AdvisorShares Vice ETF (ACT): Price and Financial Metrics ETF

ACT Price/Volume Stats - 7 Best ETFs for the NEXT Bull Market

| Current price | $34.55 | 52-week high | $34.70 |

| Prev. close | $34.20 | 52-week low | $26.13 |

| Day low | $34.02 | Volume | 213,739 |

| Day high | $34.70 | Avg. volume | 245,301 |

| 50-day MA | $31.19 | Dividend yield | 2.19% |

| 200-day MA | $29.27 |

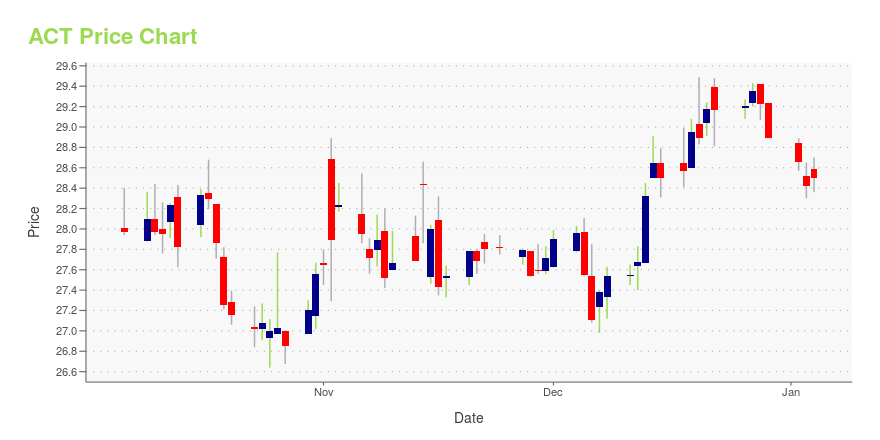

ACT Stock Price Chart Interactive Chart >

AdvisorShares Vice ETF (ACT) ETF Bio

The investment objective of the AdvisorShares VICE ETF seeks to invest in companies that make the majority of their money from the tobacco, alcohol or cannabis industries.

ACT ETF Info

| Issuer | |

| Expense Ratio | % |

| Asset Class | |

| Sector | |

| Assets Under Management (AUM) | |

| Net Asset Value (NAV) | $0.00 |

| Options? | No |

| Total Holdings | N/A |

ACT Top Holdings

| Symbol | Company | % of Total |

Latest ACT News From Around the Web

Below are the latest news stories about ENACT HOLDINGS INC that investors may wish to consider to help them evaluate ACT as an investment opportunity.

Double Your Money: 3 Ignored Stocks Primed for Mega Growth in 2025Are you looking for stocks to double your money? |

3 Growth Stocks That Could Be Multibaggers in the MakingThese growth stocks have the chance to be multibaggers. |

Enact Completes Sixth Mortgage Insurance Linked Note Credit Risk Transaction as Part of its Diversified Credit Risk Transfer ProgramSecures $248 million of fully collateralized excess of loss insurance coverage from its Triangle Re Insurance Linked Note platformRALEIGH, N.C., Nov. 15, 2023 (GLOBE NEWSWIRE) -- Enact Holdings, Inc. (Nasdaq: ACT) (Enact), a leading provider of private mortgage insurance through its insurance subsidiaries, announced that its flagship legal entity, Enact Mortgage Insurance Corporation, has secured $248 million of fully collateralized excess of loss reinsurance coverage through the issuance of an |

Enact Holdings, Inc. (NASDAQ:ACT) Pays A US$0.87 Dividend In Just Four DaysIt looks like Enact Holdings, Inc. ( NASDAQ:ACT ) is about to go ex-dividend in the next 4 days. The ex-dividend date... |

Enact Reports Third Quarter 2023 Results_______________________________________GAAP Net Income of $164 million, or $1.02 per diluted shareAdjusted Operating Income of $164 million, or $1.02 per diluted shareReturn on Equity of 14.9% and Adjusted Operating Return on Equity of 14.9%Record Primary Insurance-in-Force of $262 billion, an 8% increase from third quarter 2022PMIERs Sufficiency of 162% or $2,017 millionBook Value Per Share of $27.86 and Book Value Per Share excluding AOCI of $30.36Announces quarterly cash dividend of $0.16 per |

ACT Price Returns

| 1-mo | 13.58% |

| 3-mo | 16.06% |

| 6-mo | 21.93% |

| 1-year | 32.82% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 21.04% |

| 2023 | 25.78% |

| 2022 | 24.10% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

ACT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||