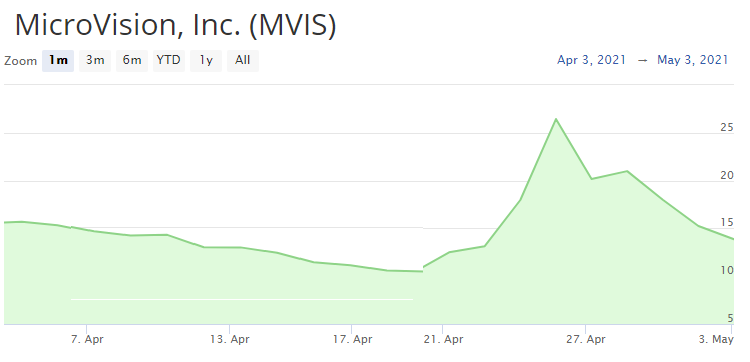

Last month MicroVision (MVIS - Get Rating) became a much talked about company on the Reddit WallStreetBets Investing forum. MVIS is a company that develops Lidar technology. Lidar, which stands for “light detection and ranging,” is a technological method used to measure the distance of an object on the earth’s surface. This technology is being used in the development of autonomous vehicles (AV).

This Reddit buzz led to an incredible 163% rally in the stock from April 20th to April 26th. However, since then the stock has plummeted 50% and is currently trading at $13.86.

Another prominent LiDAR stock is Velodyne Lidar (VLDR - Get Rating). In this article, we are going to analyze MVIS and VLDR to determine which stock is a better buy.

Another prominent LiDAR stock is Velodyne Lidar (VLDR - Get Rating). In this article, we are going to analyze MVIS and VLDR to determine which stock is a better buy.

MicroVision

MicroVision is a laser technology company that concentrates on developing lidar sensors used in automotive safety and autonomous driving applications. The company, based in Redmond, Washington was founded in 1933 and went public in August 1996. Currently, the company has a market cap of ~ $2.4 billion and trades around $14 per share.

MVIS stock: Q1 recap and valuation

In the first quarter of 2021, MicroVision revenue was down around 66% on a year-over-year basis to $479K. Also, the company reported GAAP loss per share $0.04, missing Wall Street expectations by $0.01 (33.33%). Currently, Wall Street expects MVIS’s earnings to grow 10.63% in fiscal 2021 to (0.19) per share. Following this trend, analysts forecast that its F2021 revenue could rise to $ 5.13 million. This estimate implies a rise of 65.99% on a year-over-year basis.

As of March 31,2021, the company had total cash of $75.34M and total debt of $2.96M, bringing its total net cash to $72.38M. Cash used to run the company’s operations during the first quarter of 2021 was roughly $4.5M. According to the company’s earning’s call, cash burn rate is expected to increase due to higher operating expenses in the second quarter of 2021.

Based on that, we would expect the cash on hand to be sufficient for at least 18 months.

Moreover, MicroVision looks overvalued compared to the sector’s median forward P/S ratio of 4.0x. MicroVision stock’s P/S has been as high as 1849.47 and as low as 4.84x, with an average of 90x. Assuming next year’s sales of about $20 million in the bullish case, the shares could drop to around $11.57 – a decrease of 18% from the current levels.

Bearish Options Bets

The options, which expire on May 21 saw increased put buying over the past week. The open interest for the $12.00 puts rose by 7,003 contracts to a total of 13,079 open contracts (source: barchart.com). For the buyer of the $12.00 puts to earn a profit, the stock would need to fall to around $11.35.

Also, the open interest levels for the May 21 $10.00 puts increased significantly over the past few days. According to barchart.com, the open contracts rose by 4,804 contracts to about 12,793. It’s a large, bearish bet as the open interest represents a total dollar value of about $383,790. For the buyer of the $10 puts to earn a profit, the stock would need to plunge to around $9.70.

Putting all these options transactions together, we can conclude that the options market sentiment for MicroVision stock is currently bearish. Moreover, options market trades imply approximately a 25% downside from MicroVision’s Monday closing price.

Velodyne Lidar

Velodyne Lidar is a technology company that develops a real-time three-dimensional vision for autonomous systems. The company, based in San Jose, California, was founded in 1983 and went public in September 2020. Currently, the company has a market cap of ~ $2.7 billion and trades around $12.75 per share.

As of FY2020, the company has had over 300 clients bringing in more than $670 million in lifetime revenue. In Q4, Velodyne Lidar reported revenues of $17.85 million, beating the Wall Street expectations by $1.73 million. Also, the company substantially increased its gross margin to 11.6% due to the transition to new overseas manufacturing, up from 1.2% in the prior-year period.

Comparatively, analysts covering Velodyne Lidar forecast that its revenue will remain flat in 2021 and will rise to $189 million in 2022, implying a year-over-year increase of 102.55%. Moreover, analysts expect the company’s EPS to be ($0.38) in 2021 and ($0.14) in 2022, which implies respective increases of 13.7% and 61.85% year-over-year.

In terms of growth prospects, the company believes that 194 projects could potentially yield a total of ~9 million units shipped by 2025. Based on that, Velodyne Lidar expects its revenues to increase ten-fold and exceed $1 billion by 2025 if all contracts will be awarded.

Additionally, the company looks undervalued compared to its peers. It’s trading at a forward Price-to-Sales multiple of 27.65x and an EV-to-Sales multiple of 24.03x.

Conclusion

Putting it all together, we believe VLDR, at these levels of $12.78 per share, is a better long-term “buy” candidate. The company continues to build the broadest product portfolio to meet the needs of a diverse range of industries. In addition, the average price target for VLDR is $19.44, which represents a 52% upside.

Want More Great Investing Ideas?

MVIS shares fell $0.26 (-1.88%) in after-hours trading Monday. Year-to-date, MVIS has gained 157.62%, versus a 12.22% rise in the benchmark S&P 500 index during the same period.

About the Author: Oleksandr Pylypenko

Oleksandr Pylypenko has more than 5 years of experience as an investment analyst and financial journalist. He has previously been a contributing writer for Seeking Alpha, Talks Market, and Market Realist. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MVIS | Get Rating | Get Rating | Get Rating |

| VLDR | Get Rating | Get Rating | Get Rating |