In 24 years of investing, I’ve tried pretty much every get rich quick scheme there is. One of those is shorting stocks, which sounds great in theory, but like most things on Wall Street, it is far harder to pull off well.

This is why I wanted to warn investors, during what might be a trade war-induced pullback/correction, that there are three reasons why shorting stocks is a dangerous strategy that’s likely best avoided.

Reason 1: The Market Can Remain Irrational Longer Than You Can Remain Solvent

I understand why shorting can seem so appealing. Borrowing shares of a company from your broker, selling them and then buying them back at a lower price can seem like a “sure-fire” way to make money, especially on some companies.

For example, Tilray (TLRY) a red hot cannabis stock in 2018, got into an obvious bubble, when it peaked at about $200 in 2018, a mind-boggling 650 times sales and a market cap of $20 billion (more than American Airlines).

It’s since crashed 80% from those lofty highs, and theoretically, short-sellers who timed the top could have made a handsome profit.

Or how about Beyond Meat (BYND) which soared almost 10 fold from its IPO price just a few months ago? This is a company that’s still losing money but recently hit a peak price to sales ratio of 120 and a $13 billion market cap. All for a firm that owns just two patents (has no moat), and is facing multi-billion dollar food rivals all planning on launching competing meat replacement products.

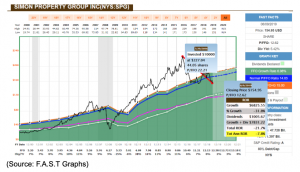

Or how about shorting an “obvious” victim of the “retail apocalypse” Simon Property Group (SPG) the largest mall REIT in America?

Simon has been in a multi-year bear market that even factoring in a fat 5.4% yield, has resulted in -8% annual total returns. Obvious this mall REIT is going to zero so why not cash in on such an obvious trend?

First, let’s address the case of bullish bubble stocks, and then I’ll explain why shorting dividend stocks is also a potentially bad idea.

As economist John Maynard Keynes explained, “markets can remain irrational longer than you can stay solvent.” Shorting stocks involves leverage (you have to borrow shares from your broker to sell and then repurchase at a hopefully lower price later). And as the Tilray and Beyond Meat bubbles show, there is no telling how irrational or how high “red hot” hype stocks can soar.

Beyond Meat was “obviously” overpriced at $50, and more so at $75 and outlandishly so at $100. Yet it managed to rise to over $200 before peaking (and it might not have peaked yet). Anyone shorting at those overvalued levels would have gotten a margin call all the way up, and in fact, the reason the stock went up so fast (Tilray too) is because of “short squeezes”. That’s when broker margin calls force shorts to buy shares back at any price, driving the price ever higher, and triggering a chain reaction of more margin call buying.

Reason 2: You Need to Be Right 3 Different Ways and It Can Be Incredibly Expensive to Do

In order to do well, shorting stocks you need to be right not once, not twice, but thrice. You must be right on timing, direction, and magnitude.

There’s a famous saying that “being early is effectively being wrong.” With long-term investing (the kind I do with dividend stocks) if you’re early you can still make out very well as long as you lower your cost basis over time and the company’s cash flow and dividends keep growing (your facts and reasoning being right will ultimately force shares to fair value, vindicating you).

With short positions, you don’t have the luxury of such time, nor are the facts on your side. For example, brokers charge about 2.5% or more to borrow shares on most blue chips (like Simon Property). For popular short positions (crowded trades) like Tilray or Beyond Meat, those interest charges can be 10% or more per year.

You’re also responsible for paying dividends if you’re shorting a dividend stock. This is why the “obvious” short of SPG actually hasn’t worked out well, even if you made the high probability call of shorting it at its 2016 highs when it was in a bubble (22 times cash flow vs 17 historical average).

SPG has fallen 8% per year. But 2.5% interest plus a 5+% dividend (that’s growing steadily over time) mean anyone who perfectly timed that short would basically have broken even. But what about the trade war and the possibility that 10% or 25% tariffs on clothing will hammer apparel retailers and crash the price faster in the next few months?

That’s possible but consider this. Today SPG is trading at 12.6 times cash flow, the lowest valuation in a decade. It owns some of the most lucrative and prosperous class-A malls in the country (and around the world). Cash flow has been growing steadily for the past decade (one of just two retail REITs that has grown FFO/share every year since 2010).

Simon is a coiled spring with 11% to 19% long-term CAGR total return potential. Since 1994 it’s been historically 59% less volatile than the S&P 500. In other words, the reward/risk ratio of shorting Simon, who reported 27% and 32% lease spreads in the last two quarters (how much higher rent it gets on new leases), is terrible.

In fact, the reward/risk ratio on most stocks is so bad I can’t recommend shorting any stock, no matter how “obvious” a play it seems.

Reason 3: Reward/Risk Ratio Is Terrible

Stocks are the best performing asset class in history and have delivered 7% CAGR inflation-adjusted total returns since 1871.

The reason stocks are so amazing is that a quality company, bought at fair value or better, can exponentially grow your income and wealth, as cash flow and dividends rise over time.

There is a limited downside (100% is the most you can lose), but infinite upside (Home Depot is up 1,200 since 1986). In contrast with shorting there is limited upside (100% is the most you can ever make before fees) but unlimited downside.

Peter Lynch, one of the greatest investors in history (29% CAGR total returns from 1977 to 1991) said: “in this business if you’re good, you’re right six times out of ten.” The key to good returns over time is managing risk, including 30% to 40% of investments that won’t turn out as planned.

Major winners, like buying great growth names like Home Depot at fair value or better, and then watching it grow 5, 10, even 20X bigger, is how you offset your losers. With shorting, you have to be right far more frequently because your upside is capped at 100% (in reality far less).

Bottom Line: Shorting Is a Speculative Strategy That Sounds Good in Theory, But Is Too Dangerous for Most Investors

Shorting stocks, like option speculation, requires you to be right three different ways, in timing, magnitude, and direction. What’s more, you need to time your entrances and exists very well, meaning you’re up against the best algo-driven/quant backed investment institutions in the world.

Basically, it’s very hard (if not impossible) to get an edge on Wall Street pros, and given the high costs involved in shorting some stocks, and terrible reward/risk ratio, I recommend staying away from this speculative strategy.

It’s far better to buy quality companies at good to great prices, and collect fat and growing dividends while you wait for the market to recognize that, in the words of Warren Buffett, “your facts and reasoning are right.” With so many great companies offering safe yields of 5% to 10%, and 15+% CAGR long-term return potentials, there is no need to risk your hard-earned money on a strategy that requires all the stars to align in your favor to earn a profit.

TLRY shares were trading at $43.20 per share on Tuesday morning, up $0.74 (+1.74%). Year-to-date, TLRY has declined -38.76%, versus a 17.80% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TLRY | Get Rating | Get Rating | Get Rating |