Rivian Automotive, Inc. (RIVN - Get Rating) produces and sells Electric Vehicles (EVs) and accessories. The company offers five-passenger pickup trucks and seven-passenger sports utility vehicles.

The company expects demand for its pickups and sport-utility vehicles to remain stable through the year. RIVN also aims to accelerate production at its in-house drive unit ahead of plan. However, like several EV makers, RIVN deals with a cash crunch and layoffs.

Moreover, the company is set to lose its spot on the Nasdaq-100, which comprises 100 of the largest non-financial companies listed on the Nasdaq stock exchange, on June 20, which could be a blow for the EV-maker.

Amid this, let’s look at the trends of some of its key financial metrics to understand why it might be best to avoid the stock now.

Analyzing RIVN’s Financial Performance: Net Income, Revenue, and Current Ratio Trends

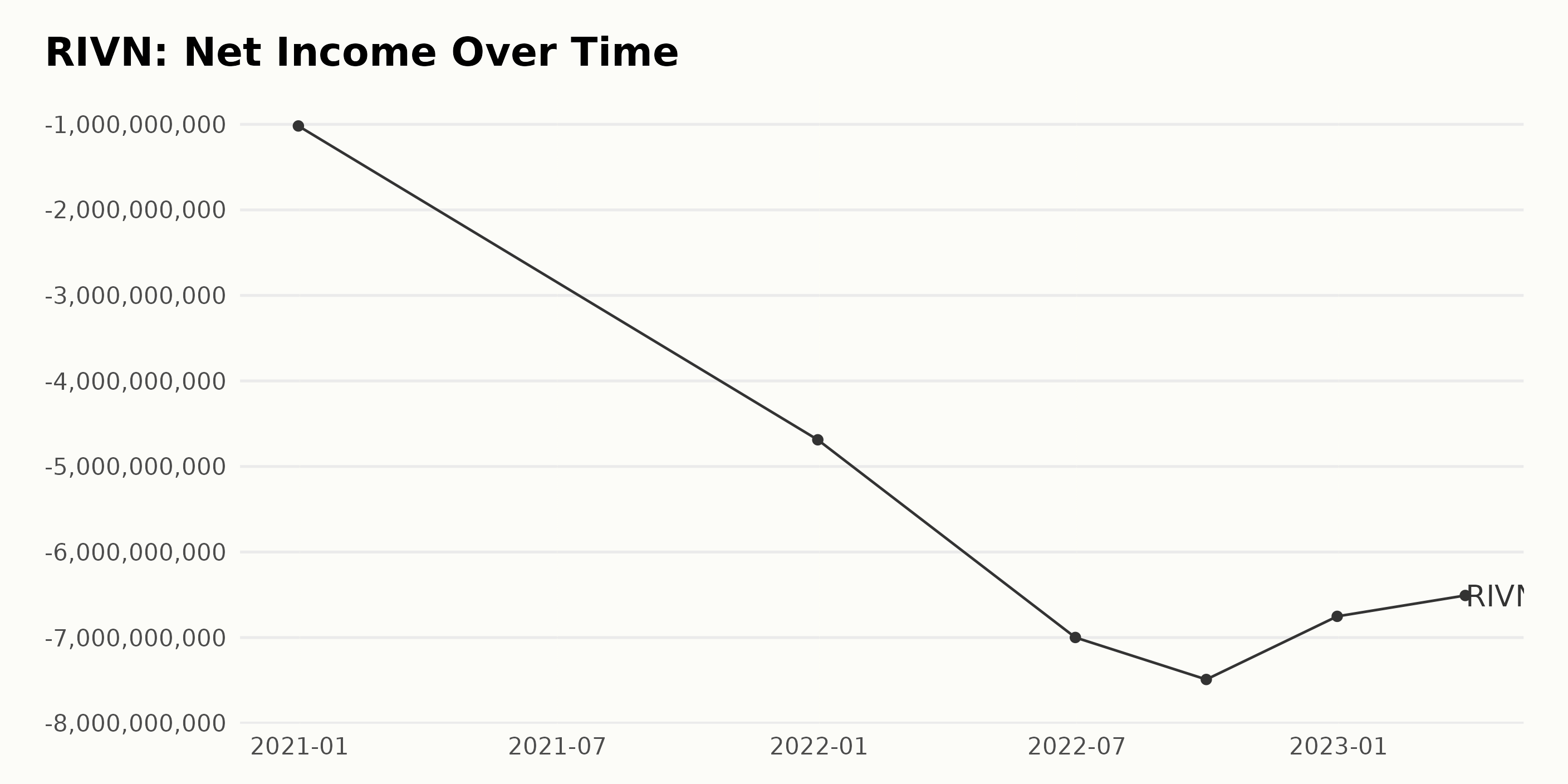

The trailing-12-month net income of RIVN has experienced a significant downward trend with fluctuations over the given period. Here is a summary of the data:

- As of December 31, 2020, RIVN’s net income was -$1.01 billion.

- By December 31, 2021, net income significantly dropped to -$4.68 billion, indicating a substantial financial decline within the company.

- By June 30, 2022, the negative trend continued, with the net income reaching -$6.99 billion.

- By September 30, 2022, net income further declined to -$7.49 billion, marking the lowest point in this series.

- However, there was a slight improvement by December 31, 2022, as the net income rose to -$6.75 billion.

- Continuing this upward trend, the company’s net income increased to -$6.51 billion by March 31, 2023.

Although there has been some recovery in the most recent data, RIVN’s net income still remains significantly negative.

