A popular idea that’s been making the financial media rounds for years is that central bank money printing has inflated asset bubbles around the world and potentially set us up for the mother of all crashes in the next few years.

This is predicated on the notion that interest rates, at their lowest levels in history, have nowhere to go but up, which could pop the unsustainable market bubble we’re now in. The shocking truth about stocks and interest rates is far different than most in the media know or tell you.

So let’s look at three crucial facts about the longest and most profitable bull market in history, including what’s likely in store for your portfolio in the years to come.

Fact #1: The 2010’s Bull Market Was NOT a Result of a Low Rate Bubble

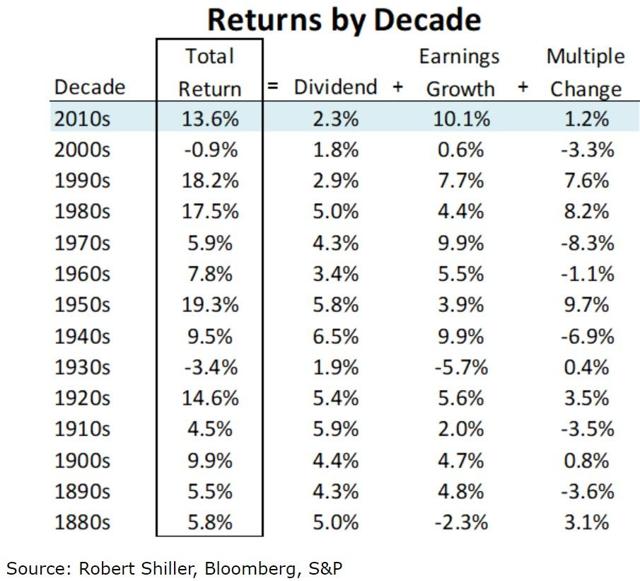

(Source: Ploutos)

The 13.6% CAGR total returns seen during the previous decade may feel unsustainable but they were actually 88% justified by earnings growth and dividends. It was the 1980s and 1990s when multiple expansion drove bubbles that eventually resulted in stocks becoming 66% historically overvalued in 2000 (including a forward PE of 27.2 vs 16.3 25-year average).

What about the idea that low rates induced over $5 trillion in buybacks that drove most of that EPS growth? According to Ed Yardeni, using Federal Reserve data, 66% of buybacks offset stock-based compensation. How much of that 10.2% EPS growth was a result of net buybacks? 1.3% or 12%.

So even if you want to blame the Fed’s QE (plus other central bank QE) for buybacks entirely then low rates and buybacks accounted for just 18% of annual returns over the last decade. 72% of the rally was justified by fundamentals.

Fact #2: Interest Rates Have Been Falling for Centuries And Negative Rates Are Actually Historically Normal

One of the most common beliefs among the financial media is that today a world of negative rates is unprecedented and thus creates dangerous asset bubbles everywhere you look, including in stocks.

But the truth is that long-term rates have been falling not just for decades (since peaking in 1981 at 16% on the 10-year Treasury yield), but for centuries.

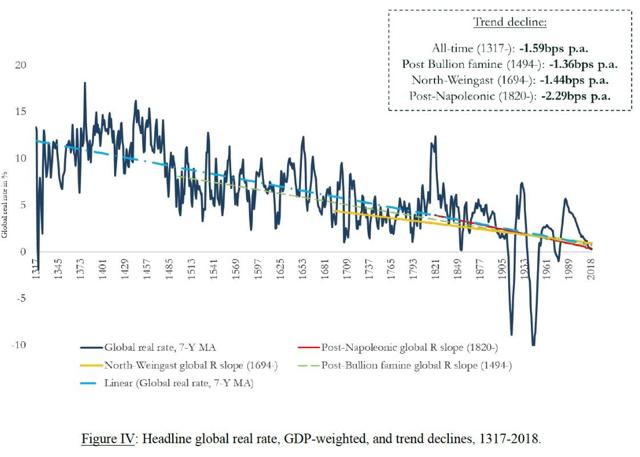

(Source: Bank of England)

In fact, the trend in long-term interest rates has been pretty steadily declining for 700 years. That’s throughout a very complex and often disastrous history of wars, money printing and governments borrowing heavily to finance military campaigns.

What explains this nearly Millenium long trend? Most likely because the world’s economy has gotten so much more productive and thus the amount of savings available to the people of the world is much greater. Factor in more stable governments and economies, and more savings looking for safe places to invest for income (bonds) naturally drives interest rates (the cost of money) lower over time.

