- Twitter (TWTR) has changed the world

- Square (SQ) continues to outperform expectations

- Twitter strikes a deal with Silver Lake and Elliott Management

Jack Dorsey is a computer programmer and internet entrepreneur who hit pay dirt with not one but two companies. Dorsey was the co-founder of Twitter, which has become an institution in the world of social media. He also is the founder of Square, a mobile payments company. As of March 6, Twitter (TWTR) and Square (SQ), two independent companies had market caps of $26.175 billion, and $31.405 billion, respectively. The two businesses have a combined market cap of $57.580 billion. While they are separate and distinct businesses, TWTR and SQ have one significant factor in common, aside from the same founder. They also have the same CEO, Jack Dorsey. An activist investor, Elliot Management, has an over $1 billion stake in Twitter, and last week he made it public that he wants Mr. Dorsey to make a choice. Running a multi-billion-dollar company is a challenge for even the most competent executive. Running two, in Elliot Management’s opinion, creates conflicts of interest, time, and is illogical.

Twitter (TWTR) has changed the world

Twitter (TWTR) is the platform of choice for public self-expression and conversations in real-time. Like the Kleenex, which became synonymous with a tissue, a tweet has become the commonly accepted moniker for a message in cyberspace. While Jack Dorsey was a founder of the company, no one has done more to raise twitter as a platform than the current President of the United States. On the campaign trail in 2016 and throughout his presidency, Donald Trump has been a master of the tweet. It became the vehicle to appeal to his political base and needle his foes.

Twitter shares did not participate with the overall bullish price action in the stock market since late 2013.

(Source: Barchart)

As the chart shows, after reaching a peak of $74.73 per share in December 2013, TWTR was trading at $33.45, under half the price on Friday, March 6.

The current risk-off conditions in the stock market have pushed Twitter (TWTR) lower from its most recent high of $39.64 on February 6. A survey of forty analysts on Yahoo Finance has an average target price of $36.09 for the shares with a range from $21 to $47.

Square (SQ) continues to outperform expectations

Square Inc. (SQ) provides payment and point-of-sale solutions in the United States and around the world. The company offers hardware and software to a myriad of businesses.

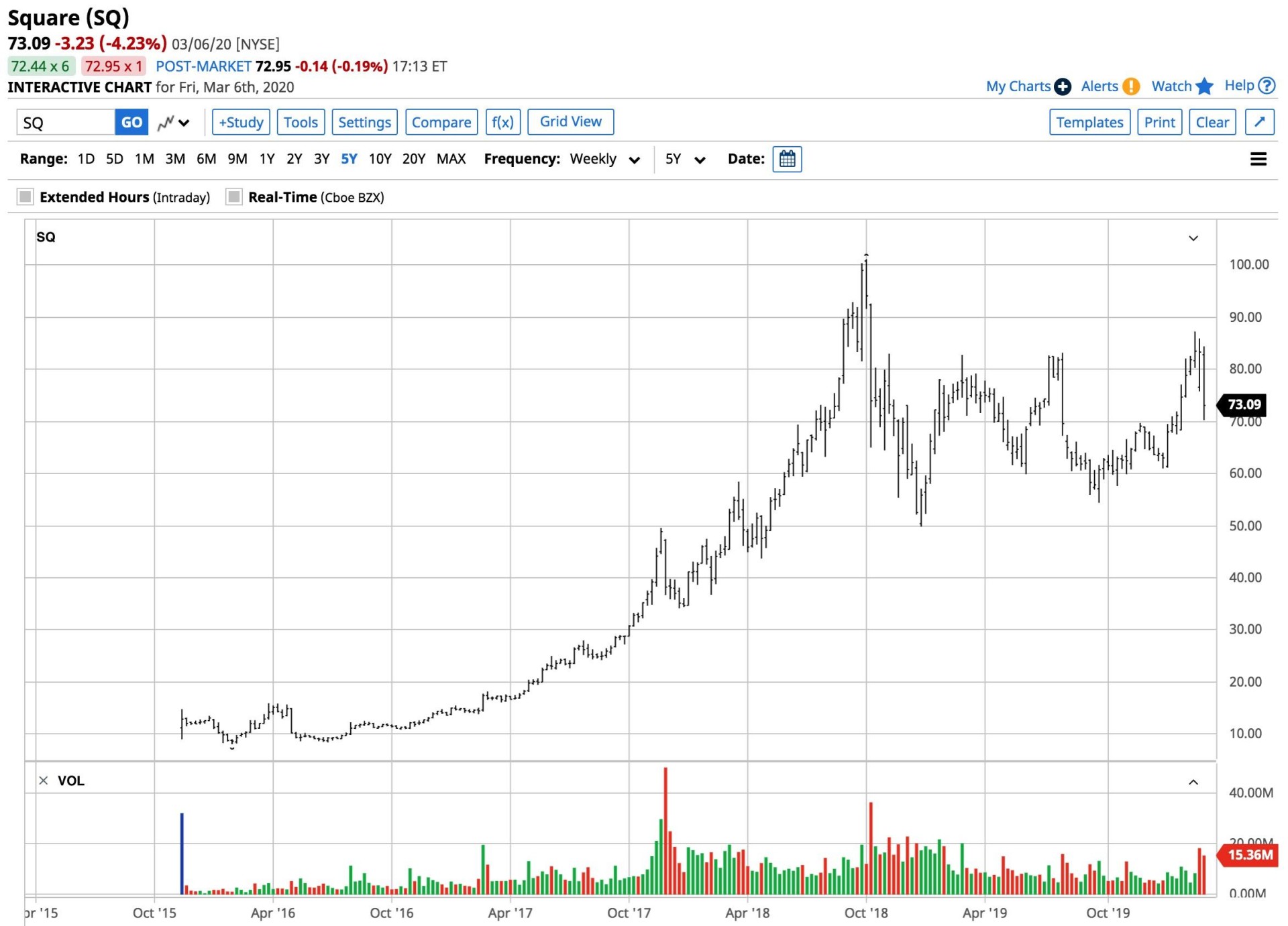

(Source: Barchart)

SQ shares had an incredible run to the upside. In 2016 the stock moved from a low of $8.42 to a peak of $101.15 in October 2018. SQ shares were better than a ten-bagger over the period. The stock was trading at $73.09 on Friday, March 6, down from its recent peak of $87.25 per share on February 20. A survey of 36 analysts on Yahoo Finance has an average price target of $83.17 for SQ shares with a range of $37 to $105.

While almost every stock with a ticker has declined in the current risk-off environment, Twitter (TWTR) and Square (SQ) have been lagging the price action in the overall stock market since 2013 and 2018, respectively.

Twitter strikes a deal with Silver Lake and Elliott Management

The performance of the two companies has caused Elliot Management to push Jack Dorsey to abandon the CEO position at one or both of the companies he founded. To make matters worse for the founder and CEO, he told markets that he planned to run the firms from abroad as he will be spending time in Africa. Jack Dorsey is a brilliant man and intuitive inventor and programmer, but the performance of TWTR and SQ shares is a sign that he is spread too thin.

While risk-off was hitting markets across all asset classes on Monday, March 9, the market cap of the combination of Twitter (TWTR) and Square (SQ) rose to $58.181 billion after Twitter struck a deal with Silver Lake and Elliott Management. The agreement kept Jack Dorsey in his role as CEO and gave each investor a seat on the company’s board and included funding for a $2 billion share repurchase program. Silver Lake will make a $1 billion investment in the company. Twitter’s board will create a temporary committee that will “build on our regular evaluation of Twitter’s leadership structure,” according to Patrick Pichette, the company’s lead independent director. While the deal settles the issue of the CEO’s position in the short-term, running two companies is not an easy task. The management situation may be over for now, but it is bound to come up again, perhaps sooner rather than later, if the share prices of TWTR and SQ do not provide the investor’s expected returns.

TWTR shares were trading at $33.22 per share on Monday afternoon, down $0.24 (-0.72%). Year-to-date, TWTR has gained 3.65%, versus a -14.78% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TWTR | Get Rating | Get Rating | Get Rating |

| SQ | Get Rating | Get Rating | Get Rating |