Nucor Corporation (NUE - Get Rating) manufactures and sells steel and steel products with operating facilities in the United States, Canada, and Mexico. The company serves heavy equipment, infrastructure, construction, automotive, energy, and agriculture sectors.

NUE’s board of directors declared the regular quarterly dividend of $0.51 per share on its common stock, payable to stockholders on August 11. This will be the 201st consecutive quarterly dividend. The company pays an annual dividend of $2.04 per share, which translates to a dividend yield of 1.25% on current prices.

During the second quarter, NUE repurchased approximately 3.1 million shares at an average price of $147.03 per share (about 5.8 million shares year-to-date at an average price of $151.41 per share). The company has returned over $1.13 billion to stockholders through share repurchases and dividend payments year-to-date.

On June 14, NUE unveiled plans for its Towers & Structures unit to establish its second utility structures production facility in Crawfordsville, Indiana. Earlier this year, the company also announced plans to build its first structure production facility in Decatur, Alabama. The new facility is expected to create 200 full-time jobs.

This strategic move is anticipated to help accommodate the escalating demand amid increasing utility infrastructure from renewable energy projects, EV charging network expansion, and grid hardening. Consequently, this advancement underlines its commitment to integrating sustainable practices more thoroughly into its operational blueprint.

Furthermore, NUE signed a contract with Exxon Mobil Corporation (XOM - Get Rating) to undertake carbon capture, transportation, and storage from its direct reduced iron (DRI) facility in Convent, Louisiana, aligning with its commitment to decarbonization. The collaboration project with XOM is slated for initiation in 2026.

Despite NUE’s comprehensive strategy towards decarbonization potentially strengthening its long-term position, realizing these advantages is likely to occupy a lengthier timescale. A prime example involves its recent collaborative endeavor with XOM.

For the fiscal quarter ending April 1, 2023, comprehensive income attributable to NUE stockholders declined 48.8% year-over-year to $1.11 billion. For the same quarter, its cash provided by operating activities declined 51.2% year-over-year to $1.21 billion, while its cash used in financing activities grew 386.3% from the prior-year quarter to $920.67 million.

With the company set to report its second-quarter financials this week, let’s look at the trends of some of NUE’s key financial metrics to understand why it could be wise to wait for a better entry point in the stock.

Analyzing NUE’s Financial Performance Through its Key Metrics (2021-2023)

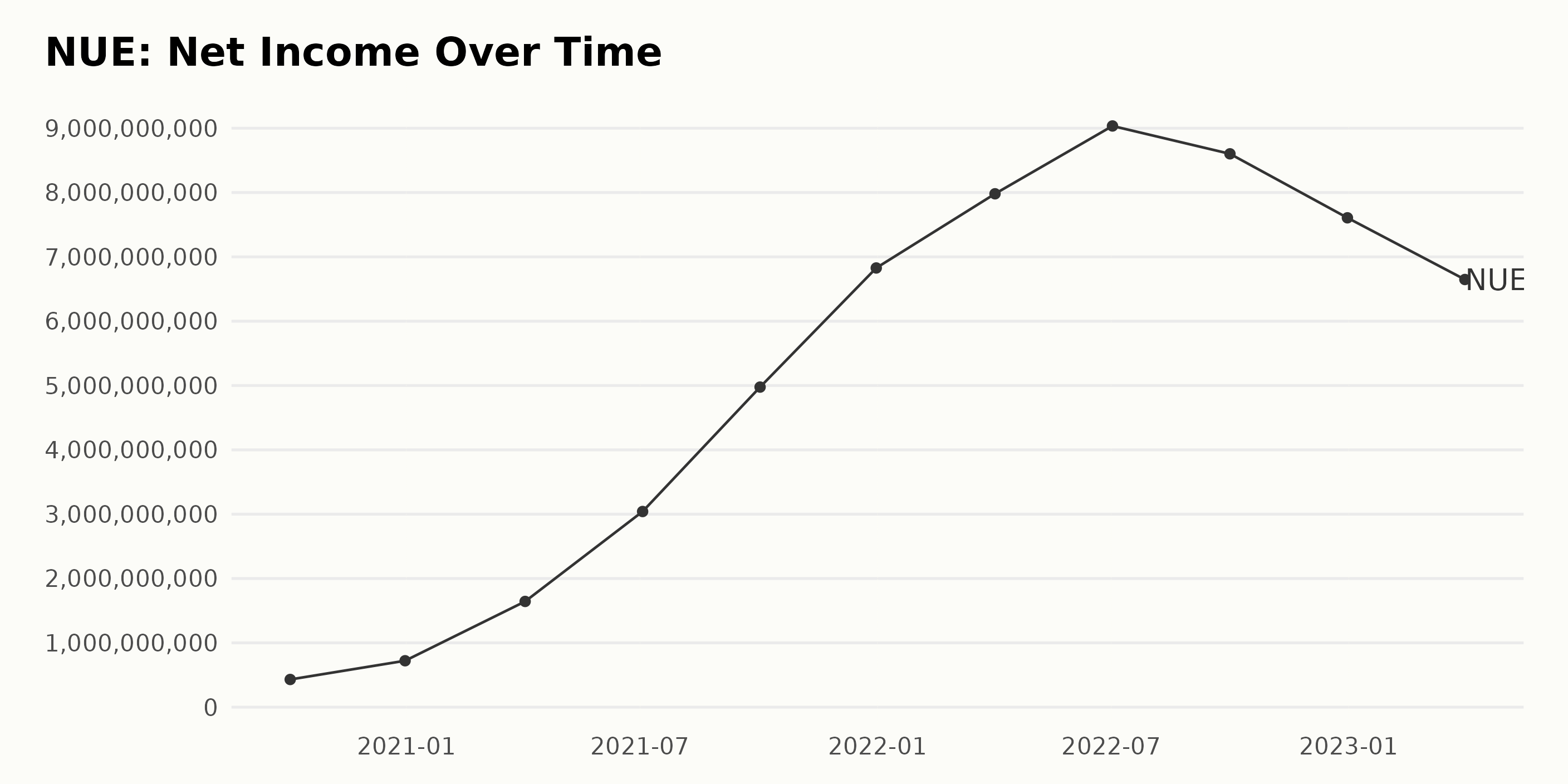

The series data indicates a predominant upward trend in NUE’s trailing-12-month net income from October 2020 to July 2022, followed by a downward trend. The reported figures fluctuate as follows: –

- In October 2020, the net income was $430.45 million.

- By December 2020, it increased significantly to $721.47 million.

- In April 2021, a dramatic surge was witnessed, with the net income shooting up to $1.64 billion.

- In July 2021, it stood at $3.04 billion.

- In October 2021, it came in at $4.98 billion.

- In December 2021, it surged to $6.83 billion.

- In April and July 2022, net income stood at $7.98 billion and $9.04 billion, respectively.

- In October 2022, it showed a slight decrease to $8.60 billion, signaling the start of the downturn.

- In December 2022, it declined to $7.61 billion.

- By April 2023, it came in at $6.65 billion.

Notably, from October 2020 to April 2023, NUE’s trailing-12-month net income exhibited a growth rate of approximately 1,445%. This noteworthy elevation, from $430.45 million to $6.65 billion, underscores the financial prosperity of the company during this period. The recent downward shift deserves critical attention when analyzing NUE’s recent financial performance.

NUE’s Price/Sales ratio displayed certain fluctuations over a period of three years, from October 2020 to April 2023.

- October 2020: 0.75

- December 2020: 0.89

- April 2021: 1.33

- July 2021: 1.39. A slight downturn appeared in July 2021 with some volatility.

- October 2021: 1.01

- December 2021: 0.97

- April 2022: 0.84

- July 2022: 0.86

- October 2022: 0.78

- December 2022: 1.04

- April 2023: 0.87.

Overall, NUE’s Price/Sales ratio shows a growth rate of around 16% when comparing the last value to the first one from the series. Worth noting is that the fluctuations were the most pronounced in 2021 and 2022, whereby the values varied between highs of approximately 1.4 and lows near 0.78 towards the end of 2022. It is also evident that the recent trend has been less volatile since late 2022 onwards.

The variances in the ratio suggest alterations in investor sentiment surrounding NUE’s revenues or modifications in the company’s top-line growth. Lastly, the most recent drop indicates a notable decrease in sales per share relative to the share price at the start of 2023.

