Wealth inequality is at historic levels and has many people extremely upset. Some populist politicians even consider the existence of billionaire to be a “policy failure” and would like to impose wealth taxes specifically designed to quickly eliminate their fortunes.

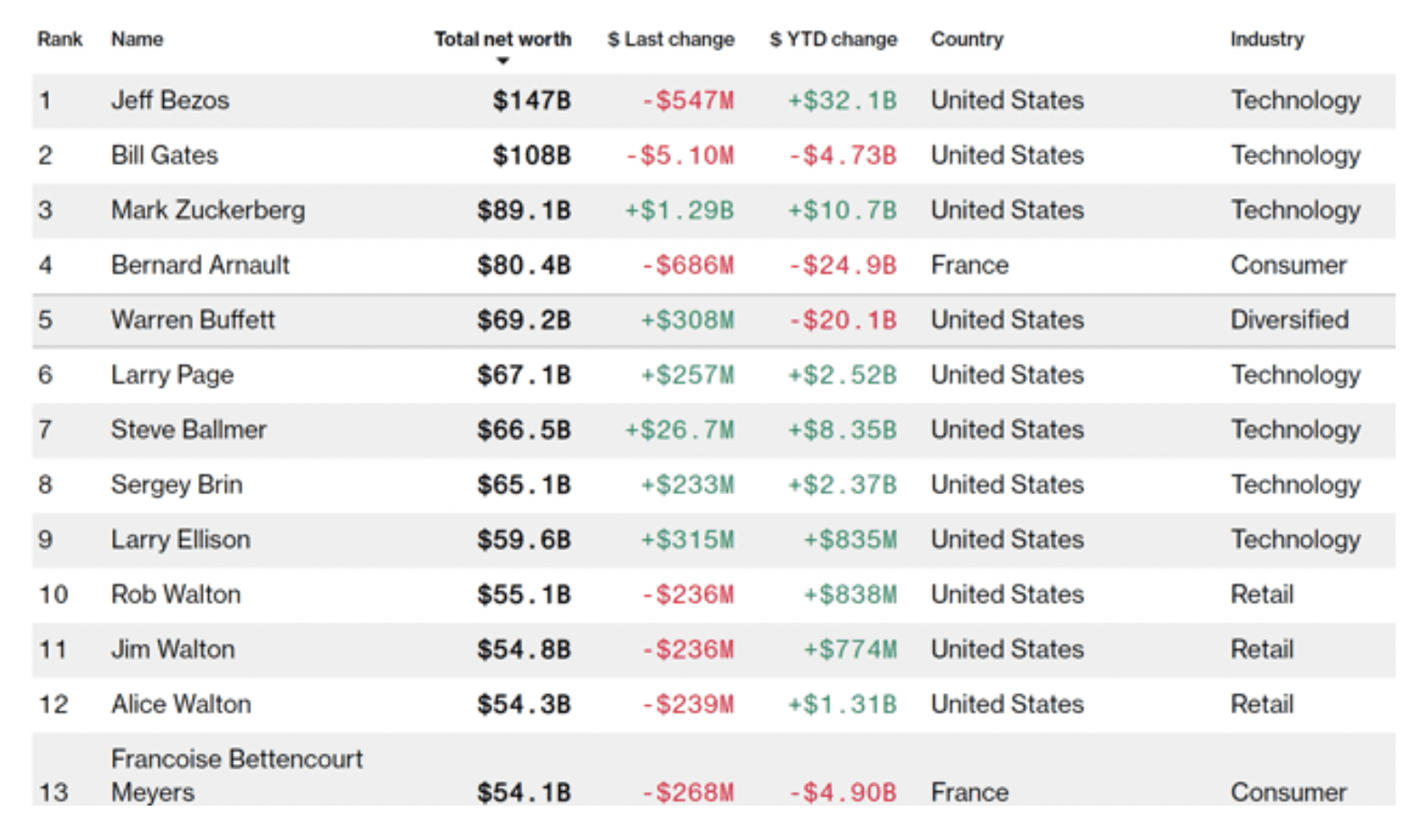

(Source: Bloomberg)

Looking at the list of the world’s richest people it’s understandable why people might look with shock and some even horror at some of the fortunes amassed by people like Amazon (AMZN) founder Jeff Bezos. In fact, had it not been for his recent divorce, today Bezos would be worth about $195 billion.

The fortunes of the 500 richest people on the planet are so enormous that on a single day in March they collectively lost $239 billion, at least on paper.

For context, $239 billion is $4 billion more than Egypt’s GDP, and Egypt is the 44th richest nation on earth.

While it’s popular to demonize such vast wealth, it’s actually not necessarily a good policy decision to try to eliminate such inequality from the earth.

In fact, I’ll show you how you can personally profit from the rise, not just of these billionaires, but the first 11 trillionaires in history.

The Rise Of The Trillionaire Isn’t Actually a Bad Thing

Nobel laureate William Nordhaus in a 2004 paper called Schumpeterian Profits in the American Economy: Theory and Measurement concluded that the present study examines the importance of Schumpeterian profits in the United States economy. Schumpeterian profits are defined as those profits that arise when firms are able to appropriate the returns from innovative activity. We first show the underlying equations for Schumpeterian profits. We then estimate the value of these profits for the non-farm business economy.

We conclude that only a minuscule fraction of the social returns from technological advances over the 1948-2001 period was captured by producers, indicating that most of the benefits of technological change are passed on to consumers rather than captured by producers.” – William Nordhaus (emphasis added). Jeff Bezos and his now ex-wife didn’t amass a fortune of $195 billion by stealing from society, but by creating a company that delivered such incredible innovation and value to the world that it enriched global GDP by approximately $9.8 trillion. That’s because, according to the Nordhaus study, 98% of the benefits of Schumpeterian profits accrue to society, and the inventors/entrepreneurs that brought us those companies keep just 2%. How much is $9.8 trillion? For context, Statista estimates that at the start of 2020 the global economy was $90.5 trillion and so Jeff Bezos is potentially responsible for 10.8% of all the wealth in the world.

The same charitable giving or wealth redistribution via taxation and social safety nets that keeps billions fed and out of poverty (and supplies us all with stimulus checks during this pandemic) wouldn’t exist if not for the likes of Bezos, Gates, Zuckerberg, etc. But what about the popular idea that Amazon is an evil corporation that grinds it, workers, under its jackbooted heels?

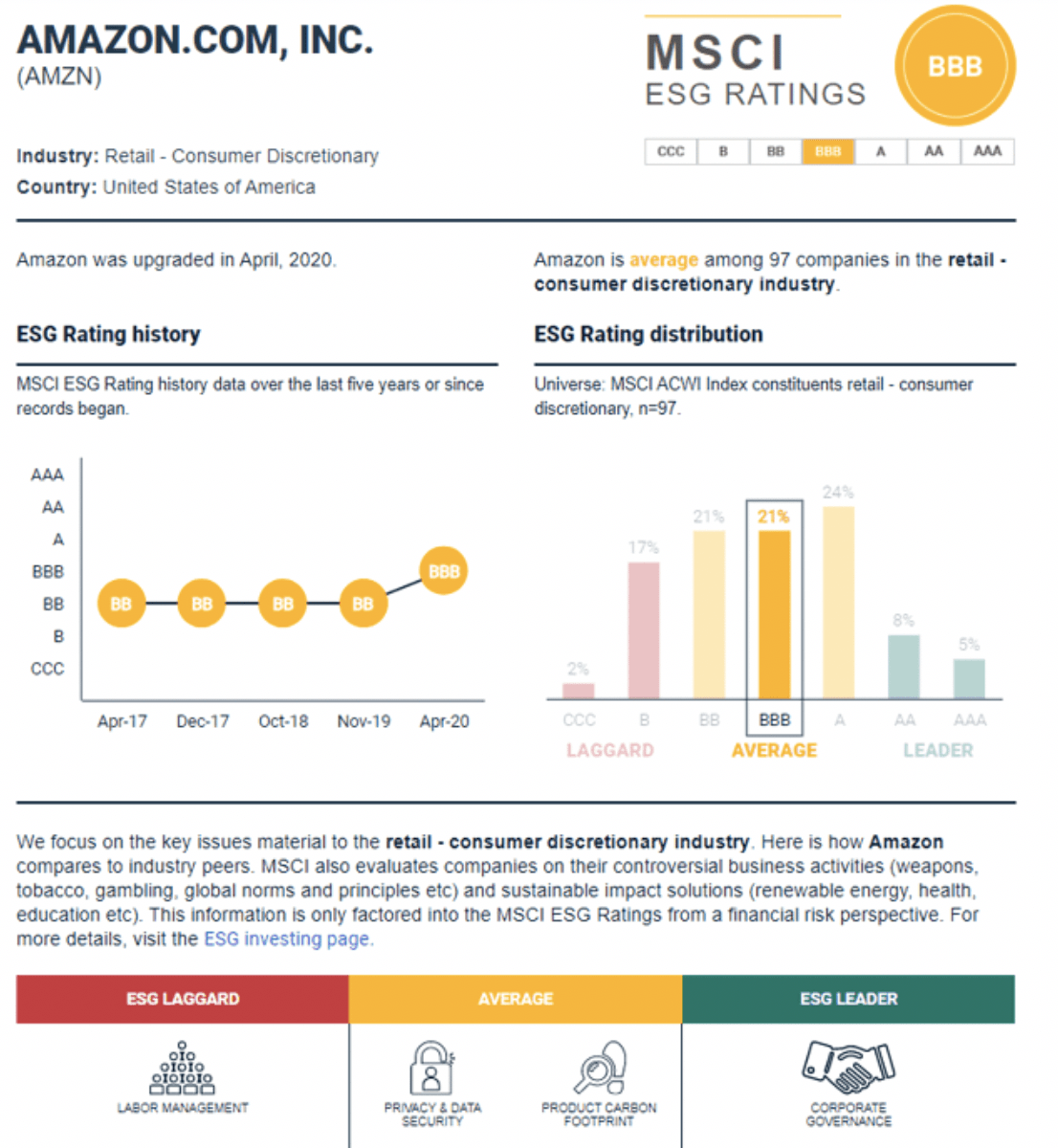

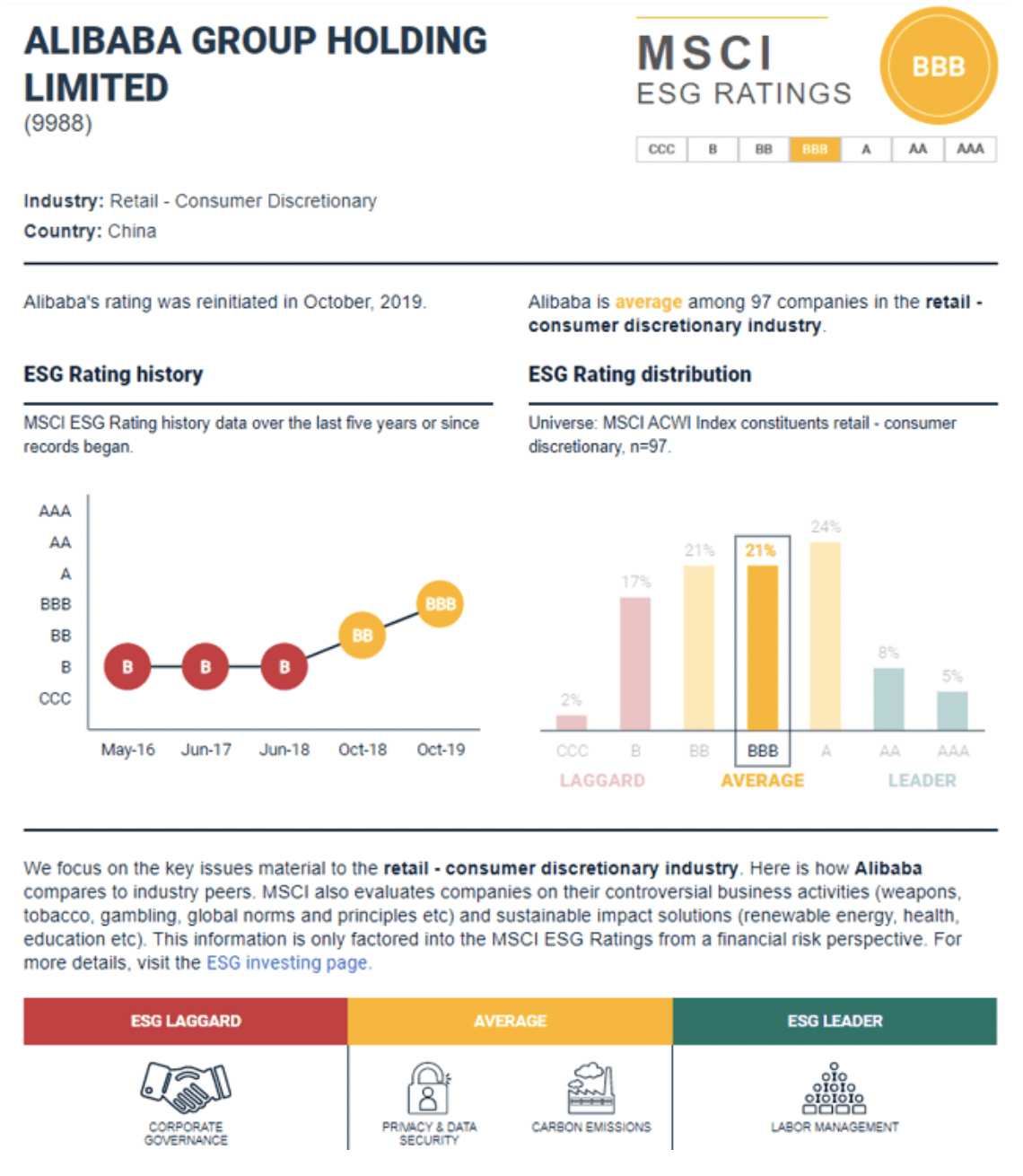

(Source: MSCI)

Actually, according to indexing giant MSCI, Amazon’s ESG score is BBB, which is about average for consumer discretionary companies. In fact, while Amazon does indeed have many ways it could improve its labor relations, it’s ESG rating improved in 2020 from below average. Or to put it another way, besides being one of the greatest job creators in history, Amazon has steadily been improving its environmental, social, and governance ratings. What about those other evil tech companies that so many ESG (and pension and retirement) funds used to generate impressive performance over the decades but today are hated by so many?

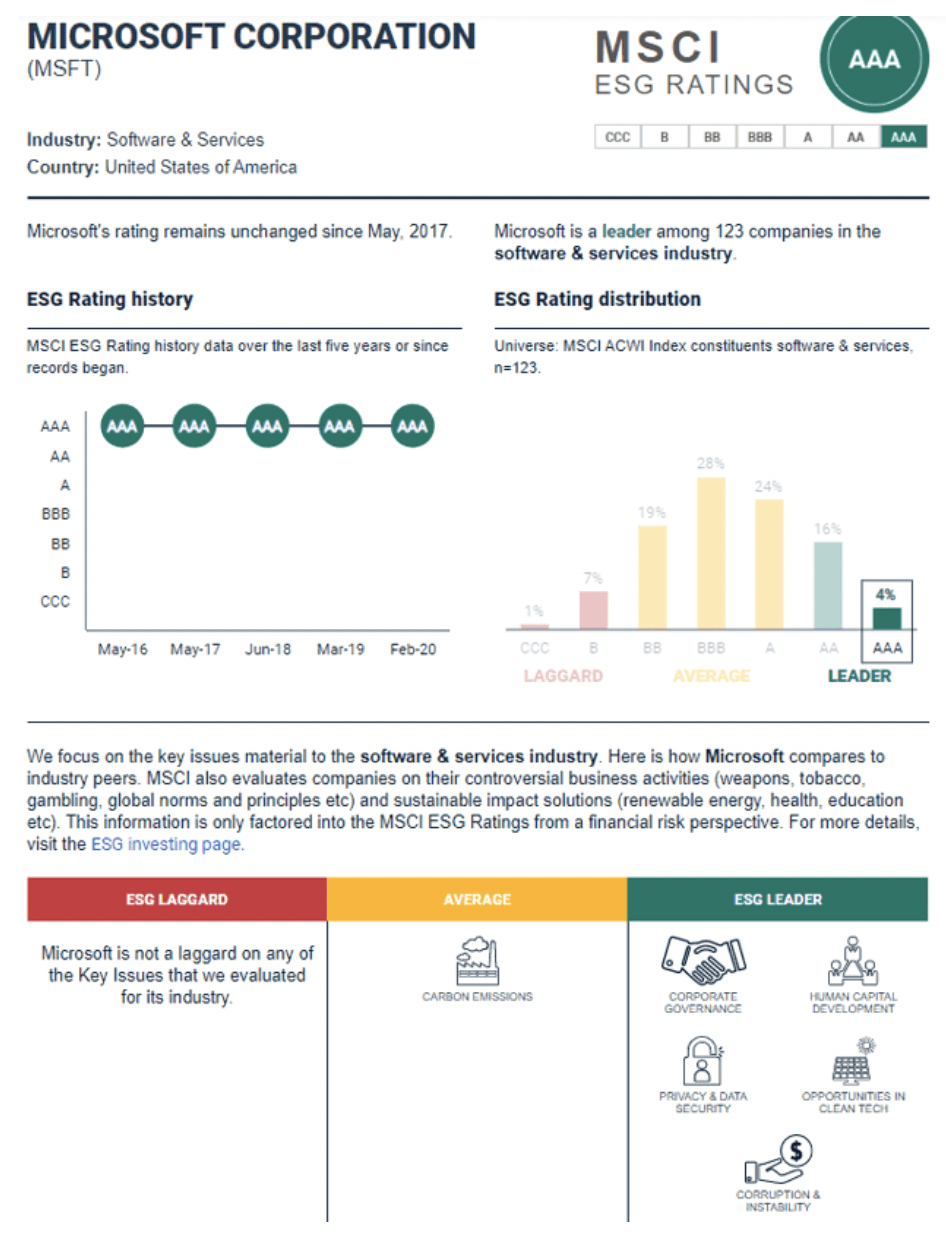

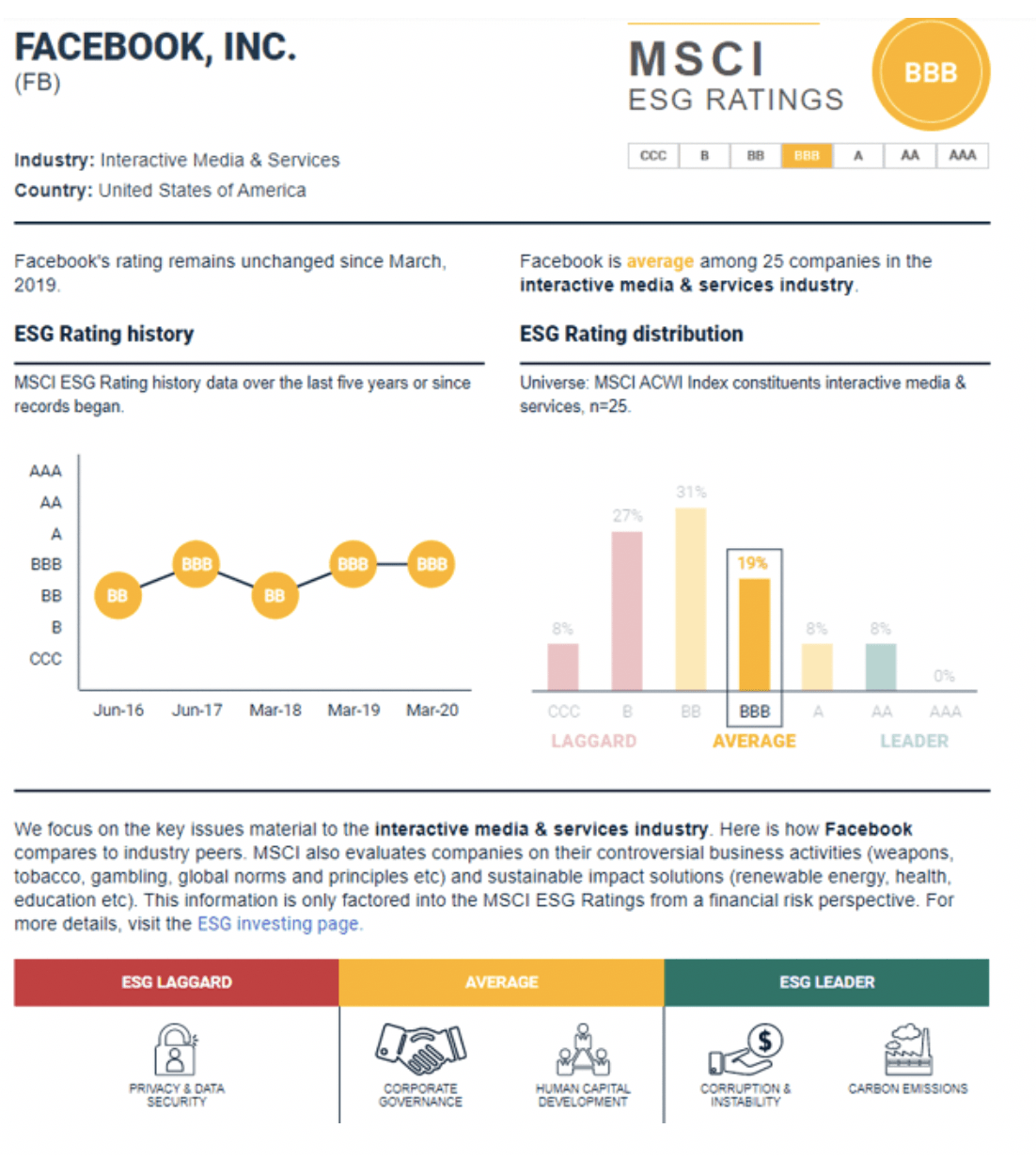

(Source: MSCI)

No company is perfect, and all have areas that MSCI, BlackRock, and the rating agencies (all of whom now look at ESG metrics) want to see improved. But note that even might Tesla, a beloved name among the environmental crowd has seen its ESG ratings sliding considerably in recent years due to, of all things, poor labor relations. Does that mean that Elon Musk is “evil” and doesn’t deserve his $40 billion fortune? No, it just means that the quintessential “environmental growth stock” has a lot of work to do in its pursuit of “people, planet, profit.”

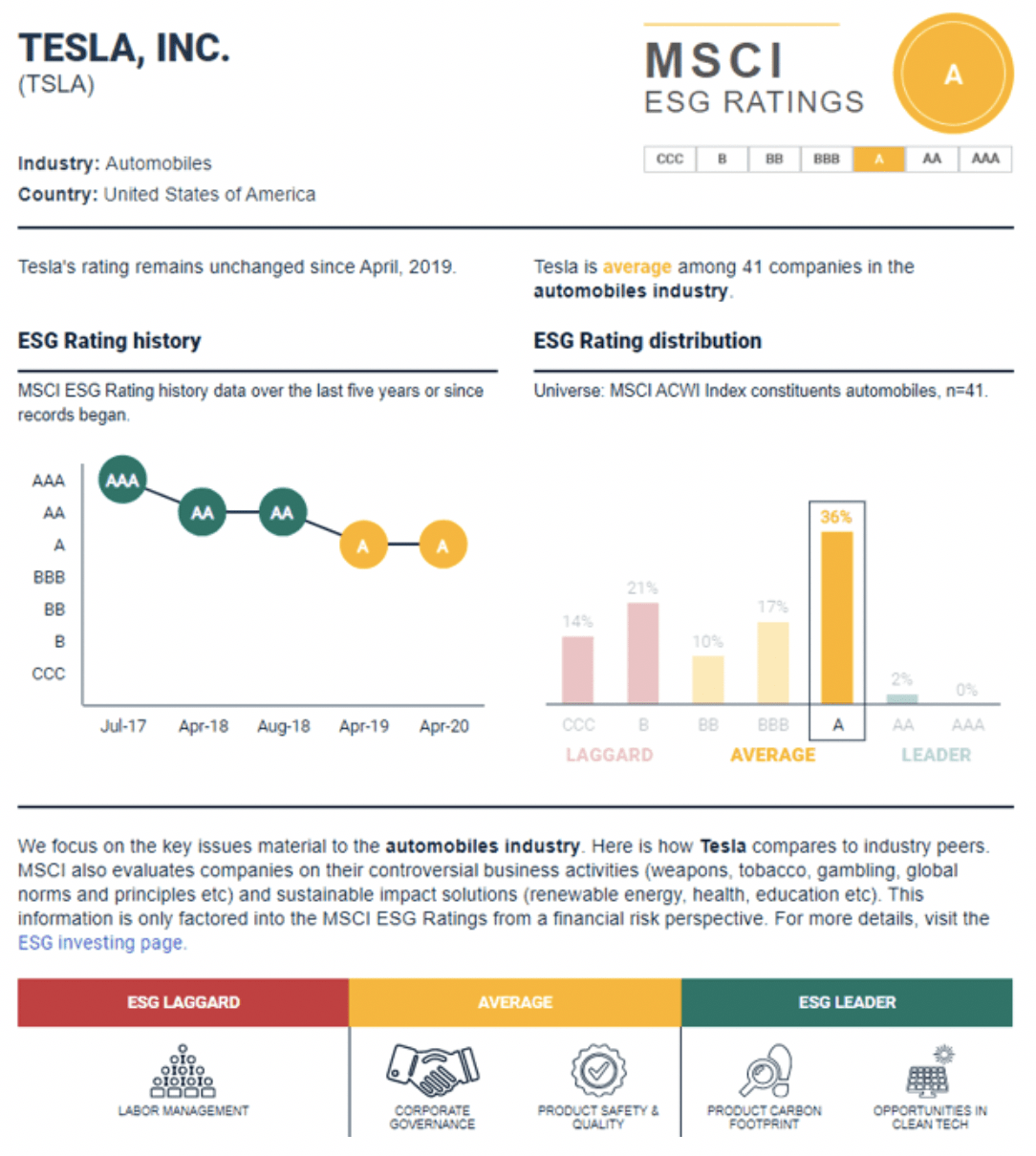

(Source: Statista)

Amazon recently upset Wall Street by announcing it would be not only hiring another 100,000 workers to help with fulfillment capacity (its online sales business has been booming thanks to lockdowns), but it would be spending 100% of profits on improving its COVID-19 response. That includes more effective protections for employees. We also can’t forget the side benefits of the online sales platform Amazon created. In 2017 there were 20,000 small businesses (who create 50% to 60% of all jobs in the US) on Amazon’s marketplace platform. These created another 900,000 jobs in addition to the 800,000 that Amazon employed directly. Today those figures are likely higher.

The “Amazon effect” has even been credited with reducing inflation over time, which has allowed for low-interest rates, which in turn, allows businesses to borrow at record low rates, fueling even more job creation. What about all the mom and pop retail jobs that Amazon has killed, or even the big department stores that it’s helped drive out of business? That’s called creative destruction and it’s how society progresses and grows. Consumers, not Jeff Bezos, killed department stores, by deciding that Amazon (or Walmart or Target)’s online offerings were better suited to their needs.

The same “woke” Millennials that decry the death of main street are the ones who subscribe to Amazon Prime and helped kill J.C Penny’s and drove Neiman Marcus into bankruptcy. And let’s not forget that innovation, through driving productivity is how the economy grows. Literally labor force growth + productivity growth are the only two factors that determine long-term economic growth.

In 1850, 80% of Americans were farmers. Today just 2% are. Yet America’s farmers, through the embrace of the tractor, fertilizers, etc., produce enough food to not just overfeed America, but even export over $120 billion worth of food to other countries. Do we lament the “jobs apocalypse” that the tractor represented? Or do we celebrate the fact that today tens of millions enjoy far less labor-intensive, mundane, and fulfilling careers? Ones that happen to pay far better than the jobs of the past.

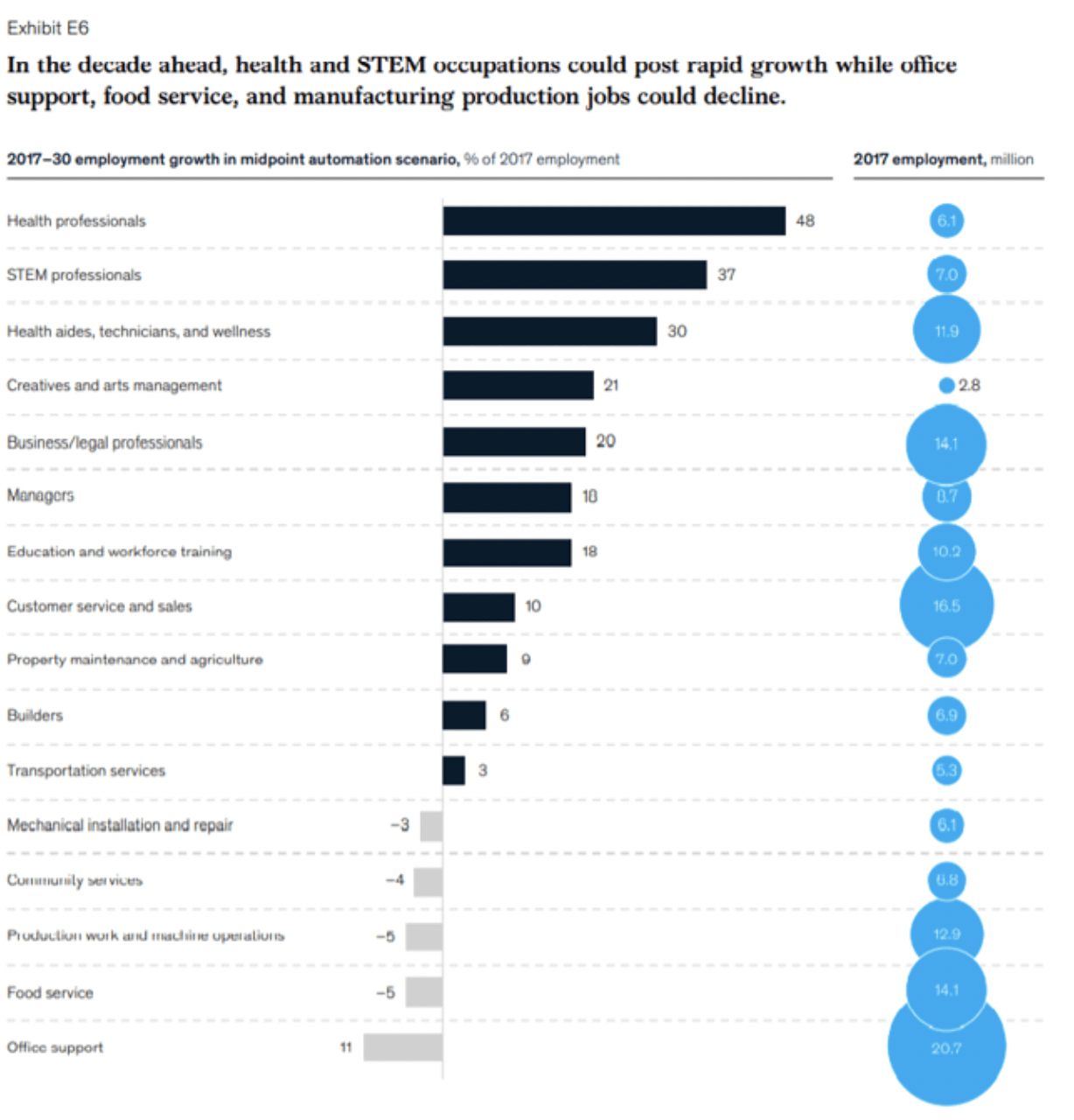

(Source: McKinsey)

Here’s analyst firm McKinsey’s estimates of which jobs will decline, and which will grow from 2017 to 2030. Yes, science, technology, engineering, and math, as well as healthcare, the highest skilled professions are expected to boom. But so are health aides, construction, creative/artistic professions, and customer service, all professions that those without college degrees can pursue. We can debate how to create the kind of equality of opportunity that most people agree is essential to a thriving entrepreneurial society such as America’s. But the way to achieve opportunity for all isn’t by banning billionaires or breaking up Amazon, Microsoft, Apple, Facebook, or Alphabet. Companies that only rose to prominence because they offered us products and services better than their competitors, at attractive prices (sometimes free), and with more convenience.

How to Profit From the Rise of 11 Trillionaires

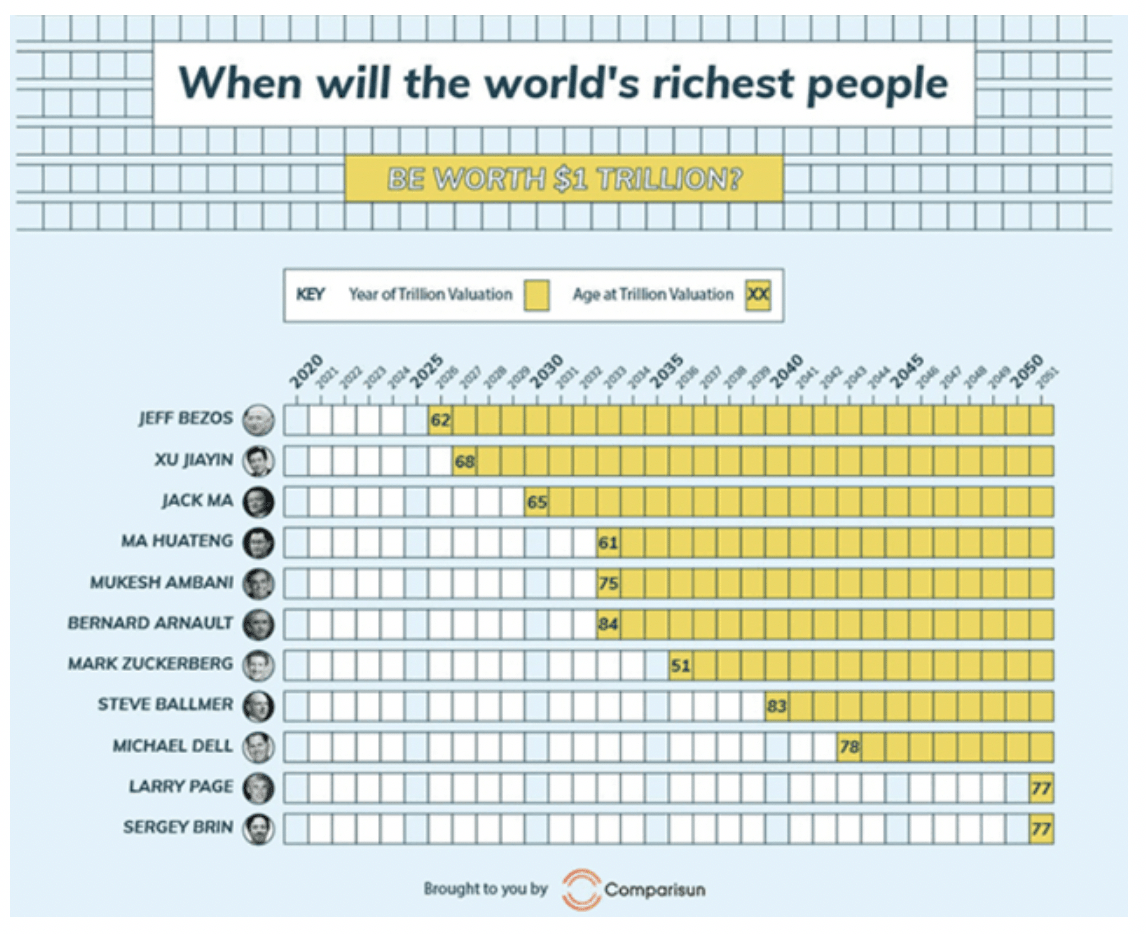

Comparison recently upset a lot of people by estimating that, if their wealth continues to grow at the same rate as the last five years, that 11 people would become the first trillionaires in history, with Bezos achieving that status in 2026. Of course, the same disruptive completion that allowed Bezos to amass such a fortune, by creating an innovative empire that spans everything from streaming, to online retail, to cloud computing and advertising, also means that none of these people are guaranteed to ever join the 4-comma club.

However, Bezos, Jack Ma, Mark Zuckerberg, and Larry Page and Sergey Brin do indeed have a good shot at becoming trillionaires eventually, because Amazon, Alibaba (BABA), Facebook (FB)and Alphabet (GOOG) are expected to continue growing at rapid rates for the foreseeable future.

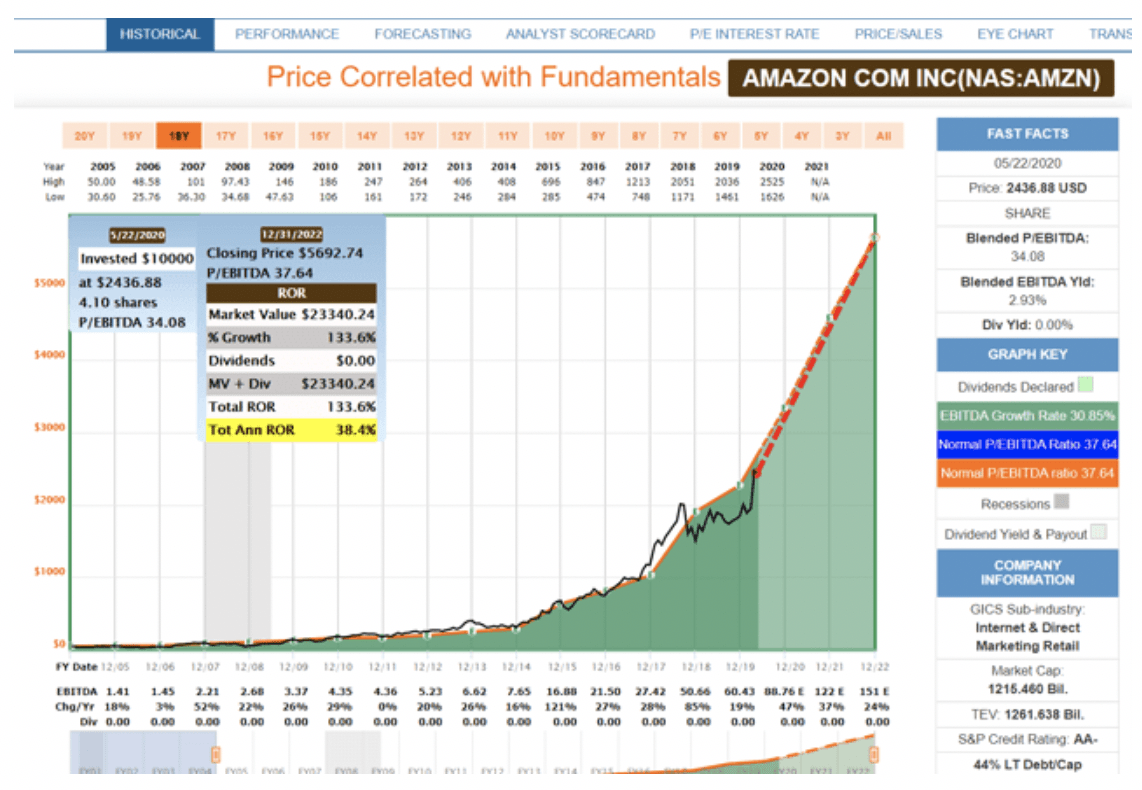

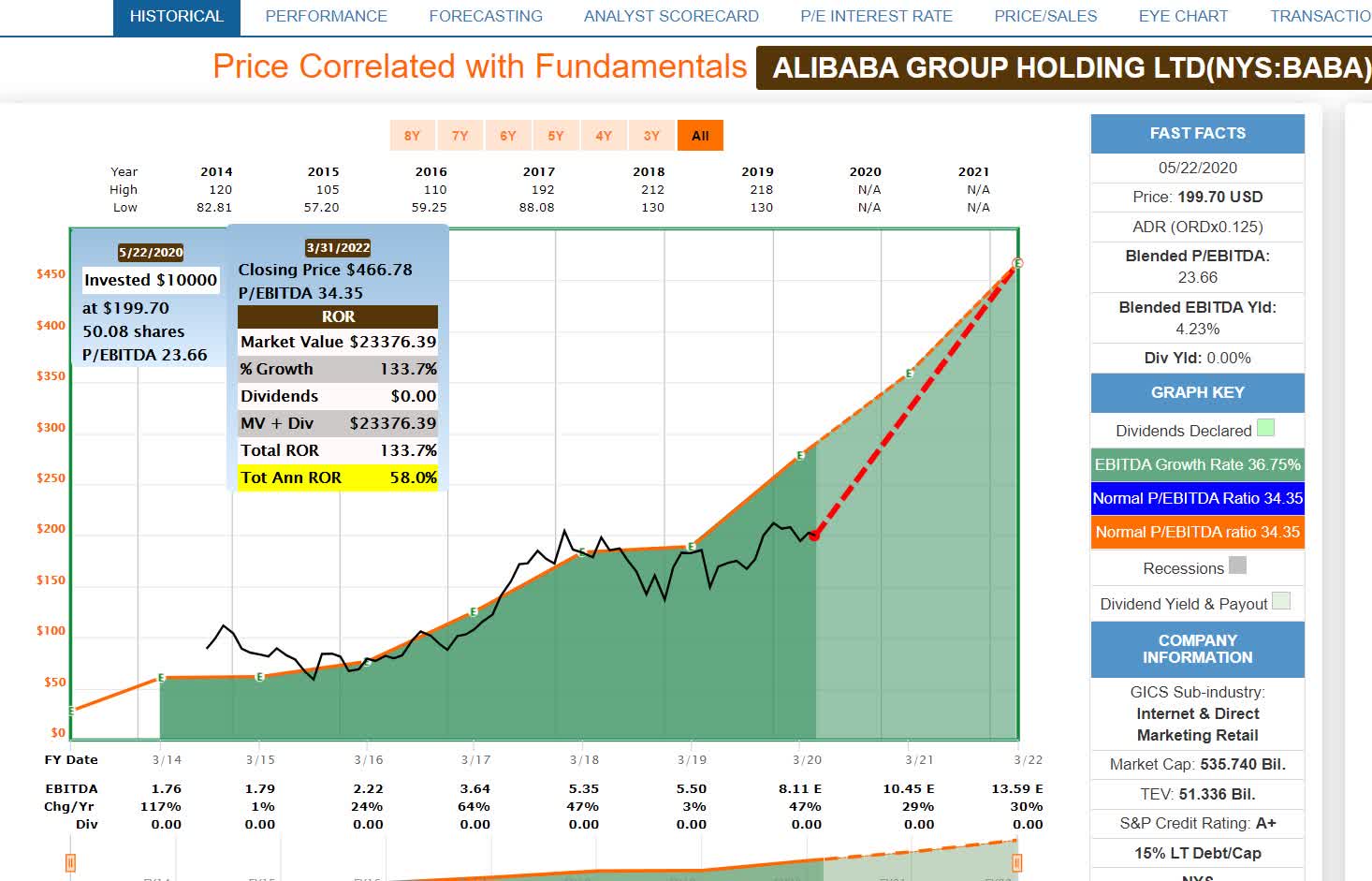

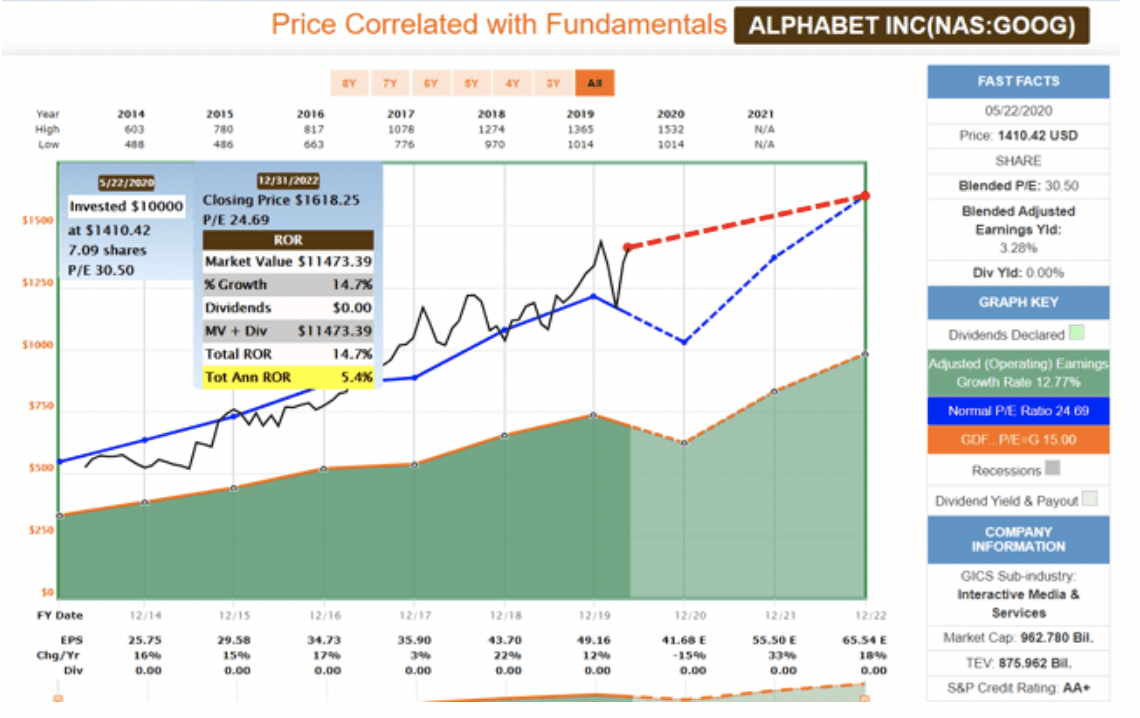

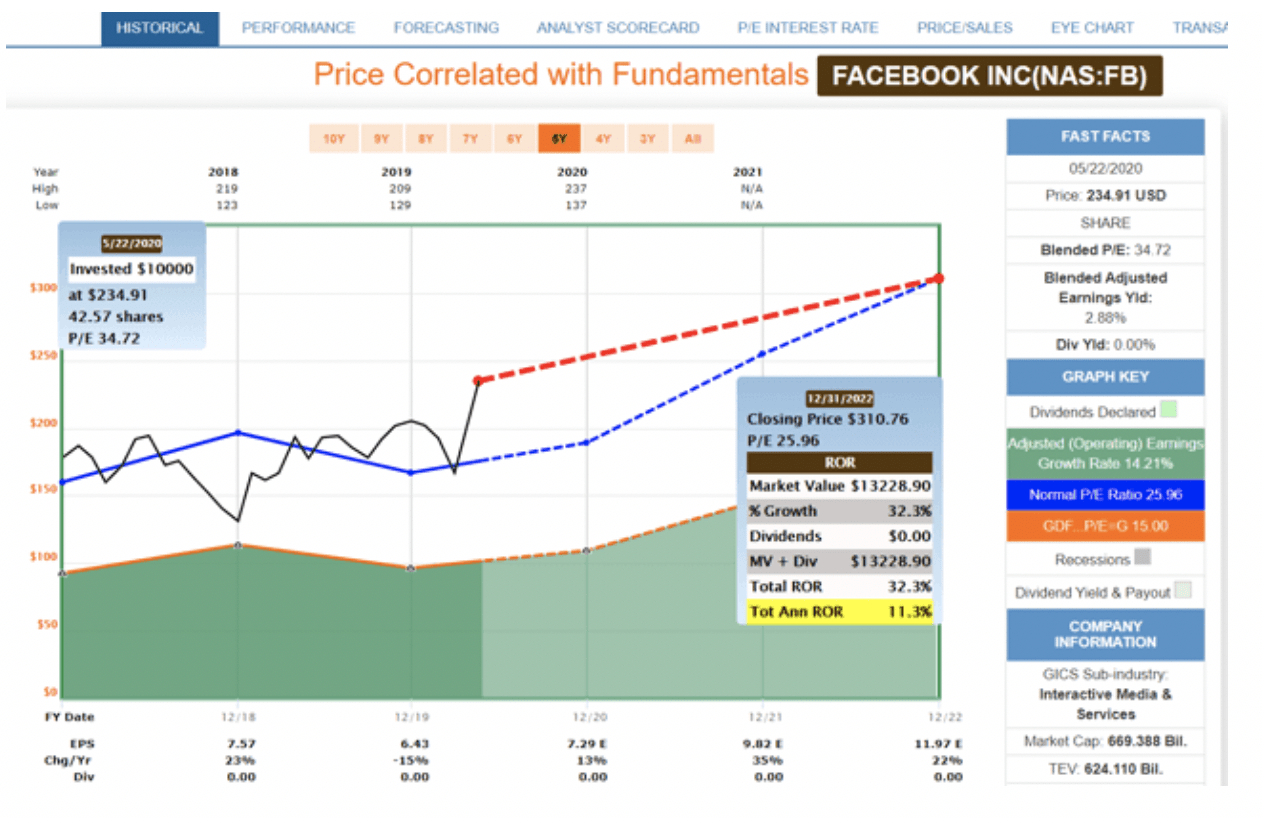

(Source: F.A.S.T Graphs, FactSet Research)

Not all of these fast-growing tech stocks are actually good buys today.

| Company | 2020 Fair Value | Current Price | Discount To Fair Value | 2022 Consensus Total Return Potential |

| Alibaba | $301 | $202.93 | 33% | 58% CAGR |

| Amazon | $2,886 | $2,435.23 | 16% | 38% CAGR |

| Alphabet | $1,417 | $1,430.47 | -1% | 5% CAGR |

| $201 | $235.37 | -17% | 11% CAGR |

(Source: Dividend Kings Research Terminal)

GOOG and FB, both of which the Dividend Kings’ Phoenix portfolio bought in late March, are now “holds” due to their strong runup in the past seven weeks. But AMZN and BABA are still trading at reasonable to outright attractive valuations. Each those companies has strong growth potential that’s expected to deliver truly sensational long-term returns if they grow as expected and return to historical fair value. Those are the same multiples the market has paid for them during periods of similar growth rates as the analyst consensus currently expects.

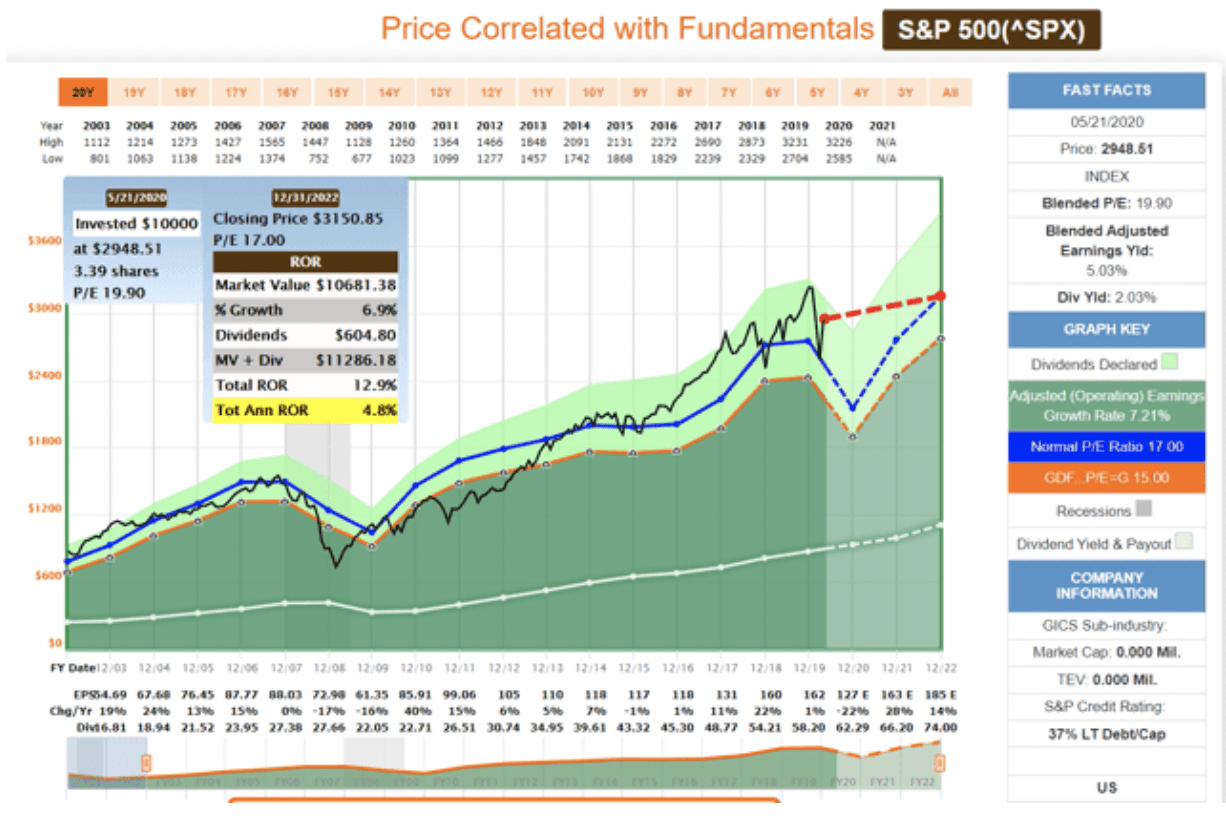

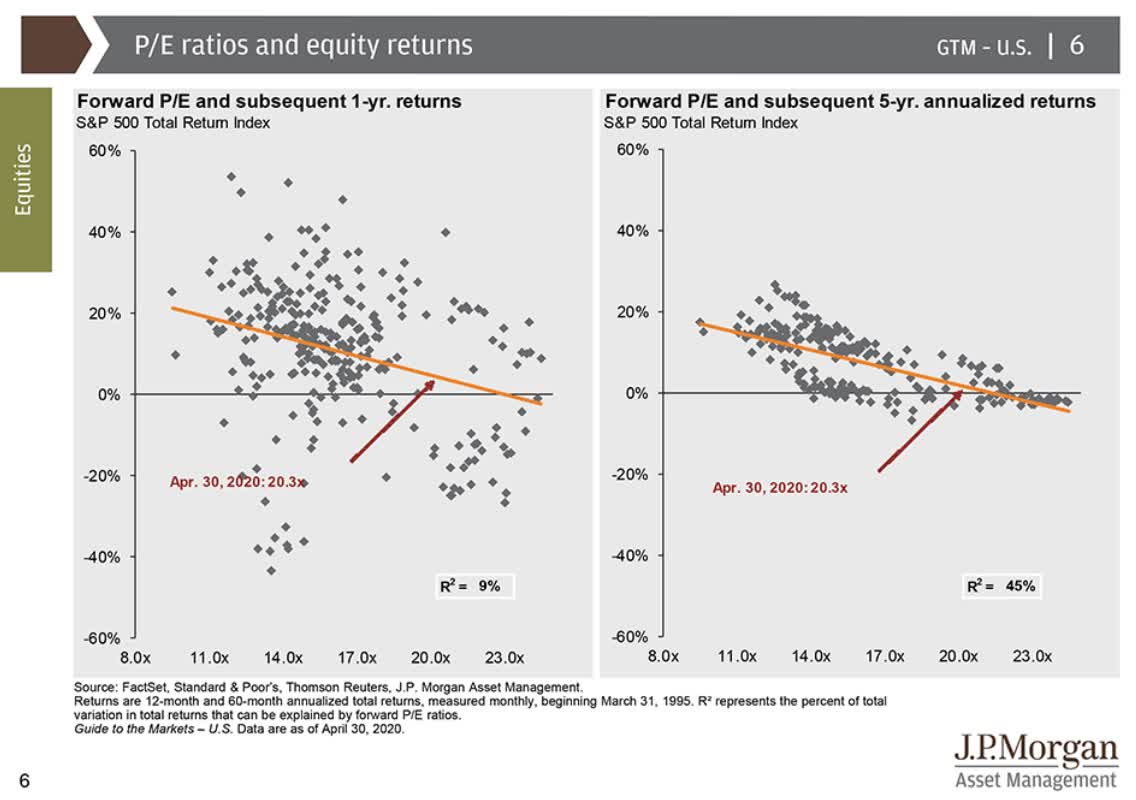

Notice how I say, “return potential” and not expected returns. According to research from JPMorgan, Bank of America and Princeton

- fundamentals/valuations explain 9% of total returns over 12 months

- 45% of total returns over five years

- 90% of total returns over 10 to 30 years

Over the short-term, that can last as long as six years, sentiment can and often does have more to do with returns than fundamentals/valuations. Only over the very long-term, 10+ years, do fundamentals dominate sentiment which is where long-term investors can make their fortune and profit from the rise of trillionaires in the coming decades.

(Source: imgflip)

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $304.06 per share on Thursday afternoon, up $0.53 (+0.17%). Year-to-date, SPY has declined -4.97%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| Get Rating | Get Rating | Get Rating | |

| Get Rating | Get Rating | Get Rating | |

| Get Rating | Get Rating | Get Rating |