Qualcomm Inc. (QCOM): Price and Financial Metrics

QCOM Price/Volume Stats

| Current price | $180.05 | 52-week high | $230.63 |

| Prev. close | $175.39 | 52-week low | $104.33 |

| Day low | $177.57 | Volume | 6,566,909 |

| Day high | $181.30 | Avg. volume | 9,186,805 |

| 50-day MA | $203.00 | Dividend yield | 1.76% |

| 200-day MA | $161.07 | Market Cap | 200.94B |

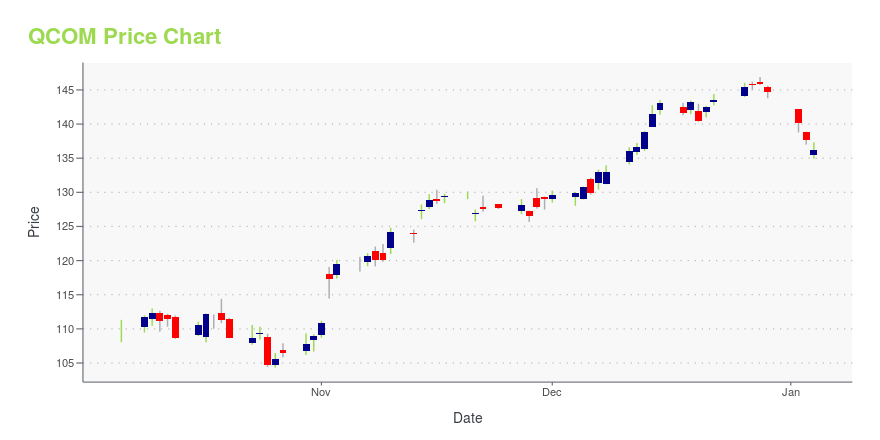

QCOM Stock Price Chart Interactive Chart >

Qualcomm Inc. (QCOM) Company Bio

Qualcomm Inc. develops and licenses wireless technology. It also engages in designing chips for mobile phones. The company is also the world's largest wireless chip vendor, supplying many premier handset makers with leading-edge processors. The company has operations in more than 30 countries around the globe, including Brazil, China, France, Germany, India, Indonesia, Japan, Mexico, South Korea, the United Kingdom, and the United States. Qualcomm’s products have applications in a variety of industries such as audio, automotive, mobile computing, networking, and smart phones. As of 2020, the company employs over 41,000 individuals worldwide and had 23.5 billion US dollars in revenue. Qualcomm is headquartered in San Diego, California and Steven Mollenkopf serves as Chief Executive Officer.

Latest QCOM News From Around the Web

Below are the latest news stories about QUALCOMM INC that investors may wish to consider to help them evaluate QCOM as an investment opportunity.

7 Megatrend Stocks to Buy for a Mighty Start to 2024Megatrend stocks benefit from exposure to real growth opportunities that have the potential to create massive gains with time. |

The 3 Hottest 5G Stocks to Watch in 2024With the 5G services market set for unprecedented growth over the next decade, investors cannot ignore the three hottest 5G stocks for 2024. |

Telecom Titans: 3 Stocks Dialing Up Success in the 5G EraInvestors seeking exposure to telecom stocks should consider these companies that are actively involved in 5G infrastructure. |

The 5G Future: 3 Stocks Leading the Next Communication RevolutionCommunications is one of the most dynamic industries out there, get ahead of its advancements with these communication stocks. |

How AI boom will benefit these nine chipmakers in 2024Here are the chip companies that have piqued investor interest going into 2024. |

QCOM Price Returns

| 1-mo | -8.76% |

| 3-mo | 9.13% |

| 6-mo | 20.56% |

| 1-year | 46.33% |

| 3-year | 36.39% |

| 5-year | 168.83% |

| YTD | 25.64% |

| 2023 | 35.07% |

| 2022 | -38.58% |

| 2021 | 22.25% |

| 2020 | 77.08% |

| 2019 | 60.76% |

QCOM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching QCOM

Want to do more research on Qualcomm Inc's stock and its price? Try the links below:Qualcomm Inc (QCOM) Stock Price | Nasdaq

Qualcomm Inc (QCOM) Stock Quote, History and News - Yahoo Finance

Qualcomm Inc (QCOM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...