National CineMedia, Inc. (NCMI - Get Rating) in New York City manages a cinema advertising network in North America through its subsidiary, National CineMedia, LLC. It sells advertising to national, regional, and local businesses through Noovie, a cinema advertising and entertainment pre-show seen on movie screens; and it sells advertising through its Lobby Entertainment Network, a series of strategically placed screens located in movie theater lobbies, as well as other forms of advertising and promotions in theater lobbies.

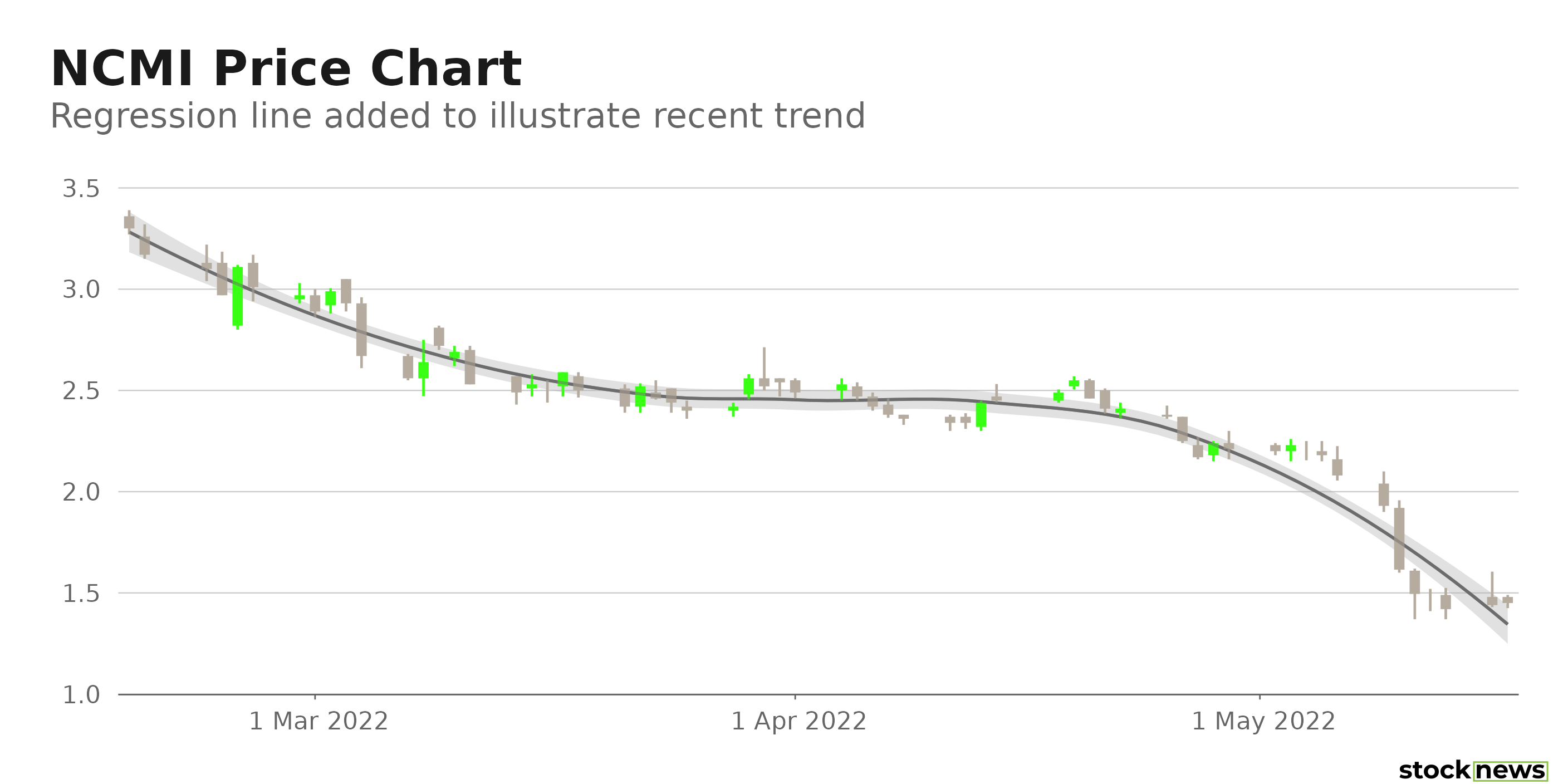

The stock rose 13.1% in price after hours yesterday after a regulatory filing revealed that theater giant AMC Entertainment (AMC) has a 6.8% stake in NCMI. However, the stock is down 67.6% over the past year and 48.4% year-to-date to close yesterday’s trading session at $1.45. In addition, the stock is currently trading 72.9% below its 52-week high of $5.37, which it hit on May 27, 2021.

NCIM faces intense competition from other direct-to-consumer streaming service providers, such as HBO Max and Peacock, whose demand soared during the COVID-19 outbreak. Furthermore, its lack of profitability may worry investors.

Here is what could shape NCMI’s performance in the near term:

Poor Bottom-line Performance

NCMI’s total revenue increased 564.8% year-over-year to $35.9 million for the first quarter, ended March 31, 2022. However, its costs and expenses increased 73.3% from their year-ago value to $58.4 million. Its operating loss came in at $22.5 million. The company’s net loss grew 29.9% year-over-year to $25.2 million. And its loss per share amounted to $0.31 over this period.

Poor Profitability

NCMI’s 34.5% trailing-12-months gross profit margin is 32.4% lower than the 50.9% industry average of 50.9%. Its trailing-12-months cash from operations stood at negative $93.80 million compared to the $283.45 million industry average. Also, its trailing-12-months ROA, net income margin, and ROC are negative 6.6%, 37.6%, and 4.5%, respectively.

POWR Ratings Reflect Bleak Outlook

NCMI has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. NCMI has a D grade for Stability, which is justified given the stock’s 1.38 beta.

Among the eight stocks in the F-rated Entertainment – Movies/Studios industry, NCMI is ranked #6.

Beyond what I have stated above, one can view NCMI ratings for Growth, Value, Quality, Momentum, and Sentiment here.

Bottom Line

While NCMI shares jumped on the recent news related to AMC’s stake in the company, its negative profit margins could concern investors. Furthermore, analysts expect its EPS to decline at the rate of 6.4% per annum over the next five years. In addition, the stock is currently trading below its 50-day and 200-day moving average of $2.30 and $2.83, respectively, indicating a downtrend. So, we think the stock is best avoided now.

What To Do Next?

If you would like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low priced companies with explosive growth potential, that excel in key areas of growth, sentiment and momentum.

But even more important is that they are all top Buy rated stocks according to our coveted POWR Ratings system, Yes, that same system where top-rated stocks have averaged a +31.10% annual return.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead:

Want More Great Investing Ideas?

NCMI shares rose $0.27 (+18.62%) in premarket trading Wednesday. Year-to-date, NCMI has declined -47.36%, versus a -13.76% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NCMI | Get Rating | Get Rating | Get Rating |