AmerisourceBergen Corp. (ABC): Price and Financial Metrics

ABC Price/Volume Stats

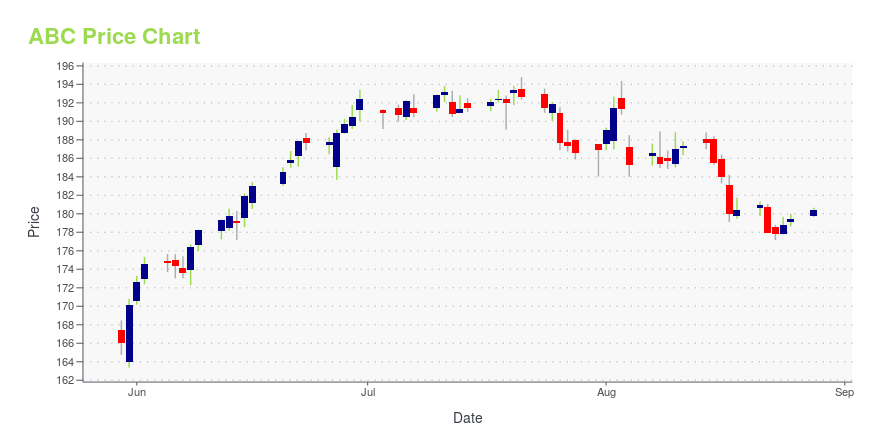

| Current price | $179.98 | 52-week high | $194.79 |

| Prev. close | $180.39 | 52-week low | $135.14 |

| Day low | $179.24 | Volume | 806,000 |

| Day high | $180.93 | Avg. volume | 1,432,623 |

| 50-day MA | $187.51 | Dividend yield | 1.08% |

| 200-day MA | $170.17 | Market Cap | 36.39B |

ABC Stock Price Chart Interactive Chart >

AmerisourceBergen Corp. (ABC) Company Bio

AmerisourceBergen Corporation is an American drug wholesale company that was formed by the merger of Bergen Brunswig and AmeriSource in 2001. They provide drug distribution and consulting related to medical business operations and patient services. They also distribute a line of brand name and generic pharmaceuticals, over-the-counter (OTC) health care products and home health care supplies and equipment to health care providers throughout the United States, including acute care hospitals and health systems, independent and chain retail pharmacies, mail-order facilities, physicians, clinics and other alternate site facilities, as well as nursing and assisted living centers. They also provide pharmaceuticals and pharmacy services to long-term care, workers' compensation and specialty drug patients. (Source:Wikipedia)

Latest ABC News From Around the Web

Below are the latest news stories about AMERISOURCEBERGEN CORP that investors may wish to consider to help them evaluate ABC as an investment opportunity.

30 Biggest Companies in the World by 2023 RevenueIn this article, we will be taking a look at the 30 biggest companies in the world by 2023 revenue. If you want to skip our detailed analysis, you can go directly to see the 10 Biggest Companies in the World by 2023 Revenue. The biggest companies in the world by 2023 revenue operate within […] |

3 Sorry Retail Stocks to Sell in August Before It’s Too LateThe retail sector rebounded since January, but these three companies are proving they can't adapt to changing times. |

Ozempic, Weight-Loss Drugs Carry Costly, Complicated LogisticsThe popular medications are pumping up revenues for pharmaceutical distributors, but the high cost of storing and transporting the refrigerated medications is thinning out profit margins. |

CVS stock tumbles after Blue Shield of California shake-up. Analysts call selloff 'nonsensical'Blue Shield of California's unbundling of pharmacy benefits services may not spell total loss for Big 3 PBM industry. |

Is This a Sign Walgreens Boots Alliance Is Getting Desperate?There's no mystery why Walgreens stock is down more than 55% in five years -- the business isn't in great shape. |

ABC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -3.67% |

| 3-year | 52.51% |

| 5-year | 122.62% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 26.26% |

| 2021 | 38.01% |

| 2020 | 17.03% |

| 2019 | 16.48% |

ABC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ABC

Want to do more research on Amerisourcebergen Corp's stock and its price? Try the links below:Amerisourcebergen Corp (ABC) Stock Price | Nasdaq

Amerisourcebergen Corp (ABC) Stock Quote, History and News - Yahoo Finance

Amerisourcebergen Corp (ABC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...