- Oil services stocks have underperformed the weak sector- The XLE versus the OIH

- Schlumberger is a best-in-breed company

- Halliburton is not far behind

It is no secret that the price action in the crude oil market exacerbated the overall meltdown that occurred in late February and throughout March. OPEC and the Russians decided to abandon production quotas and flood the world with petroleum. The price plunged, taking nearby NYMEX crude oil futures to the lowest price since 2002 at $19.27 per barrel. At a time when Coronavirus was devasting the demand for energy around the world, the cartel responded with more supplies.

Meanwhile, the writing had been on the wall for the crude oil market throughout 2019 and early 2020. As the stock market made new record highs, the prices of oil-related shares lagged. Even during periods when crude oil spiked higher like in early January, the petroleum-related stocks did not reflect the price action in the futures market.

Within the oil patch, the oil services companies did even worse than the producers and refiners. Two of the leading oil services companies are Schlumberger (SLB - Get Rating) and Halliburton (HAL - Get Rating). Both companies have found themselves at the bottom of an ugly pile.

Oil services stocks have underperformed the weak sector- The XLE versus the OIH

Shares of oil-related companies lagged the stock market in 2019 and through the first months of 2020 before the global pandemic hit markets with a tsunami of selling. The Energy Select Sector SPDR Fund (XLE) holds shares of many of the leading US energy companies including:

(Source: Yahoo Finance)

The XLE had net assets of $6.55 billion, trades an average of over 33.2 million shares each day, and charges an expense ratio of 0.13%. The ETF product is a benchmark for the oil companies that trade on the stock market in the United States.

(Source: Barchart)

The XLE closed at $60.04 per share on December 31, 2019, and was trading at $33.91 on April 9, a decline of 43.5%.

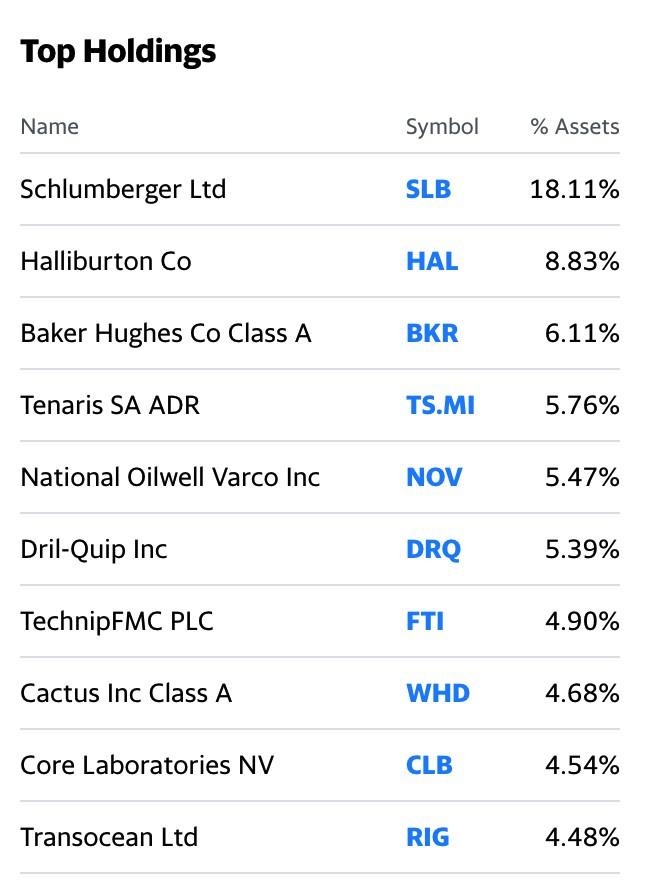

The VanEck Vectors Oil Services ETF product (OIH) holds shares in the leading oil services companies, including:

(Source: Yahoo Finance)

The OIH had net assets of $253.82 million, trades an average of over 13.5 million shares each day, and charges an expense ratio of 0.35%.

(Source: Barchart)

The OIH closed at $13.25 per share on December 31, 2019, and was trading at $4.92 on April 9, a decline of 62.9%. The oil services sector underperformed the stock market and other crude energy-related shares in 2019 and 2020.

Schlumberger (SLB) and Haliburton (HAL) account for almost 27% of the OIH oil services benchmark.

Schlumberger is a best-in-breed company

SLB is a company that supplies technology for reservoir characterization, drilling, production, and processing to the oil and gas industry around the world. The Houston, Texas-based company has been in business since 1926 and provides services for both onshore and offshore oil projects.

(Source: Barchart)

At $16.47 per share on April 9, SLB was trading at its lowest level since the mid-1990s. The shares traded to a low of $11.87 over the past weeks, the lowest in thirty years since 1990.

Halliburton is not far behind

Halliburton Company (HAL) is the other leading oil services firm that operates across the globe. HAL celebrated its centennial last year as it began operations in 1919 in Houston, Texas.

(Source: Barchart)

On April 9, the shares closed at $8.21, the lowest level since 2002. The recent low at $4.25 in March was the lowest price dating back to the 1980s.

SLB and HAL are best-in-breed oil field services companies. In an environment where only the most influential companies will survive, Schlumberger and Halliburton’s shares could offer incredible value at their current share prices.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

Investors Beware: It’s Still Really Bad Out There!

SLB shares were trading at $15.93 per share on Monday afternoon, down $0.54 (-3.28%). Year-to-date, SLB has declined -59.79%, versus a -14.38% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SLB | Get Rating | Get Rating | Get Rating |

| HAL | Get Rating | Get Rating | Get Rating |