Adecoagro S.A. Common Shares (AGRO): Price and Financial Metrics

AGRO Price/Volume Stats

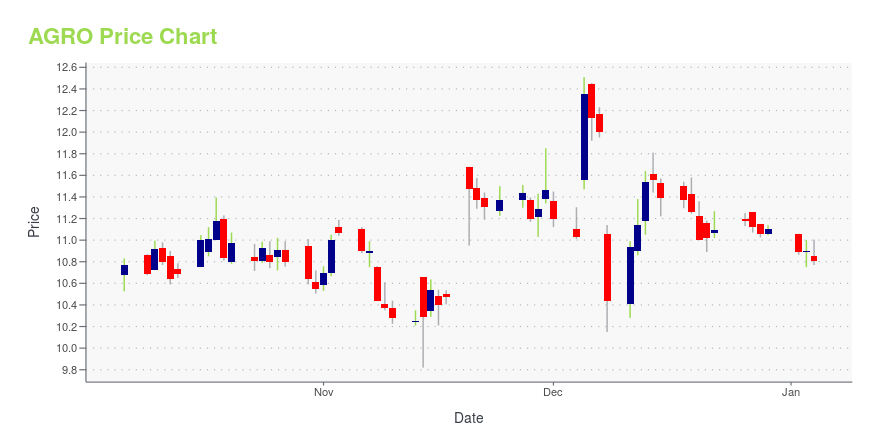

| Current price | $9.42 | 52-week high | $12.51 |

| Prev. close | $9.41 | 52-week low | $8.96 |

| Day low | $9.25 | Volume | 774,600 |

| Day high | $9.44 | Avg. volume | 580,778 |

| 50-day MA | $9.63 | Dividend yield | 3.57% |

| 200-day MA | $10.45 | Market Cap | 980.95M |

AGRO Stock Price Chart Interactive Chart >

Adecoagro S.A. Common Shares (AGRO) Company Bio

Adecoagro S.A., an agricultural company, engages in farming, energy production, and land transformation activities. It operates through Farming; Sugar, Ethanol and Energy; and Land Transformation businesses. The company was founded in 2002 and is based in Luxembourg.

Latest AGRO News From Around the Web

Below are the latest news stories about ADECOAGRO SA that investors may wish to consider to help them evaluate AGRO as an investment opportunity.

Adecoagro: Stock Has Strong Growth Potential In 2024Adecoagro is benefitting from an increase in farmland, favorable sugar prices, and the El Nino weather pattern, which has been conducive to productive crop yields. |

Should Value Investors Buy Adecoagro (AGRO) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Global Growth Gems: 3 Stocks With Multibagger Returns PotentialThese global growth stocks can unlock value from your portfolio. |

Archer Daniels (ADM) to Acquire FDL, To Expand Flavor BusinessArcher Daniels (ADM) partners with the U.K.-based FDL to expand its flavors portfolio. The deal is likely to be a win-win for both companies, particularly in expanding their reach in key channels. |

15 Quality Undervalued Non-Cyclical Stocks to Buy NowIn this article, we discuss the 15 quality undervalued non-cyclical stocks to buy now. If you want to read about some more non-cyclical undervalued stocks, go directly to 5 Quality Undervalued Non-Cyclical Stocks to Buy Now. The United States stock market has been on a roller coaster ride over the past few years. The pandemic […] |

AGRO Price Returns

| 1-mo | -2.59% |

| 3-mo | -13.44% |

| 6-mo | -6.04% |

| 1-year | -9.06% |

| 3-year | 10.92% |

| 5-year | 48.44% |

| YTD | -13.83% |

| 2023 | 38.61% |

| 2022 | 11.49% |

| 2021 | 12.94% |

| 2020 | -18.76% |

| 2019 | 20.26% |

AGRO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching AGRO

Here are a few links from around the web to help you further your research on Adecoagro SA's stock as an investment opportunity:Adecoagro SA (AGRO) Stock Price | Nasdaq

Adecoagro SA (AGRO) Stock Quote, History and News - Yahoo Finance

Adecoagro SA (AGRO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...