Another common belief is that the “normal” interest rate is much higher than it is today, and thus long-term rates have nowhere to go but up.

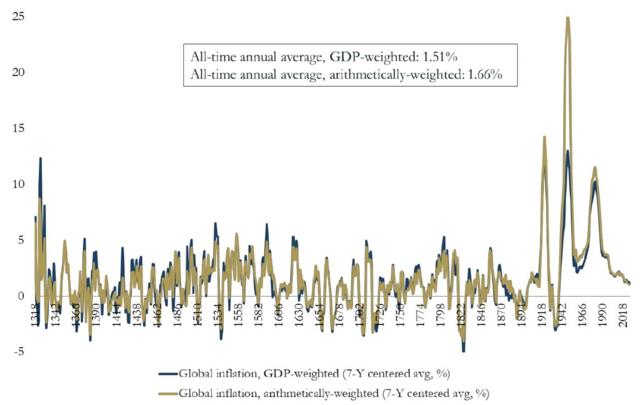

(Source: Bank of England)

Adjusted for inflation, long-term rates have averaged 1.5% to 1.7% over time, and that includes centuries in which long-term rates were in the double-digits. It’s possible that in the future the average inflation-adjusted interest rate might be closer to 0% to 1%, implying 2% to 3% long-term yields on US treasuries might indeed be the “new normal.”

OK, so maybe real interest rates haven’t been super high in the past and might not be where we return to. But surely trillions in negative-yielding debt is crazy, right? Unprecedented and dangerous and a huge risk for a future crash correct?

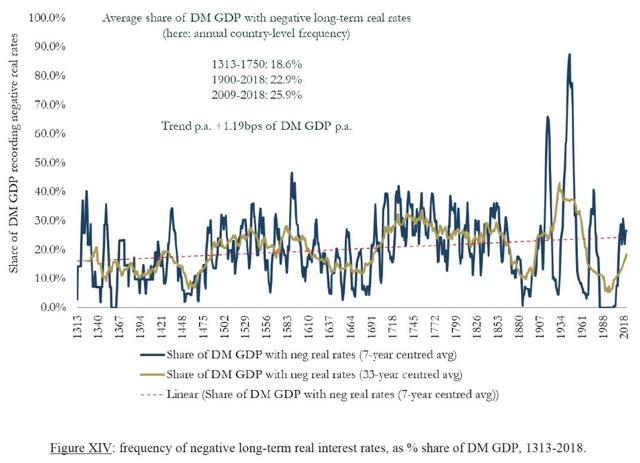

(Source: Bank of England)

Actually, throughout history, negative yields have been common in the developed world. Since the Financial Crisis 26% of all developed-world bonds have had negative interest rates, which is just 2% higher than the average since 1900 when the modern age of globalized capitalism began. Since 1300 negative rate bonds have averaged nearly 20% in the developed world.

Currently, about $14 trillion or less than 6% of developed market bonds are negative rates which is much lower than in recent years. Or to put another way, if someone tells you that falling rates and negative yields are unprecedented they are objectively wrong.

Fact #3: Low Rates Can Induce Bubbles Eventually And You Should Avoid FOMO/Bubble Thinking

Just because long-term interest rates might remain lower forever doesn’t necessarily mean that stock investors are off the hook when it comes to valuations.

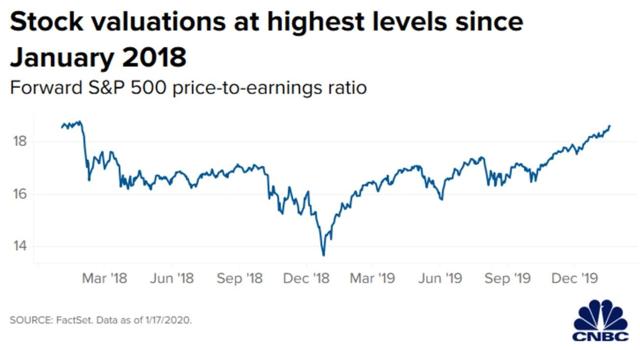

Today the S&P 500’s forward PE is 18.9, which is the highest since January 2018, right before we saw a 10% correction.

The blended PE ratio is 20.5, which is 21% above its 18 year (which excludes the tech bubble) 17.0 average. Since 2000 the market’s fair value blended PE was between 16.5 and 18.0, during periods of EPS growth ranging from 4% to 11% CAGR.

Basically, stocks are 16% to 21% historically overvalued, UNLESS you factor in earnings risk premium. The earnings risk premium is the S&P 500’s earnings yield (inverse of PE) minus the 10-year Treasury yield. Since 2000 Goldman Sachs reports that risk premium was 3.7%. Or to put another way, that’s the premium for owning “risk-assets” over “risk-free” income-producing options.

With the 10-year yield now 1.8%, that means that the interest rate adjusted fair value PE for the S&P 500 is theoretically 18.2 and thus stocks might only be about 4% overvalued. BUT it still means that stocks are overvalued. While research from JPMorgan and Bank of America tells us that just 10% of 12-month forward returns are determined by valuation, over five and 10+ years that rises to 46% and 90%, respectively.

In this case, that means about 6% CAGR five year total returns are what S&P 500 investors can likely expect. That’s not adjusting-for interest rates and over the next year or two, anything could happen.

But didn’t I just say that long-term rates might be stuck at low rates forever, or possibly even decline more? I did, historically speaking. But just because rates might stay low or go even lower doesn’t mean that the earnings risk-premium model is something to trust in the future.

| 10-Year Yield | Theoretical “Fair Value Forward PE” For S&P 500 | Potential Decline Should Rates Rise To 2.5% |

| 1.8% (today) | 18.2 | 11% (correction) |

| 1% (Moody’s recession estimate) | 21.3 | 24% (bear market) |

| 0% | 27.0 (Tech bubble highs) | 40% (severe bear market) |

| -1% | 37.0 | 56% (Great Recession Crash) |

| -2% | 58.8 | 72% (John Hussman prediction) |

| -3% | 143.9 (vs 1989 Japan bubble peak 90) | 89% (Great Depression Peak Decline) |

| -3.69% | 10,000 | 99.8% |

In normal times stocks are NOTHING like “bond alternatives” as the media likes to claim, not even dividend stocks.

Treasury bonds are a risk-free asset that pays a fixed amount of income that never changes and fluctuates in value based on long-term inflation expectations. Those expectations are about 1.7% for the next 10 and 30 years, per the inflation-adjusted TIPS, breakeven data from the St. Louis Federal Reserve.

Stocks are “risk-assets” in that they represent ownership in a company (or all index companies) and other than paying some amount of income over time, they are nothing like bonds.

Right now low rates might be somewhat inflating market multiples, but not to the extent that doomsday prophets like John Hussman claim. BUT if rates were to fall another 1%, 2%, or more, then we might indeed see crazy bubble valuations that could cause market crashes.

Based on current inflation expectations, as well as the Fed’s 2% long-term inflation target, 3.5% 10-year yields are probably the highest we can expect in the future, barring much stronger economic growth. 2.5% to 3.0% 10-year yields is probably what can be expected once the trade war is over, and growth returns to its 2% to 2.5% range, which is sustainable given current demographic headwinds.

But note the final column in that table. If 10-year yields were to fall to 1%, as Moody’s expects in the next recession (whenever that comes), then after the bear market is over, stocks might theoretically fly higher to an “interest rate adjusted fair value” of 27. That’s literally the tech bubble high.

Ask yourself whether it’s reasonable or prudent to pay 27 times earnings for risk assets? I would argue it never is, no matter how much “fear of missing out” or “there is no alternative” cheerleading the media might do.

And if long-term rates in the US were to go negative? The Fed says that would be its last line of defense in a recession and currently, Fed officials say this is a very unlikely outcome. But say it did happen and 10-year yields fell to -1%.

Then the theoretical “fair value” PE on the market is 37, an all-time high that could see stocks crash by 56% on valuations alone should the economy ever strengthen sufficiently to return the 10-year yield to a modest 2.5%.

The final row is an extreme example that highlights my overall point. A -3.69% 10-year yield would theoretically justify a forward PE of 10,000 meaning virtually any valuation would seem sensible, at least according to proponents of earnings risk premium valuation models. But if we ever saw such a scenario, it would mean that stock valuations were 99.9% determined by interest rates and the slightest increase in rates could send stocks crashing.

Economic news better than expected? That’s terrible news for stocks because it means rates will go up.

Fortunately, as I’ll now explain, just because the broader market might be getting irrationally exuberant doesn’t mean that you have to take excessive valuation or volatility risk with your portfolio.

Bottom Line: Interest Rates Today Are Not As Weird As You Might Think, But That Doesn’t Mean Overpaying for Stocks Makes Sense

Long-term rates being this low, or even negative in many countries is NOT an unprecedented or necessarily dangerous thing that precedes a major market crash.

That being said, the S&P 500 is indeed overvalued today, even if you adjust for low-interest rates. And the higher valuations climb the greater the short-term market volatility that will come from stocks if they trade more and more like bond alternatives as interest rates do become extreme.

Fortunately as my fellow Dividend King co-founder Chuck Carnevale (50 years in asset management and Seeking Alpha’s “Mr. Valuation” likes to say, “it’s a market of stocks, not a stock market.”

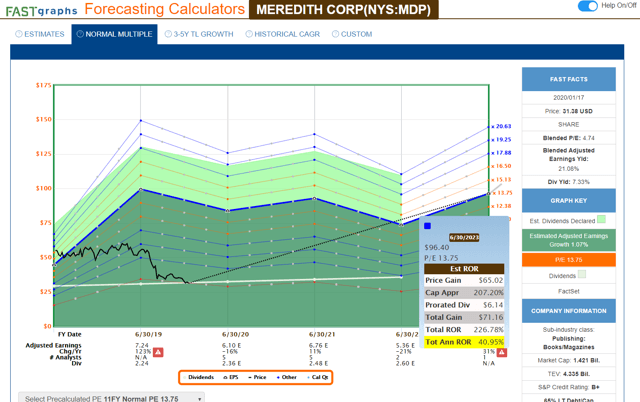

Today Meredith Corp (MDP) is one example of an anti-bubble stock trading at a forward PE of just 5.0. This is a more speculative 7/11 average quality company that analysts expect to grow 4.4% CAGR over time.

But a forward earnings yield of 20% means a risk premium of 18.2% or five times the average risk premium for stocks since 2000.

MDP is 61% undervalued, and pricing in -7% CAGR growth forever, according to the Ben Graham fair value formula. What kind of returns can buying this dividend champion (26-year growth streak) potentially get you over the next three years?

(Source: F.A.S.T Graphs, FactSet Research)

41% CAGR through June 2023, if MDP grows as expected and returns to its 13.8 average PE during periods of 4% growth. What if MDP’s more speculative turnaround nature doesn’t appeal to you?

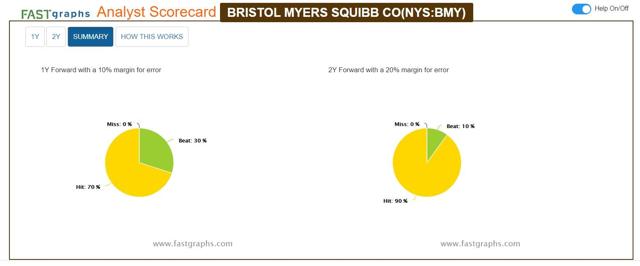

Then consider Bristol-Myers (BMY), which is expected to grow 18% CAGR through 2023 and 12% to 15% CAGR over the long-term. BMY is trading at a forward PE of 10.8 nearly as low as the S&P 500 on March 9th, 2009 (10.3).

What does double-digit growth from a 9/11 quality blue-chip drug maker trading at a valuation that implies just 1.5% CAGR long-term growth forever get you?

(Source: F.A.S.T Graphs, FactSet Research)

Potentially 37% CAGR total returns over the next three years if it grows as expected and returns to its historical 19.5 PE.

Over the last 20 years, Bristol has never missed 12 and 24 month-forecasts, within a reasonable 10% and 20% margin of error, respectively. In fact, it often beats expectations and today is 37% undervalued, making this blue-chip a “very strong” buy.

My point is that whatever your risk tolerance, needs, or portfolio goals, something great is always on sale.

(Source: imgflip)

And speaking of Joel Greenblatt, one of the best investors in history, BMY has a return of capital (pre-tax profit/operating working capital) of 129%. That’s in the top 6% of all drugmakers. Greenblatt considered ROC that’s stable over time (BMY’s is) the gold standard for determining quality companies.

Merely buying above-average quality dividend growth stocks at below-average or downright bargain prices are the best low-risk/high probability way for income investors to safely achieve their long-term goals.

SPY shares were trading at $331.98 per share on Wednesday morning, up $0.68 (+0.21%). Year-to-date, SPY has gained 3.14%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |