American Airlines Group, Inc. (AAL): Price and Financial Metrics

AAL Price/Volume Stats

| Current price | $10.62 | 52-week high | $16.87 |

| Prev. close | $10.60 | 52-week low | $9.76 |

| Day low | $10.21 | Volume | 45,668,359 |

| Day high | $10.76 | Avg. volume | 34,656,227 |

| 50-day MA | $11.68 | Dividend yield | N/A |

| 200-day MA | $13.17 | Market Cap | 6.97B |

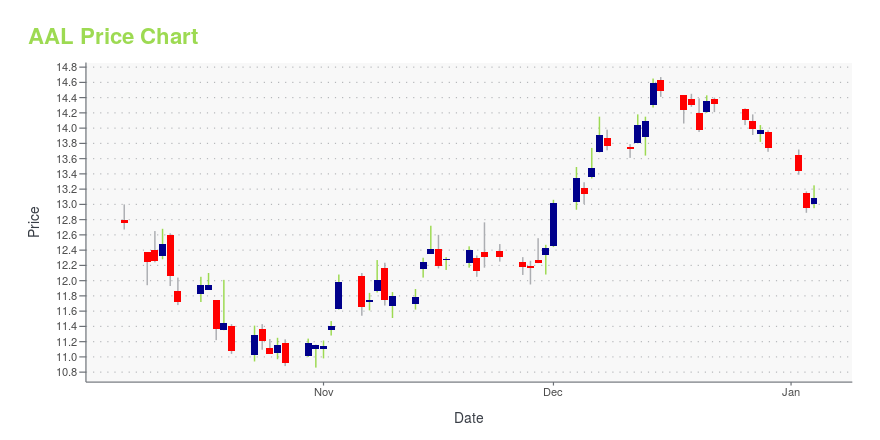

AAL Stock Price Chart Interactive Chart >

American Airlines Group, Inc. (AAL) Company Bio

American Airlines Group is the holding company for American Airlines and US Airways. Together with regional partners, operating as American Eagle and US Airways Express, the airlines operate an average of nearly 6,700 flights per day to nearly 350 destinations in more than 50 countries. American Airlines Group Inc. was founded in 1934 and is based in Fort Worth, Texas.

Latest AAL News From Around the Web

Below are the latest news stories about AMERICAN AIRLINES GROUP INC that investors may wish to consider to help them evaluate AAL as an investment opportunity.

10 Most Dangerous Airlines In The WorldIn this article, we will take a look at the 10 most dangerous airlines in the world. If you want to skip our discussion on the airline industry, you can go directly to the 5 Most Dangerous Airlines In The World. Air transport is essential for the development of the global economy as it facilitates […] |

American Airlines (AAL) Stock Sinks As Market Gains: Here's WhyThe latest trading day saw American Airlines (AAL) settling at $13.99, representing a -0.85% change from its previous close. |

Why These 3 Flying Car Stocks Should Be on Your Radar in 2024If you have a long-term outlook and a high risk tolerance, here are three flying car stocks to watch in 2024 |

Why Investors Need to Take Advantage of These 2 Transportation Stocks NowWhy investors should use the Zacks Earnings ESP tool to help find stocks that are poised to top quarterly earnings estimates. |

Southwest, American passengers react to airline alcohol controversyThere are a number of identifiable correlations between the consumption of alcoholic beverages and air travel. A couple of recent observations on major U.S. carriers, including Southwest Airlines and American Airlines , have sparked interest in the answer to a question. This is generally perfectly acceptable behavior, but there are frequent incidents of passengers drinking too much and causing problems with other flyers and airline crew members. |

AAL Price Returns

| 1-mo | -4.50% |

| 3-mo | -23.49% |

| 6-mo | -29.81% |

| 1-year | -35.91% |

| 3-year | -50.51% |

| 5-year | -65.65% |

| YTD | -22.71% |

| 2023 | 8.02% |

| 2022 | -29.18% |

| 2021 | 13.89% |

| 2020 | -44.81% |

| 2019 | -9.57% |

Continue Researching AAL

Here are a few links from around the web to help you further your research on American Airlines Group Inc's stock as an investment opportunity:American Airlines Group Inc (AAL) Stock Price | Nasdaq

American Airlines Group Inc (AAL) Stock Quote, History and News - Yahoo Finance

American Airlines Group Inc (AAL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...