- Streaming is a growing business

- Spotify shares do well, but the company continues to post losses

- Roku is in the same boat- Investors love both stocks

Streaming is the continuous transmission of audio or video files from a server to a client. When consumers watch TV or listen to podcasts on internet-connected devices, they stream the media file, which is stored remotely and transmitted a few seconds over the internet.

Streaming is real-time as compared to downloading. A video file cannot be viewed or listened to until the entire file downloads. Therefore, streaming is a highly efficient method of accessing files as the browser plays the video file without copying and saving the data.

Spotify Technology SA (SPOT) and Roku, Inc. (ROKU) are two companies that operate streaming platforms. Both companies have reported losses, but the stocks have done exceedingly well.

Streaming is a growing business

Cost and convenience are the top two reasons people use streaming services. Many people indicate that streaming services are less expensive than cable or satellite and that it is easier for on-demand programming.

In 2020, the demand for streaming services exploded as shelter in place orders, and social distancing has caused more people to remain at home. Moreover, without sports, the demand for TV, movies, and entertainment has ushered in a new era for streaming services. Spotify Technology SA (SPOT) provides streaming services worldwide. The company operates via two segments, premium and ad-supported. The premium service offers unlimited online and offline high-quality streaming access to its catalog of music and podcasts to subscribers. The ad-supported business offers on-demand online access to music and podcasts. As of the end of 2019, SPOT had 271 million active users and approximately 124 million premium subscribers in 79 countries and territories. SPOT was founded in 2006 and is based in Europe, in Luxembourg.

Roku has been around since 2002, with its corporate headquarters in Los Gatos, California. The company operates through its Platform and Player segments. The platform segment allows users to discover and access movies and TV episodes and live sports, music, news, and others. The player segment offers streaming media players and accessories under the Roku brand name and sells branded channel buttons on remote controls. Roku provides its products and services through retailers and distributors and directly to customers through its website in the US, Canada, the UK, France, Ireland, Mexico, and various countries throughout Latin America. The demand for streaming services continues to grow as Roku had 36.9 million active accounts at the end of 2019.

Spotify shares do well, but the company continues to post losses

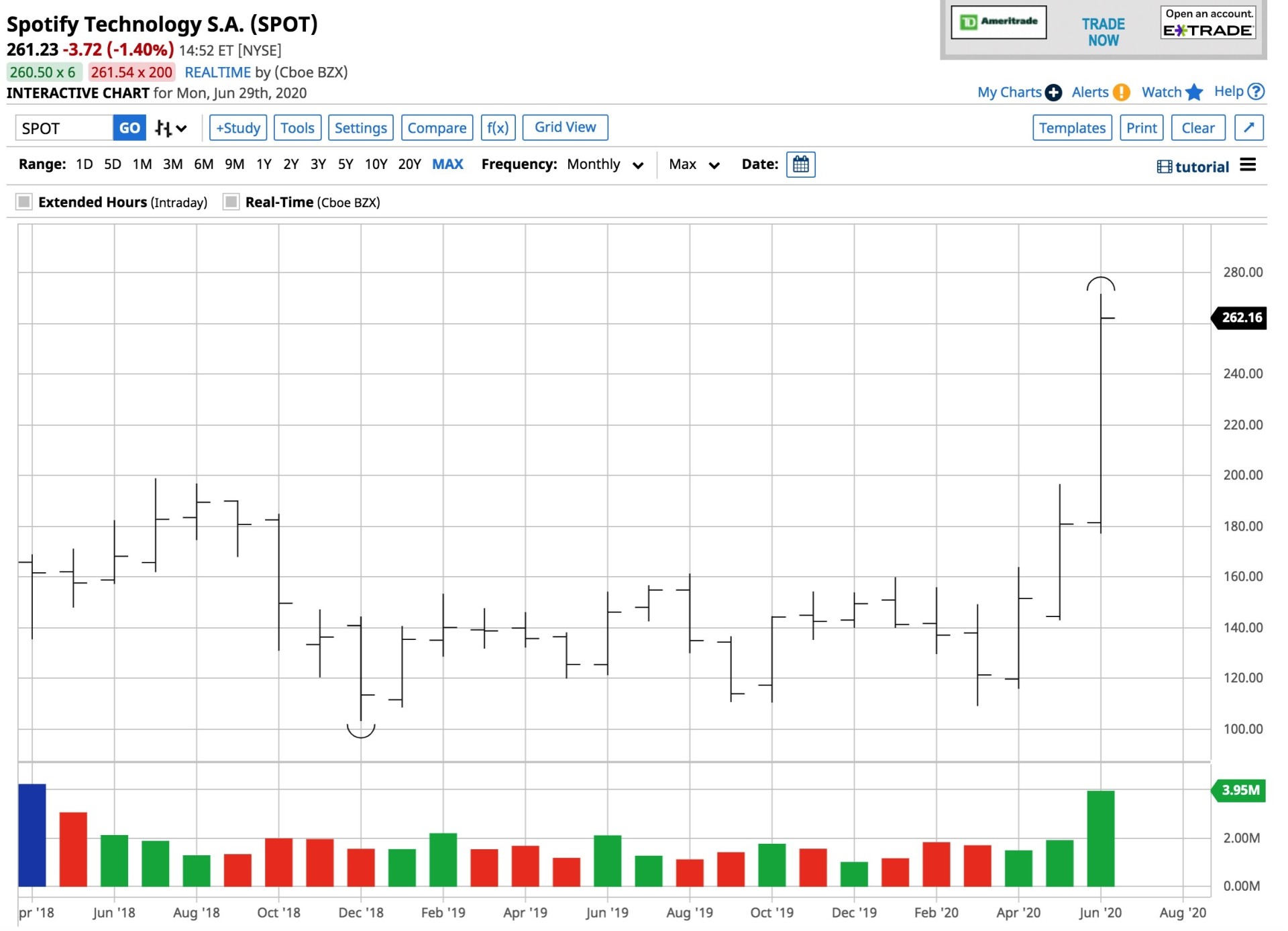

At around the $262 per share level on June 29, SPOT had a market cap of just under $49 billion. The company trades an average of over 2.4 million shares each day. SPOT’s IPO in April 2018 opened at $165.90 per share.

Source: Barchart

As the chart shows, SPOT fell to a low of $109.18 per share in March 2020 as selling because of the global pandemic hit the stock market. The shares have more than doubled over the past three months, reaching an all-time high of $271.71 in June. At the $262 level, SPOT was not far below the record peak.

Source: Yahoo Finance

The chart shows that SPOT reported earnings of 40 cents per share in Q3 2019 but has lost money over three of the past four quarters. In Q2, the consensus estimate for EPS is for a loss of 34 cents per share. Despite the losses, the share price has climbed to a record high.

Roku is in the same boat- Investors love both stocks

In September 2017, ROKU shares hit the market with an IPO price of $14 per share. The shares have outperformed SPOT as they rose to a high of $176.55 in September 2019.

Source: Barchart

The chart shows that the selling in March drove ROKU shares to a low of $58.22. They have more than doubled to over the $112 level as of June 29. ROKU has a market cap of just over $13.58 billion and trades an average of over 11.5 million shares each day.

Source: Yahoo Finance

Over the past four quarters, ROKU has not reported a profit. The best quarter for the company came in Q2 2019 when it lost eight cents per share. The current consensus estimate for Q2 2020 is for a loss of 51 cents per share.

SPOT and ROKU shares have done well despite the lack of earnings. The growth of the streaming business could make the two companies take over prospects over the coming months and years. On their own, each needs to begin to show profits to keep the upward trajectory of their share prices intact.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Top 3 Investing Strategies for the Year Ahead

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPOT shares fell $0.14 (-0.05%) in after-hours trading Monday. Year-to-date, SPOT has gained 77.29%, versus a -4.26% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPOT | Get Rating | Get Rating | Get Rating |

| ROKU | Get Rating | Get Rating | Get Rating |