(Please enjoy the January 2020 issue of the POWR Trends newsletter).

This past decade has been filled with technological advances for a variety of industries. We saw this in the medical field, retail, communication, media, etc. This advancement shows no sign of slowing down anytime soon.

And there are many companies that have been the leaders of this growth who have seen their stock prices skyrocket, such as Amazon, Google, Tesla, Facebook, Qualcomm, etc.

In this month’s report, we’re going to focus on the renewable energy sector. Though we have seen significant growth in this sector over the past decade, this is so much more to come in the next 10 years.

As the global population continues to grow, so will the energy demand. The US Energy Information Administration’s International Energy Outlook 2017 projects that world energy consumption will grow by 28% between 2015 and 2040.

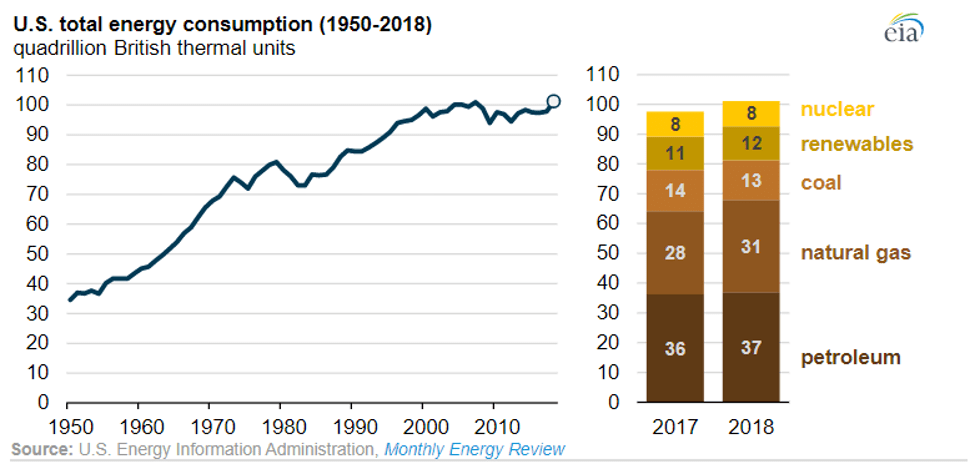

In 2018, the US Energy Information Administration’s (EIA) data showed the US energy consumption hit a record high. Fossil fuels provided 80 percent of total energy used in 2018.

However, coal consumption declined by 4 percent compared to the year before and renewable energy consumption reached a record high, rising 3% from 2017.

Renewable energy is defined by the US Energy Information Administration (EIA) as, “Energy from sources that are naturally replenishing but flow-limited; renewable resources are virtually inexhaustible in duration but limited in the amount of energy that is available per unit of time.” The major types of renewable energy sources are: solar, wind, geothermal, hydropower and biomass (wood and wood waste, municipal solid waste, landfill gas and biogas, ethanol and biodiesel).

The growth in the renewable energy sector in 2018 was driven by the addition of new wind and solar power plants. Wind electricity consumption increased by 8% and solar consumption rose 22%. Biomass consumption, primarily in the form of transportation fuels such as fuel ethanol and biodiesel, accounted for 45% of all renewable consumption in 2018, up 1% from 2017 levels.

In 2019, the UK-based oil giant BP released a report that predicted that renewable energy sources will be the world’s main source of power within two decades. BP said wind, solar and other renewables will account for about 30% of the world’s electricity supplies by 2040. In certain regions of the world such as Europe, the figure will be as high as 50% by 2040. BP concluded that renewables are establishing a foothold in the global energy system faster than any other fuel in history.

How is this growth possible?

The growth in capacity to generate electricity from low-carbon sources is due to a strong effort by world leaders to eliminate climate-damaging greenhouse gases that contribute to global warming. Now that we are experiencing falling costs to build wind and solar power plants, this is making projects in new markets make a lot more sense economically.

With their current competition being fossil fuels, many countries are choosing renewable energy projects as a way of investing in a more sustainable and cleaner future. “Investing in renewable energy is investing in a sustainable and profitable future, as the last decade of incredible growth in renewables has shown,” said Inger Andersen, executive director of UNEP. “It is clear that we need to rapidly step up the pace of the global switch to renewables if we are to meet international climate and development goals.”

Renewables energy sources like wind, solar and hydro-electric plants will draw about $322 billion a year through 2025, according to separate forecasts from the International Energy Agency. That’s almost a 300% increase from the $116 billion a year that will go into fossil fuel plants and about the same as what will be invested in power grids. Based on these astonishing numbers and forecasts, we feel that the renewable energy sector has tons of potential for 2020 and beyond.

So, let’s take a look at 4 companies in the renewable energy sector that are set to take advantage of this amazing growth:

NextEra Energy (NEE)

NextEra Energy is a clean energy-focused company. It operates two distinct businesses which are government-regulated utilities (Florida Power & Light and Gulf Power) and a competitive energy business (NextEra Energy Resources) that generates electricity and sells it to third parties under long-term PPAs(power purchase agreements). NextEra Energy’s affiliates combine to generate more electricity from the wind and sun than any other company in the world. This is a pretty impressive figure and on top of that, the company is also a leader in battery storage.

The company’s regulated utilities produce energy from a variety of sources which include natural gas, nuclear, coal, and solar. They also distribute natural gas to customers. These businesses generate very predictable income streams since regulatory bodies set rates. Demand tends to increase at a steady pace as Florida’s population and economy continue to expand. These are positive long term growth trends for NextEra Energy.

NextEra’s energy has a resource segment that owns an extensive portfolio of power-generating facilities which include wind, solar, nuclear, natural gas, and oil. On top of that, the company operates a large-scale natural gas pipeline business. The company sells the power it produces under long-term PPAs and leases capacity on its gas pipelines via long-term contracts. These agreements allow NextEra Energy to generate very predictable cash flows.

NextEra Energy has a fantastic history of growing its earnings and dividend. From 2003 through 2018, the company increased its adjusted earnings per share at a 7.8% compounded annual rate and at the same time boosted the shareholder payout at a 9.1% yearly pace. This consistent growth has allowed the company to generate market-crushing returns. In the decade from 2008 through 2018, it produced a 380% total return, which outpaced not only its utility peers (170% total return over that time frame) but also the S&P 500 (243%).

NextEra scored extremely well with the POWR Rating in StockNews.com. Not only is the overall score an A (Strong Buy), but it also is showing strength along with the 4 components:

Trade Grade = A

Buy & Hold Grade = A

Industry Rank = A

Peer Grade = A

In fact, on the Peer Grade, it is the #1 ranked stock in the Utilities-Domestic Group and the stock has been on fire this year rising from $165 to over $240.

Brookfield Renewable Partners (BEP)

Brookfield Renewable Partners is one of the largest renewable energy companies in the world. The company has an impressive globally diversified, multi-technology renewable power platform. Their power generation sources include hydroelectric generating facilities, wind farms, utility-scale solar projects, distributed generation assets, and energy storage. As of August 2019, hydro made up 75% of the company’s portfolio followed by wind at 21% and solar at 4%.

Brookfield generates revenue by selling renewable energy it generates to customers like utility companies under long-term, fixed-rate power purchase agreements (PPAs). These contracts provide the company with predictable cash flow while insulating it from volatile power prices. We favor these forms of revenue streams due to the fact that even during recessions, revenues will be less affected. The company distributes the majority of its cash flow (around 80%) back to investors through a high-yield dividend. It reinvests the rest into building or buying additional renewable energy-generating assets and expanding its business operations.

The company has a very ambitious goal when it comes to new investments. They are currently targeting opportunities that will generate 12% to 15% of total returns over the long-term. The company is able to achieve this goal by investing on a value basis, leveraging its operational expertise, and remaining disciplined. Brookfield generally targets opportunities where they can buy underperforming assets with bad management or another fixable problem and then turn them around by improving their operations and cost structure.

Brookfield has always focused on improvement and this really shines in its long-term outlook. The company plans to grow its cash flow per share at a 6% to 11% annual rate through at least 2022. This should allow them to increase their dividends at a 5% to 9% yearly pace. From an income perspective, Brookfield is an ambitious company looking to reward its shareholders. The company’s value-focused approach has been very rewarding to shareholders over the years. In the two decades since the company started through mid-2019, Brookfield has generated a 16% annualized total return. For comparison’s sake, the S&P 500 only delivered a 7% total annualized return over that time frame.

If there’s one concern with Brookfield Renewable, it’s that some of its operations reside in economically sensitive countries like Brazil. The company takes steps to reduce its risks in those regions by using hedging contracts to lock in currency rates and power prices.

While Brookfield Renewable Partners has battled its share of ups and downs over the years, it has been proven that slow and steady wins the race. The company has consistently grown its cash flow by investing in opportunities that meet its strict criteria. That’s enabled it to routinely increase its distribution to investors, allowing them to collect a growing income stream. That trend isn’t showing any signs of stopping, which is why Brookfield Renewable is a great clean energy stock to buy for the long term.

Brookfield Renewable scored very well with the POWR Rating in StockNews.com. Not only is the overall score an A (Strong Buy), but it also is showing strength along with the 4 components:

Trade Grade = A

Buy & Hold Grade = A

Industry Rank = C

Peer Grade = A

In fact, on the Peer Grade, it is the #2 ranked stock in the MLP’s-Other Group with an impressive 90% so far in 2019. And they look well-positioned for 2020 and beyond.

TerraForm Power (TERP)

TerraForm Power focuses on owning and operating wind and solar power assets in North America and Western Europe. As of mid-2019, 64% of the company’s portfolio consisted of wind assets, while the rest was solar. This company focuses solely on renewable energy sources. Like Brookfield Renewables, TerraForm Power makes money by selling the electricity it generates to end-users under long-term PPAs(power purchase agreements). Those contracts provide predictable cash flow which is highly favorable. The company is a solid income play (its payout ratio typically ranges between 80% to 85%) and delivers to investors a high-yield dividend. The company reinvests the remaining cash flow on high-return projects that expand its renewable power generating capacity.

Currently, Terraform Power has three projects underway to upgrade their existing wind farms by installing newer, larger turbines that should be completed by 2021. These investments would boost the power output at those locations by 25% to 30% while offering a 40% discount on the cost of building new wind farms. This allows TerraForm to boost its per-share earnings without investing substantial capital.

Aside from a similar business model, another reason TerraForm Power has so much in common with Brookfield Renewable is that they share the same parent company Brookfield Asset Management. Brookfield Asset and Brookfield Renewable joined forces in 2017 to take control of TerraForm Power after its former parent went bankrupt. They have done a fantastic job helping TerraForm get its financials back on track while improving its operations. They have also aided the company when it comes to focusing on their core business and reducing costs. This has dramatically helped boost the profitability of TerraForm’s legacy assets while giving it flexibility and cash flow to acquire new assets.

Since Brookfield took control Terraform has made two key acquisitions. Those transactions will provide the company with enough power to increase its dividend at a 5% to 8% annual rate through 2022. One of the biggest drivers of growth for TerraForm is their ability to improve the profitability of the assets it acquired by reducing costs.

What to Do Next?

We hope you enjoyed the January 2020 issue of the POWR Trends newsletter.

POWR Trends focuses on the biggest growth stories that investors need to be aware of from the Streaming Wars to Internet of Things to Graphene to 5G and more. If you want to find the best ways to invest in these dynamic growth arenas, then it’s time to discover the POWR Trends newsletter.

NEE shares were trading at $260.58 per share on Wednesday afternoon, up $3.69 (+1.44%). Year-to-date, NEE has gained 7.61%, versus a 3.18% rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NEE | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| FSLR | Get Rating | Get Rating | Get Rating |

| TERP | Get Rating | Get Rating | Get Rating |