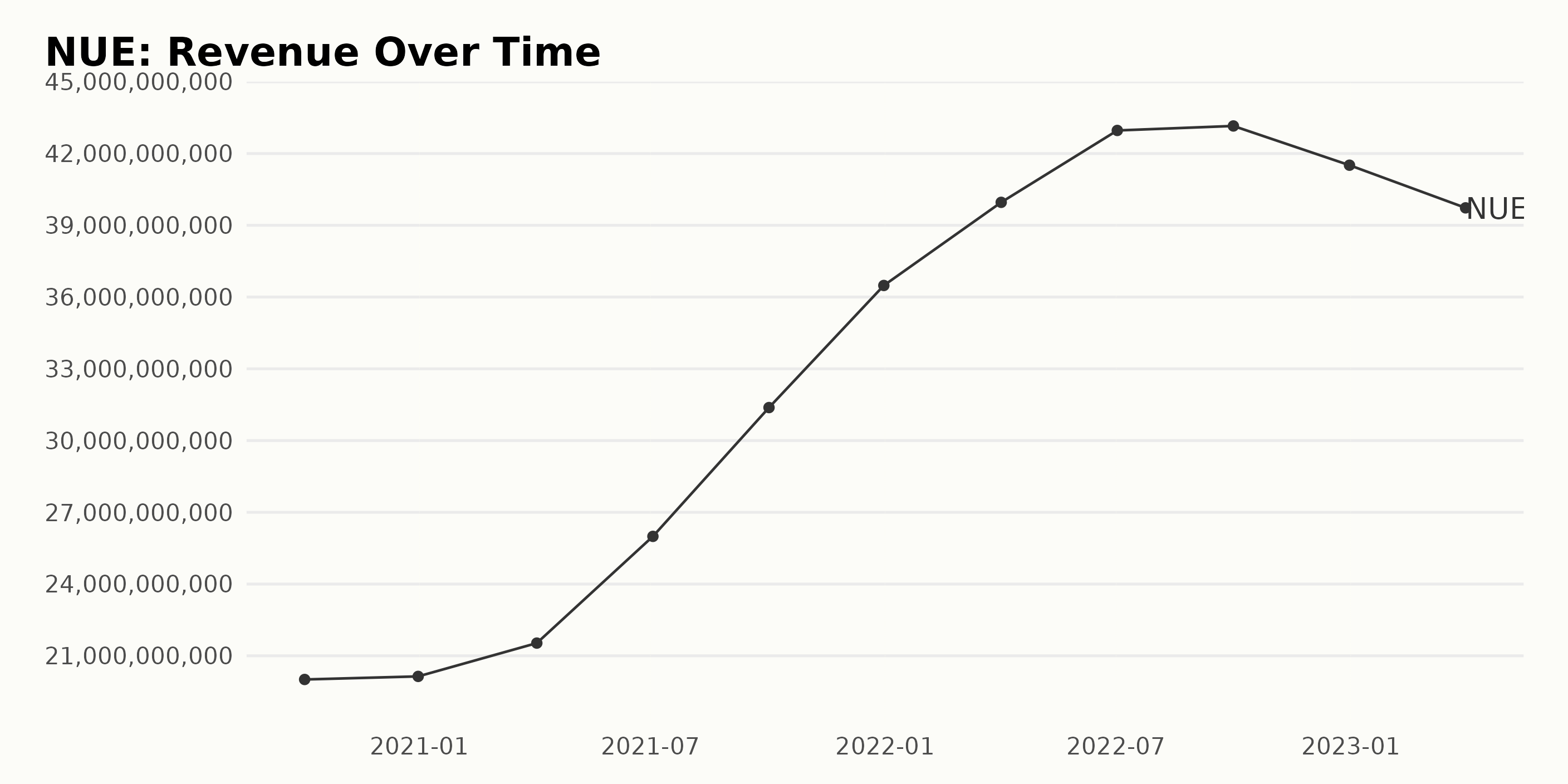

NUE’s trailing-12-month revenue trends from October 2020 to April 2023 have shown notable fluctuations, demonstrating a significant increase followed by a decrease over the final six months. This be summarized as follows:

- October 2020: $20.01 billion

- December 2020: $20.14 billion

- April 2021: $21.53 billion

- July 2021: $25.99 billion

- October 2021: $31.38 billion

- December 2021: $36.48 billion

- April 2022: $39.96 billion

- July 2022: $42.87 billion

- October 2022: $43.15 billion

- December 2022: $41.51 billion

- April 2023: The downturn persisted into the first quarter of 2023, with NUE recording a revenue of $39.73 billion (April 2023), marking the lowest point in the period post-October 2022.

Overall, comparing the latest value with the first, the company experienced a growth rate of approximately 99% from October 2020 to April 2023. However, its more recent data reflects a decline in revenue, suggesting a relative deceleration despite an overall upswing. These trends warrant close monitoring in projections of future performance.

