Aegon N.V. ADR (AEG): Price and Financial Metrics

AEG Price/Volume Stats

| Current price | $6.35 | 52-week high | $6.96 |

| Prev. close | $6.25 | 52-week low | $4.63 |

| Day low | $6.29 | Volume | 1,010,728 |

| Day high | $6.35 | Avg. volume | 2,235,336 |

| 50-day MA | $6.38 | Dividend yield | 4.62% |

| 200-day MA | $5.86 | Market Cap | 14.00B |

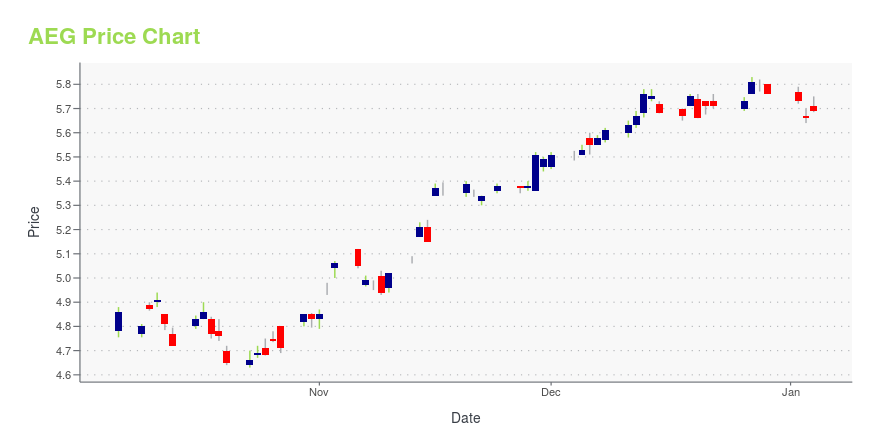

AEG Stock Price Chart Interactive Chart >

Aegon N.V. ADR (AEG) Company Bio

Aegon N.V. is a Dutch multinational life insurance, pensions and asset management company headquartered in The Hague, Netherlands. As of July 21, 2020, the company had 26,000 employees.[1] Aegon is listed on the Euronext Amsterdam and is a constituent of the AEX index. (Source:Wikipedia)

Latest AEG News From Around the Web

Below are the latest news stories about AEGON LTD that investors may wish to consider to help them evaluate AEG as an investment opportunity.

AM Best Affirms Credit Ratings of Members of Aegon Ltd.’s U.S. SubsidiariesOLDWICK, N.J., December 20, 2023--AM Best has affirmed the Financial Strength Rating of A (Excellent) and the Long-Term Issuer Credit Ratings of "a+" (Excellent) of the U.S. life/health (L/H) subsidiaries of Aegon Ltd. (Bermuda) [NYSE: AEG]. Aegon Ltd.’s U.S. L/H companies are Transamerica Life Insurance Company (Cedar Rapids, IA) and Transamerica Financial Life Insurance Company (Harrison, NY) and referred to collectively as Aegon USA Group (Aegon USA). The outlook of these Credit Ratings (rati |

Aegon Ltd. (AMS:AGN) is largely controlled by institutional shareholders who own 41% of the companyKey Insights Significantly high institutional ownership implies Aegon's stock price is sensitive to their trading... |

3 Penny Stocks With Catalysts in the Next 30 DaysCheck out these three penny stocks with catalysts in the coming month strong enough to boost any investor's portfolio returns. |

Aegon (AEG) Plans to Repurchase Shares From Vereniging AegonAegon (AEG) enters into an agreement with its majority shareholder, Vereniging Aegon, to participate in a share buyback program. |

Vereniging Aegon to participate in current share buyback programThe Hague, December 8, 2023 - Aegon has entered into an agreement with its largest shareholder, Vereniging Aegon, to partially participate in Aegon’s current EUR 1.5 billion share buyback program. The repurchase of shares from Vereniging Aegon will commence as soon as Aegon has repurchased shares for an amount of EUR 750 million under the buyback program and is expected to run until the end of the share buyback program. Barring unforeseen circumstances, the share buyback is expected to be comple |

AEG Price Returns

| 1-mo | 1.60% |

| 3-mo | 4.91% |

| 6-mo | 8.23% |

| 1-year | 24.92% |

| 3-year | 71.78% |

| 5-year | 55.39% |

| YTD | 12.92% |

| 2023 | 20.08% |

| 2022 | 5.77% |

| 2021 | 28.75% |

| 2020 | -10.42% |

| 2019 | 4.10% |

AEG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AEG

Here are a few links from around the web to help you further your research on Aegon Nv's stock as an investment opportunity:Aegon Nv (AEG) Stock Price | Nasdaq

Aegon Nv (AEG) Stock Quote, History and News - Yahoo Finance

Aegon Nv (AEG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...