New York City-based MarketAxess Holdings, Inc. (MKTX - Get Rating) operates an electronic trading platform for institutional investors and broker-dealer companies worldwide.

The company recently partnered with MSCI Inc. (MSCI) to identify and create more liquid and sustainable fixed-income portfolios for its global institutional clients.

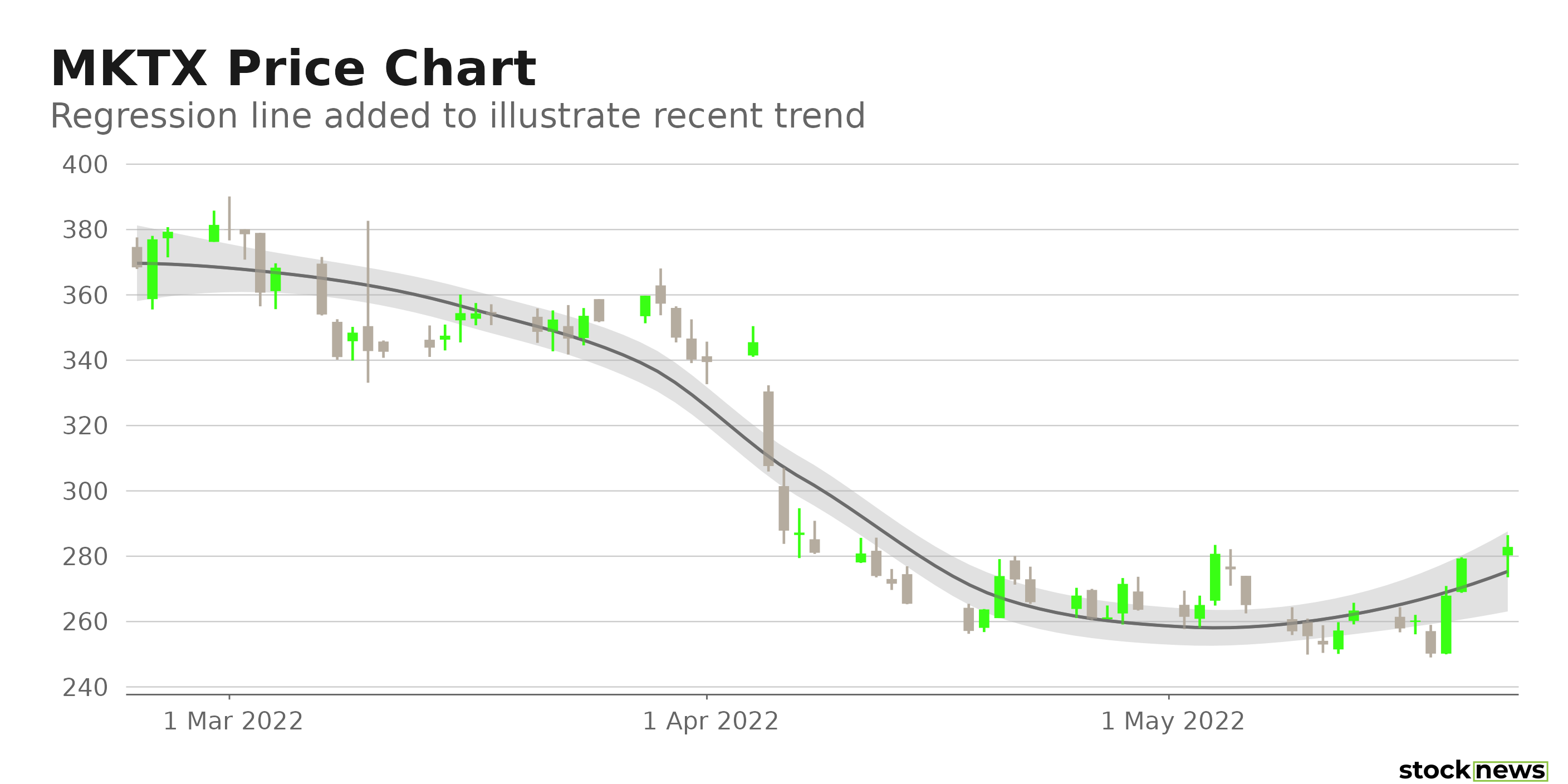

The stock has declined 23.2% in price over the past month and 31.2% year-to-date to close yesterday’s trading session at $282.85. In addition, it is currently trading 43.3% below its 52-week high of $498.97, which it hit on August 5, 2021. Also, its 12.88% trailing-12-month levered FCF margin is 33.3% lower than the 19.30% industry average. So, MKTX’s near-term prospects look uncertain.

Here is what could influence MKTX’s performance in the upcoming months:

Disappointing Financials

For its fiscal first quarter, ended March 31, 2022, MKTX’s net revenue declined 5% year-over-year to $186 million. The company’s operating income for the quarter decreased 15% year-over-year to $88 million, while its net income came in at $65 million, representing a 19% year-over-year decrease. Also, its EPS was $1.71, down 19% year-over-year.

Stretched Valuation

In terms of forward P/B, MKTX’s 9.45x is 765.4% higher than the 1.09x industry average. Its 13.98x forward P/S is 393% higher than the 2.83x industry average. Furthermore, the stock’s forward EV/S and non-GAAP P/E of 13.57x and 39.14x, respectively, are higher than the 2.81x and 9.96x industry averages.

POWR Ratings Do not Indicate Enough Upside

MKTX has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by accounting for 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. MKTX has a D grade for Value, which is in sync with its higher-than-industry valuation ratios.

The stock has a D grade for Sentiment. This is justified because analysts expect its EPS to decline in the near term.

MKTX is ranked #8 among the 12 stocks in the F-rated Financial Marketplaces industry. Click here to access MKTX’s Growth, Stability, Momentum, and Quality ratings.

Bottom Line

MKTX is currently trading below its 50-day and 200-day moving averages of $296.06 and $374.76, respectively, indicating a downtrend. So, the stock looks overvalued at the current price level, and we think it could be wise to wait for a better entry point in the stock.

Want More Great Investing Ideas?

MKTX shares were unchanged in premarket trading Tuesday. Year-to-date, MKTX has declined -30.91%, versus a -17.12% rise in the benchmark S&P 500 index during the same period.

About the Author: Nimesh Jaiswal

Nimesh Jaiswal's fervent interest in analyzing and interpreting financial data led him to a career as a financial analyst and journalist. The importance of financial statements in driving a stock’s price is the key approach that he follows while advising investors in his articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MKTX | Get Rating | Get Rating | Get Rating |