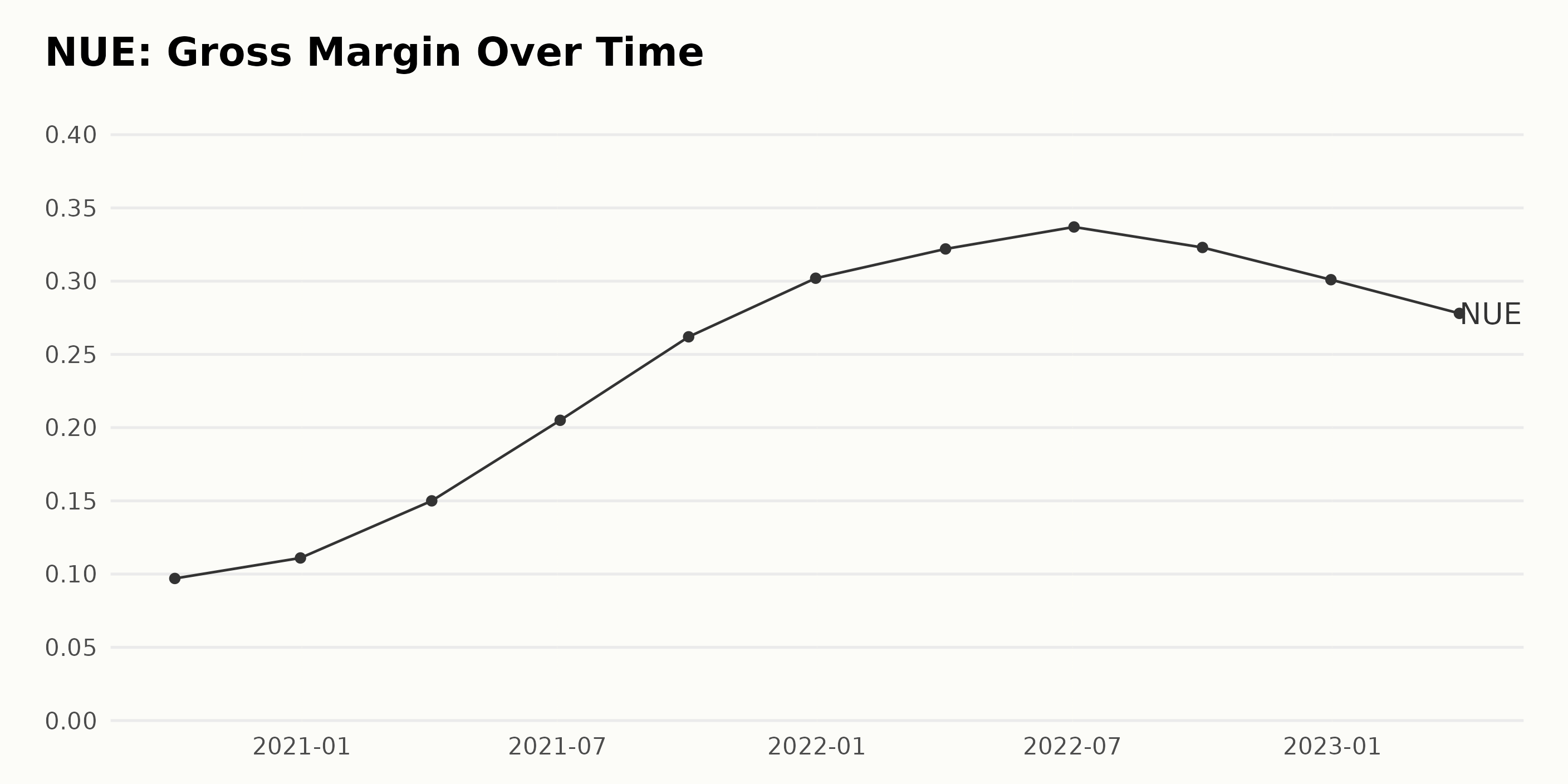

NUE’s gross margin from October 2020 to April 2023 showed an upward trend. The data details are as follows:

- October 3, 2020: 9.7%

- December 31, 2020: 11.1%

- April 3, 2021: 15%

- July 3, 2021: 20.5%

- October 2, 2021: 26.2%

- December 31, 2021: 30.2%

- April 2, 2022: 32.2%

- July 2, 2022: 33.7%

- October 1, 2022: 32.3%

- December 31, 2022: 30.1%

- April 1, 2023: 27.8%

In terms of growth rate, NUE’s gross margin increased approximately 186% from 9.7% in October 2020 to 27.8% in April 2023. Overall, the evidence suggests a general growth tendency with some fluctuations, particularly towards the more recent data points, which indicates a slight downward adjustment after an otherwise strong period of expansion.

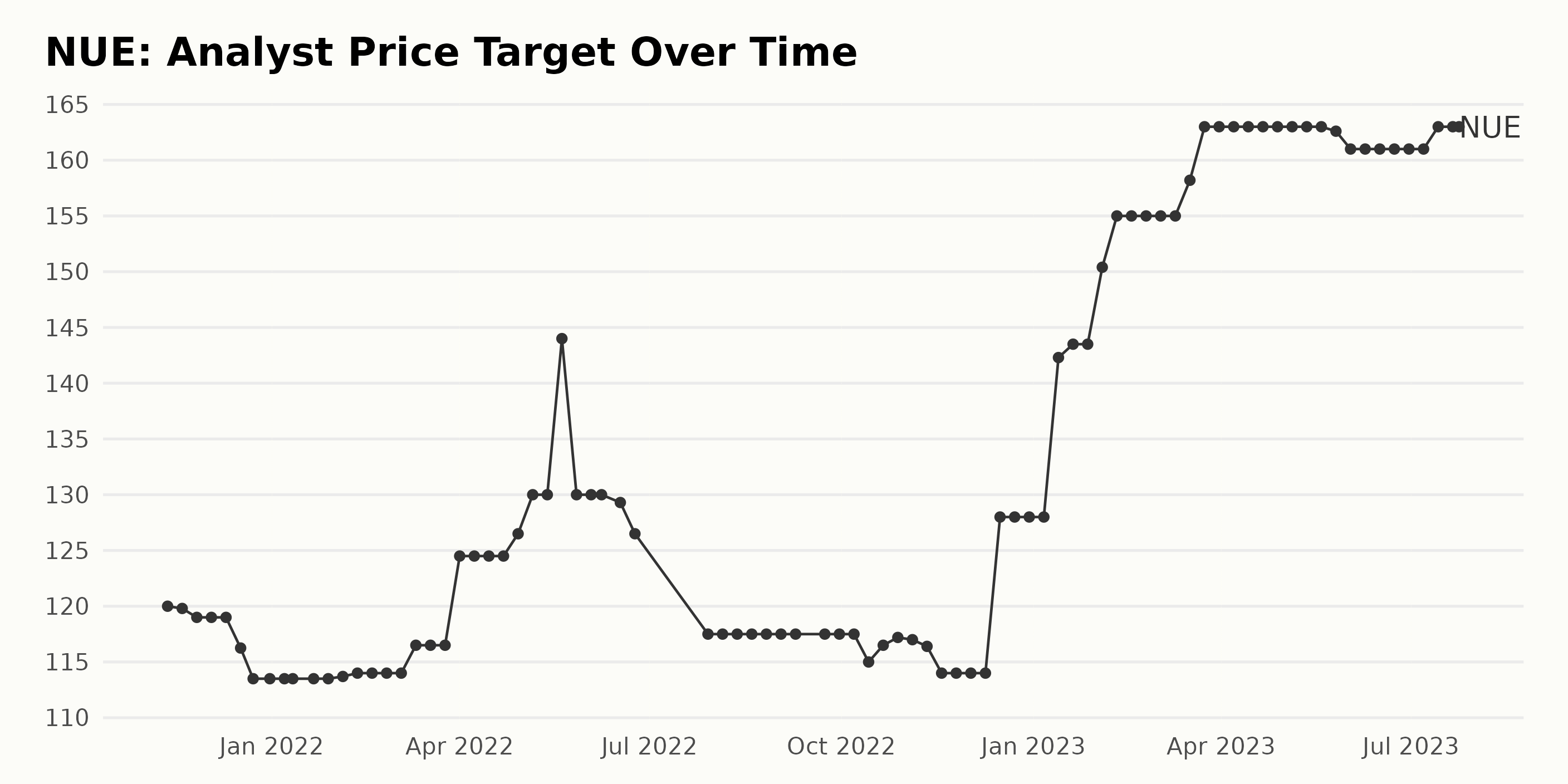

NUE’s analyst price target has seen both upward and downward fluctuations between November 2021 and July 2023. The main trend observed in the data is a general increase over the time period, with notable volatility throughout.

