In part 1 of this series, we examined what’s causing inflation and realistically how bad it might get.

Now let’s see why so many investors are so worried about the risk of rising inflation and how to protect your retirement nest egg from the threat of soaring prices.

Why Investors Fear Inflation

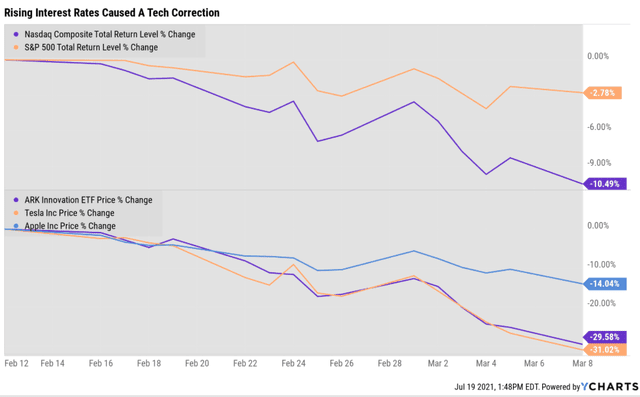

In mid-February rapidly rising 10-year yields helped cause a tech correction. While the broader market barely felt it, the tech-heavy Nasdaq fell by 10%, and many popular hyper-growth names like Apple (AAPL), Tesla (TSLA), and ARK Innovation ETF (ARKK), fell 14% to 30%.

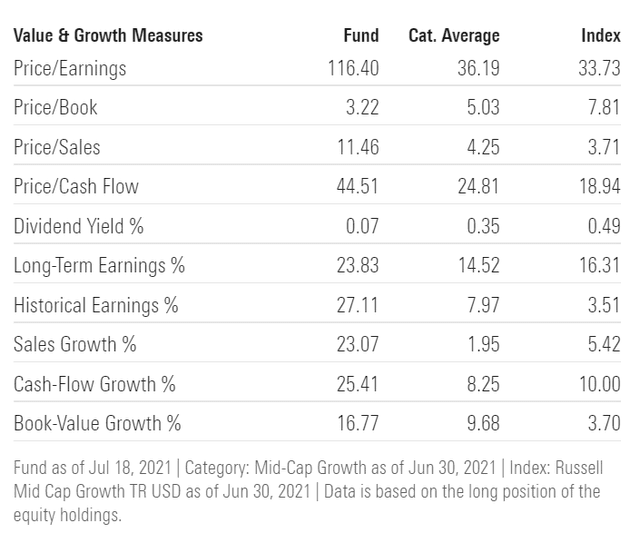

The theory behind many growth stocks investment thesis was that low rates forever would justify permanently higher multiples. How high? In the case of Apple 35X earnings and in the case of ARKK, 116X earnings.

ARK Innovation ETF Valuation: 116X Earnings 4.9 PEG

(Source: Morningstar)

If interest rates rise significantly then the discount rate on future cash flow rises as well, resulting in much lower multiples, and thus tech corrections, and sometimes bear markets.

With the S&P 500 25% tech, and the Nasdaq 50% tech, naturally, tech-heavy growth investors are worried about rising interest rates driven by higher inflation expectations.

How To Protect Your Nest Egg From High Inflation

Here’s the good news about future interest rates, they are very unlikely to soar to levels that could trigger the kind of catastrophic 50% to 70% market crash that some permabears have been predicting for the last 10 years.

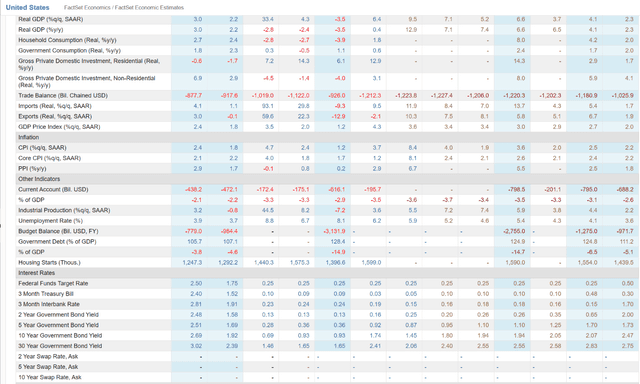

(Source: FactSet Research Terminal)

From 1.2% today, economists expect the US 10-year yield to hit 2.5% by the end of 2030.

That’s a doubling of interest rates but over a period of 2.5 years.

According to Goldman Sachs, as long as long-term interest rates don’t rise by more than 40 bp per month, stocks tend to react to fundamentals and not interest rates.

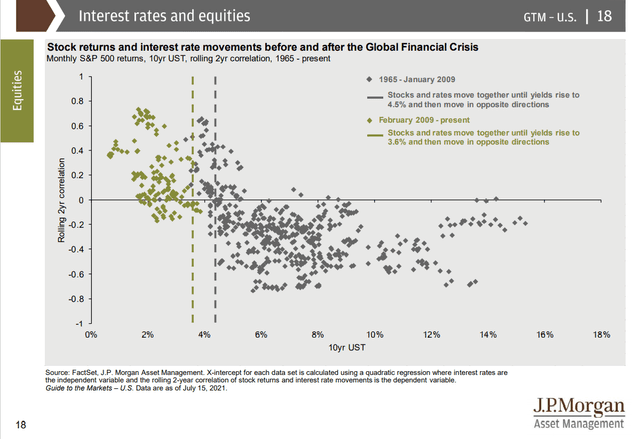

According to JPMorgan, since the Great Recession, as long as long-term interest rates are below 3.6%, rising rates don’t tend to hurt stocks.

In fact, stocks tend to be the best inflation hedge in history, with little difference in returns regardless of what inflation is doing.

In fact, stocks tend to be the best inflation hedge in history, with little difference in returns regardless of what inflation is doing.

REITs, for example, have delivered 9% to 17% CAGR total returns, even when interest rates are very high, as they were in the 1970s and most of the 1980s.

This shows the importance of focusing on the fundamentals of your portfolio.

- the quality of your companies

- the safety of your dividends and company balance sheets

- your portfolio’s yield

- your portfolio growth

- your portfolio’s valuation

- your portfolio’s asset allocation and risk management

Ultimately these are what will determine whether or not you achieve your financial goals, not the short-term gyrations of the market for whatever reason.

As I write this the market is down 2% and interest rates are falling. Why? FactSet reports that concerns over rising Delta cases have caused the market to worry that the economic boom, including rising inflation and interest rates, might not happen after all.

Delta-driven cases have been rising for weeks. The pandemic will end at some point, the economy will recover, and interest rates are likely to return to their 2% to 3% range we saw during the 2010s.

If your portfolio’s safety is reliant on super-low interest rates forever, that’s not a good long-term risk-management plan.

That’s not long-term investing, it’s speculation about interest rates.

If on the other hand, you own a diversified and prudently risk-managed portfolio, based on your specific needs, then you can safely ignore short-term spikes in inflation, interest rate whipsaws, and the market in general.

| Time Frame (Years) | Total Returns Explained By Fundamentals/Valuations |

| 1 Day | 0.1% |

| 1 Month | 0.9% |

| 3 Months | 2.0% |

| 6 Months | 4.0% |

| 1 | 6.0% |

| 2 | 17.0% |

| 3 | 25.0% |

| 4 | 34.0% |

| 5 | 42.0% |

| 6 | 50.0% |

| 7 | 59.0% The Lower End Of Statistical Significance |

| 8 | 67% |

| 9 | 76% |

| 10 | 84% |

| 11+ | 90% to 91% |

(Source: DK S&P 500 Valuation And Total Return Tool)

For up to 6 years, the majority of stock returns are explained by luck, sentiment, and momentum, not fundamentals.

This is why bubbles and bear markets can last for several years, especially for individual companies, even when they are growing at impressive rates.

This is why it almost never makes sense to obsess over short-term market swings, and why the best way to protect your nest egg from scary predictions you see on TV or the internet, is to ignore them.

Trust your portfolio’s strong fundamentals and sound risk management, and not short-term market timing.

Want More Great Investing Ideas?

SPY shares were trading at $437.40 per share on Friday morning, up $1.94 (+0.45%). Year-to-date, SPY has gained 17.76%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |