CNBC commentator Jim Cramer has made the term “Stop Trading!” well known through his various segments. As much as he uses it for dramatic flair, there is some good sense to the notion of taking a step back and simply doing nothing in the market.

From the time I first became a market maker on the Chicago Board of Options Exchange (CBOE) in 1988, I always wondered why the market needed open for 6.5 hours a day. The reality is that with post and pre-market and overseas, it’s open 24 hours.

Most days, brokers spent a good portion just standing around. Couldn’t, especially with new technology making instantaneous order execution, price discovery occur within an hour or two per day?

A recent article from Michael Batnik interestingly suggested that trading should be limited to two days a year, essentially creating a biannual purge.

I realize he was posting an extreme in order to make a point that most people tend to overtrade and that high turnover leads to lower returns over time.

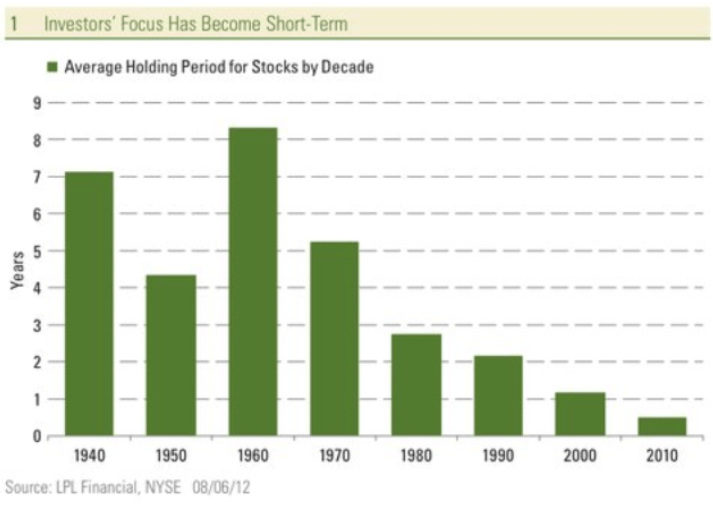

Turnover rates, that is the frequency of buying and selling, among both money managers and individual investors, have been increasing over the past decades.

The data might be a bit skewed by the huge increase in computerized high-frequency trading. But the reality is, overall investment horizons have become a much shorter term.

From a money manager’s standpoint, they’re often viewed as ‘only as good as the last trade,’ or recent performance.

For individuals, the ease of electronic trading and low fees, with constant access to market information, simply make it tempting to trade more actively. In the past, you had to look up prices in the morning paper, call your broker to get an update, and place an order that cost hundreds of dollars in commissions, which created structural obstacles to overtrading.

It will be impossible to put the toothpaste back in the bottle in terms of reducing trading hours, and downright harmful to jack back up trading costs.

But something that that might curtail the frequency of trading would be to have companies report earnings only twice a year. The quarterly cycle of reporting guidance breeds short-term thinking among both management and investors.

Going from quarterly reporting to a biannual system would allow for a sharper focus on running the business rather than wasting time on the business of managing earnings and investor’s expectations.

And investors would be less likely to overreact to minimal monthly changes in the longer term health of companies business.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!