After epic rallies in 2019 and 2020, the market is taking a breather so far in 2021.

Of course, not all stocks are performing equally well or poorly.

- S&P 500 is barely up for the year

- Nasdaq is down for the year

- Enbridge (ENB), a Canadian dividend aristocrat pipeline giant is up like a rocket, 10% in two weeks

Moody’s, one of the 16 most accurate economists in the World according to MarketWatch, has just put out its latest base-case economic forecast.

- which has important implications for your portfolio

- because while the greatest economic boom in 35 years is possibly coming

- not all stocks will benefit equally

Why Moody’s Expects Two Years of Blockbuster Growth

Moody’s points out that the US is now on track to potentially deliver a fiscal stimulus of almost 25% of GDP, the highest in the world.

With this additional boost, real GDP should be robust at just over 5% this year and the same next, bringing the economy back to full employment by early 2023.” – Moody’s (Emphasis added)

Moody’s expects inflation-adjusted GDP growth of more than 10% in the next two years.

- the best GDP growth in 35 years

Moody’s is now forecasting a $1.2 trillion net infrastructure bill.

- $1.5 trillion in total spending

- with $370 billion funded by increased taxes

- tax hikes expected to start in 2024

A total of $3.1 trillion in total fiscal stimulus is what Moody’s considers the most likely outcome.

- most likely passed in the first half of 2021

- via reconciliation

The total amount of stimulus would be close to $7 trillion, $12 trillion if you include the Fed’s QE efforts.

- 60% of GDP worth of combined stimulus

Moody’s is so far the most optimistic blue-chip economist when it comes to stimulus but Goldman and Morgan Stanley both expect about 6% GDP growth in 2021 as well.

- Goldman expects $1.1 trillion in round three stimulus ($800 billion less than Moody’s)

Why Some Stocks Will Soar And Others Will Likely Collapse

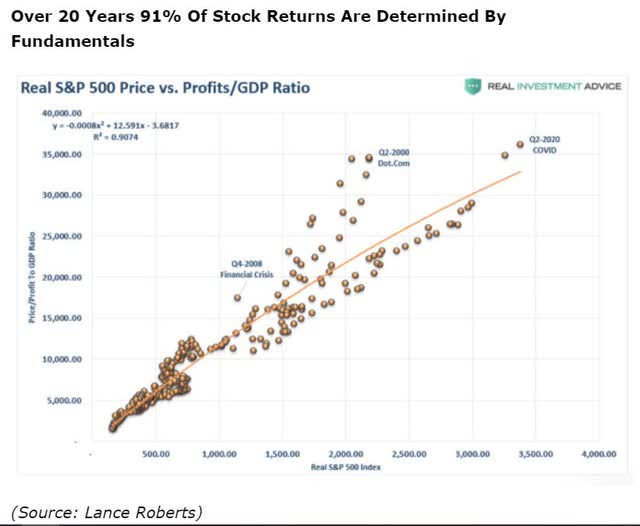

The key to understanding which companies will thrive and which are likely to fall hard is to remember the physics of finance.

Momentum has been a dominant strategy in the last decade driven mostly by multiple expansions.

- most analysts agree that this has only been possible due to low inflation and slow growth

- if growth speeds up and inflation does too, interest rates will rise

- discount rates on growth stocks will thus also rise

- likely pressuring valuation multiples

- and popping numerous dangerous speculative bubbles (such as Tesla).

With the economy projected to achieve full employment by early 2023, we expect the Fed to begin normalizing short-term rates by fall 2023. By then, inflation should be firmly above the Fed’s 2%…

It will take approximately three years for the Fed to increase the federal funds rate target to its 2.5% long-run equilibrium rate, or r-star. Long-term rates will rise sooner as the Fed tapers its quantitative easing by early 2022, and bond investors anticipate a full-employment economy with higher inflation. Ten-year Treasury yields are projected to end this year near 1.5%, 2.3% by year-end 2022, and close to 3% when the Fed starts normalizing short-term rates in fall 2023.” – Moody’s (emphasis added)

Some analysts expect 10-year yields to hit 2% by the end of 2021. Moody’s believes that 10-year yields will rise as high as 4.3% by the end of 2030 (and possibly much sooner).

Within a few years, this is the interest rate environment that Moody’s now considers the most likely.

- 3% 10-year US treasury yield

- 3.5% 30-year yield

- 2.5% Fed Funds Rate

- 3.0% high-yield savings rate (ie, Marcus from Goldman Sachs)

Now think of all the “TINA” bubbles we’ve seen in recent months.

- “Tesla is worth 350X forward earnings because interest rates are so low that there is no alternative to stocks”

- “all growth stocks can grow into their valuations because rates are so low and growth rates are so high”

- “some greater fool will buy my expensive shares when I cash out before the bubble bursts”

Of course, Moody’s forecast is just a single forecast from a single blue-chip economist. They could easily be proven wrong.

- the blue-chip economist consensus range for average 10-year yields for this decade is 2% to 3%

- the average in the 2010s was 2.0%

Economists expect higher interest rates in the coming decade than the last one. So ask yourself what’s more likely, that market multiples keep going up?

Or, as the blue-chip consensus expects, the market’s PE returns to its historical 17.3X.

How I’m Positioned To Potentially Ride The Greatest Economic Boom In 35 Years

(Source: Morningstar)

Value is potentially set to rally 50% in 2021 according to JPMorgan.

I’m 43% value stocks, in my personal Phoenix portfolio.

(Source: Morningstar)

Guess what four industries are expected to do best in a thriving 2021 and 2022 economic recovery?

- energy

- finance

- industrial

- consumer discretionary

The 4 largest sectors I have.

I’ve spent months building these positions, and now they are starting to finally pop.

Value stocks are off like a rocket this year

- S&P is up 0.4% YTD

- The Dividend Kings’ Phoenix portfolio is up 3.5% YTD

- Dividend Kings’ Deep Value Blue-Chip is up 7.6% YTD

These impressive gains are completely justified by fundamentals.

And are likely to continue for many years to come.

Phoenix Portfolio Fundamentals (81% Dividend Stocks/19% Growth Stocks)

- average quality: 10.7/12 SWAN vs 10.9 average aristocrat

- average safety score: 4.8/5 very safe vs 4.7 average aristocrat

- average credit rating: A- stable vs A- stable average aristocrat (2.5% 30-year bankruptcy risk)

- yield on cost: 4.0%

- current yield: 3.1% vs 1.6% S&P, 2.1% dividend aristocrats (our equity benchmark) and 1.8% a 60/40 stock/bond portfolio

- Morningstar long-term growth forecast: 13.1% CAGR vs 6.4% S&P 500 & 8.0% dividend aristocrats

- Dividend growth forecast: 7.5% CAGR = almost 4X the rate of inflation, double every decade (every 13-years in inflation-adjusted dollars)

- weighted average forward PE: 16.4 vs 16.7 historical norm vs 22.6 S&P 500

- average discount to fair value (Morningstar estimate): 3% vs -37% S&P 500 and -16% aristocrats

- 5-year analyst consensus total return potential: 3.1% yield + 13.1% CAGR long-term growth +0.6% CAGR valuation boost = 16.8% CAGR vs 4.1% S&P 500

- Risk-Adjusted Expected Return: 12.3% CAGR vs 3.1% CAGR S&P 500 (4.0X market’s expected return)

Over the long-term analysts expect about 16% annual total returns from the DK Phoenix portfolio. From a portfolio that is up about 40% since inception, and doubled the S&P 500’s time weighted returns.

This is what strong fundamentals look like, and the kind of incredible returns they can deliver over the long-term.

- superior yield + superior growth + superior valuation + superior quality/safety = superior long-term results

For the prudent long-term investor the only five fundamentals that matter are often what the market tends to ignore for several months at a stretch.

And that’s how you can make your own luck on Wall Street, purely buying the world’s highest quality blue-chips at highly attractive valuations and then waiting for the price to catch up to strong fundamentals.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Outperform the Stock Market?

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

SPY shares were trading at $383.36 per share on Friday morning, down $0.88 (-0.23%). Year-to-date, SPY has gained 2.54%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| TSLA | Get Rating | Get Rating | Get Rating |