History has a way of repeating itself. So it pays to check the past patterns to help plot your course forward.

I have to admit that I was a tad fearful coming into this research project. Meaning that my assumption was that from such a high peak that stocks would likely take a steep fall the following year.

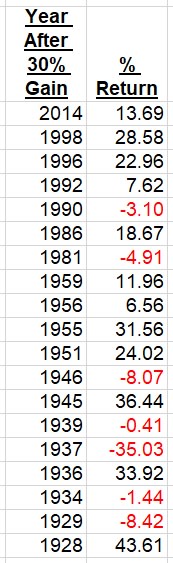

Yes, that did happen more than a few times, including a terrifying -35% downpour back in 1937. However, overall the results may surprise you.

Let’s dig into the numbers and see how it may change our strategy going into 2020.

The first thing that should pop out is the extreme outcomes. 4 times the S&P soared another 30%+. And another 3 times it tacked on more than 20%.

On the flip side we see that 7 out of 19 times the S&P fell into negative territory the following year. That includes the aforementioned -35% collapse in 1937.

However, as we take in all the data, a different picture emerges. In actuality we find that the market produced an average annual return of +11.49% in the years following those 30% gains. That is nearly identical to the +11.88% return for all years in this century long sample.

What Does it Tell Us About 2020?

Like most historical patterns it says you can’t count on anything. That truly each year is different and it is best to focus on the facts on the ground at the time to determine your investment strategy.

With that in mind I will provide you a link to my recently released 2020 Stock Market Outlook.

The teaser version is to say that we should expect the bull market to continue with gains closer to average. However, there are a few bear traps ahead that we should look out for including the obstacle that is the 2020 Presidential election. We talk about all that in more in the 2020 Stock Market Outlook.

If you have already seen my 2020 outlook, then here are some other resources to get you on the right track in the year ahead:

Top 20 High Yield Dividend Stocks for 2020

3 “Must Own” Online Growth Stocks

Wishing you a world of investment success!

Steve Reitmeister

…but my friends call me Reity (pronounced “Righty”)

CEO, Stock News Network

Editor, Reitmeister Total Return

SPY shares were trading at $322.63 per share on Friday afternoon, down $0.31 (-0.10%). Year-to-date, SPY has gained 31.54%, versus a 31.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| IWM | Get Rating | Get Rating | Get Rating |

| MDY | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |