AGNC Investment Corp. (AGNC): Price and Financial Metrics

AGNC Price/Volume Stats

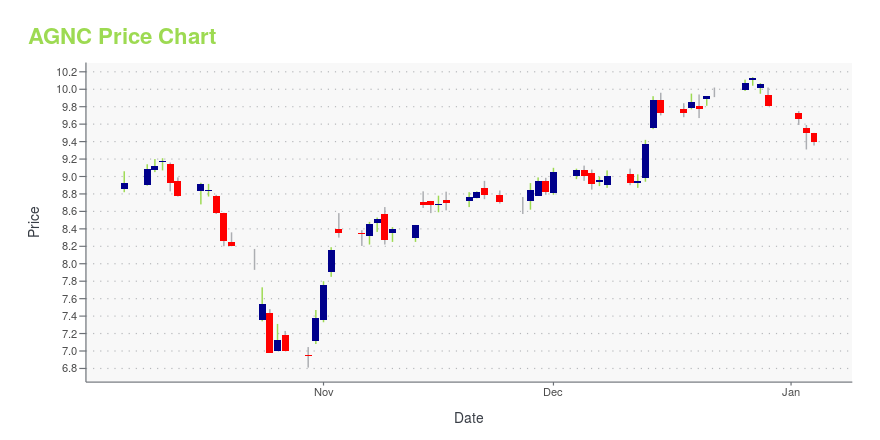

| Current price | $10.05 | 52-week high | $10.64 |

| Prev. close | $9.87 | 52-week low | $6.81 |

| Day low | $9.91 | Volume | 22,856,300 |

| Day high | $10.08 | Avg. volume | 12,251,802 |

| 50-day MA | $9.84 | Dividend yield | 13.95% |

| 200-day MA | $9.41 | Market Cap | 7.31B |

AGNC Stock Price Chart Interactive Chart >

AGNC Investment Corp. (AGNC) Company Bio

American Capital Agency originates, underwrites and manages investments in middle market private equity, leveraged finance, real estate, energy & infrastructure and structured products. The company was founded in 2008 and is based in Bethesda, Maryland.

Latest AGNC News From Around the Web

Below are the latest news stories about AGNC INVESTMENT CORP that investors may wish to consider to help them evaluate AGNC as an investment opportunity.

Why AGNC Investment (AGNC) Outpaced the Stock Market TodayThe latest trading day saw AGNC Investment (AGNC) settling at $10.13, representing a +0.6% change from its previous close. |

7 Growth Stocks That Also Pay Monthly Dividends: December 2023While it’s obvious there are great reasons to buy and hold stocks, it’s also easy to overlook a regular income gained by owning monthly dividend-paying growth stocks. |

Could These 3 Ultra-High-Yield Stocks Help You Retire a Millionaire?These dividend yields are at least on par with the stock market's long-term average annual gains. |

3 Monthly Dividend Stocks for Steady Income in 2024Watch your investments grow by enjoying monthly returns through these three monthly dividend stocks in the new year. |

AGNC Investment (AGNC) Rises Higher Than Market: Key FactsAGNC Investment (AGNC) closed at $9.85 in the latest trading session, marking a +1.18% move from the prior day. |

AGNC Price Returns

| 1-mo | 5.24% |

| 3-mo | 11.89% |

| 6-mo | 10.45% |

| 1-year | 14.79% |

| 3-year | -7.34% |

| 5-year | 5.93% |

| YTD | 10.45% |

| 2023 | 10.14% |

| 2022 | -21.65% |

| 2021 | 5.20% |

| 2020 | -1.78% |

| 2019 | 13.31% |

AGNC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AGNC

Want to see what other sources are saying about AGNC Investment Corp's financials and stock price? Try the links below:AGNC Investment Corp (AGNC) Stock Price | Nasdaq

AGNC Investment Corp (AGNC) Stock Quote, History and News - Yahoo Finance

AGNC Investment Corp (AGNC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...