas?

Do NOT Buy This Dip! Are you prepared for the bear market’s return?

7 “Safe-Haven” Dividend Stocks for Turbulent Times

9 “BUY THE DIP” Growth Stocks for 2020

MJ shares were trading at $13.59 per share on Friday afternoon, down $0.07 (-0.51%). Year-to-date, MJ has declined -18.11%, versus a -3.05% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MJ | Get Rating | Get Rating | Get Rating |