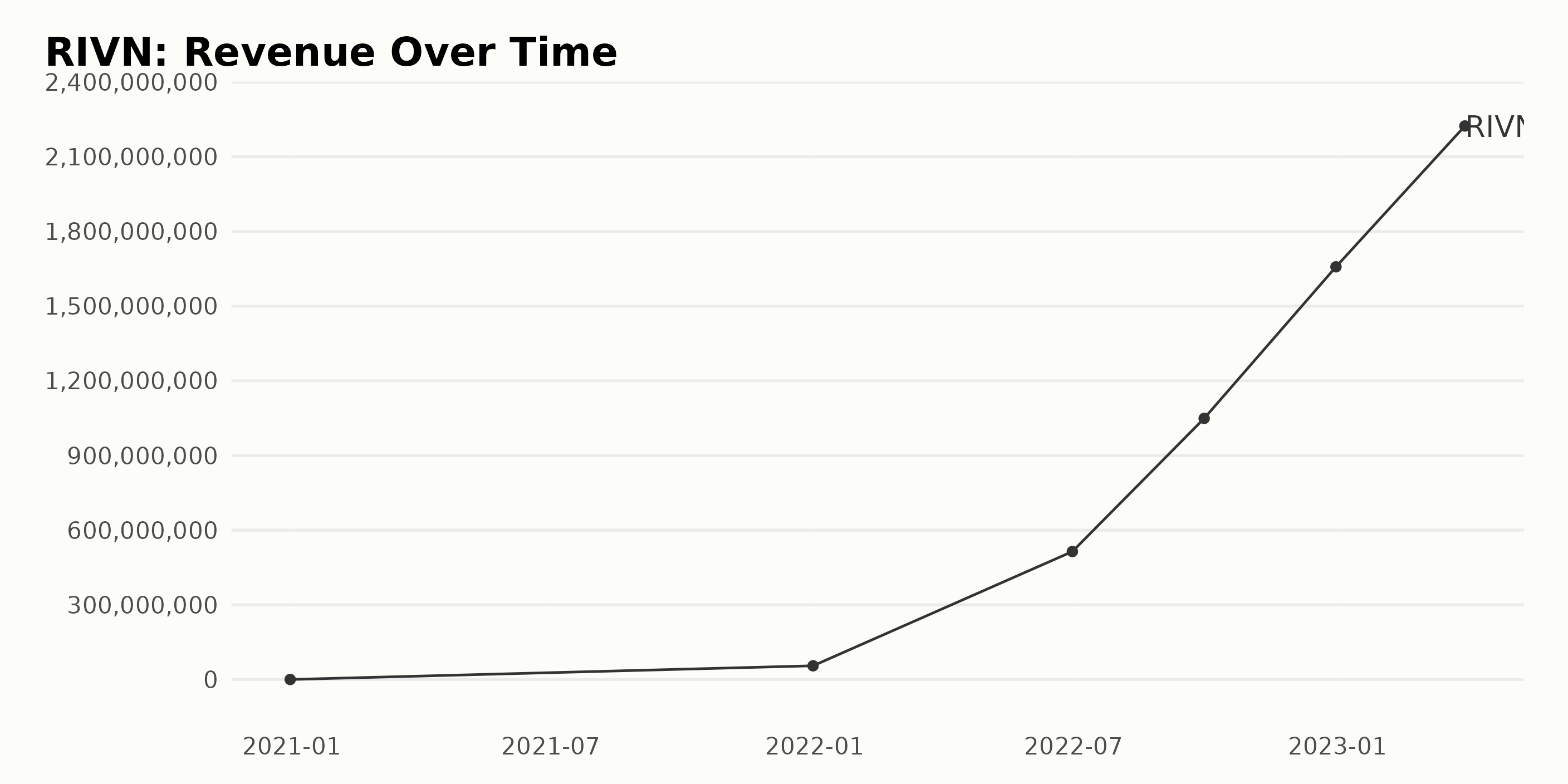

The trailing-12-month revenue trend and fluctuations for RIVN are as follows:

- December 2021: Revenue significantly increased to $55 million, marking the start of positive growth.

- June 2022: A substantial revenue surge occurred, reaching $514 million.

- September 2022: Continuing the upward trend, revenue reached $1.05 billion.

- December 2022: Once again, growth persisted, with RIVN’s revenue climbing to $1.66 billion.

- March 2023: The most recent data available shows revenue at $2.22 billion, representing an impressive increase.

Greater emphasis is placed on the more recent data and the series’s last value, demonstrating a positive growth trend for RIVN. Comparing the first and last values, there has been a significant growth rate from $0 in December 2020 to $2.22B in March 2023.

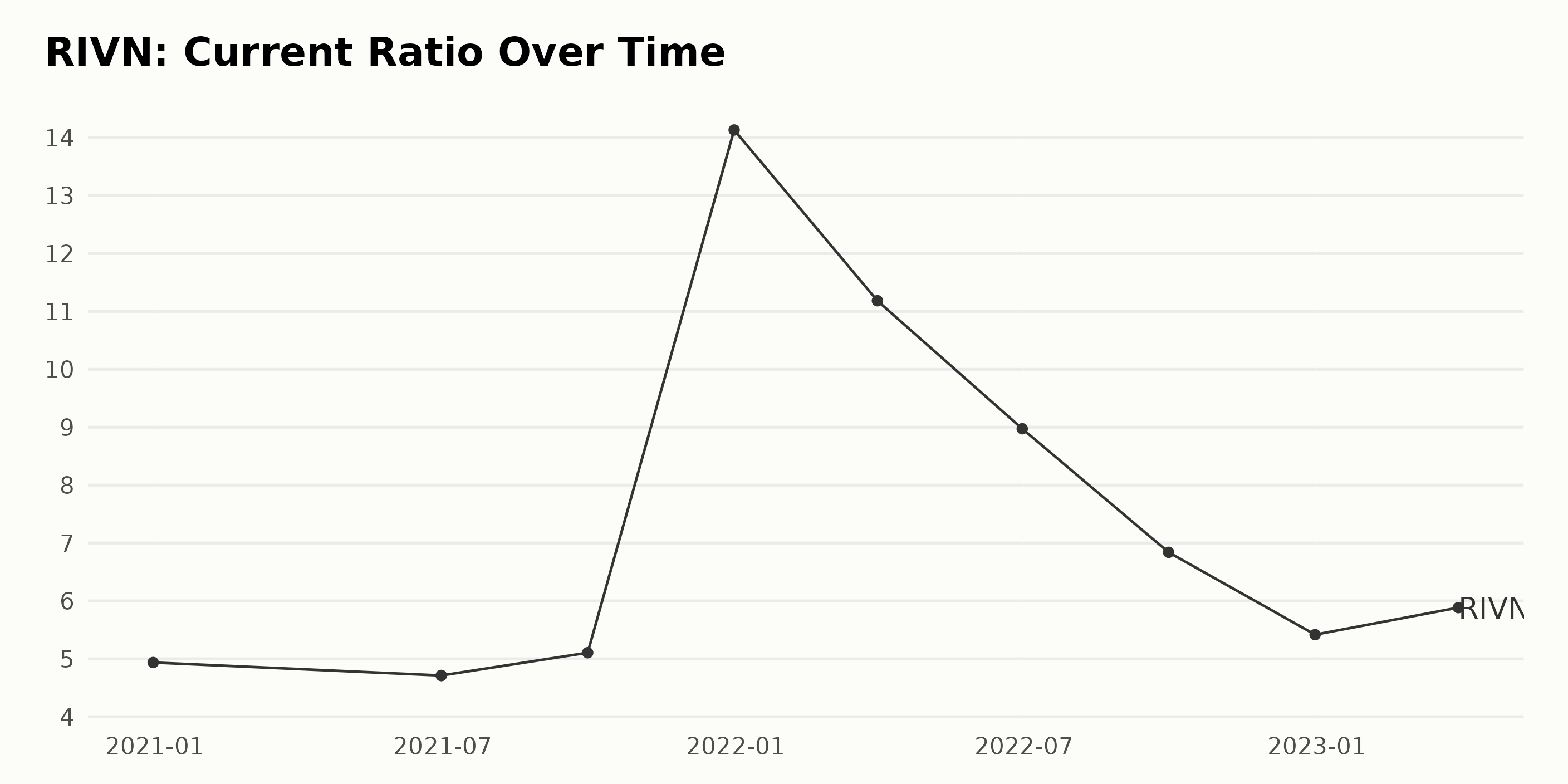

The current ratio of RIVN has shown both fluctuations and a general downward trend over the given period. Here is a summary of the key data points:

- December 2020: 4.94

- June 2021: 4.71

- September 2021: 5.10

- December 2021: 14.14

- March 2022: 11.19

- June 2022: 8.97

- September 2022: 6.84

- December 2022: 5.42

- March 2023: 5.88

While the data shows an initial slight decrease from December 2020 to June 2021, followed by an increase till September 2021, there is a significant spike in December 2021, with the current ratio reaching 14.14. Following this peak, the ratio consistently declines to 5.42 by December 2022.

Notably, the most recent value in the series (March 2023) sees an increase to 5.88. Comparing the first and last values, the growth rate is approximately 19%.

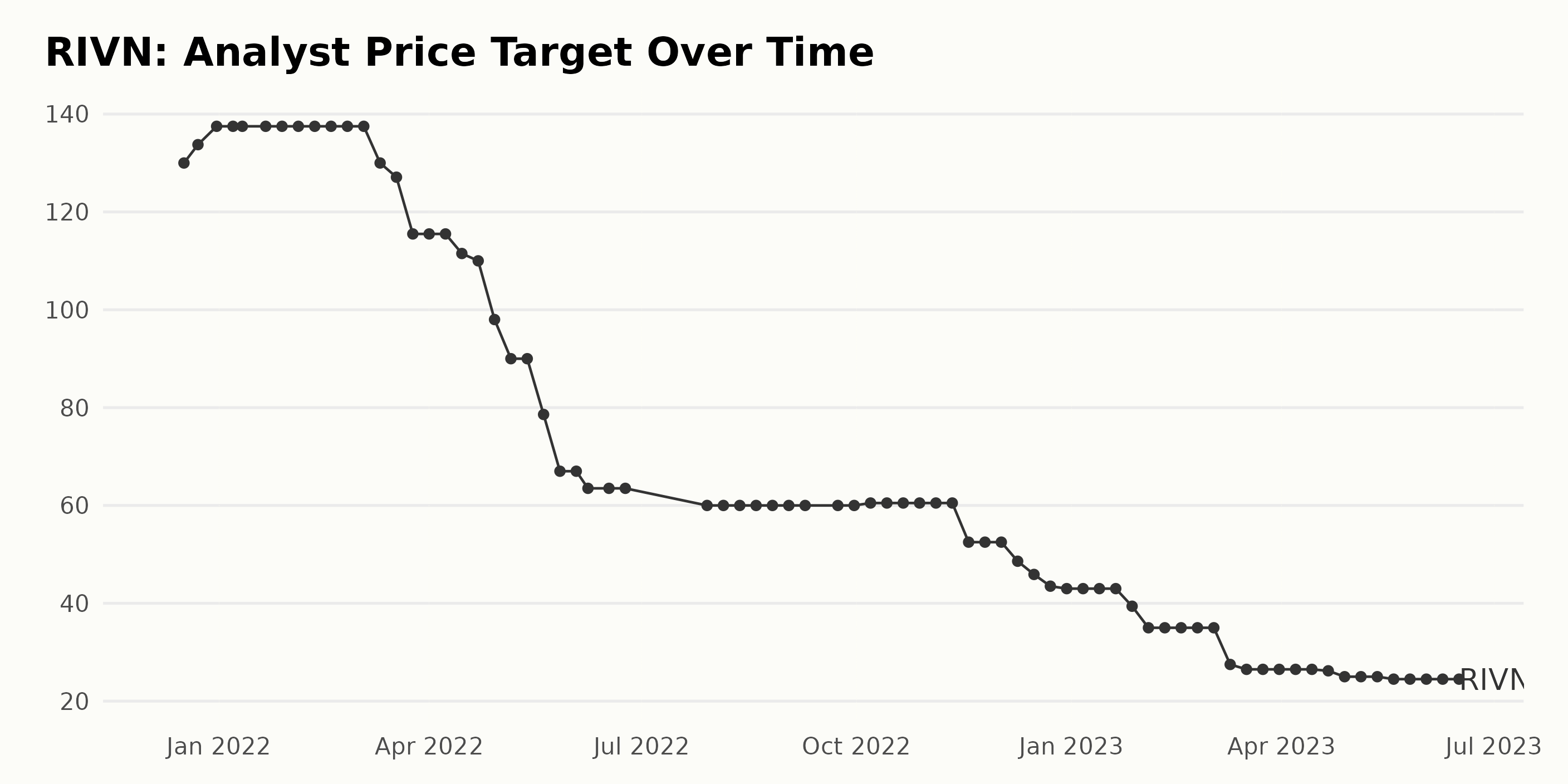

The RIVN analyst price target demonstrates fluctuating trends over the given period. Key highlights include:

- December 2021 began with a value of $130, reaching its peak at $137.5 by January 2022, where it remained steady until March 2022.

- Between March and June 2022, the price target dropped from $130 to $63.5; particularly sharp declines occurred in May.

- The value dipped to its lowest point of $60 between July and October 2022 before rising slightly to $60.5 in the same month.

- From November 2022 to February 2023, there was a significant downward trend, with the price target falling from $52.5 to $35.

- After holding steady at $35 through the end of February, the target experienced another decline, bottoming out at a low of $25 by early May 2023.

- Finally, the last reported value for June 2023 was $24.5, showing a slight decrease from May.

Overall, the growth rate from the first value to the last is negative, indicating a downward trend in the price target. The data illustrates that RIVN has seen both periods of stability, as well as times of rapid fluctuation. Emphasizing recent data, the end of May and June 2023 shows a largely stable situation at around $24.5.

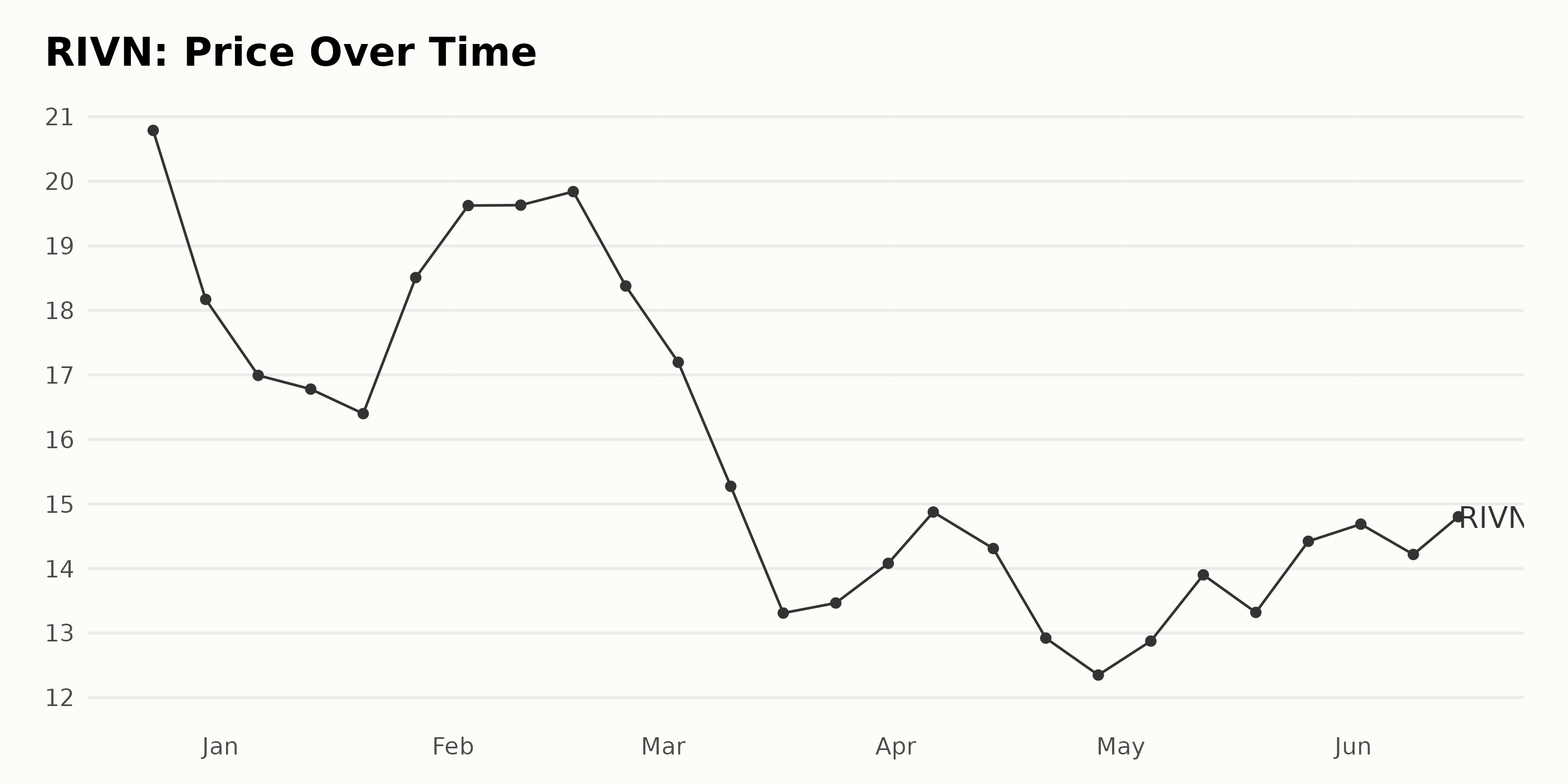

Analyzing RIVN’s Share Price Fluctuations: December 2022 – June 2023

Based on the provided data, the share price trend and growth rate of RIVN during the period between December 2022 and June 2023 are as follows: – From December 23, 2022, to January 20, 2023, there is a consistent downward trend in the share price of RIVN:

• December 23, 2022: $20.79

• January 6, 2023: $16.99

• January 20, 2023: $16.40

From January 20 to February 17, 2023, the share price experiences an increase and then stabilizes:

• January 27, 2023: $18.51

• February 10, 2023: $19.63

• February 17, 2023: $19.84

Between February 17 and March 17, 2023, the share price sees another overall decline:

• February 24, 2023: $18.38

• March 3, 2023: $17.20

• March 17, 2023: $13.31

In the period from March 17 to April 6, 2023, there’s a noticeable rebound and rise in share prices:

• March 24, 2023: $13.47

• March 31, 2023: $14.08

• April 6, 2023: $14.88

However, from April 6 to May 5, 2023, there’s another dip in share prices before they start increasing again:

• April 14, 2023: $14.31

• April 21, 2023: $12.92

• May 5, 2023: $12.88

Finally, from May 5 to June 15, 2023, the share prices for RIVN see an upward trend, followed by a slight decline:

• May 12, 2023: $13.90

• May 26, 2023: $14.42

• June 2, 2023: $14.69

• June 15, 2023: $15.24

During this period, the share price trend shows a series of fluctuations with no clear indication of steady growth or decline. The growth rate changes direction several times, making it difficult to identify a consistent trend. Here is a chart of RIVN’s price over the past 180 days.

Analyzing RIVN’s Growth, Momentum, and Value Ratings in 2023

As of the latest available data, RIVN holds an overall POWR Ratings grade of F which is the lowest possible grade and equates to a Strong Sell. It is ranked #49 in the Auto & Vehicle Manufacturers industry, which consists of 58 stocks in total. Based on the provided data, here’s a summary of RIVN’s POWR Ratings grade and rank-in-category over time:

- June 15, 2023: POWR Grade – F; Rank in Category – #49

- June 10, 2023: POWR Grade – F; Rank in Category – #49

- June 3, 2023: POWR Grade – F; Rank in Category – #50

- May 27, 2023: POWR Grade – F; Rank in Category – #50

- May 20, 2023: POWR Grade – F; Rank in Category – #49

It can be observed that RIVN consistently holds an F grade throughout the provided period, indicating a weak performance within the Auto & Vehicle Manufacturers industry. Its rank-in-category has not significantly improved or declined, generally fluctuating between ranks #46 and #54.