- The analyst price target value started at $120 in November 2021 and reached $163 by July 2023, representing an overall growth of approximately 36% over the period.

- There has been a trend of fluctuation over this time. The value decreased to $114 in November 2022 and then picked up significantly to reach $155 in February 2023.

- The data exhibited some volatility, particularly noticeable between May and June 2022, when the value peaked at $144 and subsequently dropped to $130 by the end of June.

- Since early 2023, particularly from February onwards, there has been a consistent upward trend, with the value increasing from $143.5 to $163.

- The last recorded value in this time series is $163, achieved in July 2023.

Overall, there have been periods of relative stability in NUE’s analyst price target, interspersed with times of considerable fluctuation. Despite these variations, the long-term trend shows an overall increase in the price target across the reported period from November 2021 to July 2023.

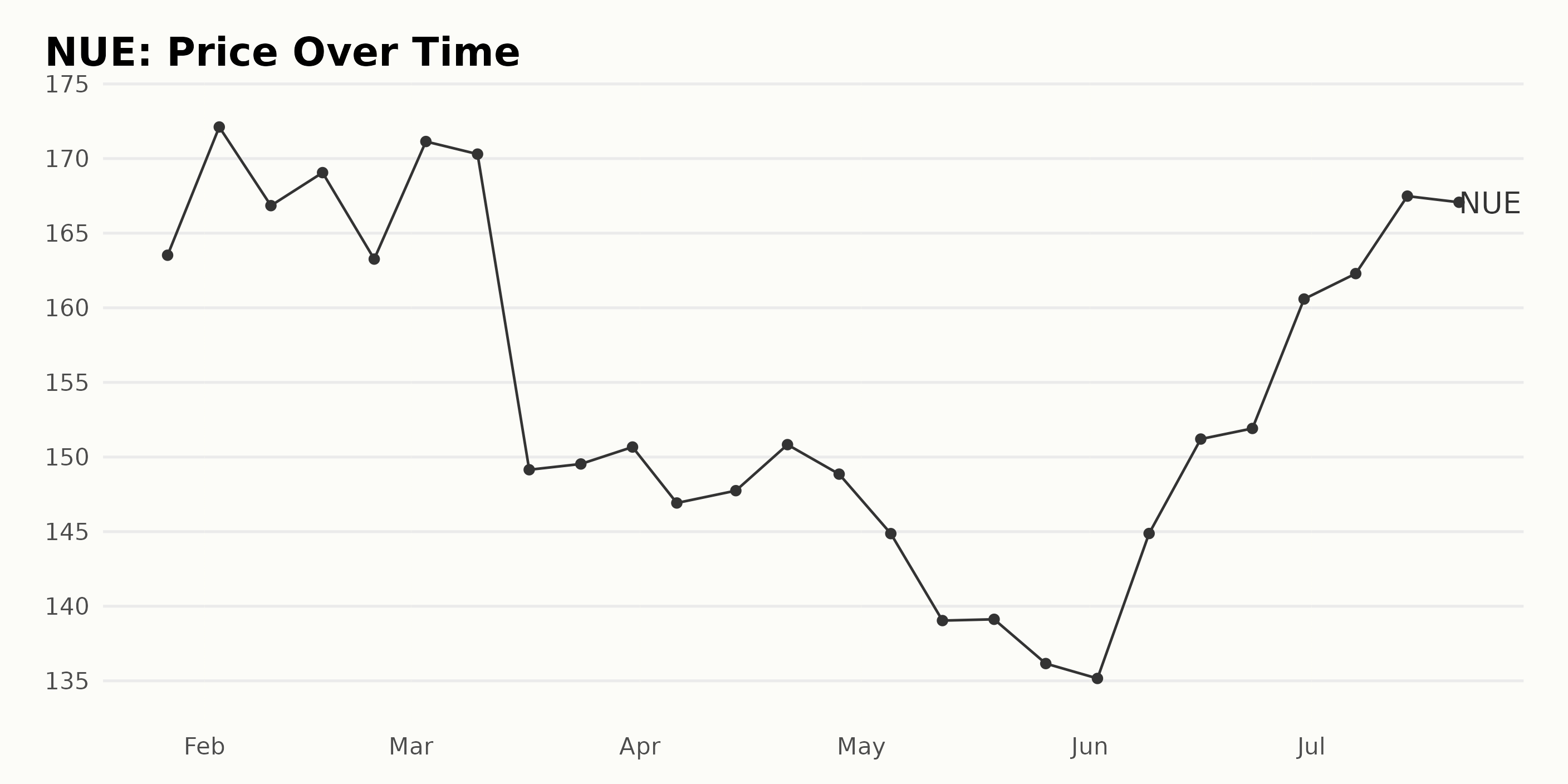

Understanding NUE’s Share Volatility: A Detailed, Cyclical Analysis from January-July 2023

NUE’s share price appears to show a series of fluctuations from January to July 2023. An analysis of the specific data points reveals:

- On January 27, 2023, the share price started at $163.52.

- There was a brief surge on February 3, 2023 at $172.12.

- The price dropped slightly over the following weeks, with some minor uplifts (maximum at $171.14 on March 3, 2023), but generally showed a downward trend through late March.

- By April and early May, the price continued to decrease, reaching the lowest point at $136.16 by May 26, 2023.

- However, starting in June, the price saw a steady recovery and generally increased through July, peaking again at $167.48 by July 14, 2023.

Overall, there is clear volatility in the NUE’s share pricing. Although there is a general decrementing trend in the first half of the year until May, an upward trend is notable starting from June until July. Consequently, giving an impression of cyclical movement without a consistently accelerating or decelerating trend within the stated period. Here is a chart of NUE’s price over the past 180 days.

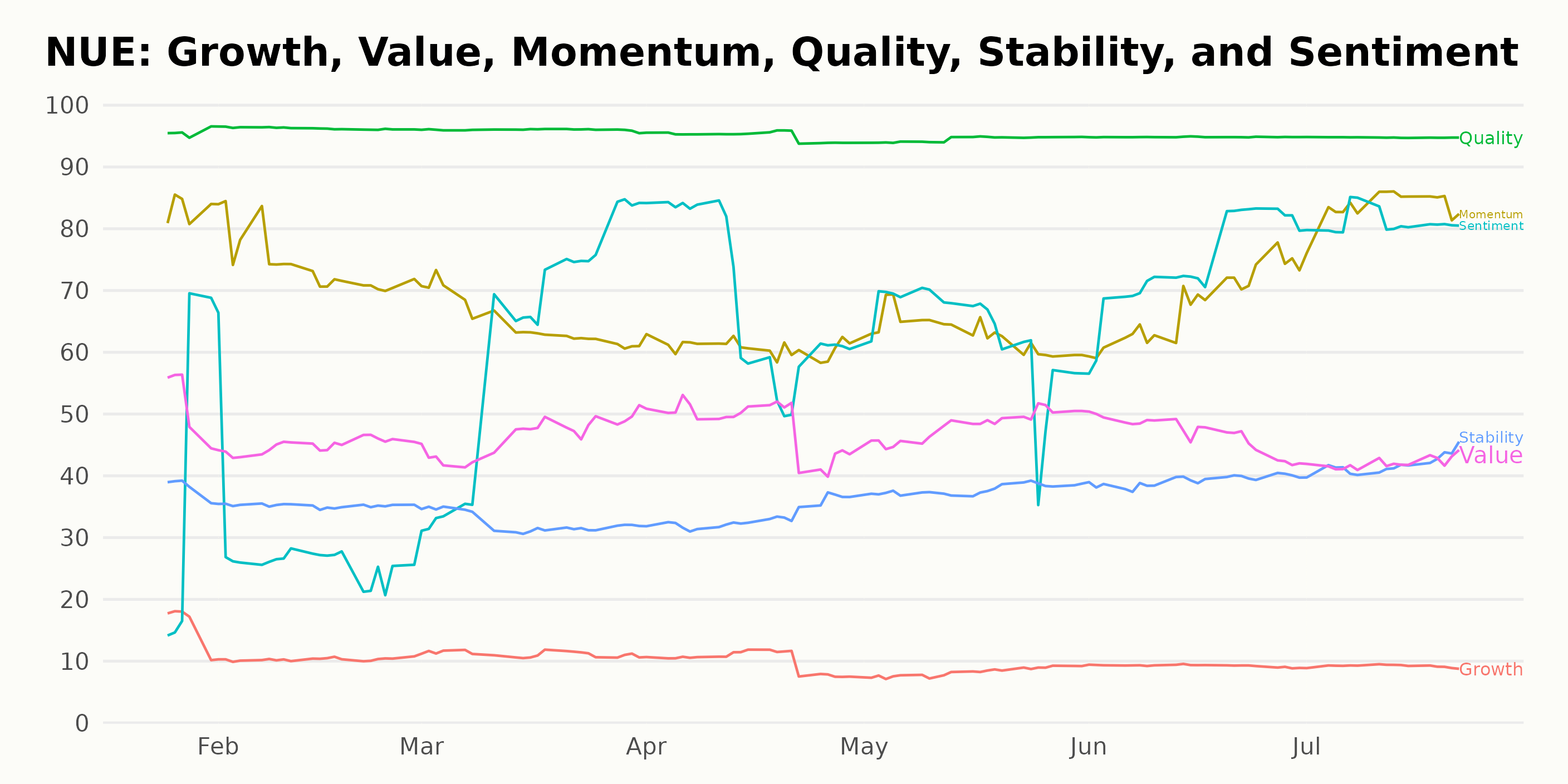

Analyzing Nucor Corporation’s Performance: Quality, Momentum, and Sentiment Highlights

The POWR Ratings of NUE, which fall under the Steel category, show gradual fluctuations over time. The latest data on the POWR grade and ranks are as follows:

As of July 22, 2023, the NUE’s overall POWR Ratings grade is a C, equating to Neutral, with its rank in the Steel category being #20 out of 34 stocks. Here is an overview of its progression:

A closer look at NUE’s ranking trend shows a decreasing pattern.

- January 28, 2023 – POWR Grade: C (Neutral), Rank: #22

- February 4, 2023 – POWR Grade: C (Neutral), Rank: #23

- March 25, 2023 – POWR Grade: C (Neutral), Rank: #19

- April 8, 2023 – POWR Grade: B (Buy), Rank: #15

- June 24, 2023 – POWR Grade: C (Neutral), Rank: #17

- July 22, 2023 – POWR Grade: C (Neutral), Rank: #20

Progressing from the #22 rank in January 2023 to the #20 rank in July 2023 suggests an improvement in its standing within the Steel category, despite remaining consistently at an overall rating of C (Neutral).

NUE’s POWR Ratings provide a valuable snapshot of the company’s performance across six key dimensions. After analyzing all dimensions, three emerge as most noteworthy: Quality, Momentum, and Sentiment.

Quality: Quality consistently received the highest ratings over the observed period. The Quality dimension started at a peak of 96 on January 31, 2023, and maintained a stable high rating throughout, only dipping marginally to 95 by April 2023.

Momentum: The Momentum dimension displayed an interesting trend throughout the given time frame. It started at a relatively high rating of 83 in January 2023 but decreased to 61 by April 2023. Surprisingly, a positive trend emerged thereafter, with the rating increasing to 84 by July 22, 2023.

Sentiment: The Sentiment rating initially showed substantial fluctuations over the recorded period, falling to 28 in February 2023 from 37 in January. However, after that, the rating gradually increased over time, reaching 81 by July 22, 2023.

In conclusion, while both the Quality and Momentum of NUE remain high, it is also notable how the perception (Sentiment Grade) towards the entity is progressively improving over the course of the year.

How Does Nucor Corporation (NUE) Stack Up Against Its Peers?

While NUE has an overall grade of C, equating to a Neutral rating, check out these other stocks within the Steel industry: voestalpine AG (VLPNY - Get Rating), Acerinox, S.A. (ANIOY - Get Rating), and Tenaris S.A. ADR (TS - Get Rating), with an A (Strong Buy) rating.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

Want More Great Investing Ideas?

NUE shares were trading at $167.57 per share on Monday afternoon, up $3.74 (+2.28%). Year-to-date, NUE has gained 27.97%, versus a 19.85% rise in the benchmark S&P 500 index during the same period.

About the Author: Sristi Suman Jayaswal

The stock market dynamics sparked Sristi's interest during her school days, which led her to become a financial journalist. Investing in undervalued stocks with solid long-term growth prospects is her preferred strategy. Having earned a master's degree in Accounting and Finance, Sristi hopes to deepen her investment research experience and better guide investors. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NUE | Get Rating | Get Rating | Get Rating |

| VLPNY | Get Rating | Get Rating | Get Rating |

| ANIOY | Get Rating | Get Rating | Get Rating |

| TS | Get Rating | Get Rating | Get Rating |

| XOM | Get Rating | Get Rating | Get Rating |