So, how do you create a stock market bubble in the midst of a global pandemic in four easy steps?

- Take interest rates to 0.00. Creating more debt to solve a debt problem, causing deflation and inflicting economic repression on savers, people dependent on yield, and other fiscally responsible parties is a good start.

- Cut trading commissions to 0.00. What we lose in margin we make up in volume. See below for additional comments on why this has become the best of times for fintech-focused firms.

- Make the printing press go Brrrrr, creating trillions of dollars, see how that just rolls off the tongue, into not only market plumbing but also directly into people’s bank accounts. The Obama Phone program ain’t got nothing on this administration currently ‘we’re all in this together’ largess. Me, I’m still waiting for my $1,200 smackers

- Shut down all the offices and sports and force everyone to sit at home. Hmmm, where does a junkie fix his or just make a damn honest living?

The poster child for the last item is David Portnoy, founder of Barstool sports, who built a media empire he launched at the tender age of 26 in 2003 with what was essentially a xeroxed and faxed tout sheet for sports gambling. In late January he cut a deal with “Penn National Gaming (PENN)” to take a minority stake valuing Barstool around $450 million. It made Portnoy very rich as a good portion of the deal was cash.

But the real rush comes in the stock portion and optionality that get vested and accelerate over the next few years. Initially, it was a complete disaster as COVID took hold, and shares of PENN went from the all-time high of $40 after the deal was struck to a low of $4.00, a mere 90% haircut. The stock has since rebounded to about $22.

So with no sports to gamble on and watching his paper wealth swing wildly, Portnoy rebranded himself as Davey Day Trader and started tweeting his exploits which included making, and more often losing, hundreds of thousands dollars a day. He quickly came to the conclusion that he didn’t know what he was doing, the daily price swings made no sense and Mr. Market will humble himself and take all his money if not careful.

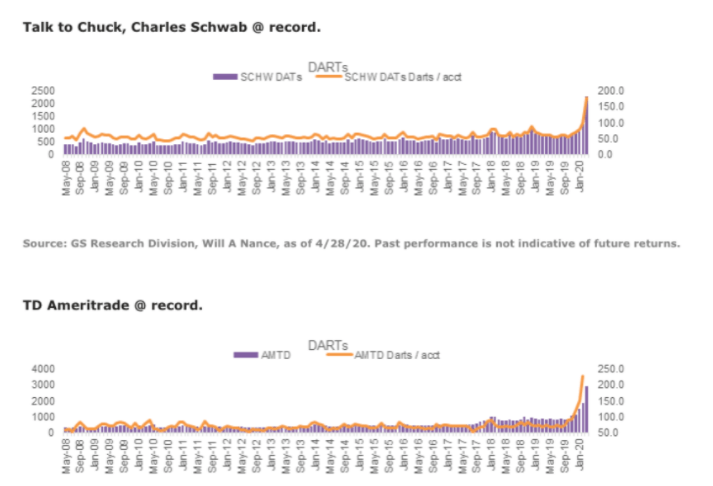

But Davey was actually late to joining the rush into the stock market especially among younger people. Look at how the DARTs (Daily Average Revenue Trades) went parabolic towards the end of last year, which is when equities were hitting new highs and transaction/trading fees were going to “free”, which of course makes the “R” less important but it’s still an important measure of trading activity.

They got your money coming in the door and being sprinkled around their casino. And financial firms’ tables are covered with their own special ‘felt’ full of friction.

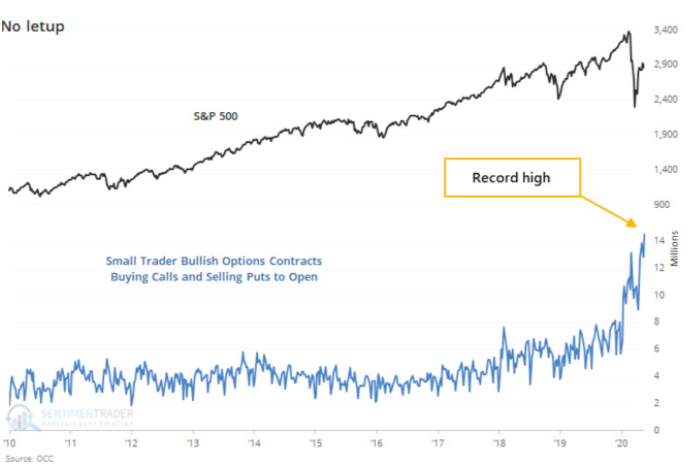

And despite the volatility, gloomy headlines, and doomy economic data the activity is not letting up, in fact, it’s accelerating and has taken on a notably bullish bias.

