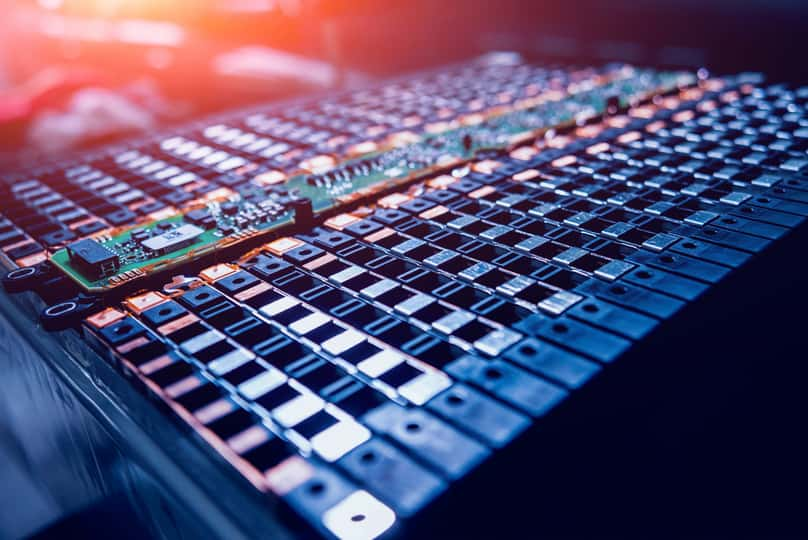

Microvast Holdings, Inc.’s (MVST - Get Rating) ultra-fast charging battery system provides comprehensive solutions for different applications, from commercial vehicles, to passenger vehicles and energy storage, to consumer electronics. The Stafford, Tex.-based company made its stock market debut on July 26, 2021, merging with a special purpose acquisition company (SPAC) Tuscan Holdings Corp.

Its shares have gained 23.2% in price over the past month to close yesterday’s trading session at $9.39, due mainly to investors’ optimism surrounding vehicle electrification and the increased need for energy storage.

However, the stock has lost 31.5% over the past three months and is currently hovering around its 52-week low of $7.38, which it hit on October 6, 2021. According to a Reuters report, 26 securities class actions were filed against SPAC-related companies from January 2021 through October 29, representing a 420% year-over-year rise from 2020. Furthermore, MVST reported losses in the second quarter. So, the stock’s near-term prospects look bleak.

Click here to checkout our Electric Vehicle Industry Report for 2021

Here is what could shape MVST’s performance in the near term:

New Capacity Not Likely to be Operational Before 2023

On November 1, MVST announced that it had purchased a new research, development, and innovation center in Lake Mary, Fla. In addition, the company announced in July 2021 that it would collaborate with eVersum to develop state-of-the-art battery solutions to electrify the current and future line of purpose-built, purely ‘eBorn’ EVs from eVersum.

However, MVST’s new capacity is not expected to be online until early 2023, in line with its key customers’ updated production schedules and forecast requirements as they also work to overcome industry-wide supply chain and logistics challenges.

Top Line Growth Doesn’t Translate into Bottom Line Improvement

For the second quarter, ended June 30, 2021, MVST’s revenues surged 53.8% year-over-year to $33.37 million. However, the company’s gross loss came in at $6.77 million, versus a $3.55 million gross profit in the year-ago period. This is primarily due to lower orders placed for a specific manufacturing line and increased raw material prices. MVST’s loss from operations in the quarter increased 244.5% year-over-year to $22.34 million. Also, MVST’s net loss came in at $27.07 million, representing a 244.5% year-over-year rise.

Poor Profitability

In terms of its trailing-12-month gross profit margin, MVST’s 4.48% is 84.7% lower than the 29.33% industry average. The stock’s trailing-12-month EBITDA margin is negative compared to the industry 13.49% average. Moreover, its trailing-12-month ROTC and ROTA are negative compared to the 6.52% and 5.09% respective industry averages.

POWR Ratings Reflect Bleak Prospects

MVST has an overall D rating, which equates to Sell in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. MVST has a D grade for Growth and Sentiment. This is justified because analysts expect its EPS to remain negative in its fiscal years 2021 and 2022.

The stock has a D grade for Value, consistent with its 24.31x forward EV/S, which is1,075.3% higher than the 2.07x industry average. Moreover, MVST’s forward P/S and P/B of 20.67x and 10.73x, respectively, are higher than the 1.69x and 3.26x industry averages.

Beyond what I have stated above, we have also given MVST grades for Momentum, Stability, and Quality. Click here to get all the MVST ratings. Also, MVST is ranked #73 out of 90 stocks in the Industrial – Equipment industry.

Click here to check out our Industrial Sector Report for 2021

Bottom Line

Even though the demand for EVs and related services is rising, global material shortages and international freight delays are expected to continue affecting MVST’s operations. The company’s losses increased in its last reported quarter. Furthermore, analysts expect its EPS to remain negative in the coming quarters. So, we think it could be wise to avoid the stock now.

How Does Microvast Holdings (MVST) Stack Up Against its Peers?

While MVST has an overall POWR Rating of D, one might want to consider investing in the following Industrial – Equipment stocks with an A (Strong Buy) rating: Compagnie de Saint-Gobain S.A. (CODYY - Get Rating), Finning International Inc. (FINGF - Get Rating), and Applied Industrial Technologies, Inc. (AIT - Get Rating).

Want More Great Investing Ideas?

MVST shares fell $0.19 (-2.02%) in premarket trading Wednesday. Year-to-date, MVST has declined -45.91%, versus a 25.99% rise in the benchmark S&P 500 index during the same period.

About the Author: Manisha Chatterjee

Since she was young, Manisha has had a strong interest in the stock market. She majored in Economics in college and has a passion for writing, which has led to her career as a research analyst. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| MVST | Get Rating | Get Rating | Get Rating |

| CODYY | Get Rating | Get Rating | Get Rating |

| FINGF | Get Rating | Get Rating | Get Rating |

| AIT | Get Rating | Get Rating | Get Rating |