ABB Ltd. ADR (ABB): Price and Financial Metrics

ABB Price/Volume Stats

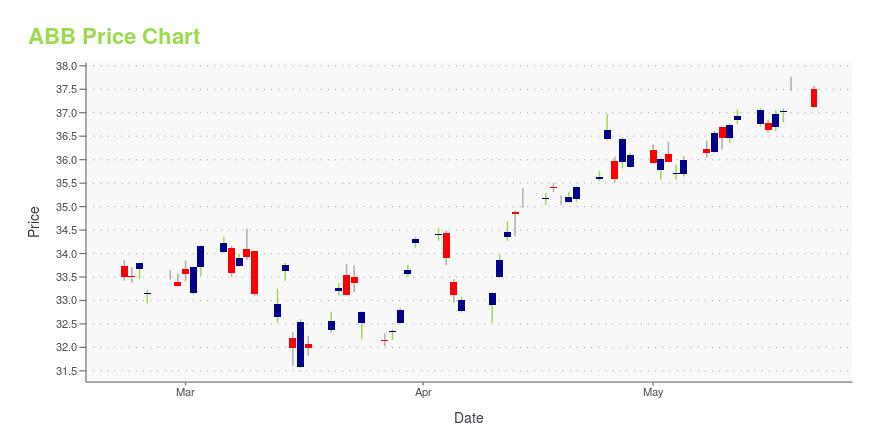

| Current price | $37.13 | 52-week high | $37.76 |

| Prev. close | $37.56 | 52-week low | $24.27 |

| Day low | $37.11 | Volume | 6,388,400 |

| Day high | $37.58 | Avg. volume | 1,562,302 |

| 50-day MA | $34.82 | Dividend yield | 1.5% |

| 200-day MA | $31.42 | Market Cap | 72.95B |

ABB Stock Price Chart Interactive Chart >

ABB Ltd. ADR (ABB) Company Bio

ABB (legal name in English: ABB Ltd) is a Swedish-Swiss multinational corporation headquartered in Zürich, Switzerland. The company was formed in 1988 when Sweden's Allmänna Svenska Elektriska Aktiebolaget (ASEA) and Switzerland's Brown, Boveri & Cie merged to create ASEA Brown Boveri, later simplified to the initials ABB. Both companies were established in the late 1800s and were major electrical equipment manufacturers, a business that ABB remains active in today. The company has also since expanded to robotics and automation technology. (Source:Wikipedia)

Latest ABB News From Around the Web

Below are the latest news stories about ABB LTD that investors may wish to consider to help them evaluate ABB as an investment opportunity.

The 3 Most Promising Robotics Stocks to Buy in May 2023These robotics stocks to buy offer spectacular long-term upside in line with the growth expected in the multi-billion dollar robotics sphere. |

General Electric (GE) Picks Ghai as New CFO, Happe to Step DownGeneral Electric's (GE) CFO transition comes at a time when the company is in the process of separating its business into three independent public companies. |

3 Undervalued Artificial Intelligence and Robotics Stocks to Buy NowArtificial intelligence (AI) has engulfed the headlines in a frenzy of fortune and fear. Zebra Technologies (NASDAQ: ZBRA), ABB (NYSE: ABB), and Honeywell International (NASDAQ: HON) are three established companies that are making meaningful investments in new technologies. Here's what makes each stock a great buy now. |

7 of the Best Energy Stocks to Buy NowEnergy stocks provide investors with solid opportunities for growth and positive returns. |

Emerson (EMR) Chosen to Automate Syzygy's Reactor TechnologyEmerson (EMR) is set to provide its automation technology and software to Syzygy as the latter aims for cost-effective decarbonization by electrifying carbon-intensive activities. |

ABB Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 4.15% |

| 5-year | 114.83% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -18.96% |

| 2021 | 38.77% |

| 2020 | 19.45% |

| 2019 | 29.84% |

ABB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ABB

Want to see what other sources are saying about Abb Ltd's financials and stock price? Try the links below:Abb Ltd (ABB) Stock Price | Nasdaq

Abb Ltd (ABB) Stock Quote, History and News - Yahoo Finance

Abb Ltd (ABB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...