Ambev S.A. ADR (ABEV): Price and Financial Metrics

ABEV Price/Volume Stats

| Current price | $2.11 | 52-week high | $3.16 |

| Prev. close | $2.10 | 52-week low | $2.01 |

| Day low | $2.09 | Volume | 11,078,691 |

| Day high | $2.12 | Avg. volume | 14,569,795 |

| 50-day MA | $2.16 | Dividend yield | 12.11% |

| 200-day MA | $2.49 | Market Cap | 33.24B |

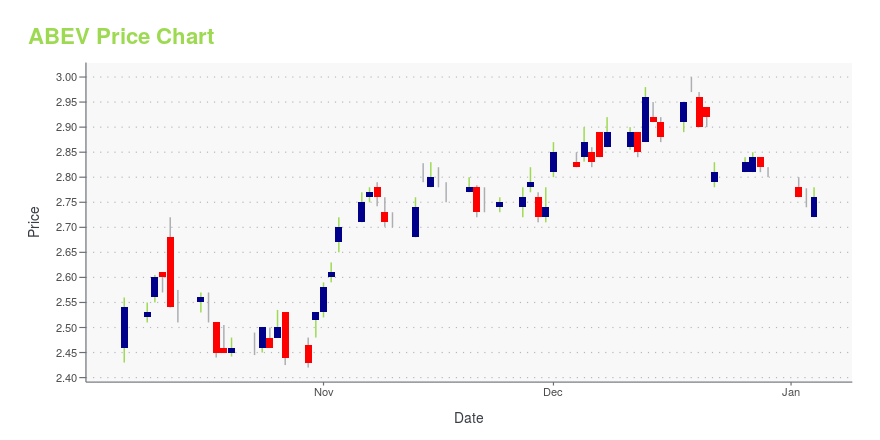

ABEV Stock Price Chart Interactive Chart >

Ambev S.A. ADR (ABEV) Company Bio

Ambev, formally Companhia de Bebidas das Américas, is a Brazilian brewing company now merged into Anheuser-Busch InBev. Its name translates to "Beverage Company of the Americas", hence the "Ambev" abbreviation. It was created on July 1, 1999, with the merger of two breweries, Brahma and Antarctica. The merger was approved by the board of directors of the Brazilian Administrative Council for Economic Defense (CADE) on March 30, 2000. The organization's headquarters are in São Paulo, Brazil. It is one of the largest companies by market capitalization in Brazil and in the Southern hemisphere. (Source:Wikipedia)

Latest ABEV News From Around the Web

Below are the latest news stories about AMBEV SA that investors may wish to consider to help them evaluate ABEV as an investment opportunity.

15 Undervalued Defensive Stocks For 2024In this article, we discuss the 15 undervalued defensive stocks for 2024. To skip the detailed overview of the market and defensive stocks, go directly to the 5 Undervalued Defensive Stocks For 2024. Defensive stocks are shares of companies that remain relatively stable during economic downturns as opposed to cyclical stocks. Defensive stocks usually outperform […] |

Ambev SA's Dividend AnalysisAmbev SA (NYSE:ABEV) recently announced a dividend of $0.15 per share, payable on 2024-01-08, with the ex-dividend date set for 2023-12-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Ambev SAs dividend performance and assess its sustainability. |

16 Most Profitable Penny Stocks NowIn this article, we will take a look at the 16 most profitable penny stocks now. To see more such companies, go directly to 5 Most Profitable Penny Stocks Now. Earlier this month investors cheered the latest inflation data report which showed the Fed’s battle against inflation might finally be working. Throughout 2023, investors and […] |

20 Most Valuable Brazilian Companies Heading into 2024In this article, we will take a look at the 20 most valuable Brazilian companies heading into 2024. If you want to skip our detailed analysis, you can go directly to 5 Most Valuable Brazilian Companies Heading into 2024. Brazil’s Economic Outlook: At a Glance According to a report by Deloitte, the Brazilian economy has been […] |

Forget the Magnificent 7. Jump Into Brazilian Stocks Instead.Why throw money into overvalued Magnificent 7 names when you could get into Brazilian stocks at cheap prices? |

ABEV Price Returns

| 1-mo | 0.48% |

| 3-mo | -9.44% |

| 6-mo | -21.27% |

| 1-year | -27.99% |

| 3-year | -28.08% |

| 5-year | -53.30% |

| YTD | -24.64% |

| 2023 | 7.85% |

| 2022 | 1.53% |

| 2021 | -7.26% |

| 2020 | -32.88% |

| 2019 | 21.55% |

ABEV Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching ABEV

Here are a few links from around the web to help you further your research on Ambev Sa's stock as an investment opportunity:Ambev Sa (ABEV) Stock Price | Nasdaq

Ambev Sa (ABEV) Stock Quote, History and News - Yahoo Finance

Ambev Sa (ABEV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...