Senmiao Technology Limited (AIHS): Price and Financial Metrics

AIHS Price/Volume Stats

| Current price | $0.87 | 52-week high | $1.12 |

| Prev. close | $0.82 | 52-week low | $0.20 |

| Day low | $0.82 | Volume | 2,900 |

| Day high | $0.88 | Avg. volume | 31,058 |

| 50-day MA | $0.90 | Dividend yield | N/A |

| 200-day MA | $0.56 | Market Cap | 8.32M |

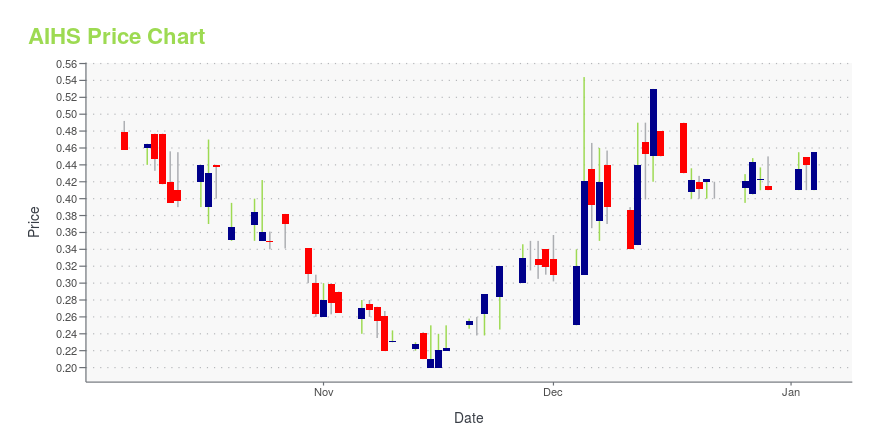

AIHS Stock Price Chart Interactive Chart >

Senmiao Technology Limited (AIHS) Company Bio

Senmiao Technology Limited engages in the automobile transaction and related services business in the People's Republic of China. Its services include the facilitation of automobile transaction and financing, connecting ride-hailing drivers to financial institutions to buy, or get financing on the purchase of, cars to be used to provide ride-hailing services. The company is also involved in the sale of automobiles; and provision of auto finance services. Senmiao Technology has strategic cooperation with Gaode Map for utilization in ride sharing initiatives. Senmiao Technology Limited was incorporated in 2017 and is based in Chengdu, the People's Republic of China.

Latest AIHS News From Around the Web

Below are the latest news stories about SENMIAO TECHNOLOGY LTD that investors may wish to consider to help them evaluate AIHS as an investment opportunity.

Senmiao Technology Announces Ride-Hailing Platform Operating Metrics for November 2023Senmiao Technology Limited ("Senmiao" or the "Company") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China as well as an operator of its own online ride-hailing platform, today announced the operating metrics for its proprietary online ride-hailing platform for the month of November 2023. In November 2023, Senmiao and its affiliates recorded more than 0.48 million total completed orders, compared to approximately 0.57 million total orders compl |

Senmiao Technology Announces Ride-Hailing Platform Operating Metrics for October 2023Senmiao Technology Limited ("Senmiao" or the "Company") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China as well as an operator of its own online ride-hailing platform, today announced the operating metrics for its proprietary online ride-hailing platform for the month of October 2023. In October 2023, Senmiao and its affiliates recorded 0.57 million total completed orders, compared to 0.61 million total orders completed in September 2023. Th |

Senmiao Technology Reports Fiscal 2024 Second Quarter Financial ResultsSenmiao Technology Limited ("Senmiao") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China as well as an operator of its own online ride-hailing platform, today announced financial results for its fiscal 2024 second quarter ended September 30, 2023. |

Senmiao Technology Announces Ride-Hailing Platform Operating Metrics for September 2023Senmiao Technology Limited ("Senmiao" or the "Company") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China as well as an operator of its own online ride-hailing platform, today announced the operating metrics for its proprietary online ride-hailing platform for the month of September 2023. In September 2023, Senmiao and its affiliates recorded 0.61 million total completed orders, compared to 0.62 million total orders completed in August 2023. T |

Senmiao Technology Announces Signing of Strategic Cooperation Agreement with Sichuan Xingyuan Ronghe New Energy GroupSenmiao Technology Limited ("Senmiao" or the "Company") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China as well as an operator of its own online ride-hailing platform, today announced that the Company's operating subsidiary Hunan Xixingtianxia Technology Co., Ltd. ("XXTX"), has signed a strategic cooperation agreement with Sichuan Xingyuan Ronghe New Energy Co., Ltd. ("Xingyuan"). Xingyuan provides automobile supply chain financing to major |

AIHS Price Returns

| 1-mo | -7.45% |

| 3-mo | 80.50% |

| 6-mo | 135.20% |

| 1-year | -0.23% |

| 3-year | -93.51% |

| 5-year | -98.26% |

| YTD | 112.20% |

| 2023 | -54.63% |

| 2022 | -75.58% |

| 2021 | -65.42% |

| 2020 | 59.70% |

| 2019 | -82.41% |

Continue Researching AIHS

Want to do more research on Senmiao Technology Ltd's stock and its price? Try the links below:Senmiao Technology Ltd (AIHS) Stock Price | Nasdaq

Senmiao Technology Ltd (AIHS) Stock Quote, History and News - Yahoo Finance

Senmiao Technology Ltd (AIHS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...