Back in mid-2020 shock-jock Dave Portnoy whipped Wall Street into a frenzy when he proclaims that “stocks only go up.” Acolytes of Portony might be forgiven for thinking this is true.

- stocks went up 30% in 2019

- stocks went up 18% more in 2020 (despite the worst recession in 75 years)

- the S&P 500 is up almost 5% YTD so far, in less than two months

- JPMorgan at the end of 2020 said that if EVERYTHING went right stocks MIGHT potentially go up 25% in 2021

- Goldman Sachs predicted that it would take until 2022 for the S&P 500 to rise another 25%

- at the current pace, stocks would melt up 51% by the end of the year

Of course, stocks can’t actually go straight up, at least not for very long.

This brings us to the economic news that could make or break your portfolio in the coming years.

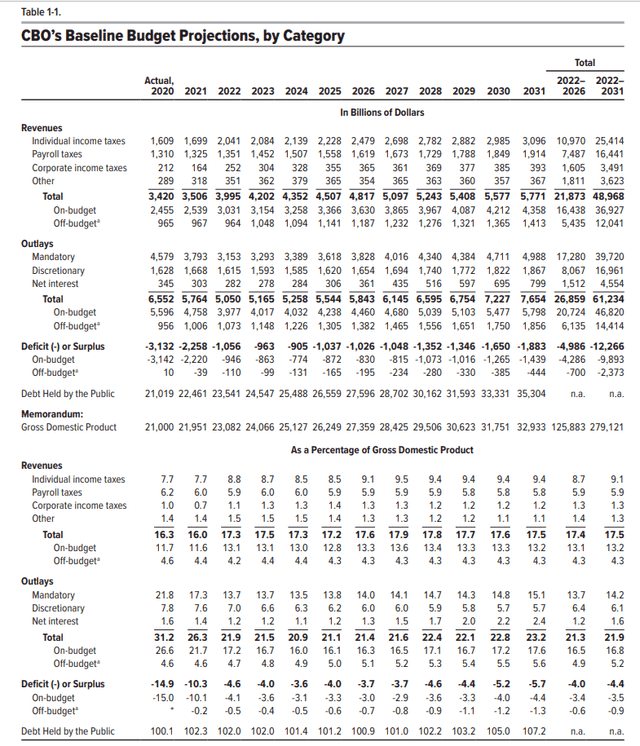

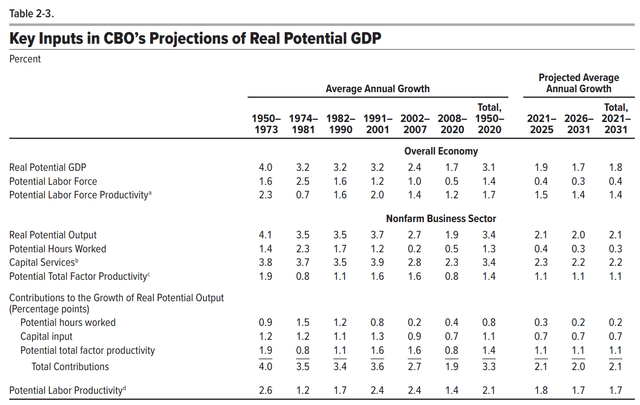

Congressional Budget Office 2021 Through 2031 Economic Forecast

- every three months the CBO puts out a decade long economic and budget forecast

- projections based on legislation passed through January 12th, 2021

(Source: CBO)

- The CBO expects most $1+ trillion deficits this decade, including a total of $12.3 trillion in cumulative deficits over the next 10 years.

- Debt/GDP rising to 107.2% by 2031 up from 100% in 2020

- $35.3 trillion in total debt held by the public

- standard economics teaches that such large deficits will cause long-term interest rates to rise

- short-term ones as well due to high inflation and thus the Fed hiking short-term rates

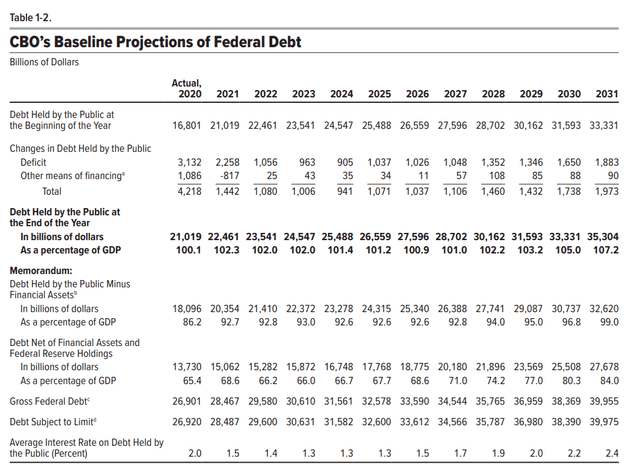

(Source: CBO)

- average borrowing costs are expected to continue falling through 2025 before rising to 2.4% by 2031

- 0.4% adjusted for inflation, as close to free borrowing for the US Treasury as we’d ever want to see

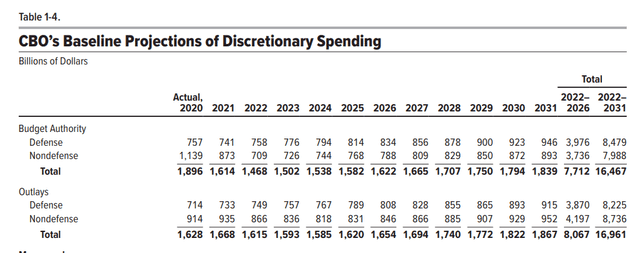

(Source: CBO)

- military spending expected to rise every single year

- yes even with Democrats in charge of Congress and the Presidency

- because lobbyists spend a lot of money and supply chains have been built in every congressional district precisely so that no budget cuts can occur without layoff photo op threats

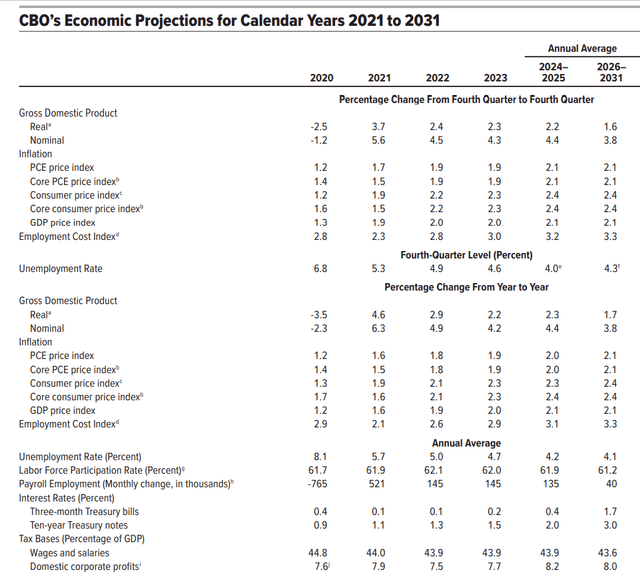

(Source: CBO)

- corporate taxes not expected to increase until 2022

- by 2025 stronger economy means corporate profits are back to record amounts

- CBO expecting very anemic growth beyond 2026

- very modest inflation of 2.0% to 2.1%

- 10-year yields averaging 3.0% from 2026 through 2031

- basically a return to 2019 10-year yield levels

(Source: CBO)

- growth rate in the labor force will be a drag on growth for the next decade

- productivity boost from infrastructure spending could offset this

- 13% to 17% is the average/median return on invested capital of infrastructure spending according to a meta-analysis of dozens of studies

- CBO estimates inflation-adjusted borrowing costs of 0.4% or less

- vs 11% to 15% inflation-adjusted returns on investment for infrastructure

- infrastructure spending, unless complete squandered on non-productive projects, is effectively self-funding

- the more infrastructure you invest in, the lower debt/GDP will be in the future

So what does this mean for your portfolio?

Why Wall Street’s Favorite Stocks Could Soon Be Slaughtered

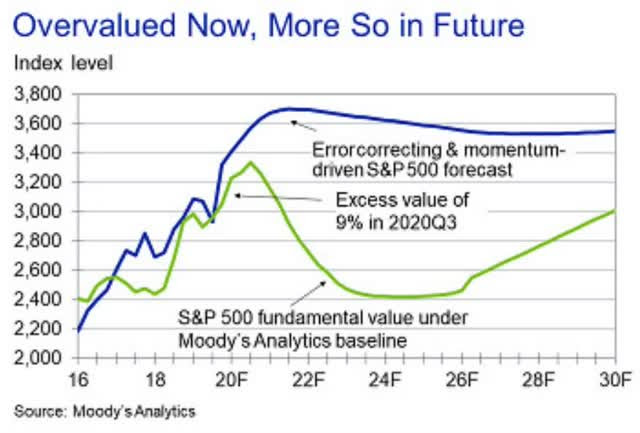

Moody’s base-case economic forecast in 2020 had a chilling warning for investors.

What kind of economic horrors would cause the market to fall 14% over a decade?

- actually, a very strong economy

- causing long-term interest rates to rise

- to 4.3% 10-year yields by 2030

Now it’s important to point out that Moody’s is on the extreme predicting 4.3% long-term interest rates.

- the blue-chip economist consensus is 2% to 3%

- CBO also expects 2% to 3% as does the Fed

However, as we’ve seen with interest rates in recent weeks, they are likely to go up from record low levels.

| Growth Rate | Fair Value Multiple (3.1% discount rate) | Fair Value Multiple (4% discount rate) | Fair Value Multiple (8% discount rate) | Fair Value Multiple (12% discount rate) | Fair Value Multiple (22% discount rate) |

| 5% | 1,133.75 | 113.2 | 22.5 | 12.4 | 5.82 |

| 15% | 1,785.44 | 177.1 | 34.3 | 18.5 | 8.24 |

| 25% | 2,707.57 | 267.3 | 50.7 | 26.9 | 11.5 |

| 50% | 6,731.94 | 660 | 121.4 | 62.4 | 24.93 |

| 100% | 28,348.60 | 2761.8 | 493.8 | 246.8 | 91.98 |

| Ratio Of 100/5 Growth Multiples | 25.00427784 | 24.3975265 | 21.94666667 | 19.90322581 | 15.80412371 |

(Source: Moneychimp)

- hyper-growth stocks benefit the most from ultra-low rates

- even a modest increase in interest rates can pop hyper-growth “growth at any price” bubbles

The Stupid-Smart Way To Profit From A Strong Economy And Rising Rates

Allow me to illustrate the best way to avoid getting slaughtered by an economy so hot that it causes a bear market, purely due to rising interest rates.

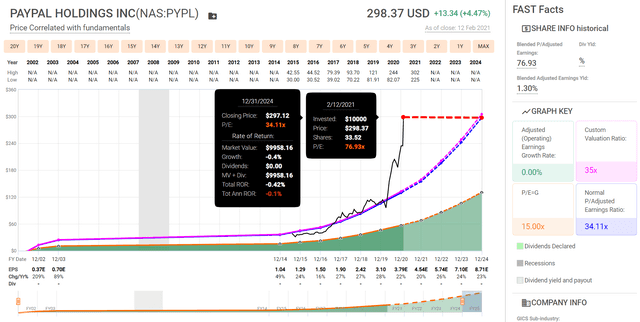

I’ll use popular growth stocks I personally own, Paypal and Alibaba.

- analysts expect both PYPL and BABA to grow 25% CAGR over time

- PYPL is over 80% overvalued

- BABA is 30% undervalued

Paypal Is Pricing In 4 Years Worth Of Hyper-Growth

(FAST Graphs, FactSet Research)

- If PYPL grows as analysts expect (no certainties on Wall Street) then a return to historical 34X earnings in 2024 would result in zero returns

- -2% annually adjusted for inflation

There are only two kinds of people buying Paypal, which I bought for $91 back in April 2020, right now.

- those that don’t know better

- short-term momentum traders

No prudent long-term investor pays 77X earnings for a company that the market has valued since its IPO at 34 to 36X earnings growing at similar rates.

Alibaba: Hyper-Growth At A Reasonable Price

(FAST Graphs, FactSet Research)

- both BABA and PYPL are expected to grow about 25% CAGR over time

- BABA offers 30% consensus return potential through 2024

- PYPL zero

I’m not personally feeling pressured to sell PYPL right now.

- anyone who paid fair value or better for Paypal will fully participate in its growth

- locked in potentially 25% CAGR total returns

However, should this market growth bubble get worse, then during my annual portfolio review/rebalancing I might trim 50% of Paypal to buy a similar hyper-growth blue-chip such as Alibaba or even Amazon.

- 50% of my investment locked in 25% consensus returns for decades

- 50% locked in thousands in profits that were then reinvested into an equally fast-growing blue-chip at undervalued and attractive valuations

This is how you avoid the dangers of rampant speculation and the “there is no alternative” bubble.

What interest rates are today has little meaning for prudent investors who plan to own stocks for the long-term.

- 2% to 3% 10-year yields make it very likely that today’s speculative bubbles will burst

- Prudent investors avoid bubbles and profit from anti-bubbles

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

SPY shares were trading at $392.19 per share on Friday morning, up $1.47 (+0.38%). Year-to-date, SPY has gained 4.90%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| PYPL | Get Rating | Get Rating | Get Rating |

| BABA | Get Rating | Get Rating | Get Rating |