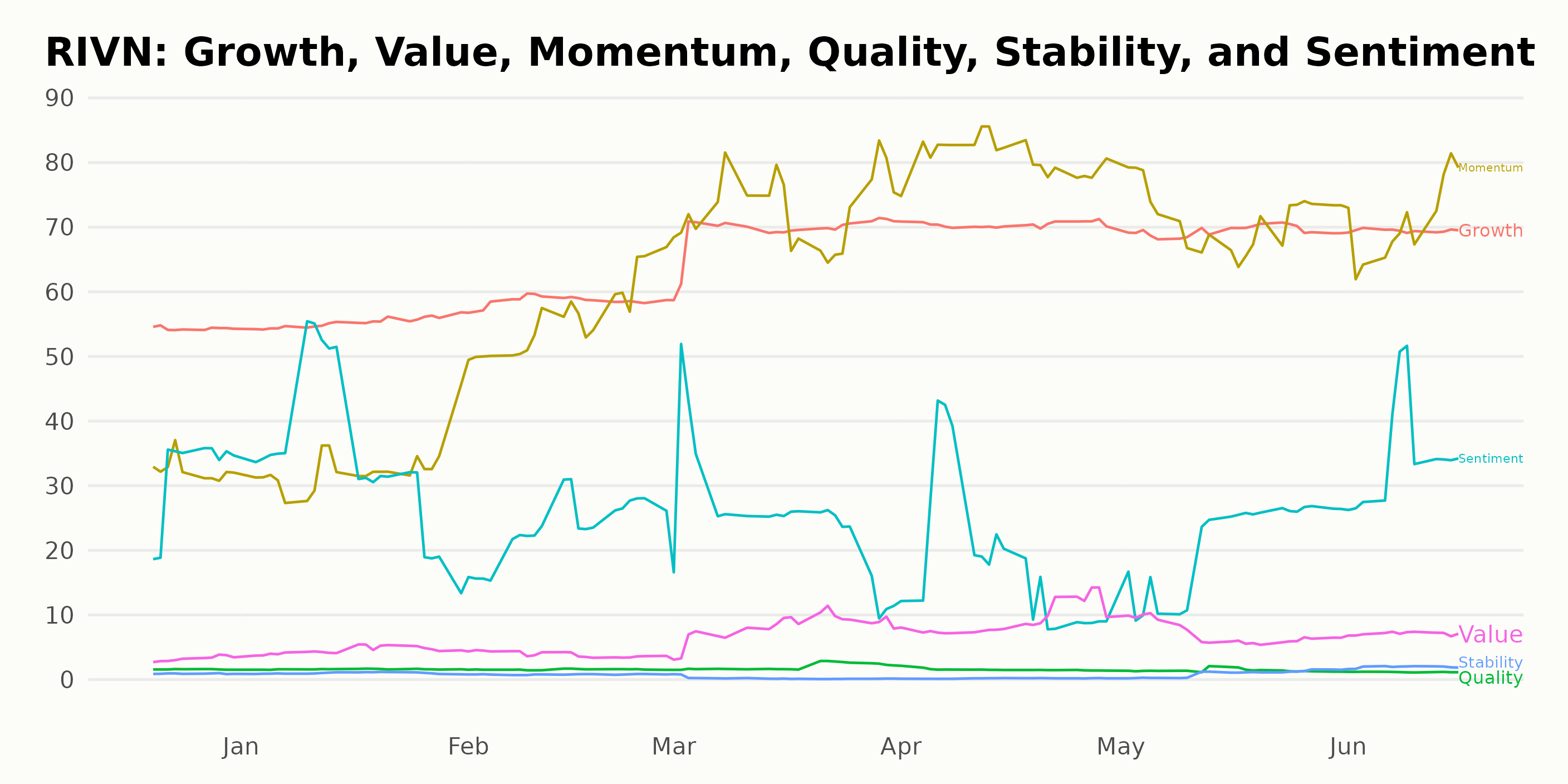

The POWR Ratings for RIVN along the three most noteworthy dimensions are as follows:

- April 2023: Growth (70), Momentum (81), and Value (9).

- March 2023: Growth (69), Momentum (73), and Value (8).

- February 2023: Growth (59), Momentum (56), and Value (4).

From December 2022 until June 2023, RIVN experiences improvement in Growth and Momentum ratings. Specifically, the Growth rating increased from 54 in December 2022 to 69 by June 2023.

Similarly, the Momentum rating increased considerably, reaching an all-time high of 81 in April 2023. However, the Value dimension also experienced a gradual increase at a much slower rate compared to the other two dimensions.

How does Rivian Automotive, Inc. (RIVN) Stack Up Against its Peers?

Other stocks in the Auto & Vehicle Manufacturers sector that may be worth considering are Volkswagen AG (VWAGY - Get Rating), Honda Motor Co., Ltd. (HMC - Get Rating), and Subaru Corporation (FUJHY - Get Rating) – they have better POWR Ratings.

Is the Bear Market Over?

Investment pro Steve Reitmeister sees signs of the bear market’s return. That is why he has constructed a unique portfolio to not just survive that downturn…but even thrive!

Steve Reitmeister’s Trading Plan & Top Picks >

Want More Great Investing Ideas?

RIVN shares were trading at $15.07 per share on Friday afternoon, down $0.17 (-1.12%). Year-to-date, RIVN has declined -18.23%, versus a 15.78% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| RIVN | Get Rating | Get Rating | Get Rating |

| VWAGY | Get Rating | Get Rating | Get Rating |

| HMC | Get Rating | Get Rating | Get Rating |

| FUJHY | Get Rating | Get Rating | Get Rating |