In what has become one of the most perplexing rallies the major stock indices have now posted their best two-month performance in 30 years. The gains have now cemented recovery from one swiftest and sharpest bear market on record.

Indeed, by almost any measure of definition, we have either resumed the long term uptrend and/or embarked on the new bull market as the “Nasdaq 100 (QQQ)” has just hit a new all-time high and “SPDR S&P 500 (SPY - Get Rating) is just 7% from its highs.

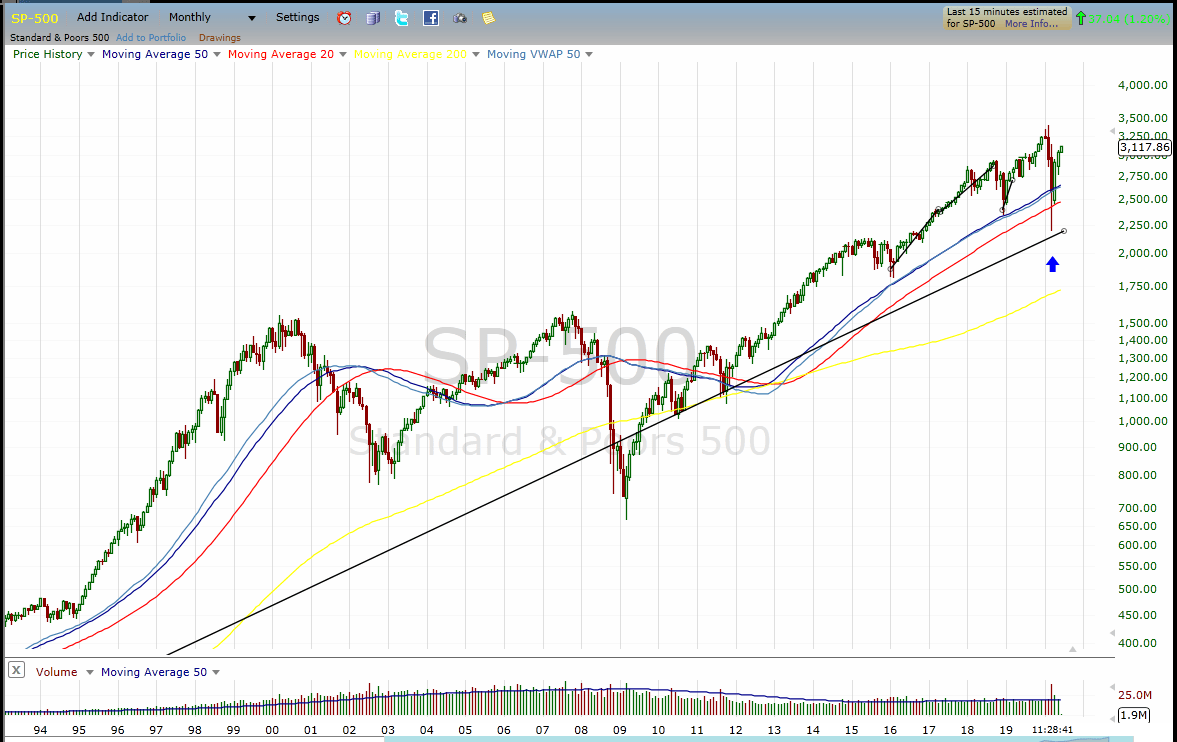

There are many people, myself included, that having a hard time reconciling the terrible economic and social news with stock market performance. We’ve already discussed there can be a persistent disconnect between Wall Street and Main Street but it seems hard to trust the sustainability of this rally. But instead of trying to reach for explanations, I tend to turn to the charts for trading purposes and have a saying when in doubt, zoom out.”

Meaning I turn to long-term charts which makes it makes it impossible to ignore the primary trends. As mentioned above we just closed out one of the best two-month gains ever so I figured it was a good time to zoom out and look at the monthly SPY chart.

As you can see major long term uptrend that began in 2009 remains intact and the recent sell-off was not only extremely brief but relatively modest compared to the financial crisis and the dot.com bust in 2000 that turned into a 3-year long bear market.

One of the complaints or causes for skepticism during the first phase of this rally was that being carried by just a handful of mega-cap tech names such as “Microsoft (MSFT) and “Apple (AAPL)” but over the past week or two there has been a distinct expansion of participation which has resulted in healthier market breadth.

In fact, the list of sector ETFs hitting all-time monthly highs, while still heavily leaning towards technology it is growing and becoming more diverse. It includes:

- Technology Index $XLK

- Semiconductors Index $SOX

- Communications Index $XLC

- Internet Index $FDN

- Healthcare Index $XLV

- Biotechnology Index $XBI $IBB

- Medical Devices Index $IHI

- Software Index $IGV

- Cloud Computing Index $SKYY

- Online Retail Index $IBUY

- IPO Index Fund $IPO

The question now becomes are investors correct to be looking past current conditions by betting the worst of the economic fallout is in the rear-view mirror.

While the market valuations are now pricing in a fair amount of good news, we are still far from the insane values of the dot.com days. In a way, on the surface, the current rally may make less sense, but it is far from the euphoria/mania of that period.

It’s awfully hard and would be foolhardy, to try calling a top or standing in the way of this renewed bull market. That said, the market and many individual stocks have come a long way in a very short amount of time so buying here may feel a bit late to the party, but a dip may not be forthcoming

One way to participate while limiting risk is to use options, particularly buying longer-dated call options, instead of the underlying shares.

To learn more about Steve Smith’s approach to trading and access to his Option360 click here.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

What If I Am Wrong About the Bear Market? Even stubborn bears need to contemplate why the market continues to rally above 3,000.

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $311.35 per share on Wednesday afternoon, up $3.27 (+1.06%). Year-to-date, SPY has declined -2.70%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |