Honda Motor Co. Ltd. ADR (HMC): Price and Financial Metrics

HMC Price/Volume Stats

| Current price | $31.28 | 52-week high | $37.90 |

| Prev. close | $30.87 | 52-week low | $29.05 |

| Day low | $31.07 | Volume | 616,309 |

| Day high | $31.33 | Avg. volume | 944,609 |

| 50-day MA | $32.41 | Dividend yield | 3.57% |

| 200-day MA | $33.15 | Market Cap | 53.51B |

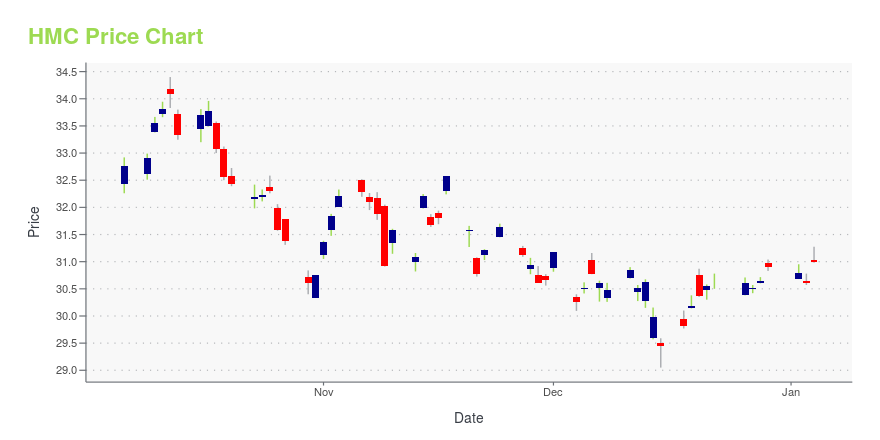

HMC Stock Price Chart Interactive Chart >

Honda Motor Co. Ltd. ADR (HMC) Company Bio

Honda Motor Co., Ltd. (Japanese: 本田技研工業株式会社, Hepburn: Honda Giken Kōgyō KK, IPA: [honda] (listen); /ˈhɒndə/; commonly known as simply Honda) is a Japanese public multinational conglomerate manufacturer of automobiles, motorcycles, and power equipment, headquartered in Minato, Tokyo, Japan. (Source:Wikipedia)

Latest HMC News From Around the Web

Below are the latest news stories about HONDA MOTOR CO LTD that investors may wish to consider to help them evaluate HMC as an investment opportunity.

Honda Motor (HMC) Stock Drops Despite Market Gains: Important Facts to NoteThe latest trading day saw Honda Motor (HMC) settling at $30.51, representing a -0.29% change from its previous close. |

25 Most In Demand Cars Heading into 2024In this article, we will be looking at the 25 most in-demand cars heading into 2024. We will be covering market trends, recent news, key players in the industry, and an overall market analysis of the automotive industry. If you want to skip our detailed analysis, you can go directly to the 5 Most In […] |

Honda (HMC) Recalls 2.5M Vehicles Over Fuel Pump DefectHonda (HMC) calls back more than 2.5 million vehicles due to faulty fuel pump that may lead to engine failure while driving. |

EV, hybrid and gas-powered: Some interesting cars coming in 2024Next year will see the introduction of some new, genuinely affordable electric vehicles as well as a couple of interesting options for the ultra-wealthy. We’ll also see the return of some classic model names. |

Japan automakers to invest $4.3 billion in Thailand over 5 years -Thai govtMajor Japanese auto manufacturers will invest 150 billion baht ($4.34 billion) in Thailand over the next five years, a Thai government spokesperson said on Monday, supporting the Southeast Asian country's transition to making electric vehicles. Toyota Motor and Honda Motor will invest about 50 billion baht each, while Isuzu Motors will invest 30 billion baht and Mitsubishi Motors 20 billion baht, spokesperson Chai Wacharoke said, adding this would include the production of electric pickup trucks. Thailand's Prime Minister Srettha Thavisin concluded a trip to Japan last week. |

HMC Price Returns

| 1-mo | -2.37% |

| 3-mo | -7.59% |

| 6-mo | -2.22% |

| 1-year | 2.08% |

| 3-year | 8.57% |

| 5-year | 39.01% |

| YTD | 2.78% |

| 2023 | 38.71% |

| 2022 | -17.30% |

| 2021 | 3.29% |

| 2020 | 2.29% |

| 2019 | 10.36% |

HMC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HMC

Want to see what other sources are saying about Honda Motor Co Ltd's financials and stock price? Try the links below:Honda Motor Co Ltd (HMC) Stock Price | Nasdaq

Honda Motor Co Ltd (HMC) Stock Quote, History and News - Yahoo Finance

Honda Motor Co Ltd (HMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...