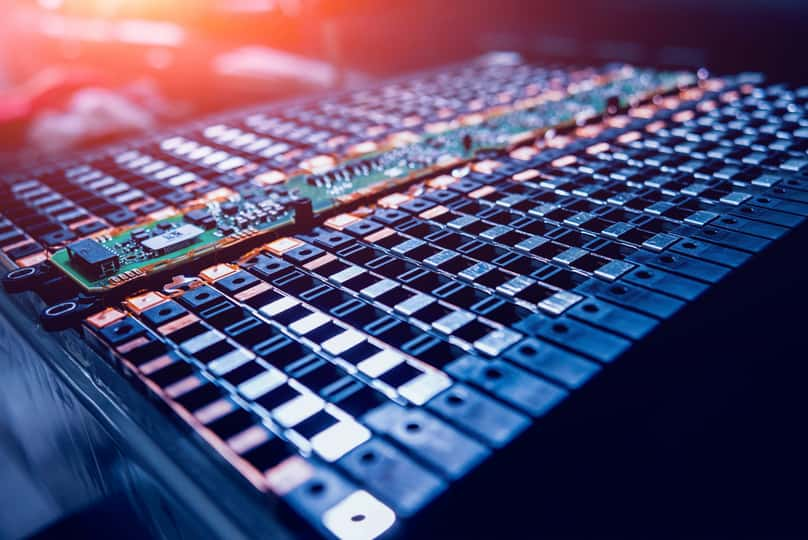

As the demand for electric vehicles (EVs) increases with a growing global desire to transition to zero-carbon-emissions transportation, the demand for lithium has been increasing too. That’s because most EVs rely on lithium-ion batteries for power.

Investors’ interest in the lithium market is evident in the Global X Lithium & Battery Tech ETF’s (LIT) 50.4% returns over the past six months versus the SPDR S&P 500 ETF Trust’s (SPY) 27.8% gains. And, according to Mordor intelligence, the lithium market is expected to grow at a CAGR of more than 10% over the next five years.

Lithium is not only an important component for EV batteries, it is also used for energy storage in batteries for many other devices, such as cell phones, laptops, and grid storage. Consequently, lithium has become one of the most highly sought-after commodities. Given the commodity’s promising prospects, analysts are very optimistic about the performance prospects of Sociedad Química y Minera de Chile S.A. (SQM - Get Rating) and Lithium Americas Corp. (LAC - Get Rating) shares in the near term. So, we think it could be wise to bet on these stocks now.

Sociedad Química y Minera de Chile S.A. (SQM - Get Rating)

Headquartered in Santiago, Chile, SQM develops and produces diverse products for several industries, including health, nutrition, renewable energy and technology, through innovation and technological development. The company has a dominant position in the lithium, potassium nitrate, iodine and thermo-solar salts markets.

This month, SQM signed a long-term agreement to supply lithium hydroxide to Johnson Matthey, a global leader in sustainable technologies and a fellow Global Battery Alliance member. The agreement is expected to run through 2028 and should lead to an increase in lithium production.

SQM’s total revenues increased 8.8% year-over-year to $513.80 million for the fourth quarter ended December 31, 2020. Its revenue from the lithium and lithium derivatives segment increased 37.3% year-over-year to $136.90 million. And its net income for the quarter came in at $67 million compared to $1.70 million in the third quarter ended September 30, 2020.

Analysts expect SQM’s EPS and revenue to increase 88.9% and 20.2%, respectively, year-over-year in its fiscal year 2021. The stock has gained 132.2% over the past year and closed yesterday’s trading session at $54.15.

Wall Street analysts expect the stock to hit $65.52 in the near term, which indicates a potential upside of 21%. Two Wall Street analysts that have rated the stock, rated it Buy.

Lithium Americas Corp. (LAC - Get Rating)

Based in Vancouver, Canada, LAC is a resource company that explores for lithium deposits. The company is focused on the development of two lithium development projects—the Cauchari-Olaroz project, which is in the Jujuy province in Argentina and the Lithium Nevada project, which is in Northwestern Nevada, in the U.S. . It operates across Canada, the United States, Germany and Argentina.

LAC announced on January 15 that the United States Bureau of Land Management had issued the Record of Decision for LAC’s Thacker Pass lithium project following completion of the National Environmental Policy Act process. The decision is expected to be a big help in the company’s growth.

For the year ended December 31, 2020 the company’s total assets increased 11.2% year-over-year to $326.70 million, due primarily to the proceeds raised from its$100 million ATM Program. Its cash and cash equivalents came in at $148.10 million compared to $83.60 million in the prior-year period.

Analysts expect LAC’s EPS to increase 78.5% year-over-year in fiscal 2022. The stock has gained 391.5% over the past year and closed yesterday’s trading session at $15.04.

Wall Street analysts expect the stock to hit $23.88 in the near term, which indicates a 58.8% potential upside. Of the four Wall Street analysts that have rated the stock, three rated it Buy.

Want More Great Investing Ideas?

SQM shares were trading at $52.77 per share on Thursday afternoon, down $1.38 (-2.55%). Year-to-date, SQM has gained 7.50%, versus a 12.17% rise in the benchmark S&P 500 index during the same period.

About the Author: Nimesh Jaiswal

Nimesh Jaiswal's fervent interest in analyzing and interpreting financial data led him to a career as a financial analyst and journalist. The importance of financial statements in driving a stock’s price is the key approach that he follows while advising investors in his articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SQM | Get Rating | Get Rating | Get Rating |

| LAC | Get Rating | Get Rating | Get Rating |