Following a historic ten year run, the stock market got boring.

It wasn’t moving up at life-changing speed and it wasn’t providing the rush that you associate with big risks.

In the 90’s, I think it was Maxim Magazine that listed Day Trading as an extreme sport, up there with skydiving.

That was when stocks like Qualcomm (QCOM - Get Rating) moved hundreds of points in a day.

The Dot-com era is long gone but what isn’t is the thrill of an opportunity.

Going all the way back to the 1600’s and Tulip mania, we are always looking for the next big thing.

The emergence of Bitcoin and its ability to change values at warp speed created a run on the cryptocurrency market. Yet highly intelligent people couldn’t even understand what it actually was.

Smart people with good intentions willing to risk their homes for the opportunity to own a coin that could change their fortunes.

They were Bitcoin groupies.

Bitcoin fanatics.

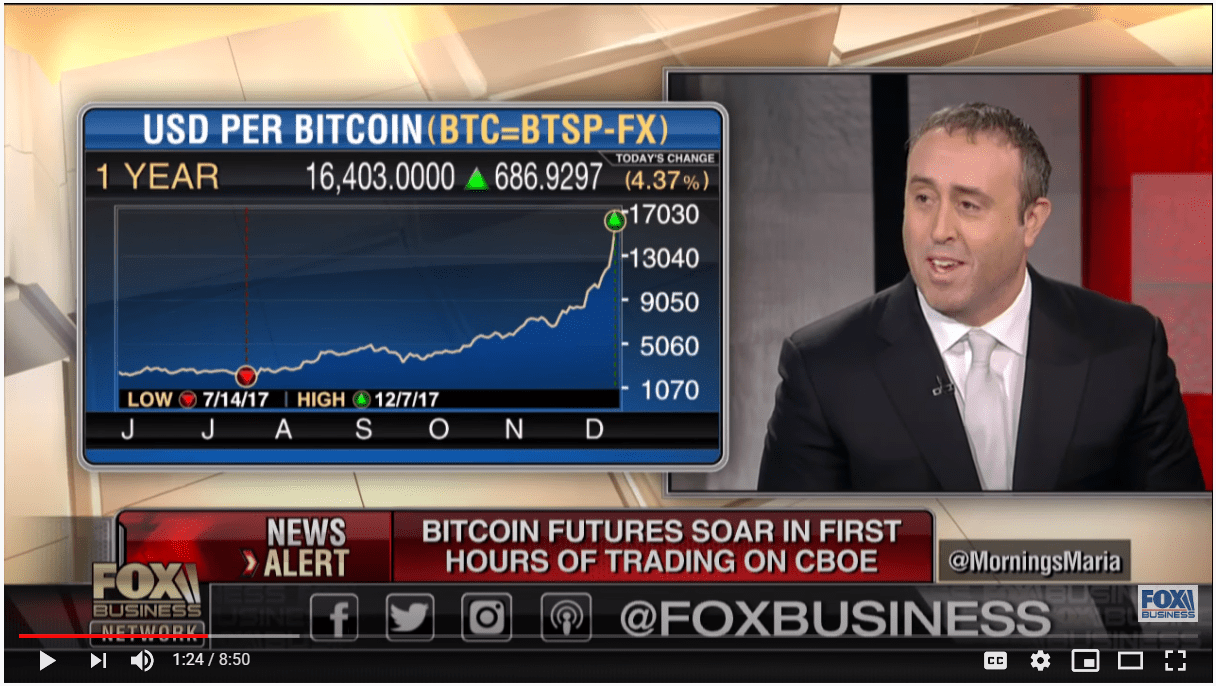

I was invited on Fox Business with Maria Bartiromo to host a segment on the day Bitcoin Futures began trading.

I had already moved out of New York City but I remember having to sleep in the city that night because the segment started so early in the morning.

Bitcoin was trading above $17,000 at the time and they asked me for my take on it.

I said clearly that we were months away from the first Bitcoin horror story.

Click HERE to watch the video.

Here are some of the hateful comments I received…

“Wow, Fox really found a moron to interview here haha, scary bitcoin, stay away, dollar safe, what a joke!”

“These are dumbest people. they know nothing about this market and it’s potential.”

“They will regret in 3 months lol”

“I hope this guy starts trading bitcoin so we can see the look on his face when his short position gets liquidated.”

There’s a lot more and they get worse!

It’s not easy having an unpopular opinion.

Well, months later, Bitcoin had crashed and got back down to $3,000, from $17,000.

Then came cannabis…

Do you remember in September of 2018 when Tilray (TLRY - Get Rating) made a Qualcomm-like move, soaring hundreds of points in a day?

It’s always the same story, the faster the move, the bigger the herd.

What’s crazy though is if you took a chart of Tulip mania and compared it to Cryptocurrencies and compared that to the charts in the marijuana sector, they all look the same!

Now, this year, in March, the stock market crashed. The S&P 500 was moving 6% a day.

That’s a Tulip move.

That’s a Bitcoin move.

That’s a Marijuana move.

Once again, the markets were moving at warp speed and the herd is now bigger than ever.

Bloomberg released a story last week that bored day traders locked at home are now obsessed with options and that trades consisting of just once contract accounted for 13% of the volume.

The article went on to say “Wall Street says it will end badly.”

I don’t blame “Wall Street” for saying that.

History has shown us it usually does.

However, this time it doesn’t have to.

There’s a difference between investing in Bitcoin or Weed and trading options, if you take a little time to understand the benefits.

Options trades come with a calculated chance of success.

You can put on a trade and see that there’s a 70% chance you’ll be right.

You could put on a trade and see there’s a 1% chance you’’ be right.

Imagine if there was a warning that came up right before you bought Tilray at $300 and it said, there’s a 99% chance this trade will lose.

It’s the message nobody wants to see right before making a trade but that’s the message you need to see.

I began day trading in 1997 and didn’t go heavy into options until 2013.

There’s a reason for that.

We didn’t always have all the “options” we have now (pun completely intended).

Options used to expire every 3 months.

My friend, Tom Sosnoff, the co-founder of Tastytrade, helped bring weekly options to the exchange.

That, combined with the over-saturation of computers in regular stocks, made options incredibly appealing.

Then it just becomes a matter of putting yourself in the best position to succeed.

After all, there are so many variables in every trade.

For example:

What’s the optimal time for a credit spread? 40 days

How long should you hold a trade to expiration? Almost never

At what Delta should you sell premium? .30

There’s a long list but it can be a rewarding list.

Unlike, closing your eyes and buying a cryptocurrency with no plan of what happens next or investing in Tilray without having any idea of where it can go or what it can cost you, options offer an understandable risk/reward scenario and they have an end date.

Without sports, without much entertainment at all, watching him swing millions of dollars on twitter has been as entertaining as it gets for me.

I’m a huge fan of his content.

I’d be entertained even if there were sports.

This has always been my arena and he makes it as fun as it’s ever been.

I even ordered a #DDTG shirt.

When I watch him buy thousands of shares of Amazon or put millions into Boeing, I can’t help thinking the same thing over and over .. imagine when he starts trading options. Imagine how many others will follow him.

So I understand why Wall Street thinks bored day traders are now obsessed with options and it will end badly.

For many, it will. (Please, spare me any hateful comments on that assessment.)

This time though, it doesn’t have to.

This time you can make the math work for you.

Kind Regards,

Adam Mesh

CEO of The Adam Mesh Trading Group

Twitter: @adammesh

Instagram: @adammeshtrading

P.S. If you want to learn some of my absolute favorite option strategies, simply email me: adam@adammesh.com with the subject: Top Options. I’ll add you to my hotlist for options education and strategy sessions. You’ll also be surprised at my renown response time.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

SPY shares were trading at $295.44 per share on Monday afternoon, up $0.56 (+0.19%). Year-to-date, SPY has declined -7.67%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Mesh

Adam Mesh started his career as a day trader in the 90's as electronic trading revolutionized the markets. After executives at the firm recognized his unique ability to breakdown and translate what's happening in the market, he quickly moved through the ranks gaining national attention. Mesh has been recognized by Fortune Magazine for an uncanny streak of successful trading and has appeared on every major financial media outlet. Mesh believes that the key to stock market success is to keep the strategies simple enough so that they can be repeated. "Consistency and Discipline" are always found at the base of every great success story. Adam can be reached via email at adam@adammesh.com. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| QCOM | Get Rating | Get Rating | Get Rating |

| TLRY | Get Rating | Get Rating | Get Rating |