In part one of this series, I explained what you can expect from the pandemic in 2021, including the most likely vaccination schedule and how bad the cases and deaths might get in the first few months of the year.

Now in part two, I want to explore what this likely means for the economy, corporate profits, and how to profit from the end of the worst pandemic in over a century.

Every crisis brings with it the potential for incredible profits, even now when the S&P 500 is in a severe bubble that threatens to derail the retirement dreams of millions.

This article will show you how to sidestep the potential landmines that are currently waiting to potentially sink your portfolio, so you can maximize your chances of achieving the rich retirement you deserve.

What The End Of The Pandemic Likely Means For The Economy

Here is what the 16 most accurate economists out of 45 tracked by MarketWatch think about America’s economic growth prospects.

(Source: MarketWatch)

The blue-chip economist consensus has slid a bit in recent weeks, but we remain on track for a very strong recovery next year.

- the strongest growth in 21 years

- record GDP by the end of 2021

- the labor market will take between 2022 and 2024 to fully recover, depending on how much stimulus we get

- that’s still incredibly fast given the economic collapse we witnessed in March and April

Of course, the chances are slim that economists, even the 16 best in the world, nail the exact economic growth we’re likely to see in 2021, or any given year. But you don’t have to be perfectly accurate, just approximately right.

(Source: Imgflip)

This brings us to what investors can expect from earnings in 2021, the ultimate driver of long-term stock market returns.

What The End Of The Pandemic Likely Means For Corporate Profits

The hardest-hit sectors in this pandemic are expected to see the strongest growth in sales as well.

And while the S&P 500’s 22% EPS growth in 2021 is pretty impressive, sectors like financials and industrials have the potential for truly spectacular earnings growth.

Of course, to actually profit from that you have to know which blue-chips are still undervalued, and thus have the easiest pathway to monster gains in 2021.

2 Blue-Chip Bargains Set To Roar In 2021 And Beyond

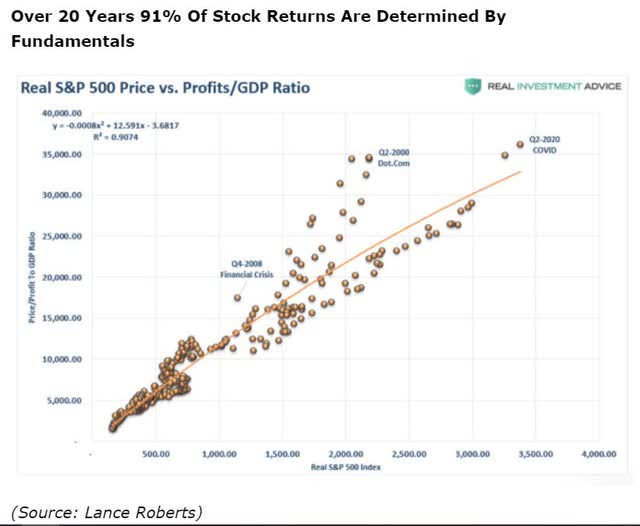

I never pay attention to 12-month analyst price targets because according to JPMorgan, just 8% of 12-month returns are a function of fundamentals.

In contrast, 91% of long-term returns are a function of just three fundamentals, starting yield, long-term growth, and changes in valuation.

These are three primary fundamentals I strive to optimize in every portfolio I manage, including all three of my personal Phoenix portfolios (where I keep 100% of my life savings).

This brings me to two blue-chip ideas that you might not think would benefit much from the end of the pandemic, but you’d be wrong.

British American Tobacco Is A Classic Buffett style “Fat Pitch”

- BTI has been impacted by the pandemic

- specifically in international markets (like Indonesia and South Africa) where lockdowns have caused significant volume declines (not normally seen in recessions)

(Source: imgflip)

A fat pitch anti-bubble investment is a growing company that’s so hated by Wall Street, that patient long-term investors who avoid becoming forced sellers for emotional or financial reasons can’t lose money as long as the company grows at 0+% CAGR over time.

(Source: FactSet Research Terminal)

By any valuation metric, you look at BTI is currently priced for negative growth according to the Graham/Dodd fair value formula.

- 2020 PE consensus: 8.3X

- 2021 PE consensus: 7.9X

- 2022 PE consensus: 7.3X

- 2023 PE consensus: 6.7X

- 2024 PE consensus: 6.9X

What kind of returns would investors earn from a safe 7.1% yielding Super SWAN if it grows at zero?

BTI Total Return Potential If It Grows At Zero Forever

(Source: F.A.S.T Graphs, FactSet Research)

If BTI grows at zero through 2025 (analysts, management, rating agencies, bond investors are all wrong), and returns to the 8.5X earnings that Graham/Dodd/Carnvale consider reasonable and prudent for companies with zero long-term growth prospects

- 31% total returns

- 5.6% CAGR returns

- vs 3.4% CAGR S&P 500

But BTI isn’t expected to grow at zero (see growth consensus section to see actual growth estimates through 2023).