According to data from the Options Clearing Corp (OCC), this week saw small accounts (those under $100k) initiate a record number of bullish option trades, as some $15.5 million contracts of calls were purchased or put on sale.

And while the absolute dollars being wagered may seem small for a multi-trillion market it should be noted that not only is it far and away record over the past decade but keep in mind it also represents a mere fraction of the leveraged or notional amount of underlying shares the options could come to control;100x multiplier (one contract represents 100 shares) it’s about $1.5 billion bet on a renewed bull market. Not a pittance for the ‘little guy.’

But isn’t when the ‘retail, main street, pissants’ starts pissing away money always a sign of a market top?

Well, so far they’re kicking most ‘professionals’ well-polished asses. As Howard Lindzon, founder of VC firm Social Leverage, prolific blogger and early investor in both StockTwits and Robinhood wrote, “You Panicked While Those Millennial Avocado Munching Robinhood Investors Caught The Bottom”.

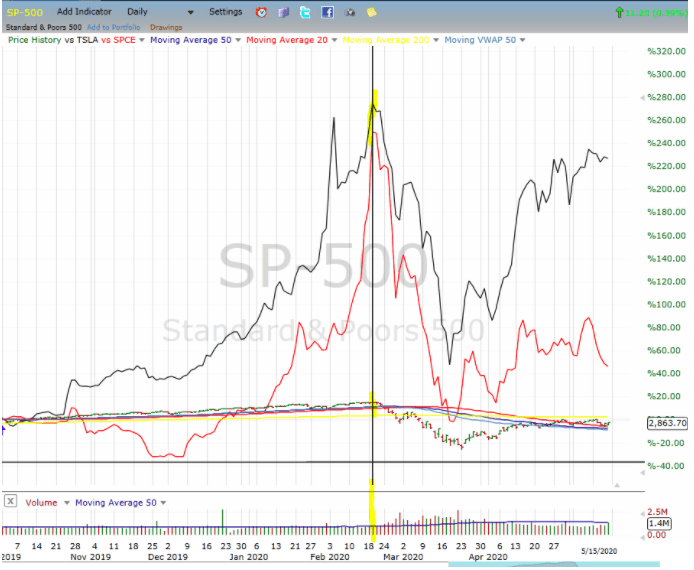

It did look like the rubes piling into concept companies like “Tesla (TSLA)” -black line- and “Virgin Galactic (SPCE)” -red line, into the stratosphere beyond any reasonable valuation were following the bubble to bust script. You can see those two names started to plop in mid-February, about two weeks before the virus took hold and shook the S&P 500 down some 30%; and even with the recount rebound, they’re, especially TSLA , far outpacing the broad indices.

But the funny thing is recent data from the likes of Robinhood have shown the most active stocks over the past few weeks have been those that crashed the hardest such as cruise ships, airlines and even the “Oil ETF (USO)” hit the top of the active list on the day oil went negative.

Meaning, there is plenty of bottom picking to go along with momentum chasing. And honestly, it might not be a bad approach. With all the liquidity and the Fed’s near explicit promise not to allow a crisis or wholesale defaults there are plenty of seasoned professionals looking to scoop up distressed securities. With people getting ready to return to a more normalized social and business activities, especially the possibility of a vaccine on the horizon this truly might be the shortest, albeit steepest, recession on record.

Retail investors are participating in recent upside more than any other investor group. This is bullish for overall business and consumer confidence. And while it is true that retail inflow spikes tend to end badly, they also have been historically predictive of the early stages of extreme bull market runs. Portnoy’s complaining might also be a good thing in that it suggests that it might not be so easy making money trading and a bull market needs a healthy dose of skepticism or at least a lack of unfettered exuberance.

This was originally published for members of Steve Smith’s Option360 Service. To learn more about Steve Smith’s approach to trading and access to his Option360 click here.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

9 Simple Strategies to REGROW Your Portfolio – Learn the 9 strategies employed by Steve Reitmeister to generate consistent outperformance…even during bear markets.

SPY shares were trading at $295.82 per share on Tuesday afternoon, up $0.82 (+0.28%). Year-to-date, SPY has declined -7.55%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |