Is 2021 still bullish or will the bear come back out of hibernation?

What groups are likely to outperform in the year ahead?

Why should investors sleep with “one eye open” in 2021?

Steve Reitmeister answers these questions and more in his just released presentation. Just click below to watch now:

2021 Stock Market Outlook: Upside & Pitfalls

This presentation shares Steve’s most up to date views on the stock market where he weighs the many bullish and bearish elements at play.

First, Steve contemplates the bullish argument including the #1 reason why stocks bounced in March even as we were in the grips of a scary recession. And why that same reason still exists today to bolster stock prices into the future.

Then he goes on to prove that the economy is rebounding better than expected. So even though still technically a recession, the direction of the economy, and the pace of improvement, point to more upside ahead.

However, before you start gushing over all the upside potential Steve shares the bearish elements at play such as the current alarming rise of Coronavirus cases around the globe. And if it continues how it will set the economy and stock market back once again.

There is also a risk of too much Fed accommodation and government stimulus creating an overheated economy. And that could generate unwanted inflation, which would be a clear negative for stocks.

Next up Steve weighs out the net effect of the bullish vs. bearish arguments to explain the likely target for the S&P 500 in the year ahead. (Spoiler Alert: It doesn’t look like tremendous gains. So those investors seeking more attractive returns are going to have to be much more selective in their stock picking in the year ahead.)

The game plan for 2021 points out specifically the types of stocks that should do best next year. Namely that the winners from 2020 will take the back seat and a new group of stocks are ready to take the lead.

In a word, 2021 will be more about “value”. The rest of it is explained in detail in the presentation. So watch it now.

Steve goes on to explain the “Formula for Success in 2021” by outlining a powerful indicator that points to stocks likely to outperform. This same indicator pointed out 2 of the big winners in 2020 including NVIDIA (NVDA - Get Rating) that sprinted 122.9% from the time the POWR Rating indicator flashed a Buy signal.

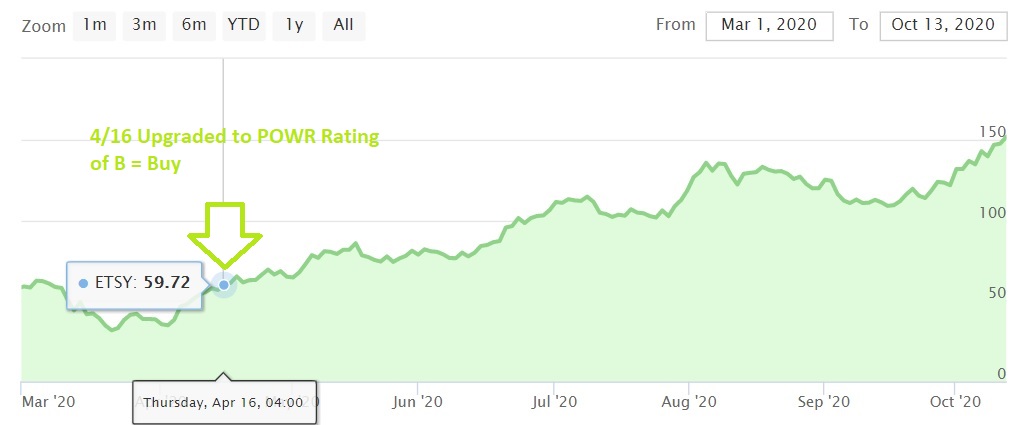

Etsy (ETSY - Get Rating) is another clear example of the POWR Rating nailing when to buy the stock and get ready for a serious momentum ride higher. Here we see the April 16th Buy signal leading the way to a 146.8% gain.

This presentation then shifts gears and talks about the serious hurdle for investors into the 2020 Presidential Election. Typically the election would be over next Wednesday. However, because of the tidal wave of write in ballots we will most certainly see delayed election results. And during that time of uncertainty the market is likely to head lower.

Even worse is the idea that the two candidates could dispute the veracity of the write in ballots thereby contesting the election results. This could lead to an elongated battle that would have investors rushing to the sidelines until this election was truly finalized.

Long story short, this presentation is one of the earliest looks at what lies ahead in 2021. Both the highs and the lows and a game plan to succeed. But also it prepares you for the most pressing matter in our midst. That being how to trade during this ominous election season.

This was one of the most well attended investment webinars of the year. And the crowd stayed locked in to the very end given the steady stream of helpful insight. You can watch it now on demand by clicking the link below:

Watch: 2021 Stock Market Outlook

Learn More About Steve Reitmeister

SPY shares were trading at $329.98 per share on Thursday afternoon, up $3.32 (+1.02%). Year-to-date, SPY has gained 3.99%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| ETSY | Get Rating | Get Rating | Get Rating |

| NVDA | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |