- MSFT is the software king with a trillion and a quarter dollar market cap

- Alphabet is in the trillion-dollar club and is an advertising monopoly

- Regulatory risk on a bipartisan basis after the 2020 election

Microsoft (MSFT) and Alphabet (GOOGL) are members of an exclusive club. Both technology companies have market caps of over one trillion US dollars. The tech sector of the stock market had a fantastic year in 2019. The NASDAQ rose by an incredible 35.23% last year, as it moved from 6,635.28 at the end of 2018 to close on December 31, 2019, at 8,972.60. At 9,283.14, on January 17, the NASDAQ had already gained 3.46% in 2020.

MSFT and GOOGL are leaders in the tech sector. As we head into an election year in the US, both companies face an environment where leadership, profits, and trillion-dollar valuations could result in unwanted attention over the coming months. The potential for regulatory changes could impact the share prices of MSFT and GOOGL as the November 2020 election approaches.

MSFT is the software king with a trillion and a quarter dollar market cap

Microsoft (MSFT) is the owner of the world’s leading computer software franchise. Bill Gates founded the company in 1975, and the stock has been a bullish beast.

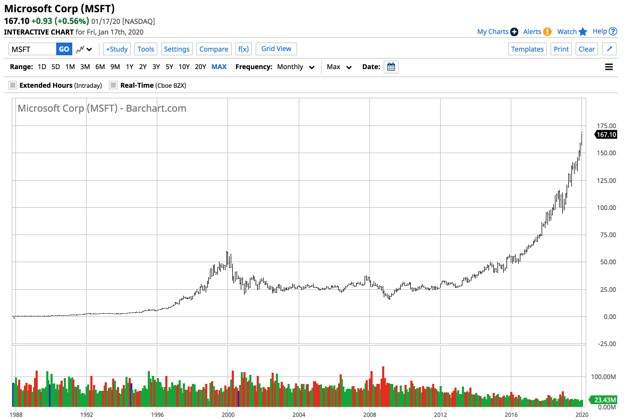

(Source: Barchart)

The long-term chart dating back to November 1987 shows the shares traded to a split-adjusted low of 28 cents before rising to a peak of $59.97 during the final month of 1999. It was not until sixteen years into the new century that MSFT shares rose to a higher high. Since breaking out to the upside in October 2016, the stock hardly looked back. The latest high of $167.47 came on January 17, and MSFT was just below that level at $167.10 at the end of last week. At that level, the company’s market cap was $1.275 trillion.

(Source: Barchart)

The image shows that MSFT has beat earnings expectations over the past four consecutive quarters. In Q4, consensus estimates are calling for earnings of $1.32 per share. A survey of 32 analysts has a target price for the shares of $168.38, with a range from $133 to $200. The profitability of the company has made Microsoft (MSFT) one of a handful of companies in the crosshairs of legislators and regulators.

Alphabet is in the trillion-dollar club and is an advertising monopoly

Before Google became the ubiquitous search engine on the internet, the saying “google it” would have been like a foreign language. Google changed its corporate name to Alphabet (GOOGL) but google is to tech what Oreo is to cookies or Kleenex is to tissues. Alphabet’s franchise is in advertising as the internet has changed the way information goes to and comes from consumers around the globe.

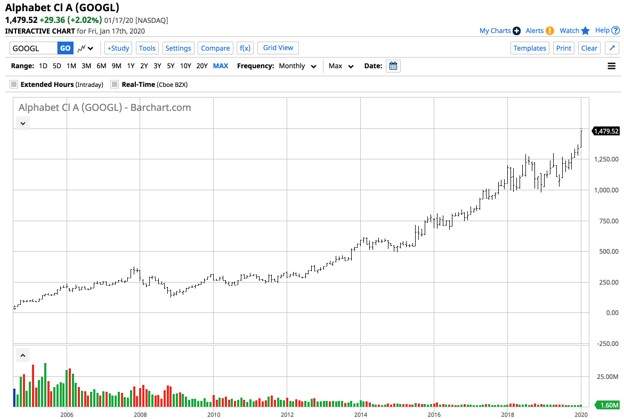

(Source: Barchart)

The stock moved from $47.98 in August 2004 to a new high of $1480.55 on January 17, 2020. At a closing price of $1479.52 at the end of last week, Alphabet (GOOGL) shares were in the highs translating to a market cap of $1.021 trillion, just a hair over the trillion-dollar level.

(Source: Barchart)

The table shows that the company has been batting 0.500 when it comes to meeting analyst earnings estimates. However, GOOGL has earned a minimum of $9.50 per share over the past four quarters. A survey of 39 analysts on Yahoo Finance has an average target for the shares of $1520 with a range of $1250 to $1907.73.

Alphabet (GOOG), like Microsoft (MSFT), is another example of a tech company that has been so successful sitting in a dominant position.

Regulatory risk on a bipartisan basis after the 2020 election

Fewer regulations and corporate tax cuts under the Trump administration have created a bonanza of profits for Microsoft’s software and Alphabet’s advertising business since early 2017. From the end of 2016, Microsoft (MSFT) shares appreciated from $62.14 to $167.10 or almost 170% as of January 17. Alphabet (GOOG) stocks moved from $771.82 to $1479.52 or over 91.6% over the same period.

The 2020 election in the US could have significant ramifications for both companies. Many of the opposition candidates support higher corporate taxes and increased regulations. At the same time, members of Congress have held many hearings and inquiries to control the domination of the tech sector by a handful of companies. The potential for government-mandated breakups, higher taxes, or other regulatory changes could cause increased volatility and corrections in the stocks that occupy the trillion-dollar club.

The risks of holding Microsoft (MSFT) and Alphabet (GOOG) shares are rising with the price of the stocks as the hot lights of Washington DC, and other legislators and regulators around the world will become brighter as their franchises yield greater rewards.

MSFT shares were trading at $167.10 per share on Monday morning, up $0.93 (+0.56%). Year-to-date, MSFT has gained 5.96%, versus a 3.13% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MSFT | Get Rating | Get Rating | Get Rating |

| GOOGL | Get Rating | Get Rating | Get Rating |