BTI 2022 Consensus Total Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

If BTI grows as analysts expect through 2022, and returns to historical fair value, then analysts expect

- 118% total returns

- 47.0% CAGR returns

- vs -3.4% CAGR S&P 500

BTI 2025 Consensus Total Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

If BTI grows as analysts expect through 2025, and returns to historical fair value, then analysts expect

- 181% total returns

- 22.8% CAGR returns

- vs 3.4% CAGR S&P 500

Basically, BTI is the most undervalued blue-chip on the Dividend Kings Master List and one of our highest conviction ideas.

- I’ve personally bought it 18 times in the last few months

- both as a regularly scheduled $100 daily buy and numerous opportunistic limits during short-term market downturns

But what if you’re not interested in dividends at all? What if pure hyper-growth is more your speed? In that case, there is a famous Wall Street darling that is poised to be one of the hottest stocks of 2021.

Amazon: A 29% Undervalued Hyper-Growth Ultra SWAN

- a booming economy is great for Amazon

- who has numerous ways to profit from both US and global economic recovery

Amazon Historical Market-Determined Fair Value

| Metric | Historical Fair Value Multiple (18-years) | 2020 | 2021 | 2022 |

| Earnings | 137.0 | $4,730 | $6,121 | $8,585 |

| Owner Earnings (Buffett Smoothed Out FCF) | 28.0 | $5,204 | $4,511 | NA |

| Operating Cash Flow | 25.1 | $2,675 | $3,377 | $4,046 |

| Free Cash Flow | 47.1 | $1,999 | $3,918 | $4,887 |

| EBITDA | 37.6 | $3,992 | $4,976 | $6,295 |

| EBIT (operating profit) | 85.2 | $3,409 | $4,822 | $6,764 |

| Average | $3,294 | $4,462 | $5,715 | |

| Current Price | $3,156.97 | |||

| Discount To Fair Value | 4% | 29% | 45% | |

| Upside To Fair Value | 4% | 41% | 81% | |

| Consensus Annualized Return Potential | 177% | 39% | 34% |

(Source: F.A.S.T Graphs, FactSet Research)

Believe it or not, Amazon, despite being just a few % below its all-time highs, remains one of the best blue-chip bargains on Wall Street.

Amazon 2022 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

The operating cash flow fair value is the most conservative and that shows Amazon still capable of 13% CAGR total returns through 2022.

- paying today’s multiples is a reasonable way to lock in far superior long-term returns

Amazon 2025 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

If Amazon grows as analysts expect then it could be worth $11,409 in 2025, generating 29% CAGR total returns.

You don’t have to own only dividend stocks in a dividend growth portfolio.

Phoenix Portfolio Fundamentals (85% Dividend Stocks/15% Growth Stocks)

- average quality: 10.6/12 SWAN vs 10.5 average aristocrat

- average safety score: 4.8/5 very safe vs 4.6 average aristocrat

- average credit rating: A- stable vs A- stable average aristocrat (2.5% 30-year bankruptcy risk)

- yield on cost: 4.2%

- current yield: 3.3% vs 1.6% S&P and 2.0% dividend aristocrats (our equity benchmark)

- Morningstar long-term growth forecast: 12.1% CAGR vs 6.4% S&P 500 & 7.5% dividend aristocrats

- weighted average forward PE: 15.4 vs 16.2 historical norm vs 23.3 S&P 500

- average discount to fair value (Morningstar estimate): 5%

- 5-year analyst consensus total return potential: 3.3% yield + 12.1% CAGR long-term growth +1.0% CAGR valuation boost = 16.5% CAGR vs 3.4% S&P 500

- Risk-Adjusted Expected Return: 12.1% CAGR vs 2.6% CAGR S&P 500 (4.7X market’s expected return)

The DK Phoenix portfolio is 15% pure growth stocks and yet still yields more than double that of the S&P 500, with far superior valuations, quality, and growth potential.

Thus a portfolio that’s up 36% in a few months, is still expected to deliver 12% CAGR total returns over the coming five years, and about 16% CAGR total returns over the very long-term.

AMZN + BTI average a 3.5% yield + 23% CAGR average long-term growth consensus and are combined about 40% undervalued.

Combined with their excellent safety and quality, those are the kinds of fundamentals that is what long-term market-smashing returns and rich retirements are made of.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

The #1 CRITICAL Investment Lesson from 2020

7 Best ETFs for the NEXT Bull Market

SPY shares were trading at $375.50 per share on Wednesday morning, up $4.17 (+1.12%). Year-to-date, SPY has gained 0.43%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| BTI | Get Rating | Get Rating | Get Rating |