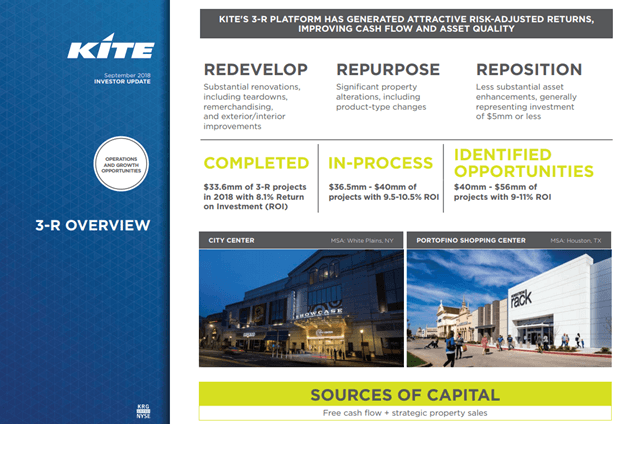

But even better than shoring up the balance sheet is Kite’s “3-R” investment strategy.

(Source: investor presentation)

The REIT is now self-funding, meaning using just its retained cash flow (FFO minus dividends = $65 million per year), plus asset sale proceeds to redevelop and improve its properties. That means not just nicer stores and centers, but also building out hotels and apartment buildings as well. These “mixed-use” properties are extra valuable since they drive higher traffic that benefits retailers via greater sales per square foot. That allows Kite to then raise rents when leases expire. In total Kite plans to spend about $121 million on these renovations in the next few years, generating between 8.1% and 11% returns on investment. That will grow cash flow by about 7% and help it to keep growing the dividend safely.

The REIT’s lease spread (how much it raises rents on new leases) is current 7.3% and 11.4% when you factor in annual rental increases built into the contracts. Double-digit lease spreads are a good proxy for quality properties that will attract and retain thriving tenants and thus generate steady and recurring cash flow to fund the dividend.

Better properties also mean higher occupancy and stronger lease spreads help to drive organic growth (what REITs call same-store net operating income or SS NOI). Yield trap REITs, with failing business models, show negative lease spreads, falling occupancy (which is typically under 90%), and negative SS NOI. On the other hand, Kite’s fundamentals are strong and moving in the right direction. For example, the occupancy rate is 93.9%, a healthy level. That’s down 0.5% in the past year mostly due to the Toys “R” Us bankruptcy. However, 40% of the space leased to that bankrupt retailer has already been re-leased, and at much higher rents. Thus this minor dip in occupancy is likely temporary. Meanwhile, SS NOI is up 1.5% for the year, and average base rent is up 5% YOY. These strong same-store fundamentals show that Kite’s business model isn’t dying, but improving, despite what the share price might lead you to believe.

But ultimately REITs are owned for their generous and growing dividends. Kite’s dividend profile is among the best in all of REITdom. That’s courtesy of a nearly 8% yield (four times that of the market) that’s low-risk. That’s due to the 64% payout ratio which is far below the industry average.

- Yield: 7.9% (vs 1.9% for S&P 500)

- FFO Payout Ratio: 64% (industry average 80%)

- 10 Year Analyst Consensus For FFO/Share (and Dividend) Growth: 4.3%

- Total Return Potential (From Fair Value): 12.2% (vs 8.3% for S&P 500)

- Valuation Adjusted 10 Year CAGR Total Return Potential: 17.8% (vs 0% to 5% for S&P 500)

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!