- High hopes for pot stocks in 2021

- Canadian Tilray has lots of action in the stock market

- Earnings need to improve

- US competition will be a challenge

- Wall Street is not in love with this company

Soybean, corn, and wheat futures prices rose to over six-year highs over the past weeks. The commodity market’s agricultural sector is booming as North America heads into the 2021 crop year. The US and Canada produce many of the commodities that feed the world. Meanwhile, the most valuable agricultural product of the future is one that was illegal for many years. Grains and oilseeds trade on the futures exchanges in highly liquid markets. Producers and consumers use the contracts to hedge, while speculators look for opportunities to profit from rising and falling prices.

Meanwhile, it will not be long before marijuana emerges as a new product in the futures world. In 2018, Canada legalized cannabis for recreational purchases. A growing number of US states are doing the same. The October 2018 Canadian Cannabis Act created a legal and regulatory framework for controlling the production, distribution, sale, and possession of pot. Under the Biden administration, it may not be too long before the US follows Canada into the legalized world of marijuana.

Tilray, Inc. (TLRY) is a Canadian medical marijuana company with interests worldwide. Its shares have been highly volatile over the past weeks. US companies are likely to fight for market share with the Canadian pot company with a market cap of over $4.5 billion.

High hopes for pot stocks in 2021

With Democrats in the White House and both houses of Congress, supporters of legalized marijuana in the United States have high hopes that the US will legalize recreational pot in 2021.

Full legalization would allow revenues from marijuana companies to flow through the credit card system and set the stage for legalized transport of the agricultural commodity across all state lines. However, it appears that the President supports decriminalization as opposed to full legalization, throwing a monkey wrench into the pot business. Progressive Democrats favor legalization, but it looks like the decision on full support for the business will remain in the state’s hands.

In the aftermath of the global pandemic, states are looking for new revenue sources from any business. Pot offers billions in tax flows. The uncertainty surrounding full federal legalization remains, which has weighed on some of the volatile pot stocks over the past weeks.

Canadian Tilray has lots of action in the stock market

TLRY began trading on the NASDAQ in mid-July 2018 at $23.05.

Source: Barchart

Source: Barchart

The chart shows the shares quickly rose to a high of $300 in September 2018 in a speculative frenzy. Since then, TLRY shares have been under pressure, falling to a bottom of $2.43 per share in March 2020. After consolidating below $12.15 until early 2021, TLRY spiked higher to $67 on February 8, but selling took the shares to below the $30 level at the end of last week. TLRY is a very volatile stock.

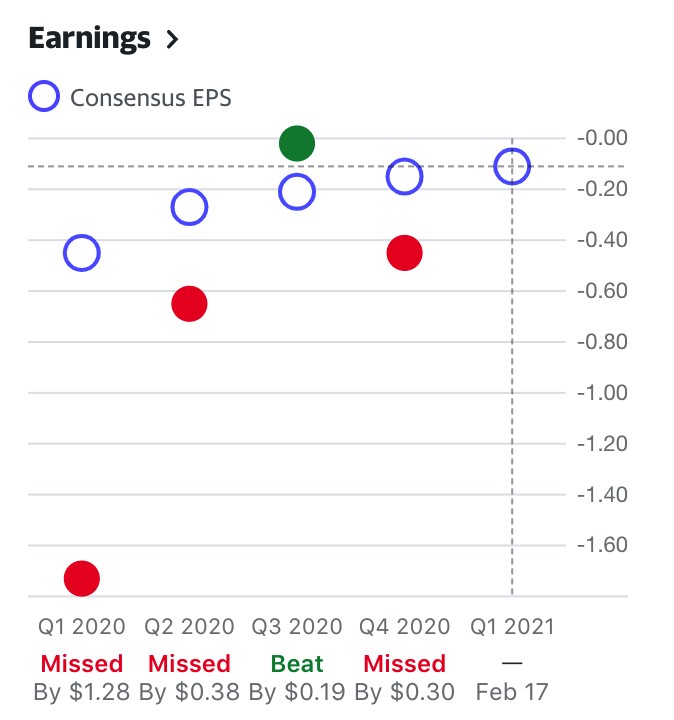

Earnings need to improve

TLRY reported losses over the past four consecutive quarters.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart shows, the company missed analyst estimates in three of the last four quarters. In Q3, TLRY edged closer to profitability with a loss of only two cents per share. The forecast for Q4 was for a loss of 15 cents. TFRY reported earnings on February 17 and missed analyst estimates by 30 cents with a 45 cents per share loss.

TLRY needs to show investors progress towards profitability. The company’s market cap stood at $4.628 billion as of February 19. The stock’s volatility makes it a popular trading vehicle in the pot sector as an average of over 40.8 million shares change hands each day.

US competition will be a challenge

As a Canadian company focused on research, cultivation, processing, and distribution of medical marijuana, TLRY operates in Europe, South America, Israel, South Africa, New Zealand, the US, and the UK. Full legalization in the US would likely favor US-based companies on the recreational side of the business.

Many emerging companies will compete for market share in the pot business over the coming months and years. Tilray could initially benefit from full legalization in the US. Still, a rally in the shares could be short-lived as competition could push TLRY to the sidelines, with US companies capturing market share.

Tilray’s pending merger with Aphria (APHA), another Canadian pot company may not help much with the growing US market.

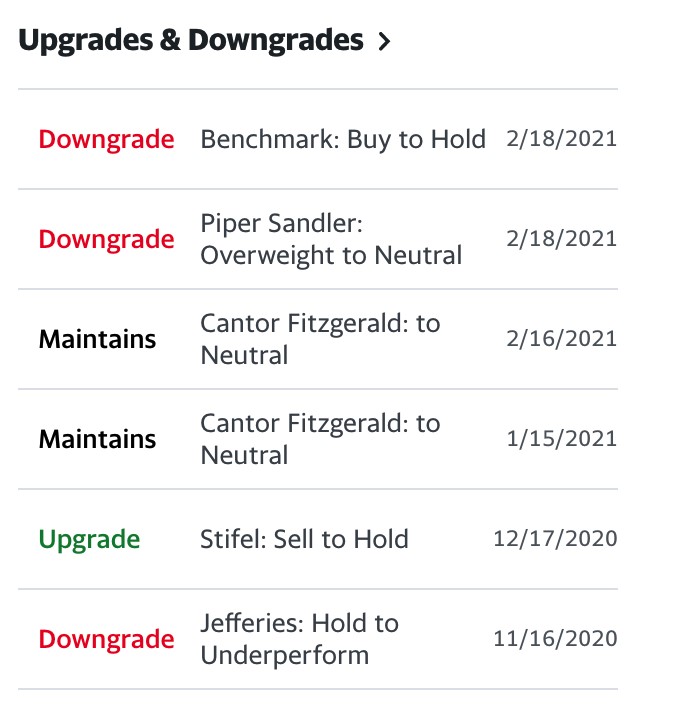

Wall Street is not in love with this company

A survey of twelve analysts on Yahoo Finance has an average price target of $10.97 per share for TLRY. The stock is trading at three times the average level. Forecasts range from zero to $24.20. The top end of the band is still below the current share price.

Source: Yahoo Finance

Source: Yahoo Finance

As the chart illustrates, the companies that cover pot stocks are not enthusiastic about Tilray’s prospects. Companies like Curaleaf (CURLF), APHA, and others have far more support from Wall Street’s analysts.

TLRY will remain a highly volatile stock in a sector where wide price variance is the norm rather than the exception. APHA could suffer from the TLRY merger.

The US will eventually approve marijuana on a federal level, which will launch many of the sector’s stocks. When that day comes, TLRY could be left in the dust because it is a Canadian company even after the merger. Tilray rallied to $300 per share when Canada legalized pot. When the US follows, the US companies will spike to the upside as they will receive the most substantial benefit.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

TLRY shares fell $1.31 (-4.48%) in premarket trading Monday. Year-to-date, TLRY has gained 238.26%, versus a 3.62% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TLRY | Get Rating | Get Rating | Get Rating |

| APHA | Get Rating | Get Rating | Get Rating |