Today Kite Realty represents one of the best, but little known, high-yield dividend growth stocks you can buy. One that offers not just a low-risk 7.9% yield and solid long-term dividend growth potential, but is likely to generate close to 18% annualized total returns over the next decade. That’s about double the market’s historical CAGR total return of 9.2%, and potentially makes Kite not just one of the best high-yield stocks you can own in the future, but one of the best investments of the next few years, period.

Why I Own Kite Realty And You Might Want To As Well

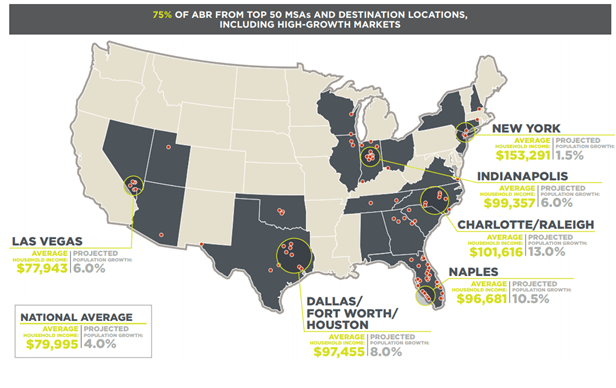

Kite Realty was founded in 1997 but IPOd in 2004. The REIT owns 115 community retail centers in 19 states. Note that KRG is NOT a mall REIT, with significant exposure to struggling or bankrupt retailers like Sears. Rather Kite’s centers are mostly focused in large, rich, and fast-growing cities. In fact, 75% of its rent comes from these primary core markets.

(Source: investor presentation)

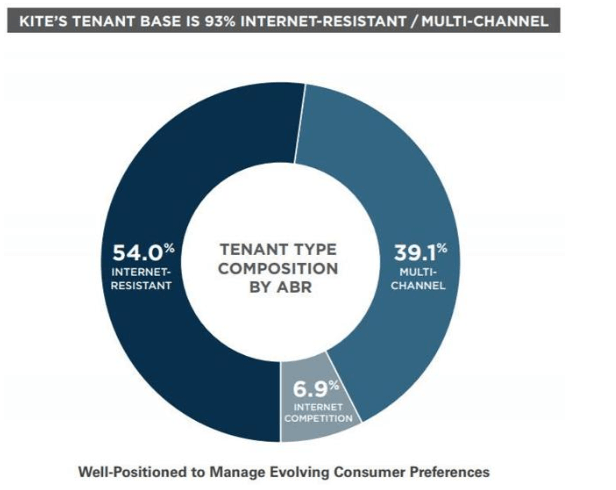

Similarly, its retailers are not the slow-moving dinosaurs who are going bankrupt these days. 93% of its rent is from retailers who are naturally e-commerce resistant (like restaurants or gyms) or have adapted online sales into their own operations (omnichannel success stories like Walmart, Target, Lowe’s, and TJ Maxx).

(Source: investor presentation)

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!